Many real estate investors buy vacation rental properties to earn a passive income. However, the global pandemic had caused a negative impact on the economy and most vacation rental owners suffered these implications tremendously, especially during the peak of this health crisis. You may be asking yourself, “should I buy a vacation rental property? Is now a safe time to invest in vacation rentals?”

While more and more people are getting vaccinated against COVID-19, the lockdowns are now being lifted gradually and the country is slowly opening up the economy. Because of this, we can expect the tourism industry to flourish again this year and beyond. With this comes the demand for vacation rental properties.

If you’re new to real estate investing, choosing to buy vacation rental is a great place to start. If you already own a traditional rental property, it’s important to note that buying a vacation rental is not like traditional real estate investing. There are key differences in the process that you need to be aware of.

In this article, we will guide you through the step-by-step process of how to buy a vacation rental property and other important things that you should know before making an offer.

Here are the seven easy steps for buying a vacation rental property:

1. Choose a Suitable Location for Vacation

The location of a property is one of the most important factors that you should consider first—after all, where you choose to invest will have a major impact on your income potential. Do not just select a state or a city to invest in—you should also consider the region or neighborhood within your chosen city.

When you buy a vacation rental property, the most ideal location is the one that is near most tourist spots. Additionally, the best place to buy vacation rental properties is where it’s close to the most basic amenities, including public transport, restaurants, shopping malls, and convenience stores.

7 Best Places to Buy Vacation Rental Property

The best vacation rental properties to buy are those that are appealing to renters. The ideal places are close to attractions such as art museums, national parks, theme parks, casinos, lakes, mountains, and beaches.

When choosing a location, you have to consider certain factors such as the number of short-term rental listings available (to know your competition), Airbnb cap rate, occupancy rate, and average monthly Airbnb income.

Before you decide to buy vacation rental properties, it’s also essential to check the local short-term rental laws regulating the state or city of your choice. Make sure that it’s legal to rent out on a short-term basis in your chosen city.

According to Mashvisor’s data, here is a list of seven of the best places in the US to buy vacation rental property, based on Airbnb cash on cash return:

Elkton, MD

Elkton is a prominent historical town located near the Chesapeake Bay in Cecil County, Maryland. It is home to the Elk River, which can be seen at the head of the bay. Colonial architecture is prominently displayed all around Elkton, making this a go-to place for those tourists who want to take a step back in time back to the colonial days.

- Number of Airbnb Listings: 13

- Average Monthly Airbnb Rental Income: $5,356

- Airbnb Cash-on-Cash Return: 8.75%

- Airbnb Daily Rate: $211

- Airbnb Occupancy Rate: 76.31%

- Walk Score: 60

2. St Robert, MO

St. Robert, home to the Onyx Mountain Caverns National Historic Site, is a gateway community to the United States Army Fort Leonard Wood. Most tourists visiting St. Robert are those who are attending Fort Leonard Wood Soldier graduation ceremonies, conferences, and other special events.

- Number of Airbnb Listings: 17

- Average Monthly Airbnb Rental Income: $2,619

- Airbnb Cash-on-Cash Return: 8.65%

- Airbnb Daily Rate: $110

- Airbnb Occupancy Rate: 66.12%

- Walk Score: 43

3. White Settlement, TX

White Settlement in Tarrant County, Texas is home to several tourist attractions, including the Splash Dayz WaterPark and Conference Center, Texas Civil War Museum, White Settlement Historical Museum, and different community parks. This area is also near Fort Worth, where you can find museums for arts, science, and history.

- Number of Airbnb Listings: 35

- Average Monthly Airbnb Rental Income: $3,784

- Airbnb Cash-on-Cash Return: 8.49%

- Airbnb Daily Rate: $162

- Airbnb Occupancy Rate: 63.34%

- Walk Score: 40

4. Springfield, LA

Springfield, Louisiana is a historic town located in Livingston Parish, which is close to the national parks and museums. One of its famous tourist attractions is Louisiana’s swamplands. Visitors take a guided swamp tour to see alligators—some enjoy fishing, kayaking, camping, and other outdoor activities at Tickfaw State Park.

