The idea of buying an investment property, just one, is daunting enough on its own. So what about buying multiple properties? What about being ambitious enough to even wonder how to buy multiple rental properties in a SINGLE YEAR?

It sounds crazy but in reality, it’s a great real estate business plan to accelerate making more money with investment properties in a shorter time frame than is typical with real estate investing. Now, this may all be true, but it’s not easy, of course. Just because something isn’t easy, that doesn’t mean there isn’t a tangible way to get it done! So, how to buy multiple rental properties in a single year? Let’s take a look.

How to Buy Multiple Rental Properties- The Challenges and Solutions

Let’s break down a few of the challenges investors face when trying to buy multiple properties in a short period of time and how to overcome each one.

Where Do You Get the Cash to Finance Multiple Investment Properties?

Herein lies the biggest issue when addressing how to buy multiple rental properties in a single year: the cash. Keep in mind, when we say “multiple rental properties”, we aren’t talking about 100 or even 10 investment properties. In reality, it’s more likely that you will manage to buy 2, 3, maybe even 4, in a single year. Still, that’s 4 times the rental income of just one rental property. But it’s also 4 times the cost.

How to Buy Multiple Rental Properties-Solution

This doesn’t have to be a wall, however, if you know all about your investment property financing options. The best real estate investment advice, in this case, is to work with a mortgage broker. This professional will scour mortgage lenders for you, finding the ones that are willing to finance more than one long term rental property. A beginner real estate investor might be thinking that a mortgage broker is just one more expense. While it will cost you, the service of a mortgage broker is invaluable when planning out how to buy multiple rental properties in one year.

Related: Rental Property Mortgage: The Ultimate Guide to Getting Approved

If you still rather go it alone, don’t be discouraged when the first mortgage lender tells you that they won’t finance multiple investment properties for one real estate investor. Simply keep looking for a mortgage or portfolio lender who prefers financing real estate investments in bulk. They exist.

What about the down payment for investment property? This is where your own skills come into play. Again, a mortgage broker can help in finding low minimum down payments and investment property mortgage rates but at the end of the day, you will have to save up for the down payment and cash reserves for any real estate investment loans you apply for. Sound difficult? With this guide, it doesn’t have to be.

Don’t forget about that credit score! Read: How Can You Improve Your Credit Score for Financing Investment Properties?

Do You Know How Much Time an Investment Property Search Takes for One Property…

let alone multiple rental properties? Months. 3 months on average to be exact. And even then, many beginner real estate investors only end up with an okay investment property- one that may have positive cash flow, but not very much. So sometimes it feels like an investor has hit the jackpot when he/she does find that positive cash flow property that will make them rich. How can you repeat these results with your investment property search every time without it dragging on for years on end?

Related: How to Find Investment Property for Sale Quickly and Easily

How to Buy Multiple Rental Properties-Solution

Now, we know the process of buying an investment property is a long one, from contacting the seller, to finalizing the loans, to negotiating closing costs. It can be hard to cut that time down. That’s why it’s even more important to cut down the time of the investment property search. What’s more important still when it comes to figuring out how to buy multiple rental properties? Not cutting down on the ROI producing quality of these real estate investments.

I can share with you the best way I know how to find multiple investment properties in only a few minutes. It sounds ridiculous to the seasoned real estate investor maybe, but that’s because many people are still trying to find investment property in the old fashioned way that, as mentioned, takes months. The US housing market is vast, filled with great choices for real estate investing and the not so great choices. That’s where technology comes into play.

