If you’re considering purchasing an investment property, you’re probably aware that the difference between success and failure as an investor is having access to fast, accurate real estate data.

So, what kinds of data do real estate investors need?

In this article, we are going to cover the kinds of data you need, why they are important, and how to get easy access to them.

#1. Property Data

The #1 piece of real estate data that you need is property data, or data about individual properties for sale. This kind of data will help you make the right investment decision based on your own investment criteria. The best way to get this data is through an investment property search tool. Mashvisor offers two separate databases that help you find the perfect property based on specific search criteria.

The Best Source of Property Data

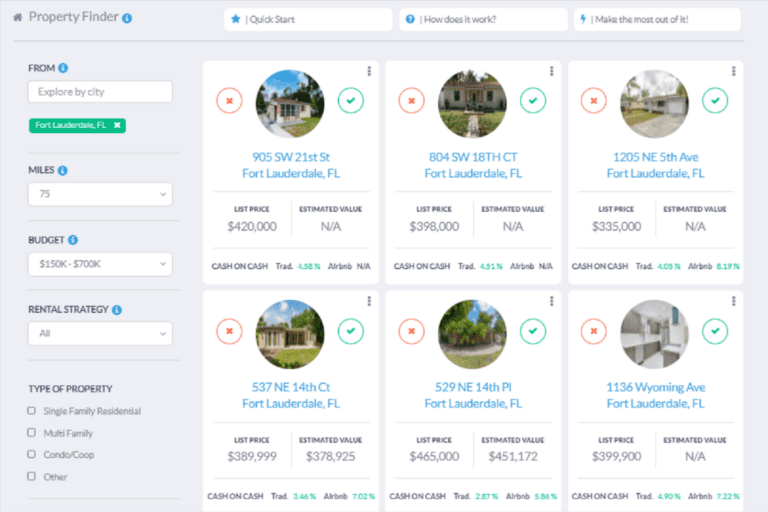

The Property Finder allows investors to find investment properties for sale in one simple-to-use real estate database. Our real estate API connects with the MLS, as well as multiple other publicly available sources of valuable property information. For investors interested in short term rental properties, the Property Finder includes Airbnb data from an Airbnb API.

Mashvisor’s Property Finder

What sets the Property Finder apart from other real estate databases are its machine-learning algorithms and predictive analytics capabilities. Essentially, the database will show you the most profitable properties first, as well as properties you are most likely to want to purchase, based on your preferences. So we don’t just show you data but analyze it for you to help you make lucrative real estate investment decisions.

Off Market Property Data

The Property Marketplace is another source of real estate data that any investor will want to get his/her hands on. Sometimes, the best deals just aren’t on the market yet. That’s why we created the Property Marketplace, so investors could find off market properties before the bigger competitors purchase them.

See also: 15 Best Ways to Find Off Market Properties

Another feature of the Marketplace is the access to homeowner data. This gives investors an edge when striking deals – you can get in touch with motivated sellers quickly, before their homes go on the market.

#2. Real Estate Market Data

Information on investment properties is not the only kind of real estate data you’ll need to be a successful investor. Before you begin your property search, you must have access to real estate market data. Market-level data tells you what states, cities, and neighborhoods have the highest performing housing markets, and you’ll need this kind of data to make a profitable investment.

State and City Housing Market Data

To gather real estate market data on the state and city level, you can visit Mashvisor’s real estate blog for articles on housing market trends and top places for buying a rental property. This is a great place to start when trying to narrow down profitable locations. Our articles provide information like housing statistics and market predictions based on current data and research.

Neighborhood Data

Once you’ve found a city you’d like to invest in, you’ll need to take your real estate market analysis further by looking into individual neighborhoods. Just because a city performs well on average doesn’t mean that every neighborhood within it is profitable.

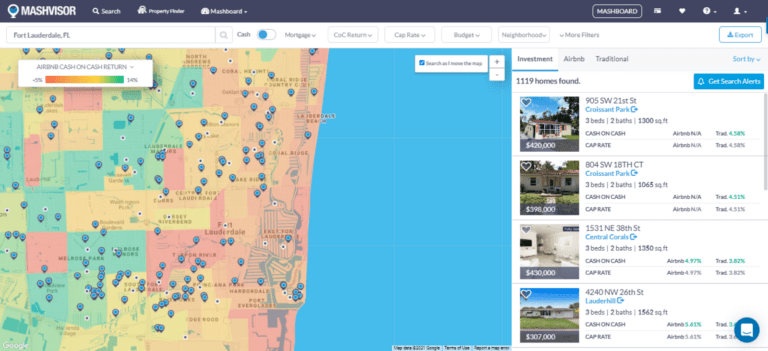

To find the neighborhood data you need, use Mashvisor’s Real Estate Heat Map. This tool will allow you to search within a city to find the most profitable neighborhoods within your price range. It will also tell you which real estate investment strategy is most profitable for that location: Airbnb vs. traditional.

