Single-family housing starts fell more than expected in Q3 2022, forcing developers to brace themselves for more declines in the next few weeks.

According to a Reuters report released last month, the number of single-family housing starts in September 2022 fell to its lowest level in two years. Data from the Census Bureau reflects how big an impact on the 2022 US housing market the Federal Reserve’s interest rate hikes are making.

Single-family housing starts fell to an annual rate of 892,000 or 4.7% in September. The figure is, so far, the lowest since May 2020. With the current higher mortgage rates today, it is unlikely that a rebound will take place soon.

Oxford Economics lead US economist Nancy Vanden Houten said they expect housing starts to moderate further in (the fourth quarter) from 1.461 million units to 1.420 million units.

Houten remarked:

“The risk, however, is for a slower pace of starts, given the weak handoff at the end of Q3 and pessimism among homebuilders who are seeing buyers retreat to the sidelines at a time when they continue to face elevated cost pressures.”

In a recent CNBC report in mid-November 2022, the numbers fell to 21% year-over-year as mortgage rates continued their upward trend and dampened the demand for single-family housing starts. Building permits also went down 22% annually. These annual declines are getting steeper.

As a result, 59% of builders are offering more incentives to generate some sort of interest to get things going. Some 37% of builders cut prices in November versus only 26% in September.

Related: Homebuilders Expecting Downturn in the Real Estate Market in 2023

What Are Single-Family Housing Starts?

By definition, single-family housing starts are simply a measure of new residential construction. It is considered a key economic indicator because it is a big-ticket capital good that leads to higher consumer spending on furniture and appliances.

The groundbreaking activity signals the beginning of a housing start. Even if it’s a multi-family housing project and not a single-family unit, each unit is treated as a stand-alone housing start. It means that if a multi-family property comprises 40 units, it will register 40 new housing starts.

One of the main reasons why housing starts are important is it is a key sector for the US economy. They are also considered crucial for the real estate, construction, and banking industries. A healthy housing sector creates more jobs and generates higher income for suppliers and builders.

However, because of the decline in single-family housing starts, as well as other factors affecting the housing sector, several folks are questioning if a housing market crash is on the horizon. While experts believe that a housing market crash is far from happening, investors and homebuyers are on the lookout for telltale signs, including the recent drop in housing starts.

Forbes even published an article about it in August 2022, with the headline stating that the housing market is facing the risk of a multi-year collapse as the demand for home construction drops.

Ian Shepherdson, chief economist at Pantheon Macro, expects the downtrend will continue to worsen all the way into 2023 as mortgage applications continue to plummet. Shepherdson said:

“The whole housing sector is now in retreat.”

Related: 8 Best Markets for Investing in Single Family Homes for Sale in 2022

3 Factors That Caused the Drop in Single-Family Housing Starts and Existing Home Sales

People can speculate all they want about what the housing market will be like in the near future, but as a real estate investor, you need to know how to filter the information coming your way. If you’re armed with the right information and data, you can make wiser and more informed decisions where real estate investing is involved.

That said, when we talk about the huge decline in single-family housing starts, we need to look at the different factors that affect the numbers. The factors include the following:

1. Housing Affordability

The very first concern for homebuyers and real estate investors is affordability. While the pandemic caused a temporary disruption in housing, the housing market quickly made an unexpected comeback. Investors took advantage of the lower prices sellers were asking for at the time just to make a sale.

The demand for housing went up during the pandemic, especially for properties located in the suburbs. Because of shelter-in-place mandates, people were inclined to buy larger properties that gave them bigger habitable spaces.

In most cases, urban center dwellers living in cramped apartments made their way out into the suburbs. It boosted the demand for single-family units. As the economy reopened, builders worked harder to catch up with the demand for housing. And while the available inventory was still a bit far from meeting the rising demand, it was catching up slowly.

The basic law of supply and demand also caught up. As the demand for more housing continued to grow, property prices also began to go up, especially during the latter part of 2021.

According to real estate website Mashvisor, the median property price in the US in January 2022 was only $387,167. Fast forward to Mashvisor’s November 2022 report, the median property price in the country is already $480,770. And while there seems to be a slight cooling down in the real estate market nowadays, it doesn’t mean that prices aren’t still going up.

