Short term rental property investors are wondering what AllTheRooms analytics are and how reliable they are for their investment decisions.

Current real estate investors know how profitable the short term rental market can be. To ensure you are investing in a beneficial way in the vacation rental market, you need to make proper calculations to back up your investment. This is the only way to create peace of mind for yourself that you are investing your money wisely.

Table of Contents

- What Real Estate Investors Like About AllTheRooms Analytics

- What AllTheRooms Analytics Need to Improve on

- Where to Find the Best AllTheRooms Analytics Alternatives

There are many different software platforms in the US market that help existing and future Airbnb hosts find good opportunities as well as boost the performance of current listings. One name that keeps showing up during research is AllTheRooms. But what is AllTheRooms, how reliable are AllTheRoom analytics, and are they worth it for investors?

In this article, we will take a look at the things that this short term rental data provider does well and the things that they should work on.

We’ll also discuss where you can find the top AllTheRooms competitors. In specific, we will compare the vacation rental analytics provided by AllTheRooms and Mashvisor to find out which offers better options and services for investors.

What Real Estate Investors Like About AllTheRooms Analytics

The AllTheRooms real estate investing platform offers some benefits to those investing in vacation rentals, and that’s why many investors opt for using it. Let’s take a look at the most important aspects of the short term rental investment process that this product helps with and that investors find value in.

Investors Can Find Short Term Rental Market Intelligence

With the help of AllTheRooms analytics, investors can conduct some level of real estate market analysis necessary for choosing the right location for investing.

It’s important to highlight that the platform does not have a straightforward way to help investors find the top short term rental markets at the moment. Instead, it helps them analyze the investment potential of a market they already have in mind.

Searching for a location will provide you with a general overview of the local market, including the following metrics:

- Total market short term rental revenue

- Average daily rate (ADR)

- Occupancy rate

- Average revenue per listing

- Number of short term rental listings

- Short term rental property type distribution

- Top amenities

- Short term rental bedroom distribution

Moreover, the market analysis includes historical data such as:

- Average daily rate

- Occupancy rate

- Revenue

for the last one month, three months, 12 months, and four years.

AllTheRooms also provides some analytics on the expected future performance of the market.

While all this information is crucial for selecting one of the best short term rental markets, it’s not enough to make an educated yet efficient decision. Investors need access to ROI metrics like cash flow, cap rate, and cash on cash return to be able to evaluate a vacation rental investment market.

Investors Can Find the Top Vacation Rental Properties in a Market

When analyzing a certain market, AllTheRooms provides real estate investors with a list of the top properties in the area. These are current rental listings that score the highest performance results based on a number of different metrics like average daily rate and occupancy.

For each of these top properties, you get to see the property type as well as the number of rooms, bedrooms, bathrooms, and guests. You can use these numbers in order to draw conclusions on what property features perform the best in the local market.

However, it’s important to note that these are existing short term rental listings and not real estate listings. This means that these properties are not currently listed for sale, and considering their excellent performance, it’s highly unlikely that the owners would like to sell them soon.

Investors Can Analyze the Potential of an Example Vacation Rental Property

On the AllTheRooms dashboard, investors can analyze not only markets but also properties, to check whether they will work out as short term rentals or not. In the AllTheRooms revenue calculator, which is similar to the AirDNA Rentalizer, you can enter property details to find out how this property is forecast to perform in a market.

The criteria you can enter include the following:

- Market

- Number of bedrooms

- Number of bathrooms

- Number of guests

Meanwhile, the numbers which the AllTheRooms revenue calculator will compute for you are:

- Average daily rate

- Occupancy

- Annual revenue

- Operating expenses

- Net operating income (the difference between the annual revenue and the operating expenses)

If you enter the expected purchase price, the platform will also calculate the cap rate for you.

This is all very helpful for a beginner investor who doesn’t have access to premium Airbnb rental data. At the same time, though, it’s not particularly useful for someone who has no idea where to start with their investment property search and analysis.

While you may be able to enter the parameters of a property you’d like to purchase, you may not know where to look for short term rental properties for sale. Similarly, you might have a certain property in mind, but you may not be sure how to figure out the fair market value so that the AllTheRooms calculator computes the cap rate.

So the revenue calculator available on AllTheRooms might not be optimal for someone with limited experience in the real estate market.

Investors Can Track Competitors

The fourth feature of AllTheRooms analytics that investors enjoy is the opportunity to track the performance of competitors in the local market. Specifically, you can select and save a few vacation rentals in the area which you consider to be your main competitors so that you can keep an eye on their metrics, including the following:

- Average daily rate

- Occupancy rate

- Booked rate

- Future demand

All these numbers are especially important as they help short term rental hosts compare the performance of their rental with competitors.

In case you perform better, you can rest assured that you’re doing everything right, so you can carry on with your vacation rental property management strategy. In case you perform worse than competitors, you can try to figure out what other local hosts are doing better and mimic their performance to boost your own results.

