Have you ever wondered where to get the finest real estate data API and how to put it to use in your business? Read this article to find out more.

From federal agencies to brokers, many businesses and professions require quick access to dependable, up-to-date real estate data. APIs are especially beneficial if you want to use real estate and property information. It enables you to import the data you need simply—and also when you need it.

Table of Contents

- What Is Real Estate Data API?

- How Do Real Estate APIs Work?

- Who Would Benefit From Using Real Estate Data API?

- Where to Find the Best Real Estate Data API in 2023

Moreover, real estate data API is ideal for obtaining housing, mortgage, and rental information. Real estate APIs are critical to your success in the market, whether you’re a product manager, developer, real estate agent, realtor, or helping real estate professionals.

In this article, we’ll explain how real estate API can make a meaningful impact for real estate investors, as well as which one you should look into first.

What Is Real Estate Data API?

The term API refers to a set of programming codes that queries data, decodes responses, and transfers instructions from one software platform to the next.

As a service provided by companies that offer them, real estate APIs give housing, rental, mortgage, or property condition data on particular or numerous properties. Moreover, real estate APIs can help you succeed in your real estate journey.

Moving on, real estate data API performs a variety of services. For example, one API may give listing data such as year built, property type, number of bathrooms and bedrooms, price per square foot, short term and long term rental income, demographics, and others.

Another real estate data API may focus on real estate-related taxes, mortgages, foreclosures, and other market data. Some other APIs may give fast and precise information on a property’s present physical attributes.

How Do Real Estate APIs Work?

Data is considered the essence of real estate investing, with the internet playing a critical role in making that data more accessible over the last three decades.

However, in the age of online real estate platforms, companies that transact, invest in, and trade rental properties are racing to use technology to help them make wiser business decisions.

APIs designed using open standard data interchange formats XML or JSON give a ready mechanism to incorporate crucial data points into user processes.

Real estate data APIs serve as mediators, receiving user requests and informing the connected backend system to deliver the required information linked to the user’s inquiry.

APIs are often provided by subscription and come in a variety of forms. Some give minimal datasets. For example, MLS-based real estate listings obtained via API do not include the use of analytics to provide value-added insights.

However, many data providers use AI or intelligent software to analyze raw data and provide valuable information relevant to their area of expertise. Moreover, insurers, investors, and traders use the said data to extrapolate their models to make rapid acquisition or divestiture decisions.

Who Would Benefit From Using Real Estate Data API?

Real estate data API is critical to your success in the market, whether you’re a real estate agent, product manager, developer, realtor, or aiding and navigating real estate investors and professionals through their investing journey.

In addition, an API provides quick and safe access to precise and up-to-date real estate and property data. In addition, a real estate data API may automatically update your app or website with current assets and real estate info.

You can leverage real estate APIs to access a variety of real estate data, from the MLS to neighborhood and crime statistics.

Additionally, you can then utilize the data to improve your SEO and drive more visitors to your website. You can also give property and area information to clients and potential customers, automate processes, and drive analytics.

Where to Find the Best Real Estate Data API in 2023

You now realize why property data is the real estate industry’s soul and why API in real estate is so important and needed. Incredibly, you can use your smartphone or computer to obtain data for any home in the US housing market.

However, many businesses provide real estate data API (be it Airbnb API or long term rental API). How can you determine which one will best service your needs and give dependable rent estimate API?

When searching for the finest real estate data API, the most critical question is: where does the product acquire its data? In other terms, what is the source of the data?

We are going to talk about Mashvisor data API and how it functions for real estate investors.

Mashvisor Real Estate Data API

Let’s start and use Mashvisor’s real estate API as an example. Mashvisor’s API collects and aggregates property data from a variety of public sources. It then enhances the data with patented AI-powered investment analysis.

It means you save a significant amount of time by obtaining access to industry-leading data analytics without the need to investigate hundreds of sources.

So, while searching the Mashvisor tool for real estate investments, you can quickly and effortlessly select the most lucrative ones in your preferred market. You can do it all with just a few clicks of your mouse.

