If you are someone looking to get into the real estate investing business or are currently an investor, rental properties in real estate investing can be one of the most profitable choices for investors. In rental properties, you earn your income by collecting monthly rent from the tenants who live in your properties.

Before you can even start collecting any rent from your tenants you need to locate a property to invest in, and figure out a real estate investment strategy that will ensure you are making money from your investment property. There is a lot of research needed to be done to make sure you are making a smart investment decision.

The most important part of your investment strategy is your rate of return on rental property. This is what ensures you make a profit and a steady income on your real estate investment. Continue reading this article to learn more about what a good return on investment is for rental properties and how to calculate your ROI.

What Exactly Is a Return on Investment?

A return on investment, or an ROI, is a type of measurement used in real estate to determine how much money is made from an investment. This is typically calculated as a percentage of the cost of the investment.

Overall, return on investment is essential for investors as it shows them how well their investment dollars are being used. ROI helps investors commit to an investment property as they are certain there will be a rate of return on rental property.

How Do I Calculate a Return on Investment?

How to calculate ROI on rental property’s is actually quite simple, you need to use this equation;

ROI = Annual Returns / Cost of Investment x 100

If this seems a little difficult to understand, you can also look at this equation to calculate your ROI. Although they appear different, they are still the same and will generate the same number.

ROI = (Gain – Cost) / Cost

- Gain refers to your investment gain

- Cost refers to investment cost

Although these equations might seem easy, there are other factors you need to consider too as an investor. These other factors are essential as they also impact your rate of return on rental property even though they are not calculated originally in these equations. Some factors to consider are:

- Maintenance and repair costs.

- The amount of money borrowed in the original investment ( which can also include interest). This term is also referred to as leverage.

- Any additional loans or mortgages.

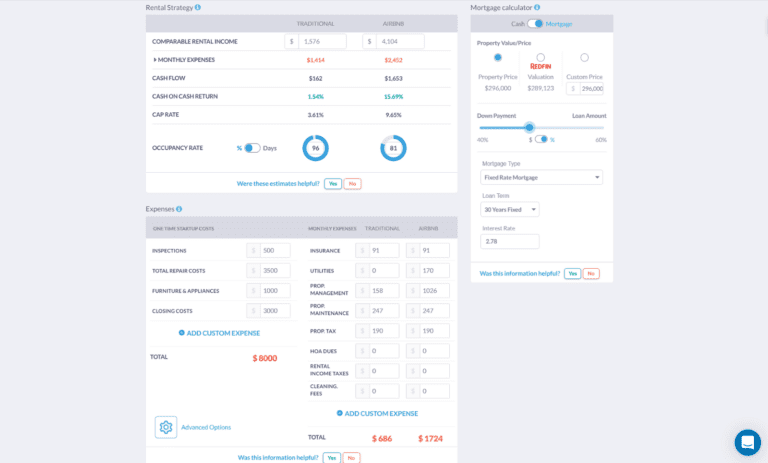

All of this may be overwhelming to try to keep in mind when calculating your return on investment for your rental properties. Mashvisor’s Rental Property Calculator Tool is a great way for investors to calculate their return on investment without having to try to remember any and all factors that could impact it.

Mashvisor’s Rental Property Calculator Tool helps investors calculate their finances, and view calculated returns all in one place. Rather than trying to make many confusing spreadsheets and do all of the calculations on your own, the Rental Property Calculator does it all for you in one place.

Mashvisor’s tool lets investors use their own numbers, relative to their rental property, to calculate their ROI so it is specific to their investment property. Additionally, the Rental Property Calculator shows investors other real estate data such as estimated costs on the interest rate, property taxes, and maintenance on the property.

Mashvisor’s Rental Property Calculator tool stands out from others as it provides investors with a rental strategy for their investment properties. This tool shows investors comparisons between how the property would do as a rental property vs a traditional property vs an Airbnb property. This clearly shows investors which investment strategy will be the most profitable.

Additionally, this tool shows investors cash on cash return, cap rate, cash flow, rental income, and rental occupancy rate. Mashvisor’s Rental Property Calculator tool is also known as the Investment Property Calculator tool.

What Is a Good Return on Investment?

There are a few factors that determine what is a good return on investment for your real estate property. These factors are usually what kind of property that rental property is. For example, your rental property could be a vacation property, which is more like an Airbnb-style rental, or a long-term rental property. Both would have slight terms on what is considered a good return on investment.

Another factor that determines how good your return on investment percentage is depends on your method of financing your investment property. Typically, investors use the methods of mortgages or cash for financing their investment rental properties.

Depending on if you have been a long-term real estate investor or you are just starting to get into the business, you will have different sources of income to finance your investments. Some investors have many larger financial resources than others, therefore they are more likely to use cash to finance their investments.

Other investors will choose to use a mortgage to finance their investments, which actually usually increases their return on investment in the long run. This is because it reduces the initial cost of the investment and provides them more leverage to acquire more properties in less amount of time.

Overall, you have to take into consideration the method of financing to determine if it is a good return on investment.

What Is Considered a Good ROI on a Rental Property Financed With Cash?

If you are an investor considering purchasing a property with cash, you would have to use the cap rate to determine your ROI. Basically, Cap Rate, also known as capitalization rate, is the ratio of the NOI ( Net Operating Income) on the property, to its market value.

If you are considering financing your rental investment property with cash, you might be wondering now “ how do I calculate cap rate?”. This equation can help determine the cap rate:

Cap Rate = NOI/ Fair Market Value x 100

To calculate your Net Operating Income (NOI), use this equation:

Annual Rental Income – Annual Rental Expenses

You can also refer to Mashvisor’s Rental Property Calculator tool to view your cap rate.