As an investor, you should remember that you don’t operate in a vacuum. What other investors around you do will always have a major impact on your own Airbnb business.

Investors Can Research Nationwide and Global Markets

One advantage of AllTheRooms, which makes it comparable to AirDNA, is the global coverage. US housing market predictions for 2023 show that the US short term rental industry will continue expanding next year, but there are profitable opportunities elsewhere as well. AllTheRooms analytics are available for international markets.

Having access to worldwide short term rental data is important if your current market takes a downturn or if you’d like to expand and diversify your investment portfolio.

Investors Get Access to Airbnb and Vrbo Data

While Airbnb is by far the largest and best-known vacation rental property marketplace, Vrbo is a major competitor which provides some benefits. So, for investors, it’s good to have access to both Airbnb data and Vrbo data so that they know on which platform they should list their property.

The good news for investors is that AllTheRooms analytics factor in data from both Airbnb and Vrbo.

Investors Can Use AllTheRooms After Buying a Short Term Rental Property

Last but not least, real estate investors like the fact that AllTheRooms analytics keep helping them even after they purchase an investment property. Once you buy a property and list it on Airbnb, you can enter the Airbnb listing URL to be added to your dashboard on AllTheRooms.

Then you can use the AllTheRooms tools to monitor the performance of your property and compare it to competitors. You can use market-level data and competitor performance data to adjust daily rates, amenities, and other features to enhance the performance of your own short term rental.

What AllTheRooms Analytics Need to Improve on

While AllTheRooms provides some important tools and analytics to real estate investors, it is not a very comprehensive short term rental analytics platform. It lacks some major features and capacities which some of its main competitors have. Let’s take a look at them.

AllTheRooms Does Not Allow Investors to Search for Profitable Properties for Sale

Beginner investors do not only need help in analyzing markets and properties available for sale, but they also need help in finding these properties for sale.

Traditional investment property search methods like checking out local newspaper ads, driving for dollars, and networking are becoming less and less popular amid the advancement of tech. Meanwhile, only licensed real estate agents have access to the MLS database.

So, the top platform to support beginner investors when first getting started with real estate should have the functionality to look for profitable short term rental properties for sale.

Like Mashvisor!

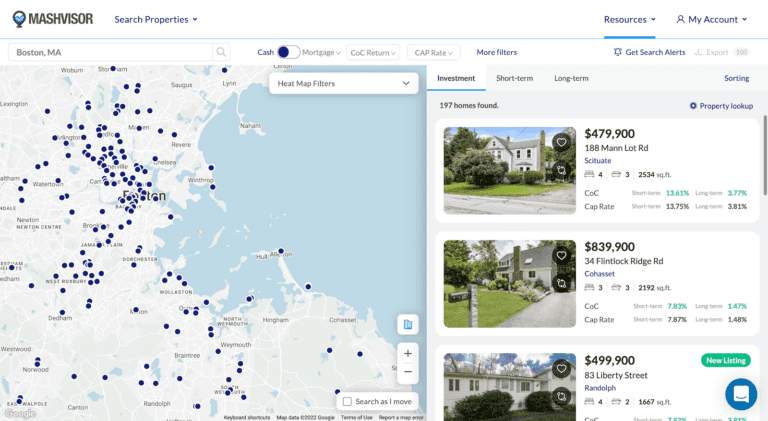

With the help of the Mashvisor investment property search engine, investors can enter their criteria to get a list of MLS listings available in the area which match their expectations.

Mashvisor’s Investment Property Search Engine

Moreover, they even get access to some off market properties, which usually come at discounted prices and thus offer good opportunities for first-time investors with limited budgets.

This is something that the AllTheRooms dashboard does not provide. Although it shows the top properties in a market (which Mashvisor also does), these are not properties that are available for sale. What this means for investors using AllTheRooms is that they still need to use external resources to search for vacation rentals for sale.

AllTheRooms Does Not Help Investors Analyze a Specific Vacation Rental for Sale

Another shortfall of AllTheRooms is that the platform does not allow investors to conduct rental property analysis on a specific property that they are interested in buying. It’s true that you can analyze an example property—based on a market and a certain number of rooms and guests. However, this is not the same as analyzing a concrete property.

After all, each real estate property is unique—with its own type, size, finishing, amenities, extras, and features. AllTheRooms recognizes the importance of amenities, for example, as they list the top amenities in a market, but they fail to include those in the investment property analysis.

At the same time, the Mashvisor rental property calculator allows you to analyze the investment potential of any property listed on the platform. So as soon as you’ve identified a few potentially good opportunities, you can immediately see what return on investment you can expect from them.