- Number of Airbnb Listings: 10

- Average Monthly Airbnb Rental Income: $3,236

- Airbnb Cash-on-Cash Return: 8.46%

- Airbnb Daily Rate: $224

- Airbnb Occupancy Rate: 53.4%

- Walk Score: 33

5. Pontiac, MI

Pontiac is a city in Oakland County, Michigan. It is a smaller but beautiful upcoming tourist destination. It is home to several tourist attractions and offers a variety of art and cultural activities that will give you an insight into the city’s history, traditions, and artwork.

- Number of Airbnb Listings: 12

- Average Monthly Airbnb Rental Income: $2,542

- Airbnb Cash-on-Cash Return: 8.34%

- Airbnb Daily Rate: $125

- Airbnb Occupancy Rate: 58.3%

- Walk Score: 79

6. Levittown, PA

Levittown is a census-designated place in Bucks County, Pennsylvania. It is recognized as one of the largest suburbs of Philadelphia in Pennsylvania. It is close to tourist attractions such as the Swaminarayan Temple, Historic Bolton Mansion, Driftwood Water Adventure, Sesame Place, and more.

- Number of Airbnb Listings: 15

- Average Monthly Airbnb Rental Income: $4,017

- Airbnb Cash-on-Cash Return: 8.33%

- Airbnb Daily Rate: $132

- Airbnb Occupancy Rate: 73.67%

- Walk Score: 35

7. Ladson, SC

Ladson is a census-designated place in Berkeley, Charleston, and Dorchester counties in the state of South Carolina. Tourists would love to see the top sights near Ladson, including Middleton Place, Colonial Dorchester State Historic Dite, Gahagan Park, Crowfield Plantation Lake, and more.

- Number of Airbnb Listings: 16

- Average Monthly Airbnb Rental Income: $3,511

- Airbnb Cash-on-Cash Return: 8.14%

- Airbnb Daily Rate: $156

- Airbnb Occupancy Rate: 62.31%

- Walk Score: 24

2. Know the Local Short-Term Law & Regulations

Each city and municipality has its own short-term law and regulations that vacation rental property owners need to comply with. In some areas such as New York City, you can’t rent out a full residence for less than 30 days (unless the homeowner is also staying in the home).

In Santa Monica, renters must live on the property during the renter’s stay—in addition to registering for a business license and collecting a 14% occupancy tax, payable to the city.

Some of these short-term rental laws and rules may seem really strict. However, most areas in the U.S. offer more flexible regulations when it comes to vacation rentals. Before you buy vacation rental properties, it’s best if you can work with a trusted realtor to help you understand the short-term law and regulations in your community.

3. Conduct a Comprehensive Real Estate Market Analysis

As soon as you have determined your potential locations, the next important step is to conduct an in-depth market analysis to closely examine the market and demand.

Before you buy vacation rental properties, you should understand that the demand for vacation rentals is different from the demand for traditional rentals. While most traditional renters rent for a long-term basis, short-term rentals are usually seasonal and they have fluctuating demands throughout the year.

A detailed Airbnb data analysis in your chosen location can help you determine the possible income you can earn from a vacation rental. Consider important factors such as the property’s proximity to popular attractions, accessibility, how the tourism demands peak and fall, the potential average income, and if the Airbnb cash flow can offset the operating expenses.

Also, consider if the demand is consistent enough to generate sufficient income for the vacation rental investment to be sustainable.

Analyze the vacation trends and know which property types are popular in a particular area, then conduct some market comparison. Determine the comparables so you can have an overview of how the market performs for a particular type of property, depending on the season.

It’s also important to know your potential competitors and analyze how they fare. Identify a possible rental price range to determine a reasonable projected income from the property.

Fortunately, our Mashvisor tools, including Mashvisor’s Airbnb revenue calculator, can provide you with the necessary comprehensive market data and analysis to help you get started. Sign up for Mashvisor now and get 15% off.