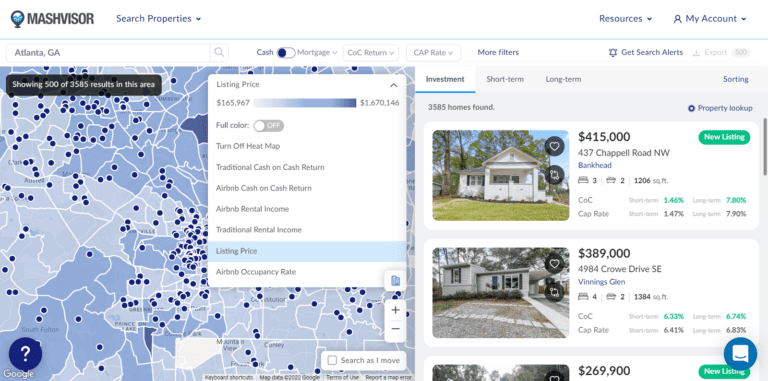

Mashvisors allows real estate investors to search for and find affordable houses based on their respective listing prices.

2. Mortgage Rates

The second thing affecting the year-over-year drop in housing starts is the ever-increasing mortgage rates. Because inflation is high, the Federal Reserve initiated several rate hikes over the past few months to mitigate its effects. However, the Fed’s move comes at the cost of the borrower.

A lot of investors lack the financial capability for all-cash transactions. Many of them need to resort to mortgages to finance their purchase. Plenty of real estate investors took advantage of the record-low mortgage rates during the pandemic, which resulted in the housing market making a strong recovery.

However, because of global economic events, we are now seeing record-high mortgage rates. In fact, November 2022 mortgage rates already hit 7% (30-year fixed-rate mortgage and jumbo loans).

The continuous upward movement of rates is causing investors to hold off on buying investment properties. If you’re an investor and you want to find the best deals at this time to offset the rising mortgage rates, Mashvisor can help you find the most profitable investment property for you.

To learn more about how we will help you make faster and smarter real estate investment decisions, click here.

3. Local and Global Economic Conditions

Once 2022 rolled in, interest rates for all goods started to soar. 2022 predictions stated that the year would end with a high of 5% in mortgage rates, but they didn’t anticipate the Eastern European war. Because of the geopolitical crisis, the entire global economy was affected. The main culprit for price increases across the board was the disruptions in oil supply.

Because of the war, the price of oil in the world market shot up and went through the roof. The price increase negatively affected the entire global supply chain, causing a massive domino effect across all industries.

To this day, despite the rate of inflation slowing down a tad, it continues to go up with no signs of stopping. Local economies need to make certain adjustments to offset the growing expenses. Rental property owners, for instance, are forced to increase rental rates to sustain their business operations.

Will 2023 Be a Bad Time to Buy a New Investment Property?

All that said, is now a good time to buy an investment property? It depends on a few factors.

One, you must consider your financial situation. If, at this time, even with everything going on, you can afford to buy an income property for sale, then you may still be able to find great deals. But you need to be wise and prudent. If you’re taking out a loan, you need to perform due diligence and look for lenders that will give you the best possible terms.

Speaking of due diligence, on top of being able to afford a property at this time, you also need to find out the actual condition of the market you’re considering. If you plan to buy a property and rent it out as a long-term or short term rental, you need to see what the rental market is like in your area of choice. The numbers will tell you all you need to know about the market.

Find out what the area can offer by way of rental income, cap rate, cash on cash return, and occupancy rate, as they will significantly influence the property’s profitability.

At the end of the day, getting an honest assessment of your financial situation and performing due diligence will give you better chances at investing success, even if the market isn’t performing as well as it should. It also helps to keep yourself updated with the latest information and news, so you know what to expect and how to adjust accordingly.

Related: 20 Best Markets for Real Estate Investing in 2023

Wrapping It Up

Despite single-family housing starts dropping significantly, it shouldn’t discourage you from investing in real estate, especially if you have the means and a solid investment plan.

You just need to look for investment properties that will give you a good return on investment and let you earn a decent profit. There’s no better way to do it than going with real estate platform Mashvisor.

Mashvisor provides state of the art real estate investment tools to help you make wise investment decisions and walk you through your investment journey. Please sign up here to start analysing the investment opportunities in both short trem and long term rental industry.