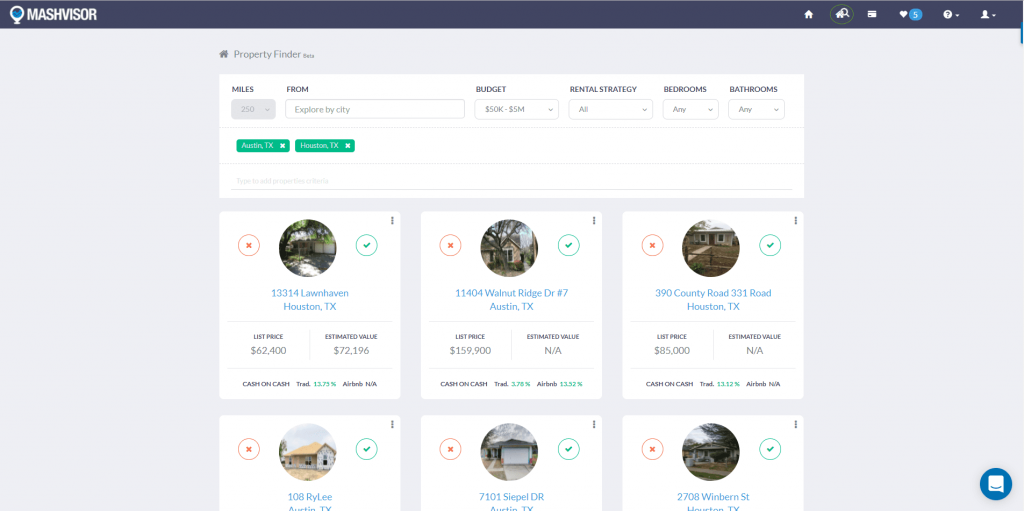

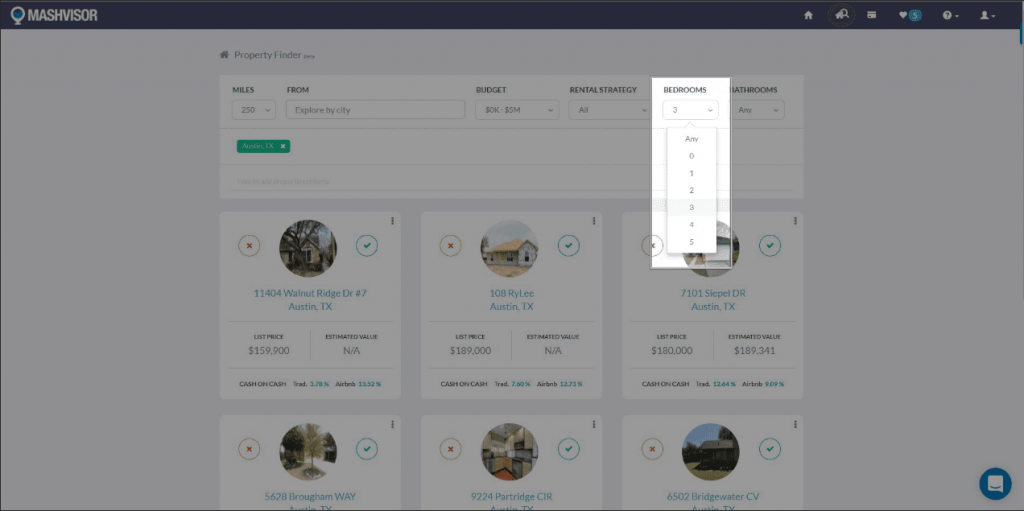

Searching for investment properties online is the best way to find a real estate investment. However, just looking at real estate listings available online is not going to suffice in terms of market research, investment property analysis, and comparative market analysis. What you need is real estate investment analysis software. Something along the lines of the ultimate property finder tool- Mashvisor’s Property Finder Tool. Take a look:

With a powerful Property Finder Tool, you can choose a few cities that you are considering for where to invest in real estate. This first step is important, especially when wondering how to buy multiple rental properties. Why? Investing in different real estate markets can lower the risk of your investments with the right choice of location.

