When learning how to invest in real estate, determining the ROI on rental property is often the first one investors should look into.

If you are wondering how to invest money to generate cash flow and build wealth, real estate investing is an excellent option. However, finding a profitable investment property is not as easy as it may seem. Before you decide to purchase an income property, you need to do a lot of research and run the numbers.

The most important metric to look at when analyzing profitability is the expected return on investment (ROI). For instance, investors who are planning to invest in rentals should know the expected ROI on rental property to determine whether or not such income property will make a good investment.

In fact, one of the reasons beginner property investors lose money is because they don’t know the answer to the question “What is a good return on investment?” To avoid taking unnecessary risks, it’s vital for investors to know what “return on investment” means and what is considered a good return on investment.

What Is Return on Investment?

Return on investment is a metric used to measure the performance of an investment property based on the ratio of the annual returns of the property relative to the total cost of the investment. The value of ROI is typically expressed as a percentage.

Business owners and investors calculate the ROI of an investment as a way to determine its profitability. The return on investment is a way to measure success over time, which can be extremely important in making immediate and future investment decisions.

Why Is It Important to Know the ROI on Rental Property

For rental property investors, being able to calculate ROI on rental property is exceptionally beneficial. It can help investors better understand how well an investment property is doing, and it can also tell which areas need improvement—both of which are crucial for a successful investment.

A wise investor should try to find out the return on investment of a particular income property before investing in it. If you’re planning to invest in rental properties, make sure to calculate the ROI of the property that you’re interested in to determine its profitability. Knowing the ROI on rental property before actually buying it can help prevent making wrong investment decisions.

How to Calculate ROI on Rental Property

It’s important to note that ROI can be used to determine the profitability of any investment, including real estate, stocks, bonds, and any business. For real estate investments, calculating ROI on rental property can be tricky as the manner in which you acquire the property can affect the computation. For instance, your return on investment may be different if you purchased the property entirely in cash or with a mortgage.

In general, investors calculate the return on investment by dividing the annual returns by the total cost of investment. Then convert it into a percentage by multiplying it by 100.

Here is the general return on investment formula:

ROI = (Annual Returns / Cost of Investment) × 100

The above equation is typically used for fixed investments such as stocks and bonds. However, computing the ROI on rental property is more complicated than the formula above, because you need to take into consideration several factors, such as the repairs and maintenance costs, property management costs, interest expenses, and the overall financing costs.

Related: ROI Calculation Formula: All You Need to Know About It

What Is a Good Return On Investment?

Before deciding “what is a good return on investment percentage”, you should keep in mind that ROI is also a measure of risk. The higher the ROI, the higher the risk. It means that properties with the highest ROIs aren’t necessarily the best investments, depending on your risk tolerance. Therefore, you’ll often need to stick to a particular optimal ROI range.

If you ask around, however, you will find out that what real estate investors consider to be a good return on investment range varies widely. It is because the answer to the question “What is a good return on investment” actually depends on a number of factors such as location, property type, the risk associated with the investment, etc. To determine if an ROI on rental property is good, you need to consider all the said factors.

If you want to know what is a good ROI on rental property, you need to understand that it will ultimately depend on your financing method (whether you will purchase the property through cash or with a mortgage). Some investors with huge financial resources opt to purchase rental properties with cash.

However, most beginner and savvy investors tend to finance their income properties with a mortgage. Using a mortgage increases their return on investment (by reducing their initial cost of investment) and gives them leverage to acquire more rental properties within a shorter time than they would take by buying fully in cash.

Consequently, investors need to consider their financing method when answering the question: “What is a good rate of return on investment?”. Depending on your method of financing, you’ll need to use a different metric to calculate the expected rate of return and determine whether a rental property will make a good investment or not.

What Is a Good ROI on Rental Property Bought With Cash?

What is a good return on investment when buying a property with a cash?

If you are buying rental property with cash, you’ll use cap rate to calculate your ROI. Cap rate (capitalization rate) is the ratio of the property’s net operating income (NOI) to its fair market value.

Here’s the cap rate formula:

Cap Rate = NOI / Fair Market Value × 100

To get the net operating income formula, you need to deduct the annual rental expenses from the annual rental income. You can use the formula below:

NOI = Annual Rental Income – Annual Rental Expenses

So, what is a good ROI in real estate based on the cap rate formula? Most real estate experts suggest a cap rate above 4% is optimal. However, as we mentioned earlier, return on investment will vary depending on location, property type, etc.

Therefore, when comparing cap rates for multiple income properties, make sure that they are in the same market and are similar in terms of size, property type, number of bedrooms/bathrooms, etc. Comparing the cap rate of a rental property with the median cap rate for similar properties in the area will show you if it’s a good deal or not. Generally, the average cap rate in the area you are considering should be the minimum target when buying a rental property.

Related: Is It Better to Buy Investment Property With Cash?

What Is a Good ROI for a Mortgage-Financed Rental Property?

