If you’ve been reading about US housing market predictions, you are already aware of the fact that Airbnb rentals are expected to remain a defining factor in many markets across the nation. Despite opposition from the hotel lobby and local homeowner associations, short term rental properties are here to stay this year and beyond.

This is why you, as a beginner or even an experienced real estate investor, are wondering whether you should purchase an Airbnb investment property next year and what the best location for this type of real estate investment is. The answer to the first question is “Absolutely YES!”, and the answer to the second one is “In the Florida real estate market.”

Buying an Airbnb Florida Investment Property

The main reason why you should be considering buying a vacation rental in the Florida housing market is the high demand. Florida is not only one of the most visited states by both domestic and foreign tourists but also becoming an international business hub.

As you already know, in real estate investing a high number of tourists and business visitors translates into demand for vacation homes, or high Airbnb occupancy rate, which on the other hand translates into money for Airbnb rental property investors.

The second most important reason to go for an Airbnb Florida rental is the fact that the local legal and regulatory environment remains friendly to short term rentals, unlike many other popular destinations in the US, such as California for example.

So, if you are still not sure whether buying a vacation home in Florida is the right choice for you, let’s have a look at the average Airbnb occupancy rate by city in the Sunshine State. The high levels will clear all your doubts!

Airbnb Occupancy Rate by City in Florida

If you are a new real estate investor, you might be thinking “What is a good occupancy rate for Airbnb?” While no one has a precise answer to this question, not even the top real estate experts, obviously the higher, the better. But we can generally say that anything above 50% is a good Airbnb occupancy rate, especially in a highly competitive rental market as Florida this year and beyond.

As you will see from the figures above, most places in Florida provide higher than typical Airbnb occupancy rate. Let’s take a look at the Airbnb occupancy rate by city in the Florida real estate market at the end of 2018 as these figures are expected to continue:

- Key West: 74.6%

- Miami Beach: 64.9%

- Orlando: 59.5%

- Jacksonville: 57.0%

- Fort Lauderdale: 56.2%

- St. Petersburg: 55.1%

- Sarasota: 54.4%

- Miami: 54.2%

- Lake Worth: 53.5%

- Tampa: 52.9%

- Naples: 52.3%

- Fort Myers: 52.1%

- West Palm Beach: 50.8%

- Boca Raton: 43.4%

- Miami Gardens: 43.3%

- Greenacres: 31.3%

- Punta Gorda: 23.8%

As Airbnb data from Mashvisor’s investment property calculator reveals, the highest Airbnb occupancy rate by city in Florida is in Key West, at 74.6%, while the lowest Airbnb occupancy rate by city is in Punta Gorda, at 23.8%.

The rest of the top places to invest in real estate in the Florida housing market have short term rental occupancy rates in the 40s, to 50s, and even 60s. So we can conclude that the average Airbnb occupancy rate in Florida is about 50-55%.

What’s the Importance of the Airbnb Occupancy Rate by City for Investors?

The average Airbnb occupancy rate in the location where you plan to buy a vacation rental is crucially important because it will determine your rental income, or in other words – how much money you will make from your short term real estate investment property.

Your Airbnb rental income is a function of two factors: 1) The nightly rate which you charge for your property and 2) The occupancy rate of your rental. While there is no way to know EXACTLY what part of the time your Airbnb rental will be occupied and what part vacant, the typical Airbnb occupancy rate by city is a close approximation of what you should expect in this regard.