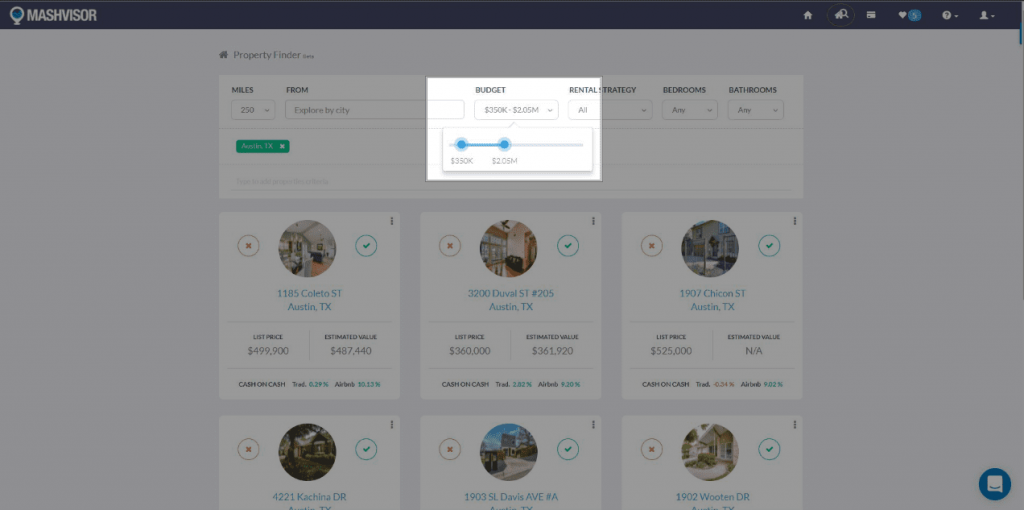

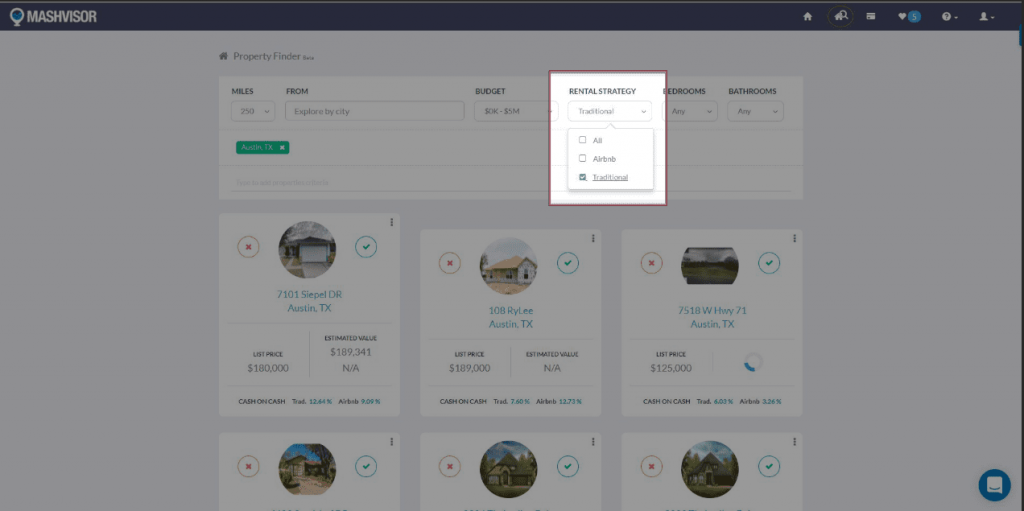

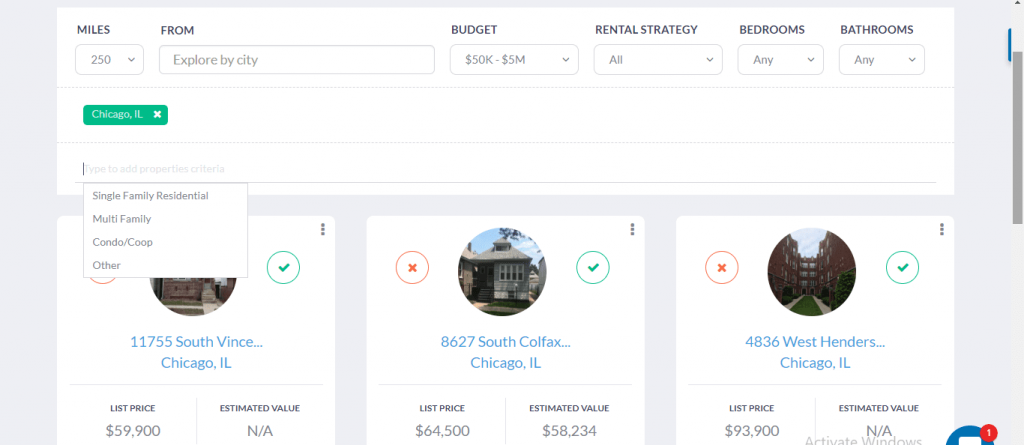

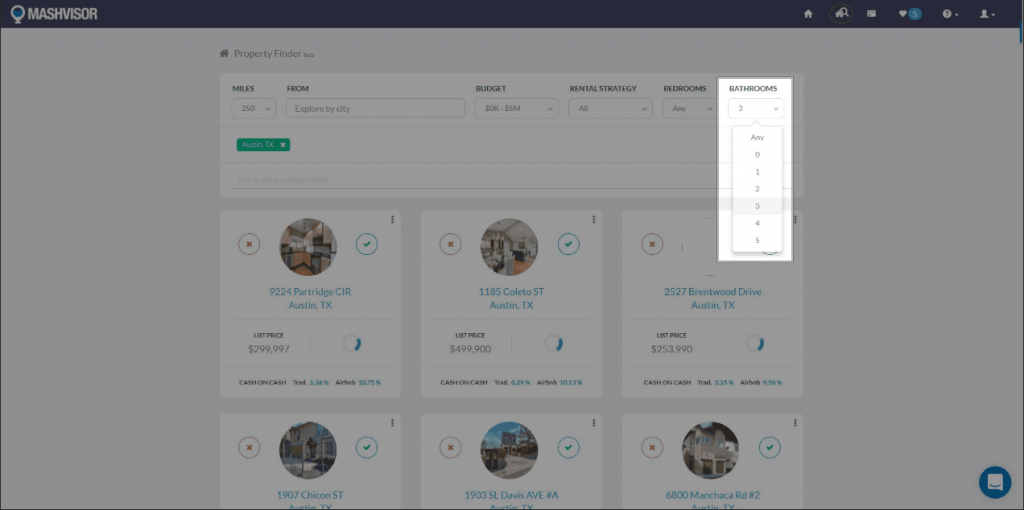

Next, a property investor can set a few more choices for criteria:

Budget for Investing in Real Estate

Preferred Rental Strategy (Airbnb or Traditional)

Preferred Rental Strategy (Airbnb or Traditional)

Type of Real Estate Investment Property (Single Family Home, Multi Family Home, etc.)

Type of Real Estate Investment Property (Single Family Home, Multi Family Home, etc.)

Number of Bedrooms and Bathrooms

Number of Bedrooms and Bathrooms

And what does this real estate investment tool return? The top performing properties with the highest return on investment (cash on cash return) in the locations of interest. Basically, in one sit down, you can find the best real estate investments that will make you money.

The Investment Property Analysis and Comparative Market Analysis Take Even Longer

Finding a property with the promise of a great return on investment is one thing. But having the confidence to actually invest in real estate property is another. This requires in-depth analysis- investment property analysis to ensure you’re getting a good ROI and comparative market analysis to make sure the price is right.

Manual calculations, spreadsheets, data for real estate comps, these can all be a burden for an investor looking for answers to how to buy multiple rental properties in a single year. So, skip them? No, that’d be a terrible rookie mistake that would leave a hole in your pocket, make that 4 holes for 4 rental properties.

How to Buy Multiple Rental Properties- Solution

You may have guessed it, but Mashvisor has another real estate tool to solve this issue of how to buy multiple rental properties in a year: the investment property calculator. This all-in-one tool, which also serves as an Airbnb calculator, works alongside the Property Finder Tool. Once you select an investment property, the calculator will provide further calculations and data for occupancy rate, rental income, cap rate, expenses, and more. Everything becomes more accurate when a property investor adjusts any predicted values to ones found during research or inquiry from the seller or seller’s agent.

