Like residential homes, short term commercial rentals are an investment that provides you with a stable year-to-year income from real estate.

Table of Contents

Commercial properties are a perfect vehicle to diversify a real estate portfolio, and it’s an excellent alternative to a residential property or an asset to an existing real estate portfolio.

But, you have to lease the commercial rental to a business entity or a business owner. A property increases in value if you stack it with relevant amenities for a specific business.

We prepared this guide to help you navigate commercial rentals. Keep reading to find out what commercial rentals are, how to invest in them, and get the most out of your investment!

What Are Short Term Commercial Rentals?

Commercial real estate (CRE) is a rental property you exclusively lease to businesses. An example of CRE is an office, warehouse, studio, or restaurant.

To understand the appeal of a CRE, imagine what it’s like to open an Italian restaurant located in a busy city center. It’s been around for a few months, and it’s steadily growing. Owners had to rent the place when starting since they couldn’t afford it.

When they look for commercial space for rent, they look at amenities and kitchen equipment. They spot a functional kitchen with a furnace to make pizzas and a kitchen in decent condition. With small investments, the owners start their restaurant, which is only possible if there is a furnace.

Investors in commercial rentals increase the value of their property with more niche amenities. The purpose of initial investment also guides your strategy for operating CRE. It drives the decision whether to lease for the long term or short term and how to manage your investment property.

Long term commercial rentals are spaces businesses lease for at least three to five years. Short term commercial rentals are spaces businesses lease for a year to two years. It all goes back to what kind of return on investment (ROI) you want to see from your investment.

Related: 7 Things You Need to Know About Commercial Real Estate

What Are the Pros and Cons of Investing in Commercial Rentals?

Tenants look for commercial property for lease in known business centers, buyer’s markets, and tech hubs. A perfect example of a business center and tech hub is Silicon Valley in San Francisco.

For the last 20 years, there has been a high demand for commercial properties in Silicon Valley. New startups appear daily, and all they need is an office for up to five people, computers, and desks.

From an investor’s perspective, that’s at least a year-long lease. If the company fails, the market is stable enough that you may find new tenants in no time.

Your goal should be to find a location with a rising influx of people or a strong housing market. Once you find it, you have to learn how to operate short term commercial rentals and buy investment properties.

Pros of Investing in Short Term Commercial Rentals

Pros of investing in short term commercial rentals are flexibility, short lease periods, and high client turnover. Without micromanaging tenants, short-term CRE gives you a stable year-to-year income from a single property.

Take an office as an example. All businesses need office space, even if they start with a high failure probability. And, you could offer them a year-long lease for that crucial period in the life of their company. After half a year, chat with the owners and see how the business is going. Ask them if they want to lease it for another year. If you get a negative response, then you could start looking for new tenants before they vacate your property.

A smaller commercial property is perfect since it allows tenants to move from it as they scale their business. That also benefits you since your goal is a high client turnover with leases lasting at least a year.

However, that’s too specific an example since it starts with the idea that you have a small space to rent. It’s much different if you have a bigger property that allows you more versatility and a higher net operating income (NOI) from a single property.

Related: 5 Creative Ways to Boost Rental Income from Real Estate

Cons of Investing in Short Term Commercial Rentals

Cons of investing in short term CRE are the legal matters and negotiations with tenants. Tenants may want to negotiate more than you are willing to give them.

Legal issues concern the terms of the commercial lease. These terms may include taxes, commercial landlord insurance, and the use of amenities. From the legal perspective, it’s risky to approach these matters without a lawyer or an agent.

If you were to draft a lease without professional help, you might sign a contract on unprofitable terms, which binds you to a contract lasting for a year without a way out.

With proper preparation, these are minor legal inconveniences. The pressing issue should be finding the right property. The ROI of commercial rentals depends on their value to the local businesses.

ROI of Short Term Commercial Rentals

So far, we have discussed what commercial rentals are. But, most investors want to know the ROI of this type of investment. Short term CRE provides a stable year-to-year income and a solid NOI.

Compare that with Airbnb rentals that require a constant stream of tenants. Commercial leases are contracts lasting at least a year. While it’s not exactly passive income, it gives you stability and requires less involvement than dealing with tenants daily.

Mashvisor provides state of the art real estate investment tools to help you make wise investment decisions and walk you through your investment journey. Please sign up here to start analysing the investment opportunities in both short trem and long term rental industry.

The problem you may encounter is that you might set a price that turns out to be unprofitable. And, if you signed the lease, it’s not possible to change your monthly or yearly rate. Take a moment to examine the difference between these rental models.

Related: What Is ROI in Real Estate? A Complete Guide

AirBnB vs Commercial Rentals

The elementary difference between Airbnb and commercial rentals is in the legal definition, and Airbnb falls in the category of residential rentals, a space people use for living.

Airbnb isn’t a commercial rental unless specified by the state where it’s located. The general rule is that commercial rentals are properties with the specific purpose of doing business.

In terms of return on investment, these are two distinct types of rentals. Airbnb is easier to scale, and there are various loans to support an Airbnb operation. Commercial rentals are harder to scale but provide a year-long stable income, and they are more flexible and require less work overall.

Types of Commercial Rentals

Another benefit of commercial rentals is that there are several types of CRE. The most popular types include:

- Offices

- Warehouses

- Garages

- Restaurant spaces

- Farmland

The best thing is that it’s possible to modify any property for commercial purposes. Turning an apartment into an office is a relatively common scenario, and that strategy works even better if you own a small apartment near the city center.