4. Conduct an Investment Property Search

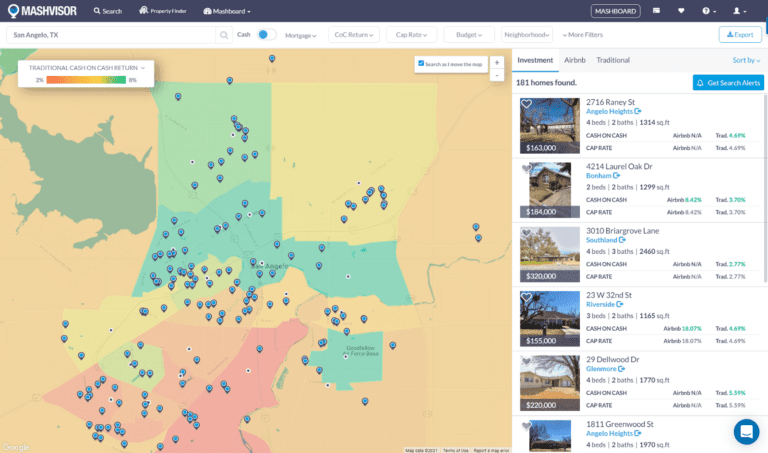

If you don’t know where to buy vacation rental property, a quick online search can help you get started. There are online platforms that offer quick and easy online searches to help you find vacation rentals to buy. For instance, Mashvisor offers a simplified search tool to allow investors to find Airbnb investment properties and optimize their rental performance.

Mashvisor’s interactive property and neighborhood insights aim to deliver informative real estate analytics so that you can make informed decisions in your investment before you buy vacation rental properties. Our vacation rental data and analysis includes key metrics and essential information that can help you with your Airbnb research, such as:

- Airbnb pricing

- Airbnb rental income

- Rental property expenses

- Optimal rental strategy

- Airbnb occupancy rate

- Airbnb cash on cash return

- Airbnb cap rate

- Airbnb rental comps

- Seasonality trends

- Revenue potential

- Cost assumptions

- Cash flow calculation

- Financial and purchase investment analysis

5. Calculate Your Income & Expenses

Once you identify a potential property, you need to make sure you can afford it and it can generate enough cash flow even during low season and when it’s vacant. You need to know the occupancy rates for a vacation rental in a particular location so you can calculate your potential income. Local property managers, real estate agents, and comprehensive online platforms such as Mashvisor can help you find this information.

Your income will depend on the area where you buy vacation rental. To offset your expenses, most vacation rental investors set their weekly rental rate at 10% to 20% higher than their expected monthly mortgage payments—those in high-demand locations can set their rates even higher.

This is why it’s important to do your market research and analyze comparables. It’s important to strike a balance of ensuring that you earn sufficiently each month, but you also don’t want to scare away prospective guests.

Aside from your mortgage, you also need to know the additional costs and other expenses that come with owning a vacation rental property to find out when you can get your Airbnb return on investment. You need to adjust your income to cover more than your expected mortgage and operational expenses, as well as factor in the inevitable downtimes, especially during the off-peak season.

The following are the expenses you need to expect and understand before you decide to buy vacation rental properties:

- Mortgage: This is your expected monthly payment if you decide to take a loan to finance the purchase of your property.

- Closing costs: This is an additional expense when you purchase your property through a mortgage. They typically include appraisal fees, home inspection fees, attorney’s fees, loan origination fees, and title search fees. The total closing cost could range between 3% to 6% of the purchase price.

- Property taxes: These are the taxes paid on property owned by an individual or other legal entity, which are typically tax-deductible. To take advantage of the most tax deductions available for a vacation rental, work with a certified public accountant or find property tax information online.

- Rental income taxes: These are the taxes collected on the average gross annual income on a rental property. Rental income taxes may vary depending on the location of your vacation rental.

- Occupancy taxes: These are taxes that you pay anytime you rent out a bed, room, or any other space but are usually charged to the guests. They are also known as hotel tax or lodging tax, which generally range from 5% to 19% per night, depending on your state.

- Property insurance: This protects your property from theft, fire, floods, earthquakes, and other risks. The type of coverage you need depends on where your property is located, how often you will rent the property, and how often you will use it yourself.

- HOA fees: If investors buy vacation rental properties in a condominium or a home in a planned community with common areas, you will be required to pay HOA fees, which are usually charged on a monthly basis. The amount will vary based on property type, size, location, and amenities.

- Utilities: These include expenses for heating, cooling, electricity, water supply, and gas for cooking. The costs will vary depending on how you and your guests use the property.

