Pinning down some of the best investment property hotspots can be a pretty straightforward process—when you have the right tools, that is.

With rising rent prices, the long-lasting consequences of inflation, and the ever-changing trends in the real estate market, finding investment property hotspots can, at times, seem like a “mission impossible.”

Table of Contents

- 5 Qualities of an Investment Property Hotspot

- Truths About the Real Estate Market

- How to Find Profitable Markets for Property Investments

At this point, real estate investors do not have much room—let alone time and finances—for gambling and taking shots in the dark.

The safest course of action is, of course, to rely on investment tools, up-to-date information, and detailed reports. Proper research and access to accurate data can make or break any investment strategy, and you can’t really proceed without it.

Now, for the good news:

Platforms like Mashvisor offer online tools that are specifically designed to make the lives, as well as business ventures, of investors a lot easier. And one of those tools is the Market Finder, which lets you see a bird’s eye view of the housing market.

If you’re interested in making a successful investment in 2023, stick around. We’ll show you how to uncover some of the best investment hotspots right now.

5 Qualities of an Investment Property Hotspot

You should be aware that researching investment property hotspots is not a one-day task. It’s a process that requires a lot of hard work, dedication, information, and determination on the investor’s end.

And, of course, a helping hand from investment tools is always more than welcome.

But before we get to that, let’s go over the five key qualities of profitable investment property hotspots.

1. Location

When searching for a profitable investment property, choosing the right location and then researching every corner of that neighborhood will most likely be the most intricate part of the entire process. It also happens to be on the very top of every investor’s to-do list.

Why is that?

The location of your investment directly affects other factors that we will mention here. The said factors are of crucial importance to the success of your strategy. They also influence the safety, financial future, and well-being of the people spending time on that property.

However, when you say “location,” keep in mind that it is a bit of a general term.

Investment property location concerns many things, including the community, the proximity of different amenities, road networks, and transportation, among other things.

What is important to remember as an investor is that one location cannot—and certainly will not—work for everyone.

Here’s an example:

A quiet location with a good road network, highly-rated schools, and lots of green areas and parks will be better suited for families with kids who want to rent a property long-term.

On the other hand, lively locations in metropolises, with tourist attractions, amusement parks, and clubs, and generally busy neighborhoods, will probably be more suitable for people looking for short-term accommodation.

In either case, when you identify a potential location for your investment property, be sure to check the following:

- Connectivity (public transport)

- Neighborhood crime rates

- Infrastructure development

- Available facilities and amenities

2. Property Taxes

Before going any further, it is crucial to distinguish between personal property taxes and real estate taxes.

While real estate taxes only deal with real estate properties, personal property taxes will also include different kinds of movable personal property, such as cars, mobile homes, and the like.

The taxes are charged semi-annually or annually, and the local government determines the tax rate you will be required to pay.

It’s also important to note that taxes can vary quite a bit depending on the location. Tax rates for real estate investors will generally be higher in large cities and lower in rural areas.

On that note, here are the top ten locations with the highest property tax rates in the US:

3. Crime Rates

The third factor that characterizes a quality real estate investment is the local crime rate.

Here’s the deal:

When you are searching for the next investment opportunity, you need to put yourself in your tenant’s shoes. And when you see things from the tenant’s perspective, you’ll realize that the location matters.

Not just location as an indicator of where the property is located, but its safety, too.

Your goal is to ensure that the residents will stay on your property for a long time or—if it is a short term rental—that they’ll want to come back soon.

From official websites to digging for public information from the city’s local government, you must include information regarding crime rates in your strategy and your final decision.

Keep in mind that, depending on the potential location of the rental property, crime rates may differ. The numbers tend to fluctuate from one neighborhood to the other.

If you’ve been in the business for a long time now, you are likely aware that hiring a property manager at this point would be a wise move.

Such professionals are able to provide insights and expertise that are specific to the area you’re investing in. They can help you connect the dots and point out the potential “red flags” of a neighborhood. You can benefit from the professionals’ insights and avoid making an unsuccessful investment further down the line.

Of course, you can always visit the neighborhood yourself and check the situation firsthand.

