In the sea of real estate tools and software, you must find one that fits your needs well. Find out if Reonomy cost is worth the investment.

Commercial real estate professionals require access to property owner contact details, listing visibility, market analytics, and many other data to develop their businesses constantly. The finest research databases provide deal-predictive information, comprehensive lead filtering, and specialist tools and services to aid business growth.

Since identifying the true property owner frequently requires combing through layers of shell firms and holding companies, we are here to provide you with a Reonomy review. Let’s take a closer look at the features Reonomy provides, how accurate they are, and how they compare to competitors.

Table of Contents

Related: 7 Things You Need to Know About Commercial Real Estate

What Is Reonomy?

Reonomy is a large commercial real estate database that uses proprietary software. You can get information on the mortgage, lender, renters, and occupants, as well as contact information such as names, telephone numbers, emails, and addresses, in addition to property details.

Such information is especially beneficial for locating new potential clients and showing listings to purchasers. Furthermore, Reonomy’s connectivity with CRM software enables you to access and view information wherever it is most practical for you.

Reonomy, based in New York, has acquired $128 million in funding from top investors such as Sapphire Ventures, Bain Capital, Softbank, Primary Ventures, Georgian Partners, Wells Fargo Strategic Capital, Citi Ventures, and Untitled Investments.

Continue reading to find out about Reonomy cost and if it’s worth the money.

Reonomy Features

Since Reonomy is a cloud-based real estate intelligence platform that uses AI, it helps real estate organizations uncover opportunities, manage risks, and obtain insight into rivals.

Reonomy employs artificial intelligence (AI) and machine learning to predict the possibility of a specific deal or deals across whole markets. It obtains information from restrictive partners, such as over 3,000 local county assessors, census data, cabinet secretaries, and GIS providers. This technology can assist you in becoming a successful real estate agent by directing you to the most lucrative leads and places.

Marketing teams can use cold calls or targeted email or text campaigns to reach property owners. Customers can access all related properties by searching the owner’s portfolio by name, contact number, email address, or mailing address. It also supports API-based connectivity, allowing administrators to integrate Reonomy into internal operations.

More Reonomy features include the following:

- Over 50 million commercial properties

- Mortgage and lender data

- Customized reports

- Ownership data and contact information

- Customer relationship management (CRM) software integrations

- Customer service is available via phone, email, and live chat during business hours

Related: This Is the Property Management Technology You Need

How Much Does Reonomy Cost?

Some reviews indicate that the platform offers a free 7-day trial and a price of $49 per month for individual accounts. When it comes to team and enterprise packages, the price is negotiable, and no information is found on their website. However, some individuals report that the Reonomy pricing starts at $299 per month, requiring a yearly contract.

Reonomy Reviews

According to many users, Reonomy is one of the most detailed commercial real estate platforms with cutting-edge tools and technologies. Unfortunately, there is no mobile app to conduct research while on the go.

Furthermore, regardless of Reonomy cost, numerous customer evaluations mentioned frustrating functionality gaps, such as search filters that did not work correctly or incorrect contact information on homes. Many users employ it as a beginner step for future open-source data mining to identify up-to-date, accurate contact information.

Reonomy Competitors

Now that we have insight into Reonomy cost and see that it’s negotiable and varies, we will list a few worthy competitors and see how they perform.

CIMLS

One of the few free commercial property databases publicly available is CIMLS. You can look for commercial properties on the market or lease anywhere in the United States, as well as sales comps for a particular property. Investors, renters, and owners, on the other hand, can look for a real estate professional to engage with.

Because it is free and open to the general public, CIMLS is a good way to add your listings and be noticed by possible clients in your region looking for your type of skills. There are also various search options, such as city, property type, phrases, price range, and square footage. You can even use this information as a starting point for your data and connect it with a more sophisticated database to access more detailed information about properties.

According to CIMLS user reviews, the platform is basic and easy to use, and customer support is efficient and friendly. There is no harm in signing up, and you can search properties and professionals before entering any of your personal information.

Since its Gold membership is only $20 per month, and Reonomy cost is way higher, you can try and use it as an alternative but as a supplement to other real estate data sources.

CoStar

CoStar is a source of commercial real estate data and analytics made to give industry professionals accurate available data. It offers a variety of tools to a wide range of audiences, including landlords, assessors, lenders, multifamily owners, investors, realtors, and brokers. Its capabilities simplify creating financial projections, making customized reports, and searching for data worldwide.

It provides thorough and reliable information from data sources and individual research, making it simple to access and generate easy-to-understand analytics and reports. They include aerial and map projections for a more geographical view of assets estimates generated by local business specialists and market and submarket patterns charts. Depending on geography, building type, or sales activity, you can design your reports.

