Having a portfolio of Airbnb rentals may appear to be a good approach to increasing your passive income.

Table of Contents

- Airbnb vs. Traditional Rental: How Much Can You Earn?

- Airbnb Business vs. Traditional Rental: Pros and Cons

- Things to Consider Before Investing in Airbnb Rentals

- How to Know if a Property Would Be Profitable as an Airbnb Rental

- Conclusion

But now, the issue over Airbnb vs. traditional renting gained traction due to the coronavirus outbreak. Long-term leases might offer more stability in challenging times but at the cost of flexibility.

This article will assist you in determining the optimal investment plan for your business.

Airbnb vs. Traditional Rental: How Much Can You Earn?

Well-booked Airbnb house rentals may be more profitable than leasing the same home to a single long-term renter. That is because you can normally charge more on a nightly basis.

According to Mashvisor’s latest data, the average monthly traditional rent in Seattle is $2,209 per month. Based on a 12-month lease, this translates to $26,508 in gross income.

Moreover, traditional landlords must comply with the lease agreement and may not alter the price on the spot. That means you will receive the same amount of rental money each month, maintaining a consistent cash flow.

On the other hand, you can be more flexible with your price on Airbnb rentals. Hosts can utilize various pricing methods and alter their prices almost daily in response to many criteria such as day of the week, popularity, season, and more. This is why the average monthly Airbnb income in the city is $3,543, or $42,516 per year, according to Mashvisor.

Let’s now focus on the demand for Airbnb vacation rentals and traditional rentals as well as some upfront fees.

Initial and Regular Charges

Because the property should be thoroughly equipped and furnished, the initial fees for Airbnb rentals may be larger. Ongoing expenditures are also higher since you must always keep the property in perfect shape.

That means some things will need to be replaced and restocked frequently. Additionally, if you engage with a property management firm, their rates will be higher if they must oversee short term rentals.

But if you take the traditional rental approach, you will not be financially concerned—just find the ideal tenant, and they will look after the property. You will have to cope with an emergency if one arises (although that is rare). However, you will also be responsible for regular property maintenance, but that is a requirement of having any property.

The following are some examples of traditional rental expenditures:

- Sewage

- Water

- Garden upkeep

- Trash disposal

The following are some charges that an Airbnb host must pay in addition to the costs of regular renting:

- Decoration

- Bedding

- High-quality furnishings

- Towels

- Appliances

- Utensils for the kitchen

- Coffee, tea, sugar, and other everyday food items

- Cable television

- Wi-Fi

- Service costs for cleaning

- Utilities

- Air conditioning

Learn More: 5 Airbnb Costs to Owner You Should Know Before Buying a Property

Demand

Airbnb rentals are prone to seasonality, resulting in decreased occupancy and income during the recession. On the other hand, short term rental hosts have an easier time making money during the busy season due to more visitor turnover and increased pricing.

However, demand for your property will not occur overnight. Before you can obtain additional bookings, you must first earn a few five-star ratings. That implies that when you start, you may need to lower your pricing to get potential guests to notice your listing.

Airbnb Business vs. Traditional Rental: Pros and Cons

Suppose you have wondered whether Airbnb monthly rentals are a better real estate strategy than traditional rentals. In that case, we are here to list a few crucial advantages and disadvantages to understand better which is a better strategy for your needs.

Airbnb Pros

Let’s start with some Airbnb rental benefits and why you should consider them.

1. More Chances to Increase Your Income

Since you would be renting out your home at a higher nightly cost, you will be able to generate more money if you have a great occupancy rate. With vacation rentals, you could sell additional services to your Airbnb visitors, allowing you to boost your rental revenue.

Moreover, Airbnb rentals can generate much more money than full-time rentals. It may be challenging to estimate income when you initially start your short-term rental business, but over time, your holiday rental has the potential to produce more cash in a week than a month of full-time renting.

2. More Pricing Flexibility

Each day, hosts have the option to alter their pricing in response to a number of criteria. You may, for example, provide discounts for extended or midweek stays. The opposite is also valid. You can charge extra for weekend reservations. That implies you can have two (or more) rates to adapt to the demand.