After you have determined your cap rate on your rental investment property you can calculate your rate of return on rental property. For properties financed by cash, investors and the real estate market consider 4% a good cap rate.

Although many things can impact this percentage such as the location of the property, the type of property it is, and monthly costs. No matter the type of property or location, when you are considering purchasing an investment property, the average cap rate of rentals in the area should the minimum percent you are looking for before you purchase a property to ensure it will be a good investment.

What Is Considered a Good ROI on a Rental Property Financed With a Mortgage?

Instead of using a cap rate to help determine your rate of return on rental property like you do with a property financed with cash, you have to look at cash on cash return for rental properties financed with a mortgage.

Overall, cash on cash return basically shows investors the amount of money a rental property will produce. This is based on the amount of money put into the property but doesn’t take into consideration the money that was borrowed to finance the property. Something that differentiates the cap rate formula and the cash on cash return formula is that the cash on cash return formula considers financing costs.

To calculate cash on cash return, ( Coc return) follow this equation:

Coc Return: Annual Pre-Tax Cash / Total Cash Invested x 100

If these calculations seem overwhelming, consider using Mashvisor’s Rental Property Calculator tool to calculate your cash on cash return along with any other calculation needed to determine if a property is worth investing in.

Now that you know how to calculate your cash on cash return, you are probably wondering “what is a good rate of return on rental property on a mortgage financed rental property?” Investors consider anything between 8% and 12% a good rate of return on rental property that is financed by a mortgage.

If you are an investor, it is important to note that the percentages of cash on cash return will always be higher than the cap rate as a CoC return is the most reduced cost of investment. Alike cap rate though, you should keep in mind that a good ROI for rental property will change due to factors such as the location of the property and style of property.

What Is Considered a Good ROI on a Vacation or Airbnb Rental Property?

Although the factor of how your vacation rental property is financed should be considered when determining what is a good rate of return on rental property, vacation rental ROI is slightly different, despite how it was financed. Anything between 10% and 20% is considered a good ROI for vacation rentals.

Just like any rental property, the location of the pretty and the style of property is also influencing its ROI. Use Mashvisor’s Rental Property Calculator to help determine the rate of return on rental property. This tool takes all factors, such as the type of property and the location of the property into consideration when doing its calculations.

How Do I Maximize my ROI in My Rental Property?

The best way to maximize your ROI in your rental property is to use the proper tools to help create accurate calculations. Mashvisor’s Rental Property Calculator provides extremely accurate calculations so investors can be sure of their real estate investment decisions. This tool allows investors to use their own data to create the most precise calculations.

Depending on how you financed your rental property, you will need to look at either cap rate or cash on cash return to know your ROI. The Rental Property Calculator makes these calculations for investors while also determining ROI on a property. This tool ensures investors will be making money in real estate.

How Do I Find an Investment Rental Property?

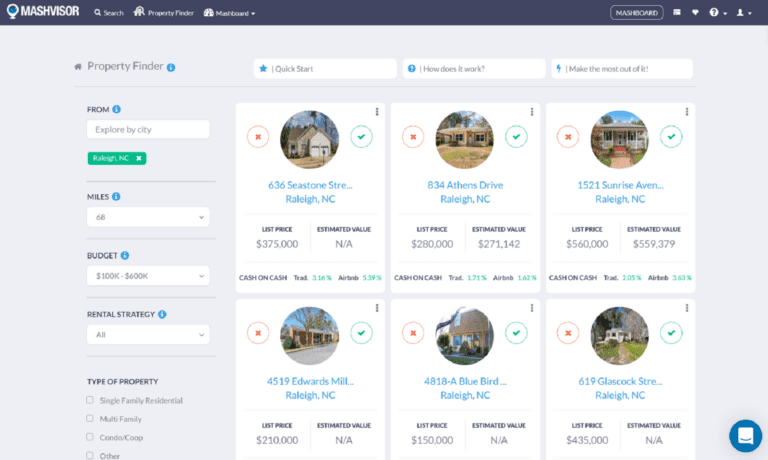

Now that you understand what an ROI is and how to calculate it, you need to find an investment property that fits all of your wants and needs as an investor. To look for properties in your area, use Mashvisor’s Property Finder tool to explore profitable properties. This tool allows investors to search through properties that match their specific criteria. This could be a certain location, a price point, or a certain type of property.

Once you have located a potential property that you are interested in investing in, you should consider working with a real estate agent when purchasing the property. They can get you the best deal on the property and ensure you are spending your money wisely.

To look for real estate agents in your area, use Mashvisor’s Real Estate Agent Directory. You can look through an agent’s real estate portfolio to see which agent you think you would work best with. The Real Estate Agent Directory makes it easy for investors to connect with agents in their area, or any area they are interested in purchasing a property in.

The Bottom Line

After reading this article you should now understand what a return on investment is and how to calculate the rate of return on rental property. Make sure to consider how you are financing your rental property when determining the ROI.

The average percent of the ROI on your rental property can change depending on whether your property is financed by cash or mortgage financing. Factors such as the location of the property, the type of property, and any additional payments to help maintain the property can also impact the rate of return on rental property.

Mashvisor’s tools make it easy for investors to calculate the rate of return on rental property.

Mashvisor provides state of the art real estate investment tools to help you make wise investment decisions and walk you through your investment journey. Please sign up here to start analysing the investment opportunities in both short trem and long term rental industry.