Many customers describe it as an easy-to-use tool that makes it simple to generate and interpret detailed data. They also mention how quick, helpful, and pleasant the customer support is. However, some reviews have experienced issues with intermittent incorrect data and are unable to validate the software’s cost.

If we do a quick Reonomy vs Costar comparison, we see that they are similar with CoStar membership starting at $466 per month (varies based on your level of access). So this platform has a somewhat similar price to Reonomy cost (about $300 as reported by some users) but with more features.

CRE Collaborative

CRE Collaborative platform connects commercial real estate (CRE) professionals to real estate data, business connections, and real estate technologies. It’s basically a hub for all forms of real estate data, and it combines the data to make sure that you have up-to-date information. You can then use the data in your marketing activities, commercial client service, and networking with other experts.

With its collaborative character, this platform offers many services. Marketing and technology consultants, property searches and data, and the ability to share and advertise homes, send texts, expand your network, and link to social media are a few examples of the range of services available.

Few other commercial real estate databases offer such information or tools, making this a good resource for preparing for discussions with future and present clients and general real estate business expertise.

However, third-party CRE Collaborative user reviews are limited. Nevertheless, the existing evaluations are good, and users like the convenience of having a single platform to manage all data and advertise properties. Its starter plan is free, and if we compare its Premium membership of $59.99 per month to Reonomy cost, we can see that it’s way cheaper.

Mashvisor

If you are looking for a platform that is similar to Reonomy’s features but for residential properties, Mashvisor is a perfect option. It is a website that provides real estate investors with precise, up-to-date data to help them make investment decisions. It uses technologies that do extensive and predictive analyses on any investment property in the US real estate market. Based on numerous aspects, including historic and comparable data, the company’s analytics offer insights on future trends and the predicted success of a property.

In short, here’s what Mashvisor has to offer:

- Property search in certain cities and neighborhoods

- Calculation of crucial indicators such as the cap rate and return on investment

- Evaluation of a property’s investment potential

Related: The Ultimate Investment Property Search Tool

Mashvisor Tools

Mashvisor comes equipped with a plethora of tools that make the life of a real estate investor more convenient. Some features such as real estate analytics or rental property calculator are addressed more below.

#1 Property Search

On Mashvisor’s homepage, the search bar is the very first thing you’ll notice when you arrive. Click Search once you’ve entered the city, neighborhood, or zip code of an area in which you’d want to make an investment. A map of the place you picked, as well as a list of homes for sale in that area, will be displayed after you click on the link.

When you first look at the map, you have two options.

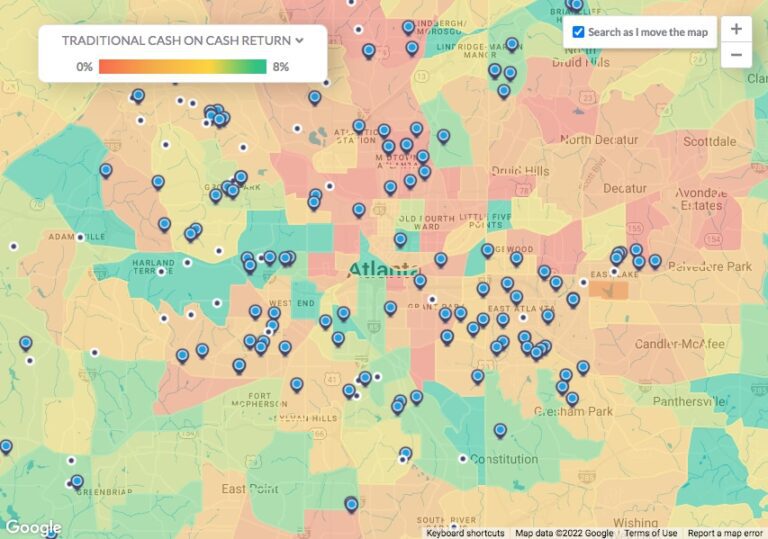

1. Heat Map

If you want to start with a particular, profitable neighborhood, the Heat Map option is a great alternative to consider. To do so, click on the drop-down button on the bar marked Heat Map Data Set to see the data filtering choices available. You will see the following:

- Traditional Cash on Cash Return

- Airbnb Cash on Cash Return

- Airbnb Rental Income

- Traditional Rental Income

- Listing Price

- Airbnb Occupancy Rate

Choose one that fits your investment objectives. If you want to invest in a vacation rental, for example, use Airbnb Occupancy Rate as your criteria. Based on your choice, a color-coded map will pop up to display high-performing locations. The green-shaded places have the highest figures, while the red-shaded parts have the lowest.