What’s more, you have total control over your house for rent when you host a short-term rental. That is especially helpful if your occupancy rates are greater at some periods of the year than others. In addition, you may optimize your revenues and take advantage of busy seasons by being able to alter your price accordingly.

The best part is that you can always convert your short-term rentals to Airbnb long term rentals and get more benefits that come with it.

3. There Is No Lease Agreement

When having Airbnb rentals, a leasing agreement is not required. You have your own set of restrictions, and Airbnb has its own rules to safeguard hosts. That implies that if a guest violates your home regulations, you can contact Airbnb immediately rather than engaging in a lengthy legal process.

Nevertheless, if your jurisdiction allows Airbnb rentals, you may be required to get permission—implying that you’d have to pay more costs. If you think about skipping this step, reconsider since you might get penalized. Moreover, if your rental property is in an area with a Homeowner’s Association (HOA), you may need authorization from them.

4. Airbnb Host Guarantee

The Airbnb Host Guarantee is a fantastic feature that provides up to $1 million in insurance. In addition, Airbnb’s review system also provides some safety to hosts. You can get a better sense of what to anticipate by reading the reviews that previous visitors have left.

Furthermore, investing in short term rental insurance can effectively safeguard you from property damage and liability caused by guest accidents. Most homeowners’ or renters’ insurance policies do not cover damage caused by visitors.

This rental property insurance is particularly tailored for almost all Airbnb rentals (including Airbnb cabin rentals) and can provide coverage for:

- Guests’ injuries

- Liability for any damage sustained on your property

- Income loss (sometimes)

- Guests’ robbery or property damage

5. Less Wear and Tear

One of the advantages of utilizing a house as a short-term rental, contrary to popular misconception, is that there is substantially less wear and tear. This is due to the employment of professional cleaners between guests, and guests handle the house as though they are visitors rather than full-time residents.

As a result, individuals are less likely to make changes like nailing objects into walls as they would in their own house. That lessens the overall wear and tear on Airbnb rentals.

Airbnb Cons

When handling short-term or long term Airbnb rentals, there is always a side that has disadvantages, and every potential real estate investor should be aware of it.

1. Unpredictable Income

Do not expect to be able to lease out your rooms for rent all year round. Actually, you’ll enjoy it that way (hosting various guests can take an emotional toll). You might be entirely booked for one month and then just have one booking for the next one.

Typically, your earnings will be seasonal—your location, services, and events will significantly impact your occupancy. In addition, several cities limit the number of days you can rent out your Airbnb. As a result, you may be obliged to cut off some days.

2. More Effort Required

You must advertise your house to be a successful Airbnb host. That will include taking high-quality images and changing them frequently to reflect the season, writing interesting property descriptions, and writing evaluations for guests.

You also have the added responsibility of ensuring that your property is completely prepared for every guest. Given the considerably larger turnover rate, this means a lot more work. To summarize, being an Airbnb host is more hands-on than just being a landlord.

Things to Consider Before Investing in Airbnb Rentals

When picking between regular rentals such as townhomes for rent and Airbnb, keep the following aspects in mind:

1. Local Rules and Regulations

Traditional renting will be the wiser alternative in some cities with strict short-term rental legislation. You should also consider additional requirements, such as permits or length-of-stay limits. These may appear minor, but they can significantly reduce your rental earning potential.

In fact, there are certain locations that outlaw short-term rentals. As a result, you may not even have the choice of choosing between Airbnb and traditional renting in these cities.

2. The Highest Possible Income You Could Earn

In general, Airbnb generates a greater nightly fee than a traditional rental. Several hosts have even claimed to make four times as much as they would have with standard renting. However, this only applies to Airbnbs with a high occupancy rate.

Even if you have a fantastic apartment in a terrific location, don’t expect to start earning rental revenue right away.

3. The Location of Your Property

If you choose short-term rentals, you will only be able to enjoy high occupancy rates if your home is in an excellent location. What is its appeal?