Warning Signs to Look Out for

If you’re interested in investment property hotspots that are near one another and you are up for a trip, don’t hesitate to pay a visit to such neighborhoods. And while you’re there, look for the following warning signs:

- Fewer kids playing in the street

- Poor street lighting

- A heavy presence of police in the area

- Nearby properties that are in a state of disrepair (broken windows, overgrown yards, and run-down buildings)

- Abandoned storefronts

- Unkempt parks and public spaces

4. Job Market

When the pandemic was at its peak, 47% of tenants were below the age of 30. Fast forward to 2023, and the situation remains almost the same. Renters still average at around 30 to 39 years old.

The above numbers tell investors one thing:

The younger generation is moving from their hometowns in search of career opportunities. Many of them are looking for growing job markets where they can continue to prosper and develop as professionals.

How does it affect investors?

It’s simple.

Investing in growing markets can only benefit you as an investor and a landlord.

Nowadays, more students are choosing not to stay on campus, so they’re more interested in renting a place nearby. Also, young professionals with their new degrees seem to be eager to leave their hometowns and move to a bigger city.

That’s where your well-planned investment comes in handy.

If you set a reasonable rental rate, which would allow you to generate profit while still ensuring that these younger generations can afford it, you can count it as a win-win.

With that said, here’s a short list of US states with a growing job market:

- Colorado

- Massachusetts

- New York

- California

- Minnesota

- Virginia

- Washington

- Connecticut

- Maryland

- Ohio

5. Amenities

Last but not least, amenities play a major role in choosing high-quality residential real estate. They represent different things, from the community amenities in an apartment building to the internal ones, like appliances.

Naturally, the more amenities that can be found in the residential property, the better quality it provides to the tenants.

That’s because amenities are mostly about ensuring a pleasurable and enjoyable stay at the property. Besides, we can’t ignore the evident connection between good social infrastructure and the well-being of residents.

Here are some examples of community amenities in an apartment building:

- Swimming pool

- Parking lots

- Fitness center

- Social areas

- Rooftop gardens

- Bike parking

- Package lockers

- Party room

- Building Wi-Fi

- Greenery and paved trail systems

- Surveillance cameras

- Valet waste removal

- Outdoor areas

- Billiards table

- Clubhouse

Most short term renters will generally be more interested in internal amenities, including the following:

- Online rent payment options

- Complimentary Wi-Fi

- Large bathtubs and bathrooms

- Security systems

- Intercoms

- Smart home functionality

- Balcony

- Central air conditioning with heating

- High-end fixtures and finishes

- Dishwasher

- Built-in washer and dryer units

Truths About the Real Estate Market

Since we are here to help you find investment property hotspots, we’d like to take a moment to discuss the three major truths about the real estate market:

1. Money Is a Necessity

Before you begin the search for investment property hotspots, the first truth you should keep in mind is that money is absolutely a necessity.

Of course, the best-case scenario here would be for you to already have some money saved up as you head into the real estate business. Getting involved with banks by applying for a loan is a much riskier option, especially for beginners.

2. Short Term Rentals Are Riskier

Some stick to the opinion that short term rentals represent riskier investments than long term ones. And there’s truth to this, at least to some extent.

Such hotspots are definitely attention-grabbing, especially in bigger cities and metropolitan areas, where people just want to spend a few days and enjoy their stay. However, they might not be as stable as a long term rental.

If the market flops, you could lose a lot of money. Besides, you should also bear in mind that short term rentals tend to be a fluctuating passive income.

3. More Information Is Available Today

There’s no denying that the amount of information available nowadays is vastly different from five or ten years ago, for example.

There was a time when real estate investors were compelled to work with limited resources. Nowadays, thanks to the internet and instant access to information, everything you need to know is readily available. You can easily find what you need to know about crime rates, demographics, and rental rates in just a few clicks.

How to Find Profitable Markets for Property Investments

If you’re set on giving real estate investing a shot and need some guidance, we’ve prepared a simple step-by-step guide on how to navigate this complex journey successfully:

Check Your Financial Situation

As we’ve already mentioned, investing in real estate is an expensive business venture. You’ll definitely need to have some cash saved up to get started on the right foot.

Here’s an overview of the costs that are considered necessary for a start-up in this industry:

- Down Payment of 20%: Keep in mind that there is no zero-down mortgage program for investment properties. You’ll be required to come up with a minimum of 20% of the purchase price for your property.

- Upgrade and Repair Costs: If you go with the bargain approach and decide to buy a real estate property that’s not in the best condition, get ready for certain upgrade and repair costs. Reaching a satisfactory condition that will attract tenants is going to cost you.