For a closer look at what this tool can do, read: Rental Property Calculator: Why Every Real Estate Investor Needs One

Or Take the Shortcut for How to Buy Multiple Rental Properties

Now, we know when you are thinking about how to buy multiple rental properties, you want to actually purchase and own investment properties. You want to realize the full benefits of having a few rental properties in your real estate investment portfolio. However, if everything we have talked about above hasn’t encouraged you and convinced you that it is, in fact, possible to buy a few rental properties in one year, there is an alternative way.

Consider investment strategies like real estate crowdfunding or REITs. These routes typically allow a real estate investor to invest in a portfolio filled with multiple rental properties. Here’s why this can be a good alternative:

- Invest with less cash (sometimes as little as $500)

- No need to search for profitable investment properties, the company would have done that for you

- No need to worry about loan approvals or shopping around for mortgage lenders

- Don’t have to manage rental properties yourself or become a landlord

Those are just a few benefits of these types of real estate investing. The only thing that may take time here is finding the right crowdfunding site or REIT company for you. While your ROI may not be as high as when you have full property ownership, it’s a good alternative nonetheless.

We have presented you with two real ways for how to buy multiple rental properties in a single year. Either use the right tools and professionals that are at your disposal or go the alternative route. Either way, it is possible to have a few rental properties under your belt by the end of one year and be comfortably making money in real estate by then.

Need more help? Read: 5 Tips for Buying Multiple Investment Properties