It’s simple—there must be a compelling reason for visitors to come to your area. Alternatively, it must provide something truly distinctive if your home is not in a large city or a famous vacation area.

How to Know if a Property Would Be Profitable as an Airbnb Rental

For those asking how to get started with an Airbnb, one of the most important things to know is how to find an Airbnb property that would provide a great positive cash flow for investment.

This requires extensive investigation and Airbnb data analysis. You can do this either traditionally or using a real estate online platform such as Mashvisor.

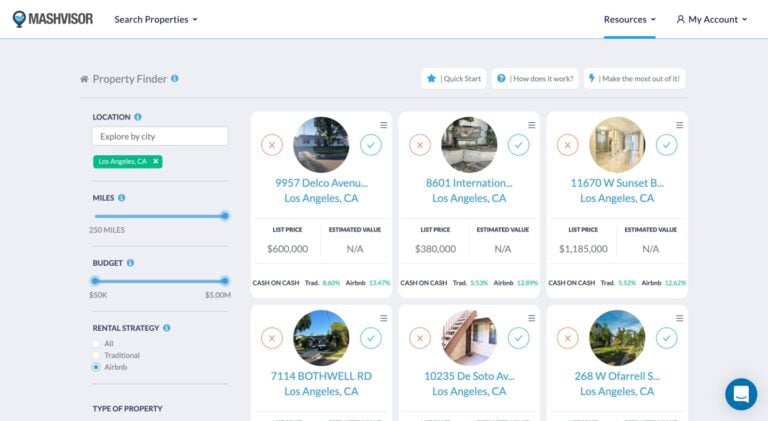

Mashvisor’s website simplifies the process of obtaining an Airbnb property into five simple steps.

1. Identify Your Target Market

After you’ve assessed your finances and established a budget, you’ll need to decide what kind of visitors you want to attract since this will influence the sort of property you can buy.

It is critical to keep changes in mind when deciding which demographic to target. More than merely looking at the typical demographics (families, business people, and others), short-term rental investors must be aware of emerging trends to maintain their market relevance.

2. Find a Good Location

Regarding real estate, especially rental homes, location is everything. While there are several reputable real estate platforms online, Mashvisor provides consumers with a more comprehensive view of the housing market 2022, with data from nearly every market in all 50 states.

All users need to do is visit the website and enter their desired location into the Property Finder tool. The application allows users to search for houses in various markets around the United States by entering the address, neighborhood, town, or zip code of their chosen area.

It will then direct them to a page with a real estate heat map of the region and investment homes listed on the MLS.

Mashvisor’s Property Finder lets you search for properties in up to 10 cities at once, making finding profitable Airbnb rentals more efficient.

3. Carry Out a Thorough Data Analysis

Once you’ve decided on a location, conduct comprehensive rental market research to determine which houses would best meet your needs. That will help guarantee that the home you purchase will provide you with a good Airbnb income and will not make you dread your decision.

You can do this by using the site’s heat map and filters or employing the platform’s Airbnb calculator.

4. Cooperate With a Local Agent

Once you’ve reduced your options, talk to a local real estate agent who understands the market. The agent can lead you through property searching, answer your questions, and offer expert advice.

Users of Mashvisor also get access to a vast real estate agent directory, which assists both buyers and sellers in locating the right expert in any town or city across the country.

5. Close the Deal

Finally, once you’ve narrowed your search to a single house that fulfills your criteria, it’s time to close the transaction and purchase that property.

Conclusion

Ultimately, it is critical to conduct research before determining whether to rent out your properties as Airbnb rentals or in a more traditional manner. Both have advantages and disadvantages that should be evaluated.

You can make the best choice for your scenario if you take the time to learn about the laws and restrictions in your region and what is involved in each sort of rental.

To make things easier, you can always consider giving Mashvisor a try. Mashvisor users already have an advantage when finding a suitable investment property. They may use the site not simply to look for properties but also to undertake extensive neighborhood and property analyses.

Mashvisor provides state of the art real estate investment tools to help you make wise investment decisions and walk you through your investment journey. Please sign up here to start analysing the investment opportunities in both short trem and long term rental industry.