Mashvisor’s Real Estate Heat Map

The Heat Map will provide you with the following data:

- Traditional and Airbnb cash on cash return

- Airbnb occupancy rate

- Traditional and Airbnb rental income

- Listing price

#3. Real Estate Investment Data

So what happens when you’ve found a property you can afford within a profitable neighborhood? You’ve gotten all the data you need to make a solid investment decision, right?

Not quite. There’s still one more piece of real estate data you need, and that comes with investment property analysis. Just like you have to analyze cities to find the profitable neighborhoods, you must analyze neighborhoods to find profitable properties. Just because a neighborhood is profitable on average doesn’t mean that every property in it will provide positive cash flow and good return.

Investment Property Data and Analysis

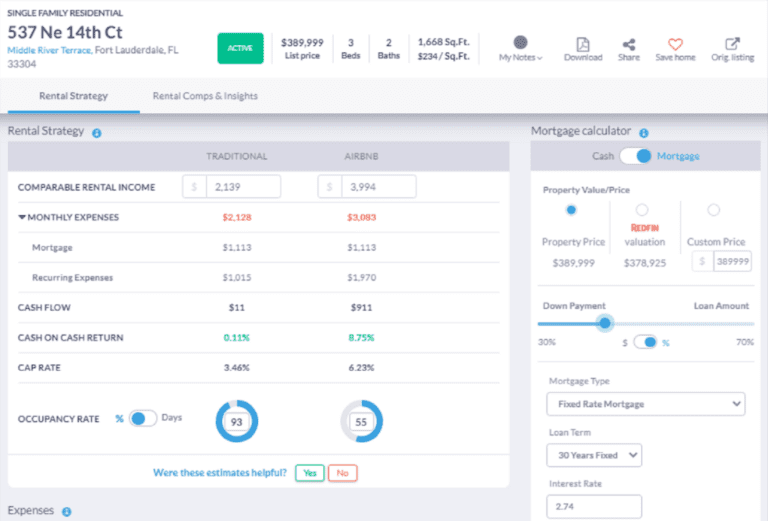

For this we use the Rental Property Calculator. This real estate investment tool will automatically tell you whether or not a property is worth investing in. The Calculator provides metrics such as:

- Projected rental income

- Estimated expenses

- Cap rate

- Cash on cash return

- Cash flow

- Overall return on investment

Related: How to Find Positive Cash Flow Properties

Mashvisor’s Rental Property Calculator

In addition, the Rental Property Calculator also acts as an Airbnb Calculator, offering Airbnb analytics and a glimpse into a property’s optimal investment strategy. With this tool, you’ll know whether a property performs best as an Airbnb or a traditional rental, and you will know what kind of income and return on investment you can expect with each strategy.

See also: Airbnb Data: What Real Estate Investors Need and Where To Get It

In addition, the Calculator will give you access to real estate comps for each property in our database. You can use this real estate data to get a sense of how your property is valued against similar properties, so you’ll never pay more than what a property is worth. Furthermore, we will provide you with a list of traditional and Airbnb rental comps to help you find out how much you can charge for rent.

The Most Convenient Real Estate Data Source

When it comes to finding convenient real estate data sources, Mashvisor has you covered. We provide every kind of real estate data that investors need to be successful, allowing you to make faster and smarter investment decisions.

From downloadable data files to our interactive online platform, you can easily access your real estate data on the go in your choice of format. Say good-bye to hours of searching through websites and using real estate investment spreadsheets. Say hello to your new best friend: Mashvisor.

While many investors turn to real estate agents with MLS access for their real estate data, there are several problems with this approach:

- You will end up waiting on your agent to get back to you.

- You are only getting the property recommendations they give you.

- You are limited to what is listed in the MLS. Agents don’t usually know how to find off-market properties.

The solution? Taking control of your investment strategy. This means gaining access to Mashvisor’s real estate investment software. We instantly show you the best properties on and off the market.

No more waiting on agents.

No more depending on only what your agent wants to show you.

No more guessing which properties are most profitable because Mashvisor’s real estate investment tools provide real estate data analytics and automatic calculations.

To learn more about how Mashvisor can help you find and analyze profitable investment properties, schedule a demo.

Mashvisor provides state of the art real estate investment tools to help you make wise investment decisions and walk you through your investment journey. Please sign up here to start analysing the investment opportunities in both short trem and long term rental industry.