That’s why, in 2022 and 2023, Mashvisor’s real estate investing software offers some of the best and most dependable real estate data APIs.

Now, let’s focus on Mashvisor’s comprehensive list of real estate data APIs.

1. Data and Analytics for Short Term Rentals

Here, you can access detailed and trustworthy statistics and analytics on the success of actual Airbnb and other short term rentals in any neighborhood, city, zip code, or street.

Mashvisor real estate data analytics allows you to research your preferred market and access any information you need. Some of them are the number of active listings, median listing price, short term rental listings, and comparable rental estimates.

Real estate investors will also gain excellent insights into the city’s investment performance, its top areas, an overview of the neighborhood, and the best investment property suitable for real estate investing.

Here is a complete list of short term data:

- Short term rental income

- Short term rental daily rate

- Short term rental occupancy rate

- Cash flow

- Cash on cash return

- Cap rate

- Short term rental reviews and ratings

2. Data and Analytics for Long Term Rentals

With Mashvisor’s analytics, you can get reliable, certified data and analysis on long term rentals in any US property market location. Moreover, you can estimate the monthly rental income, cash flow, occupancy rate, cash on cash return, and cap rate of any residential property.

With such data, you can purchase an investment property that offers a reasonable return on investment and surpasses the local housing market.

Mashvisor, as previously said, analyzes MLS listings. You may use the search tools to identify properties for sale, get a rental estimate, and acquire the following real estate evaluation data, thanks to real estate API:

- Cash flow

- Long term rental cash on cash return

- Long term rental cap rate

- Long term rental income

- Daily rate

- Occupancy rate

With real estate data API, you can obtain the rental estimate and other real estate metrics, such as cash flow, cash on cash return, and occupancy rate.

3. Property Information

With such API data, you can get comprehensive data about MLS listings in the United States. Also, you can analyze previous sales of similar houses to the one you’re thinking about buying in order to get fair market value.

Here is a complete list of what you can acquire through property information real estate data API:

- Property information and characteristics

- Historical rental income

- Sales history

- Tax history and tax information

- Property owner information

- Neighborhood data

Mashvisor provides state of the art real estate investment tools to help you make wise investment decisions and walk you through your investment journey. Please sign up here to start analysing the investment opportunities in both short trem and long term rental industry.

4. Data on Property Ownership

Accessibility to property ownership information assists real estate professionals in generating real estate leads from prospective property sellers. Such information is also useful to investors who want to know the homeowner and whether it meets their criteria for an investment property.

Utilizing our extensive property database, you may quickly locate and contact property owners for off-market possibilities. Then, you can communicate with them directly using our connected email system.

If you don’t have particular homes for sale in mind, you may seek property owners in a certain region and obtain a homeowners dataset.

Mashvisor’s property owner data includes, but is not restricted to:

- Length of residence

- Household income

- Email address

- Street address

- Age range

- Owner’s first name and last name

- Phone number, including area code

5. Investment Analysis Data

Mashvisor differs from other real estate data APIs because it gives its users the resources required to do a thorough investment property study. It helps them to make profitable real estate investments and fulfill their financial objectives.

You may access the Rental Property Page by clicking on any listing on the platform. There are forecasts and computations for each property, facts, attributes, the owner’s details, and tax records.

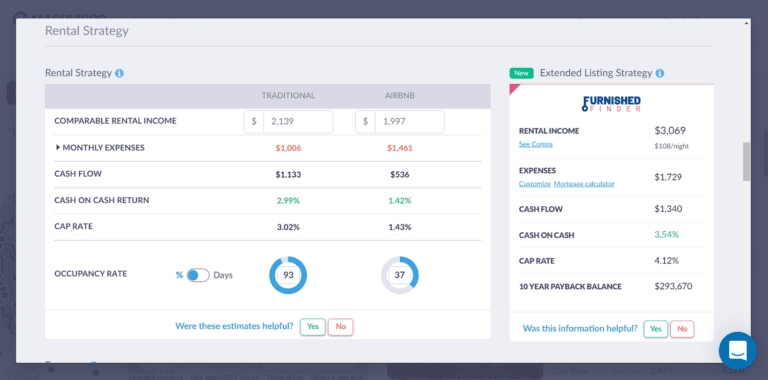

Underneath is Mashvisor’s dynamic Rental Property Calculator API. The cap rate calculator provides all the calculations required for the return on investment criteria used to assess rental homes.