Assume you’ve selected a location that is believed to be favorable for Airbnb. The following stage is to search for a particular property to provide you with good cash on cash return. On the left side of the heatmap’s top bar, click “Property Finder” beside the Search button. You’ll be taken to the Property Finder page.

2. Property Finder

If you’ve decided on a particular neighborhood, use the Property Finder feature. To pin down your property search, you can use the following filters:

- Cash on cash return

- Property size in square feet

- Cap rate

- Budget

- Listing Price

- Number of bedrooms and bathrooms

- Year the house was built

- Property type

- Neighborhood

- Type of property

Mashvisor’s heatmap gives its users a quick overview of which parts of a city are high performing according to their investment objectives.

#2 Investment Analysis

Mashvisor provides many investment analysis tools, but let’s simply concentrate on two of them this time.

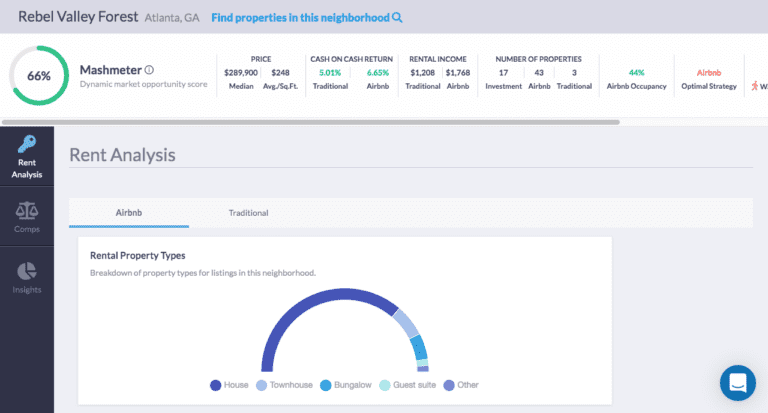

1. Neighborhood Analytics

Your property search will enable you to swiftly examine the real estate data in the area of your choice. The following information can be found in the top bar of the Neighborhood Analytics page:

- Mashmeter Score

- Median Price

- Price per Square Foot

- Rental Income for traditional and Airbnb rentals

- Airbnb Occupancy Rate

- The optimal strategy

- Number of properties for investment

- Walk Score

- Cash on Cash Return for traditional and Airbnb rentals

2. Rental Property Calculator

The rental property calculator, commonly known as the investment property calculator, calculates the following essential metrics for investment properties:

- Rental expenses (one-time start-up costs and recurring monthly expenses)

- Rental income

- Occupancy rate

- Cash flow

- Return on investment

The tool gives information on the two rental strategies, allowing you to decide between a traditional rental and an Airbnb rental. When you buy investment properties, real estate comparisons can also assist you in determining whether or not the selling price of the property you intend to purchase is fair and reasonable.

Additional Mashvisor features:

- Knowledge Center

- Investment Blogs

- Real Estate News and Analytics

Mashvisor lets users analyze each neighborhood of their city of interest to help in their market analysis.

Mashvisor Pricing Plans

Investors have the option of selecting one of three pricing options, depending on their requirements. All options include a 7-day free trial period.

The Lite Plan is suitable for examining individual properties’ rental income and return on investment based on existing rental comps. It will cost you $17.99 each month and will give you:

- Long-term and short-term rental rate

- Projected rental return on investment

- Investment opportunity scores

Meanwhile, the Standard Plan enables you to identify the most profitable cities, neighborhoods, and properties based on your target profit and tailored estimated expenses, as well as your revenue target and projected expenditures. The plan has a monthly charge of $49.99.

Lastly, the Professional Plan enables you to study enormous datasets and look for properties using multifamily and foreclosure filters. At $74.99 a month, you can enjoy all of the Standard Plan’s features as well as the following:

- Search for multifamily and foreclosure properties

- Real Estate Agent and Property Manager CRM

Conclusion

There are numerous commercial property categories (from industrial to retail to multi-family homes) and multiple sales professionals, investors, landlords, and service suppliers. As a result, we examined each platform based on the fundamental criteria needed by various professionals, such as detailed property data, CRM connection, and customer evaluations.

We hope that we have given you insight into Reonomy cost, its features, and competitors. It is a platform that has rich features, but on the other hand, rich pricing as well.

Try Mashvisor’s powerful platform if you’re wondering how to invest in real estate—specifically residential properties—and if you only want one real estate software to sign up for and subscribe to. Click here to begin your free Mashvisor trial.