- Inspection and Licensing Fees: Investing is not just about putting money into a real estate property. Most US states will require rental properties to be inspected for safety hazards, adding to your list of expenses.

- Maintenance: You’ll also need to factor in property maintenance costs. Your tenants are paying rent and expect you to provide a safe residence with working appliances in return. Plus, you need to take care of maintenance between tenants to ensure that your property is in rent-ready condition.

Find a Good Housing Market

Once you’ve arranged your finances, it is time to focus on the US real estate market and the place that is most favorable for your next investment.

As mentioned, finding a profitable location is the most important step. Whether you’re new to the business or a seasoned investor, you will need to conduct a thorough real estate market analysis. It will help you pin down the top-performing real estate investment property hotspots.

It implies digging deep into the real estate market—state, city, and neighborhood. Some of the factors that affect it, as we previously mentioned, will be crime rates, the job market, demographics, infrastructure, and the like.

Using tools that were specifically developed with real estate investing in mind will be of great help in your venture.

And that brings us to Mashvisor’s Market Finder:

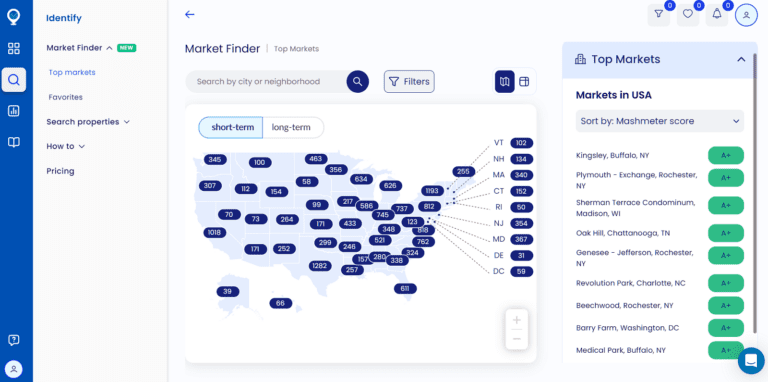

This investment tool allows you to zoom in on particular real estate areas, making it possible to examine what a city or a neighborhood can offer in greater detail.

Mashvisor’s Market Finder also offers a variety of options for investors to hunt down the next investment property. One of its notable features is the visual representation of different neighborhoods that shows how they’re performing at the moment on a heatmap.

Mashvisor’s Market Finder provides real estate investors with a visual representation of different neighborhoods, allowing them to find their next investment property.

Create a Successful Business Plan

Once you’ve pinned down a real estate investment hotspot, it is time to develop a successful strategy. Generally speaking, a good real estate strategy must cover everything, down to the tiniest details.

First and foremost, you need to decide whether you’re interested in long term or short term rental markets. Think about your financial situation, goals, expectations, the time you will spend on the field, and similar factors.

Once you’ve developed a solid plan, you will gain better insights into what you can expect, your potential income, and, ultimately, your real estate success.

Without a business plan in place, it is easy for beginner investors to get distracted or expect something impossible from their property.

Mashvisor provides state of the art real estate investment tools to help you make wise investment decisions and walk you through your investment journey. Please sign up here to start analysing the investment opportunities in both short trem and long term rental industry.

Wrapping Up

We’ve successfully covered the topic of how to find investment property hotspots. Now, let’s just go through some key points:

Searching for an investment hotspot is more than just going online and looking up real estate properties in a particular area. Whether you are a seasoned investor who’s been in the game for a while now or a beginner, you will need market insights.

For one, you should be aware of the characteristics that denote a highly profitable real estate property, including low crime rates, property tax rates, nearby amenities, and the like.

Once you’re done assessing a potential investment hotspot, you can get down to business. It involves checking your financial situation, exploring the real estate market, and coming up with a profitable real estate plan.

The bottom line is:

You can do it yourself—but there’s no harm in asking for assistance.

Mashvisor’s investment tools are specifically designed for this purpose. Our tools, like the Market Finder, will help you view the real estate market from a wider angle. You can evaluate the profitability of certain areas and pin down your best choice.

We’re here to help Airbnb investors find and manage their rental properties in the best way possible.

Sign up for our 7-day free trial now and get your investment career off the ground.