Most notably, Mashvisor underlines the need to compare rental techniques. The ROI figures and data for both renting strategies will be presented. It allows investors to make a quick rental strategy comparison to see which approach delivers the highest returns.

Furthermore, the API cash on cash return calculator contains a part for determining your financing option and a section for computing all property expenses and costs (it will be filled with default data figures based on averages for each location).

All of the above parts are connected, and any alterations you make to any elements will impact the rental plan’s computations and the property’s return on investment. Of course, it is all accomplished by real estate data API.

If you wish to get more information on the Mashvisor real estate data API and see what it offers, start here.

Mashvisor’s Investment Analysis Data List

Here is a breakdown of all the rental analysis data available from Mashvisor:

- Down payment

- Loan type

- Interest rate

- Payment type

- One-time startup cost

- Monthly expenses

- Total expenses

- Long and short term rental income

- Cash on cash return

- Cap rate

- Long term rental vacancy rate

- Short term rental occupancy rate

6. Rental Comps Data

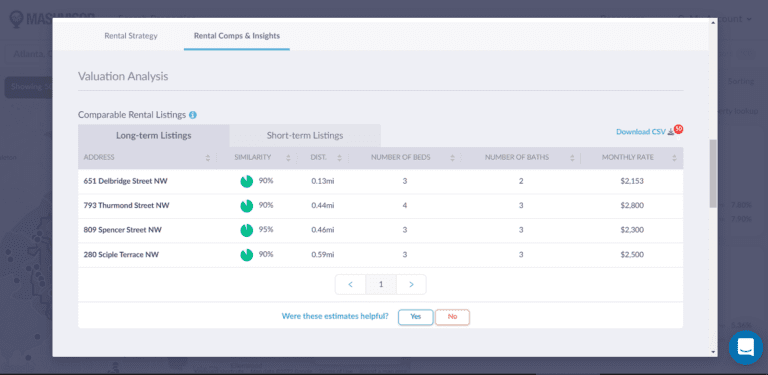

Investors used to spend hours doing a comparative market study to generate a list of real estate comps before the creation of real estate data APIs. With Mashvisor, it becomes outdated in 2023. Mashvisor’s real estate investing tools include recent sales of comparable homes as an aspect of the real estate investment search.

Moreover, such data API enables investors to assess the current market worth of a rental property and determine how close it is to the listed price. In addition, real estate comps data also helps investors in determining if the market is a suitable area to invest in real estate.

Rental comps are another form of comparison that can assist real estate investors in determining how much rent to ask. The comparables data displays the monthly revenue from other similar rental units nearby.

The data will assist you in understanding how different assets perform compared to one another. Rental comps, like real estate comps, are generally acquired through rental market study.

However, they are easily accessible online using real estate software such as Mashvisor. The platform’s real estate data API will provide you with rental comps data that covers both long term and short term rental properties in the neighborhood.

Mashvisor’s real estate data API provides users with rental comps data covering both long term and short term rental properties in a particular neighborhood.

Conclusion

Access to real estate data API as an investor is critical to your success in the market.

Now, you can forget about wasting time gathering data, maintaining it in numerous spreadsheets, and updating it each time an investment opportunity presents itself. Instead, utilize a real estate data API to handle all of the labor for you.

The Mashvisor real estate data API combines property data on over 450,000 homes, whether you’re seeking to invest in a short term or a long term rental properties.

The Mashvisor data API scans dozens of publicly available sources and then enhances them with proprietary AI-powered investment analytics. Such an approach can provide you with a selection of the most suitable investment homes that most closely match your search parameters.

Ready to schedule a free demo and see what Mashvisor offers? Get in touch with one of Mashvisor’s Product Specialists.