If you haven’t been very successful in Airbnb real estate investing, it might be because you’re not using one very important factor – Airbnb analytics.

What Are Airbnb Analytics?

It’s not as complicated as it may sound. Airbnb analytics is basically the analysis and interpretation of Airbnb rental data. It encompasses all the important figures, ratios, and percentages you need to get higher returns from Airbnb investments. But these aren’t just numbers, they’re much more. If you’re an Airbnb host/investor, you’re definitely going to want to take advantage of this amazing real estate investment tool.

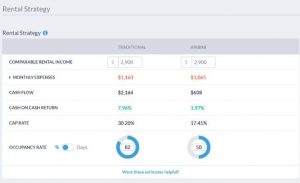

Airbnb analytics utilizes both traditional and predictive analytics. It uses the past to predict future outcomes. By using big sets of historical data, algorithms can make accurate projections for future market trends. In general, this helps Airbnb investors confidently make sound investment decisions and mitigate risk when investing in Airbnb rentals. The biggest advantage, however, is the analysis of key return on investment (ROI) metrics specific to Airbnb rentals you’re interested in. This way you get a better projection of how this property will perform in the long-term and it’s overall profitability. This Airbnb rental data includes:

- Comparable Rental Income

- Estimated Rental Expenses

- Cash Flow

- Cash on Cash Return

- Cap Rate

- Occupancy Rates

- Rental Comps

These are key metrics which should be important to any real estate investor. But how does having this information, along with an interpretation of the data, help keep you ahead in the real estate market? Let’s see exactly how you can compete and succeed with Airbnb analytics.

Related: The Ultimate Guide to the Airbnb Investment Property

Staying Ahead of the Competition with Airbnb Analytics

Making money with Airbnb rental properties is only achievable if you use the right tools and resources. To beat the competition, investors need to realize the true value and effect of Airbnb analytics on making the best investments. Here are three ways you can use Airbnb analytics to your advantage:

#1. Be the First to Identify Market Opportunities and Threats

We all know this real estate rule: location is key. Knowing where to search for your next investment and which markets to avoid is a huge advantage. Airbnb analytics guide investors towards the right Airbnb location for their next investment. Knowing the predicted performance levels of the real estate market can point you to the best cities for Airbnb investment. Airbnb analytics specific to a certain neighborhood’s profitability will let investors know what locations are in high demand and what properties attract tenants.

#2. Locate the Best Profitable Investments Before Anyone Else

The great thing about Airbnb analytics is that you can get a long-term analysis of an investment property when searching on online platforms. For example, Mashvisor uses Airbnb analytics as the foundation for our many real estate investment tools, such as the heatmap and property finder, but we’ll talk more about that in a bit. In general, if you’re using Airbnb analytics during your property search, you can be sure to find profitable investments.

Related: How to Find the Best Airbnb Properties for Sale

#3. Minimize Risk

Airbnb analytics basically act as a map, pointing you towards the right decisions and away from the wrong ones. Whether it’s location, investment strategy, or property performance, real estate analytics will always provide a clear action plan. Knowing what to expect in regards to Airbnb occupancy rates and vacancy rates, for example, keep Airbnb investors one step ahead. Risk can be managed and mitigated according to a market or property’s occupancy rates.

Related: What Airbnb Occupancy Rate Can You Expect in 2019?

The above-mentioned points are all great motivators to using Airbnb analytics, but how exactly can you get access to this amazing tool? Well, signing up for Mashvisor will absolutely be a great way to accomplish what we just mentioned and much more. Mashvisor centers its entire platform towards helping investors make the best traditional and Airbnb investments through predictive analytics. Let’s give you a better idea of what we mean by that.

How Mashvisor Uses Airbnb Analytics to Help Real Estate Investors

Mashvisor is the go-to Airbnb analytics platform for any investor looking to stay ahead of the game. Our platform is actually great for both traditional investments and Airbnb investments alike. But for those of you searching for an investment property to list on Airbnb, our tools can help you narrow down your property search from general markets to a specific profitable property in just 15 minutes. Here’s how we do it:

-

Airbnb Profit Calculator

This functions as a rental property calculator, but it’s specifically made for analyzing short-term rentals. With Mashvisor’s calculator, Airbnb analytics will conclude whether or not the property in question will be profitable as an Airbnb property.

Learn More: Airbnb Profit Calculator: The Ultimate Real Estate Investment Tool

-

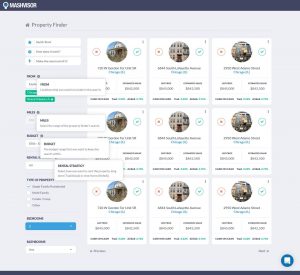

Property Finder

If you have a certain city in mind, use Mashvisor’s property finder tool to locate the top-performing Airbnb properties in that area. Just enter in the investment location and area range, the rental strategy of Airbnb, and your budget. From there, the property finder tool gives you a list of the top properties based on cash on cash return. You can then choose one to analyze.

Do you have a free Mashvisor account? Use our Property Finder to find lucrative investment properties that match your criteria in a matter of minutes!

-

Increasing Occupancy Rates

Airbnb analytics data will show you exactly how you can maximize occupancy rates. Mashvisor’s occupancy insights provide the top factors that increase rates (specifically Airbnb reviews). You can also benefit from the seasonality trend, which will help investors identify which locations match up with peak-seasons, and which don’t, based on occupancy rate data for neighborhoods.

-

Interactive Investment Analysis

We already know that Airbnb analytics lead to identifying high-return properties. However, return on investment starts with your management of costs and expenses. Our interactive analysis allows you to modify and adjust cost projections to have them better suited to your personal investment strategies. So investors can play with different costs to see their effect on cash flow. The analysis will use Airbnb analytics to then estimate the timeline of the return on investment.

Improve your Airbnb business or start one the right way- with Airbnb analytics. To start your 14-day free trial with Mashvisor and subscribe to our services with a 20% discount after, click here.