It’s undeniable that the use of AirDNA data skyrocketed in recent years. Investors and hosts are choosing to rely on the tool to come up with more accurate numbers. Many investors depend on AirDNA to help formulate a successful rental strategy and assess the profitability of their target real estate property. Potential users often look at AirDNA reviews on the internet to see if the platform is the right one for their needs.

Of course, at the very mention of AirDNA, opinions differ. As you’re probably aware, investing in real estate is a complex and very demanding process. While some investors manage to realize their plans over a short period of time and keep their property busy, others also encountered significant difficulties in dealing with the tool.

We’re on a mission here – to clear the air regarding the platform and comment on the abundance of AirDNA reviews out there.

Should Airbnb investors consider using the AirDNA platform or not?

We’re about to see.

If you’re interested in hearing more about users’ experiences with this tool, stick around – we’ll be weighing in with our professional opinion!

The Story of AirDNA

First of all, we need to be broad-minded here, and it means taking into account that some of you are at the beginning of your investment research journey on AirDNA alternatives.

Nevertheless, you’re probably looking for an accurate answer to a question such as “What is AirDNA?”

The emphasis is on AirDNA reviews, but we believe that it will not be complete and convincing enough without some background information – so here’s what you should know about AirDNA.

AirDNA is one of the leading data analytics tools within the multi-million-dollar short-term rental industry. This information alone tells you how much data AirDNA actually deals with, doesn’t it?

The aim of the all-encompassing AirDNA data is to encourage thriving rental businesses, hosts, and potential investors to participate in a thorough investment property search and make profits on their vacation rental space.

Informed investing is not the only benefit from using the platform, though. You can check out listings, optimize them, and do marketwide research.

Business Is Thriving

We can’t continue our AirDNA review without mentioning the path of the investment tool to success.

AirDNA’s co-founder, Scott Shatford, started the entire story by listing his apartment minutes before leaving for vacation. Six months later, his rash decision turned into a multi-short-term rental business that was bringing in substantial revenue for Shatford.

However, the revenue Shatford was generating was not enough. He needed something that would help him keep track of rental expenses and the general performance of his listings.

Luckily, investors don’t need to do virtually anything on their own nowadays. In the case of AirDNA, algorithms are there to deal with statistics for us. With the help of technology, your investment property search can be done within minutes.

Technology works both ways, meaning it has the power to influence our decision-making, as well. You could end up dismissing the idea of using this platform because you read a couple of explicitly negative reviews.

And to that we have to say:

Don’t be so quick to judge and bear with us ’till the end.

Related: How to Conduct a Thorough Airbnb Investment Analysis

The Science Behind It: How Does It Work?

While reading AirDNA reviews, we came across numerous comments where users complained about how confused they were about using the tool. So, let’s clear that up right now.

Here are a few bullet points that will clear up the matter on AirDNA:

- AirDNA keeps track of more than 10 million properties on Airbnb and VRBO.

- AirDNA covers over 120,000 global real estate markets.

- The data within AirDNA is collected from more than 1 million partner properties.

- AirDNA’s artificial intelligence helps you track the revenue potential.

- AirDNA’s accuracy is estimated at almost 97%.

AirDNA Reviews on “Active Rentals”

Now, it’s time to focus on the specific features of AirDNA, evaluate its effectiveness, and see if future investors actually need them or not.

The first would be the “Active Rentals” feature, which can be very useful during busy seasons. It’s always helpful to know how dynamic the current market is. It tells you exactly how many rentals – entire properties, private rooms, and shared rooms – there are in the area you’re researching. The data is updated every 5th or 8th of the month.

AirDNA Reviews on “Market Grade”

“Market Grade” helps investors calculate the success and performance of their target markets compared to other real estate markets.

The feature includes the following parameters for investment property analysis:

- Rental Demand: It shows how many times the property was booked over the course of one year.

- Revenue Growth: As an investor, you want to find ways to increase your revenue, and the revenue growth parameter helps you see how much the property is earning.

- Investability: Probably the most important one, the “investability” parameter gives investors an insight into the profitability of the desired property and whether it is a “fruitful location” for investing.

- Airbnb Ratings: The ratings are based on cleanness, location, check-in, value, and accuracy.

How Much Does AirDNA Cost? Is It Worth It?