- Property management fees: If you choose to hire a property manager to handle the day-to-day operation of your vacation rental, you need to factor in their professional property management fees. These fees vary based on the services provided by the management company, which are usually charged as a percentage of the rent collected.

- Marketing costs: These are the cost you need to pay for advertising your property on both online and offline platforms to ensure that it gets the right amount of exposure.

6. Finance Your Property

The next step for investors who plan to buy vacation rental properties is to decide which financing method to choose. You can typically finance a vacation rental property with a variety of loans, such as the following:

-

Conforming Loans

The qualification requirements for a vacation rental property are stricter than for a primary residence but more lenient compared to a traditional rental property. Lenders know that vacation rentals are seasonal and borrowers are not entirely dependent on rental income to pay the mortgage. Typically, a 20% down payment and a credit score over 680 are required.

-

Portfolio Loans

If you plan to buy multiple vacation rental properties or finance a vacation property with multiple units, a portfolio loan may be the best option. This is designed for investors planning to buy vacation rental properties who are looking for lower personal qualifications and fewer property requirements.

-

Multifamily Loans

If you need to finance a two- to four-unit multifamily vacation property or an apartment building with more than four units, a multifamily loan may be right for you. Your options include conventional mortgages, government-backed loans, portfolio loans, and short-term multifamily financing.

-

Short-term Loans

There are two options for short-term loans: a hard money loan and a bridge loan. Hard money loans are a good option if you are buying a property that needs to be rehabbed before you refinance it with a permanent loan.

Hard money lenders look at the after repair value (ARV) of the property rather than your credit standing. Bridge loans can be used as interim financing, which you can use to finance a property before you get approved for long-term financing.

In most cases, getting a pre-approval for a mortgage is an advantage especially in popular markets because it’s a sign that you are serious about buying the property. A pre-approval letter will also let the sellers know that you’ll be buying a vacation home based on a credible financing offer.

Here are some important requirements for a mortgage pre-approval:

- Identification: Be ready with your identification documents and other necessary information, including your Social Security number, driver’s license, and proof of current address

- Proof of income: This refers to your most recent payslips or records of tax returns

- Good credit: Most lenders require a credit score of 620 or higher. Some lenders approve you for a loan even if you have a lower score—you’ll just be required to make a higher down payment

- Employment verification: If you are employed, most lenders will require the name and contact details of your employers

- Proof of assets: You may also be required to show your proof of assets such as your bank statement, investments in bonds, stocks, retirement savings, mutual funds, and life insurance

How to Buy a Vacation Rental With No Money Down

Investors who want to buy vacation rental properties but have little to no money for a down payment may consider the following options:

-

Get a Home Equity Line of Credit (HELOC) or Home Equity Loan

If you already own a property with equity, you can use that property’s equity to finance your vacation rental through a home equity line of credit (HELOC) or home equity loan. This type of financing allows you to take out a line of credit or loan up to 80% of your home’s equity.

-

Purchase the Property Through Seller Financing

Seller financing or owner financing is a form of financing where the seller or owner acts as the lender for the buyer instead of them going to a bank or lender for traditional financing.

-

Assume a Seller’s Mortgage

You can buy vacation rental with no money down by assuming a seller’s or owner’s mortgage. Depending on your agreement with the seller, the process is just as simple as buying the property based on the terms of the owner’s current mortgage.

7. Market Your Property

After you buy vacation rental property, the next important step is to plan effective marketing strategies and advertise your property on both online and offline platforms so that it can get enough exposure. This is essential if you want your property to get enough bookings so you can quickly realize your Airbnb return on investment.

There are several booking sites—such as Airbnb, VRBO, HomeAway, and VacationRentals.com—that allow vacation property owners to get as much exposure on their properties with minimal fees.

Should You Hire a Property Manager?

Once you buy vacation rental property, you have the option to manage it yourself or hire a professional property manager to do it for you. As mentioned, property managers charge fees and a percentage of the rent for their services.

You should consider this especially if you need to minimize your overall cost. If you choose to manage the property yourself, it’s best if you live close to the property. You may also need to hire care maintenance, cleaners, and other helpers, especially during the peak season.