If you are financing an income property using a mortgage, the ROI formula that you need to use is cash on cash return. For instance, if you buy a short-term rental property through financing, using the cash on cash return measure can help you determine what is a good ROI on vacation rental property, taking into consideration the amount of money that you initially invested.

In simple terms, cash on cash return estimates how much profit the property will generate relative to the actual amount of cash that was put into the property. It does not include the amount of money borrowed to finance the purchase. Unlike the cap rate formula, the cash on cash return formula also takes into account the financing costs, costs of repairs, and other initial expenses paid for in cash.

The cash on cash return is calculated by expressing the property’s annual pre-tax cash flow as a percentage of the total cash invested.

You can use the following cash on cash return formula:

Coc Return = Annual Pre-Tax Cash / Total Cash Invested × 100

The annual pre-tax cash flow is basically NOI less the financing costs.

So what’s a good return on investment based on the cash on cash return formula? A rental property’s cash on cash return will often be higher than its cap rate because of the reduced cost of investment. It is because you only take into account the actual amount of cash invested, which is usually the down payment and mortgage closing costs. Therefore, even the range for “good” cash on cash return is usually higher.

However, the amount of a “good” cash on cash return is generally subjective. Just like the cap rate, a good cash on cash return will also depend on several factors, including the location of the property, your rental strategy, and how the market performs. Most real estate experts would agree that a cash on cash return of between 8% and 12% is a good range. In some real estate markets, however, a cash on cash return of around 3% to 4% is considered acceptable.

Related: All You Need to Know About a Mortgage for Rental Property

Mashvisor’s Return on Investment Calculator

Now that you have some insight into what makes a good return on investment, let’s discuss how to calculate ROI. Memorizing ROI formulas and doing calculations manually is definitely hectic and time-intensive, especially if you are analyzing multiple properties.

Keep in mind that if you do the calculations manually, you’ll need to do your own research to find out the important information needed, such as the annual income, expenses, fair market value, and interest rates. That is why real estate experts do not recommend doing manual computations because this can be very laborious and it can eat up a lot of your time.

Fortunately, there are several real estate investment tools available that can help you calculate the ROI on rental property without having to go through all of these tedious tasks. If you are looking for a real estate investment tool to do ROI calculations accurately and in a matter of minutes, you can use Mashvisor’s return on investment calculator.

Our rate of return calculator doesn’t just allow you to compute REO metrics but also gives you access to a wide range of useful real estate data such as cash flow, traditional or Airbnb occupancy rate, rental comps, optimal rental strategy, and more. With all this data, you’ll be able to make smarter investment decisions. Also, keep in mind that ROI is not the only factor in deciding whether a rental property is a good investment.

Mashvisor will also help you do an in-depth real estate market analysis to find the best places to invest in real estate in the US based on average ROI. This is something you need to do even before you do your property search and investment property analysis.

To easily find the best cities for real estate investment, check for city data on Mashvisor’s blog. After identifying a profitable city to invest in, you need to narrow down your market analysis to the neighborhood level.

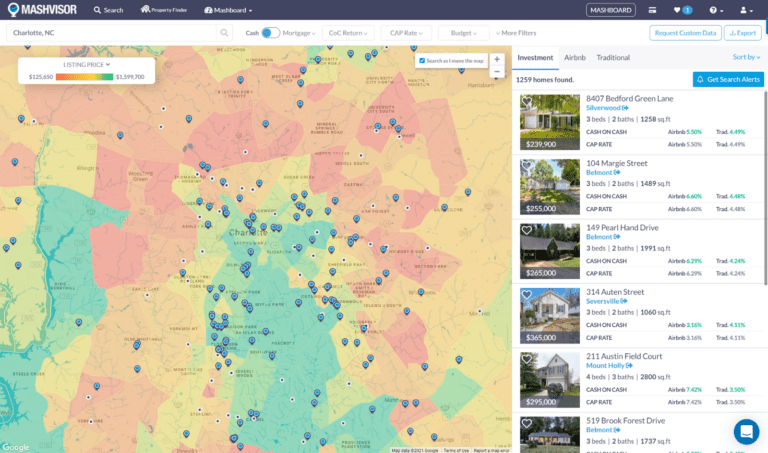

You can conduct an in-depth neighborhood analysis using Mashvisor’s real estate heatmap. The heatmap tool allows you to easily identify the best-performing neighborhoods in your city of choice, based on average cash on cash return and other important real estate metrics.

The Bottom Line

If you want to know whether or not a rental property for sale is a good investment, you need to calculate the expected return on investment. However, when it comes to answering “What is a good return on investment ?”, the answer depends on a number of factors including method of financing, location, property type, and risk tolerance. Be sure to use Mashvisor’s tools to find markets and rental properties with a good return on investment in the US.

Mashvisor provides state of the art real estate investment tools to help you make wise investment decisions and walk you through your investment journey. Please sign up here to start analysing the investment opportunities in both short trem and long term rental industry.