Whether it’s AirDNA reviews or you talking to your colleagues and fellow investors, the topic of cost is bound to come up at one point. And it raises the following question:

Is it worth it – or is the price you’ll be paying for this investment property calculator too high?

MarketMinder

First, there’s the MarketMinder – a platform for investors and hosts. It provides users with an insight into:

- Historical market performance trends

- Property insights on Airbnb occupancy rate

- Personalized nightly rate recommendations

- Investment tools

- Pacing Airbnb data

- Custom comp creation

- Unlimited searches

As for the cost of using the tool:

- $19/month for one market with less than 100 active listings

- $39/month for one market with 100-1,000 active listings

- $99/month for one market with more than 1,000 active listings

It’s a handy tool in terms of efficiency, mainly because it allows investors and hosts alike to estimate their expected Airbnb income.

Enterprise

The Enterprise Plan is aimed at serious professionals and established businesses. So, if you choose to go with this option, you’ll have:

- A more thorough real estate market analysis

- Customized options by city, region, or country

- Information delivered and downloaded or an API

- Granular property data

- Detailed information about tourism, financial services, academia, etc.

With the above plan, there are no explicit prices; instead, you need to reach out to AirDNA and hopefully agree on acceptable quotes. Since you operate within a business, we assume that you have a larger budget – so there’s a good chance that you’ll reach common ground price-wise.

Global Plan

Lastly, if you take real estate investing seriously, you should go with the “Global Plan” within AirDNA.

Here’s what you’re looking at:

- Unlimited access to MarketMinder’s Airbnb cap rate and data in 191 countries

- Insight into the pricing, pacing, and investment data on 10 million active listings in more than 120,000 global markets

The cost is as substantial as the tool’s features:

- $999/month or $599 if you want to be charged annually

We understand that the above information is not an everyday price for such tools, especially when comparing them with the initial package.

If you’ve been in the business for a long time, you’re familiar with the trends, and this chance can help you, as an investor, to estimate your Airbnb return on investment.

Related: The Pros and Cons of Airbnb Real Estate Investing

AirDNA Competitors

Real estate investors and people, in general, like to be given the benefit of the option. So, it’s only natural to explore a few AirDNA alternatives when it comes to real estate market analysis.

1. Airbtics

Airbtics is one of AirDNA’s competitors that explicitly deals with short-term rental data and managing businesses. The analytics board shows:

- Occupancy rate

- Average daily rate

- Guest demographic

The only potential downside to the Airbtics platform is its updated pricing for 2022.

2. SeeTransparent

SeeTransparent aims to increase vacation rental revenue by using an innovative dashboard. More precisely, you’re able to explore:

- Booking and pricing data for 12 months in advance

- Individual property performance data

- Insights into supply, distribution, and competition

The above Airbnb hosting calculator fails to provide guest origin, though, so it’s harder to determine your target visitors.

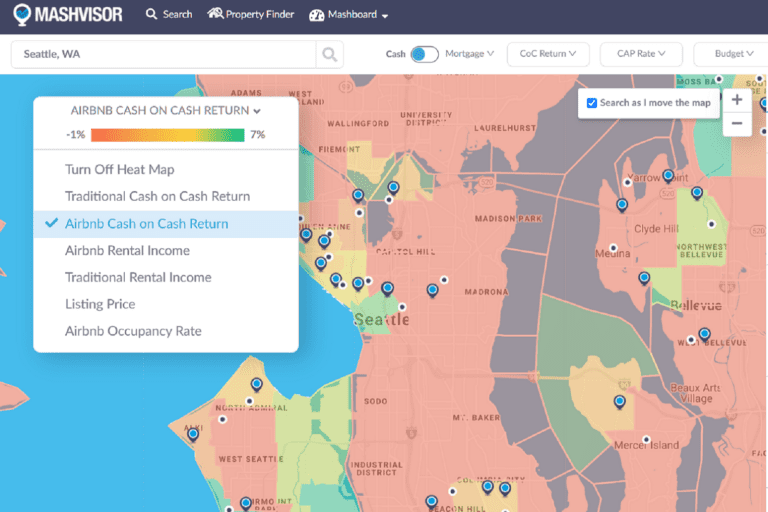

3. Mashvisor

Of course, an expected competitor would be our own, Mashvisor. Specifically, we’re referring to Mashvisor’s Rental Property Calculator here.

Our Airbnb calculator is designed to assist real estate investors in choosing the right location by researching the real estate market and easily assessing the profitability.