AllTheRooms Does Not Provide Crucial ROI Metrics

Average daily rates, occupancy rates, and monthly/annual revenue are at the core of the short term rental business. After all, these are the metrics that determine whether your property will yield positive or negative cash flow and good or bad return on investment. Nevertheless, looking at actual estimates of the cash flow and ROI metrics is crucial.

And AllTheRooms analytics fail to provide these key pieces of information.

Within the market intelligence, there is a complete lack of average cap rate and cash on cash return within the area. This prevents investors from ensuring that a location is a good choice for buying a vacation rental property.

Even if you know how much money you will make from a property, you can’t know if this is good unless you know how much money you will spend. And what ROI this will yield.

Similarly, when you analyze how a certain type of short term rental property will perform in a given market, AllTheRooms gives you a cap rate estimate. But only after you enter the expected purchase price. However, as a beginner investor, you don’t always know how much to expect to pay for such a property.

Moreover, while the cap rate is a good initial indicator of profitability in real estate investing, it does not suffice to make a good decision. You need to take a look at the cash on cash return as well, which considers the method of financing. You can’t calculate ROI unless you factor in the money you’ll be spending on monthly loan payments.

Where to Find the Best AllTheRooms Analytics Alternatives

Since AllTheRooms analytics do not succeed in meeting all the needs of real estate investors, the question becomes: What is the best AllTheRooms competitor for all investor needs?

The answer is simple: Mashvisor is the best AllTheRooms alternative in the US short term rental market.

Why?

Because Mashvisor helps investors with all the crucial steps in the vacation rental property investing process:

- Finding the best markets for Airbnb rentals

- Searching for top short term rental properties for sale

- Analyzing the potential of vacation rentals for sale

Finding the Best Markets for Airbnb Rentals

While AllTheRooms analytics allow investors to conduct some level of Airbnb market research on locations they have in mind, Mashvisor actually helps investors find top markets.

First, you can check out the Mashvisor real estate investing blog, where the team publishes up-to-date rankings on the best markets for buying a short term rental property. These lists can be based on a number of different factors like occupancy rate, daily rates, rental income, cap rate, and cash on cash return.

Once you select a city-level market, you can check the local short term rental regulations to confirm that non-owner-occupied vacation rentals are legal.

Then you can use the Mashvisor real estate heatmap to search for areas within the city with low property prices, high income, high occupancy, and high cash on cash return.

As a final step of the local rental market analysis, you can access the Mashvisor neighborhood analysis pages, available for every neighborhood in every US city and town. These provide all the data covered by AllTheRooms analytics and much more, like:

- Median property price

- Average price per square foot

- Average cash on cash return

- Number of investment properties for sale

Searching for Top Short Term Rental Properties for Sale

Another function that makes Mashvisor the best alternative to AllTheRooms for short term rental property investors is the ability to look for properties for sale.

Once you enter your market, budget, financing method, expected income, and ROI, you get a list of properties for sale in the local area. You can rank them by a number of metrics to find the best opportunity for your particular situation.

This is not something that AllTheRooms analytics allows you to do.

Analyzing the Potential of Vacation Rentals for Sale

Finally, the Mashvisor investment property calculator is superior to the AllTheRooms revenue calculator (as well as the AirDNA Rentalizer).

The Mashvisor real estate investing app provides a detailed rental property analysis of every property listed on the platform. This includes absolutely all the data points and analytics you need to decide on a profitable vacation rental property for sale.

The data included in the property-level analysis is as follows:

- Listing price

- Average price per square foot

- Number of bedrooms and bathrooms

- One-time startup costs

- Monthly rental income

- Recurring monthly expenses

- Cash flow

- Cap rate

- Cash on cash return

This means that with Mashvisor you can analyze the investment potential of a specific property that you are considering buying. And not an imaginary property based on the number of bedrooms and guests, like with AllTheRooms analytics.

Mashvisor provides state of the art real estate investment tools to help you make wise investment decisions and walk you through your investment journey. Please sign up here to start analysing the investment opportunities in both short trem and long term rental industry.

Conclusion

When investing in short term rentals, access to good, reliable, comprehensive, and up-to-date data is crucial. The vacation rental industry has become so competitive that basing all your decisions on solid data is the only way to move forward.

Our review of AllTheRooms analytics shows that they can definitely help investors with some aspects of market and property research and analysis. They allow investors to save some time when analyzing opportunities before buying an Airbnb property.

However, AllTheRooms analytics alone are not enough to find and choose the best market and property to invest in. Instead, Mashvisor is a much more comprehensive alternative that provides investors—even beginners—with absolutely all the data and analysis they need to succeed.

In specific, Mashvisor helps investors locate good markets, research their potential, search for profitable properties for sale, and analyze their expected performance. All data and analysis are based on the performance of short term rental comps in the area, which makes them highly accurate and reliable.

To learn more about how Mashvisor can help you invest in profitable short term rentals in the US market, schedule a free demo with our team.