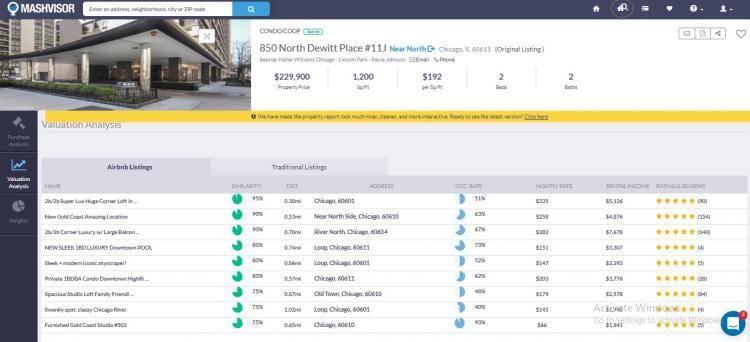

Moreover, when searching for and analyzing prospective investment properties to buy through Mashvisor, you get to see what occupancy rates other properties (similar to the one you are looking at and in close geographic proximity to it) actually get when listed on the Airbnb platform.

That’s where the data for the average Airbnb occupancy rate by city presented above comes from, which means that it is highly accurate and reliable as it is based on actual bookings on Airbnb.com.

But that’s not all. In addition to determining your rental income (i.e., how much you get from Airbnb guests per month from your vacation home), the Airbnb occupancy rate also plays a major role in calculating your cash flow and return on investment.

To show you how important the occupancy rate is for your return on investment, let’s have a more detailed look at Key West.

This island city has not only the highest average Airbnb occupancy rate by city in Florida but also the highest Airbnb rental income ($8,560) and the highest cap rate (7.0%).

For comparison, the monthly Airbnb rental income in Punta Gorda is only $1,240, while the cap rate is close to 0. The high occupancy rate makes money for short term rental investors in Key West, while the low level in Punta Gorda does not allow investors there to even break even.

How Can You Boost Your Airbnb Occupancy Rate?

As an investor in vacation rentals, you must be wondering how you can push your occupancy up – above the average Airbnb occupancy rate for your location – in order to make more money. Here are some tips and tricks that will help you out in this regard:

1. Develop a Comprehensive Airbnb Pricing Strategy

Pricing your Airbnb rental property right lies somewhere between science and magic. Getting the right rental price for your property is hard, but it is crucially important for your success. The first step is to investigate what other, similar short term rentals in the area charge – where Mashvisor’s valuation analysis will be of indispensable help.

The next step is to evaluate the high and the low seasons in your location and to adjust your price accordingly. Don’t forget to factor in weekends and weekdays as well. Most importantly, remain flexible. Once you’ve settled your nightly rate, if it prevents you from achieving a high occupancy rate, consider lowering it.

After all, it’s better to rent out your property for a few dollars less than to keep it vacant. If, on the other hand, demand is strong at the current price, you can consider raising the rate a bit and see if this affects demand negatively.

2. Excel as an Airbnb Host

Reviews from Airbnb guests are one of the key factors for the success of your rental business. The more and the better Airbnb reviews you have, the more people will be willing to stay in your vacation home and the higher rate they will be willing to pay.

Make sure your Airbnb rental is equipped with everything needed to assure a comfortable stay and that it is always clean between guests. If needed, hire an Airbnb property management services company. While this will cost you a fee, these professionals will take the best possible care of your property while allowing you to focus on other more important aspects of your real estate investment business, such as growing your property portfolio.

3. Provide More Extras

If you want to have a high Airbnb rental income through a higher than average Airbnb occupancy rate, don’t go for just the basics of what’s required from a vacation rental. The homesharing business has become so competitive that you have to put in some extra effort in order to stay on top of your competition and score a higher occupancy rate than the rest of the properties in the area.

One of the best ways to do that is to provide some extras to your guests such as good coffee and tea, some breakfast items, toiletries, good wi-fi, and others. Your guests will definitely note those in their Airbnb reviews and secure more demand for your rental.

And as you already know, more demand means higher Airbnb occupancy rates, which means more money in your pocket or bank account. Or ideally, money to buy multiple investment properties.

After learning about the average Airbnb occupancy rate by city in Florida, you are a step closer to becoming a successful short term rental property investor. The next step is to find the most profitable property for sale which matches your budget and your personal preferences.

Mashvisor provides state of the art real estate investment tools to help you make wise investment decisions and walk you through your investment journey. Please sign up here to start analysing the investment opportunities in both short trem and long term rental industry.