In this scenario, the location would be perfect for business. A slight color refresh with new carpets, desks, and chairs would make it appealing to potential tenants. Of course, that is if the kitchen and bathroom are functional. Instead of renovating the whole apartment as you would for AirBnB, you could take out the stuff and lease it to a small agency or a lawyer.

In this scenario, you could save on renovation costs and get a year-long agreement, and the tenants could cover the maintenance expenses.

How Mashvisor Can Help You Succeed in Short Term Rental Investment

If, after reading this guide, you think short term commercial rentals are not for you, then consider investing in short term rentals like Airbnb. Mashvisor can help you invest in residential properties, which you can either rent out traditionally or on Airbnb. Its various tools like the rental property calculator will help you pick the best property for short term rentals.

Search for Investment Properties

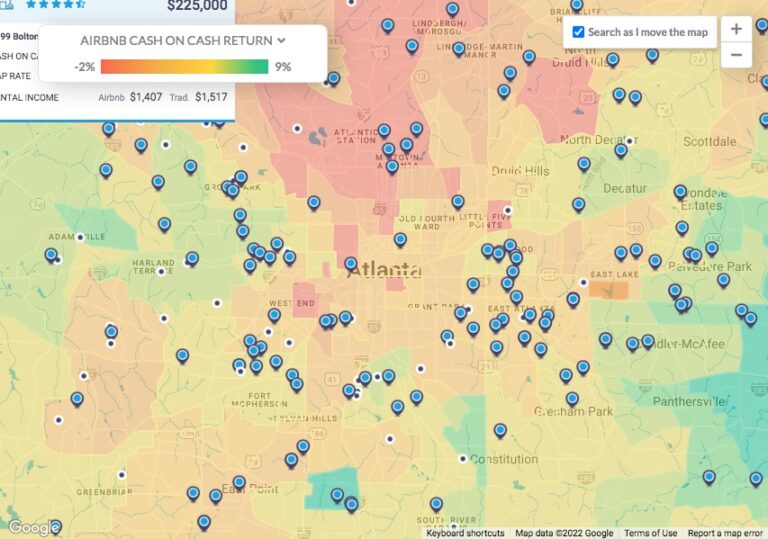

Everything starts with a property search. Mashvisor allows you to research areas and compare prices and metrics for Airbnb rentals and traditional rentals. An additional tool to help you is the real estate heatmap.

The real estate heatmap tools give you an insight into relevant investing locations. When you use it, the tool gives you a similar feel to a weather forecast displaying data in color forms. So, all of the data you need for research is available from a simple search.

Another awesome thing is that the heatmap tools work for Airbnb rentals as well. You also get access to a variety of data types, which are valuable for beginner and experienced investors alike.

The data available includes:

- Median Property Price

- Average Price per Square Foot

- Days on Market

- Number of Traditional or Airbnb Listings

- Monthly Traditional or Airbnb Rental Income

- Traditional or Airbnb Cash on Cash Return

- Traditional or Airbnb Cap Rate

- Price to Rent Ratio

- Airbnb Daily Rate

- Airbnb Occupancy Rate (%)

- Walk Score

Once you get all the data you need, export it as a list and use it for further research. The only thing left for you is recognizing which data is valuable for you and how to interpret it. Of course, once you have more experience, you can create your data sets and focus on data for the specific type of investment.

After all, beginner investors often take loans to finance their investments. So having a complete financial projection is crucial for the success of your investment.

If you decide that short term commercial rentals are not for you, you could try investing in Airbnb rentals instead. Mashvisor’s real estate heatmap can help you find an area in your city that would be lucrative for your chosen rental strategy.

Use the Data

To better understand the data, please take a moment to learn more about cap rate, return on investment, and rate of return. Understanding these terms helps you better understand how to get the highest ROI from your property.

Let’s return to the financing for a moment. It’s rare to meet a beginner investor with enough capital to purchase the property with cash. When you take a loan, you have to pay the down payment and plan how to pay out the loan.

Using the real estate heatmap, you get access to relevant data like:

- Listing price

- Traditional and Airbnb rental income

- Cash on cash return

- Airbnb occupancy rate

Together, the data presents you with the earning potential of properties in a specific price range. If you were to invest in Airbnb rentals, you want to know how much you can earn from your rental in a month and a year.

Then, you get an overview of how much money you net per month and year. Once you subtract it from the costs of owning the rental, you get a precise estimate of the property’s ROI.

And you can examine all that before even owning the property! Data is the most powerful tool in your investing arsenal since it supports your investment strategy down to a molecule. Calculate the data and find out right away instead of wondering whether you made the right decision.

Of course, learning more about Airbnb rentals and the short-term rental market is valuable. Once you move the data out of the way, managing an Airbnb rental becomes so much fun. It’s all about making another person feel welcome on your property and giving them a guest experience they won’t forget.

Invest in Short Term Rentals

Now you know what short term commercial rentals are and how to invest in them. But, they may be too overwhelming for a beginner investor. Instead, you can try to invest in short term rentals like Airbnb.

Either way, it’s best to start by learning more about real estate investing and examining data. Both are available if you sign up for Mashvisor for a free trial.

With precise data, guides, and strategy, starting a profitable Airbnb venture will be much easier. Instead of worrying too much about businesses, just try to create an outstanding guest experience. Add multiple financing options and high ROI, and you have a perfect investment choice for a first-time real estate investor.