We provide information such as:

- Airbnb listings

- Airbnb cash on cash return

- Airbnb rental income

- Airbnb occupancy rate

- Median property price

Mashvisor has a real estate heatmap that helps investors find the best areas in a city based on Airbnb cash on cash return, Airbnb rental income, Airbnb occupancy rate, etc.

AirDNA vs Mashvisor: Is Mashvisor Better Than AirDNA?

For more information on the AirDNA vs Mashvisor comparison, you can check out the video below:

AirDNA Reviews: Users’ Experiences

We can go on about the characteristics of AirDNA and its investment property search algorithms. However, nothing is as convincing as the very stories of investors who have used the platform and are willing to share their experiences.

With that in mind, let’s look at some real-life examples from past and current users of AirDNA data. You may even identify with some of the comments mentioned below.

Review #1

“Great data and easy to use interface; however, the pricing structure isn’t fair or clear at first. You pay £16 per area, which in my case was a town of 80,000 people, and subsequent areas would cost an additional £16, so very expensive! I wanted to look at whole regions and multiple towns and cities.”

Our comment: To be honest, we expected the price to be a potential problem with AirDNA. It’s not uncommon for new investors to hold back on their decision and reconsider investing because of the cost.

Review #2

“I used it to purchase data earlier in the year, and so far, it seems to be accurate. When we purchase our next STR, I will purchase data from them again to factor into my calculations.”

Our comment: As far as data goes, AirDNA elicits confidence with 96.2% accuracy. It’s vital for investors to know that they’re not wasting their time with outdated information on a specific property.

Review #3

“I use AirDNA for market data as a whole and rough estimates using Rentalizer. Their specific data on specific properties is often unreliable, but I have no plans of canceling my subscription to AirDNA anytime soon. (It’s worth it).”

Our comment: With AirDNA reviews, you’ll rarely find only positive or only negative ones; people will always argue in their opinions.

You should remember not to get too attached to strictly negative AirDNA reviews, as they might be coming from poor investment strategies.

If you end up using the tool for your future real estate market analysis, why not write a review of your own? It will certainly help someone who’s having a hard time figuring it out.

Why Investors Still Choose to Rely on AirDNA?

Now that you’ve read some AirDNA reviews, you can see that people have “mixed feelings” about the platform. Nevertheless, they always somehow come back to it.

And since we are bringing this article to an end, let’s take this chance to list some commonly shared reasons why investors choose to rely on AirDNA, despite negative AirDNA reviews.

Keep An Eye Out on the Competition

We’ve seen it in AirDNA reviews, and you can figure it out on your own. It’s an excellent way to “spy” on other markets and evaluate their success before you make the final choice.

Investors and hosts will have a chance to see who they’re competing with in a specific area. Some real estate markets are busier than others, and you could likely use the extra information.

Deciding Where to Invest

What AirDNA reviews fail to emphasize is the importance of the location. If you’re in the Airbnb business, you should know that location is vital – and seeing the data can serve as a guideline as to where your investment plan would profit the most.

Deciding If You Want to Host

Expecting Airbnb income is one thing, but generating that income is a whole different story. It’s usually more complicated than it seems.

It would be best if you take the time to dive into rental market analysis and get to know the numbers you’re up against. Reading reviews and using the available tools will help you decide that won’t hurt your financial plans.

AirDNA Reviews: The Final Word

It’s time to consider everything we’ve mentioned so far and come to a conclusion regarding AirDNA.

For starters, this platform has gained immense popularity in recent years and captured the attention of investors and hosts worldwide – not just in the US. However, as we come across both positive and negative AirDNA reviews, we see investors putting their rental strategies on hold or searching for AirDNA alternatives.

As far as we’re concerned, AirDNA helps research potential real estate markets and evaluate their performance. You’ll have a better insight into the information crucial to your decision, and it’s time-efficient.

Even with its price-related drawbacks, there’s no reason for Airbnb investors not to check out this platform. If you still want to seek out the alternatives, there’s Mashvisor.

One thing’s certain, though – Mashvisor is your proven source of information and personal assistant. You can develop a sound short-term rental strategy with the help of our accurate and up-to-date information!

Mashvisor provides state of the art real estate investment tools to help you make wise investment decisions and walk you through your investment journey. Please sign up here to start analysing the investment opportunities in both short trem and long term rental industry.