Short term rentals are known to provide gainful returns. It is why many new investors buy an STR investment to get started with real estate.

Many people consider short term rentals (STRs) a popular investment option. With the rise of platforms like Airbnb and VRBO, it’s now easier than ever to rent out a spare room or even an entire property to travelers. In fact, even those who are new to real estate prefer to start with an STR as their first investment.

Table of Contents

- What Is an STR Investment?

- STR vs LTR Investment: Which Is Better for First-Time Investors?

- How to Find Your First Profitable STR Investment

STRs offer several advantages as a first investment. They require a lower upfront investment if you’ll only rent out an extra room in your primary residence, making them an attractive option for those without a large amount of capital to start with. It is why STRs are a great choice if you just want to test the waters in real estate investing.

Additionally, short term rentals can generate higher profits in a shorter amount of time, making them appealing to those looking to see a quicker return on their investment. However, there are also potential downsides to investing in an STR. One of the biggest risks is the potential fluctuations in demand, which can impact occupancy rates and, ultimately, rental income.

It is the reason why it’s crucial to find the best short term rental markets to invest in, as your investment location can significantly impact your success. Also, if you want to compete in the market, you must spend on your vacation rental’s amenities and aesthetics. With the said factors in mind, you can decide if an STR is the right first investment for you.

What Is an STR Investment?

A short term rental investment, or STR for short, is a type of real estate investment strategy that involves renting out a property for a short period, typically less than 30 days. Short term rentals, sometimes referred to as vacation rentals, continue to grow in popularity, thanks to the rise of online home-sharing platforms.

Platforms like Airbnb, HomeAway, and VRBO make it easy for STR property owners to list and rent out their homes to travelers. The home-sharing platforms aim to connect STR hosts with travelers looking for a place to stay. It’s worth noting that Airbnb or any home-sharing platforms do not own the properties listed for rent.

Short term rentals can come in many different forms, from a spare room in a private home to an entire vacation rental property to unique accommodations like tents and cabins. They can be located in urban, suburban, or rural areas, and can offer a range of amenities depending on the specific property.

The key feature that distinguishes an STR property from hotel accommodations is the homey atmosphere that the former provides. Most short term rentals offer amenities like a fully-functioning kitchen, allowing travelers to cook at the property while they are visiting the place. To stay ahead of the competition, it’s essential to study the market demand so you can keep up.

In general, STR investments can be lucrative, as they allow property owners to earn generous income. What’s more, there’s a strong demand for short term rentals, especially in the right STR market. In fact, even with the slight cooling down of the US housing market, the STR industry remains strong.

However, they also require careful consideration and planning to ensure that they are profitable and legal.

STR vs LTR Investment: Which Is Better for First-Time Investors?

Before we analyze what the best investment strategy for first-time real estate investors is, let us first identify what is a long term rental investment and how it differs from short term rentals.

A long term rental, also known as LTR investment, is a type of real estate investment where a property is leased out to a tenant for an extended period of time, typically six months or longer. Long term rentals involve a more traditional landlord-tenant relationship, compared to short term rentals. An STR is often rented out for a few days or weeks at a time.

Long term rentals also come with a lease agreement that outlines the terms of the tenancy. With an LTR, tenants should commit to the lease for a specific period. Usually, tenants are not allowed to pre-terminate the lease, which means landlords get to enjoy a steady income stream during the entire duration of the lease term.

How Does LTR Investment Differ From STR Investment?

Long term rentals differ from short term rentals in many ways. The major difference is, of course, the length of the rental period. With STR, as the name implies, guests only stay for the short term, typically for 30 days or less. With long term rentals, on the other hand, renters stay for an extended period, usually for at least six months to one year, sometimes even longer.

Another difference between LTR and STR investments is your target guests. With short term rentals, most of your guests are temporary visitors who are traveling to the area for either leisure, business, or personal reasons. It means that to be successful in short term rentals, you need to find a location that’s frequented by visitors all year round.

On the other hand, your target renters for an LTR investment are new residents in the area, as well as couples and families who cannot afford to buy their own houses yet. To get a high occupancy rate, you need to find a place with amenities that attract long term tenants, like proximity to schools, medical services, and business areas.

It’s worth noting that both LTR and STR investments are governed by state and city laws. For long term rentals, you need to abide by the landlord-tenant law in your state, as well as the Fair Housing Act. For an STR investment, you need to follow the STR rules and regulations in your city. Make sure that it’s legal to operate a short term rental business in your location.

Pros and Cons of Long Term Rentals

Long term rentals can be an excellent investment opportunity if you are looking to generate a steady stream of real estate income over a long period of time. However, you need to determine the investment strategy’s pros and cons to know whether investing in long term rentals is right for you. Here are some of the key advantages and disadvantages of an LTR investment:

Pros of LTR Investment

Here are the advantages of investing in long term rentals:

- Steady Cash Flow: One of the biggest advantages of investing in long term rentals is the steady cash flow they can provide. With the right tenant in place, you can expect a consistent monthly rent payment that can help cover your mortgage, property taxes, and other expenses throughout the tenancy.

- Home Value Appreciation: Over time, real estate values tend to increase, especially in lucrative real estate markets. Investing in a good location and taking care of your property provides a good chance for your property to appreciate in value. It means you can earn a profitable return on investment when you decide to sell later on.

- Less Turnover: Since most long term rental tenants sign a lease for an average of one year, you won’t need to deal with constant turnover procedures, like marketing and advertising. The longer the tenants stay, the less costly it is for you to operate the rental business.

- Fewer Operating Costs: While you still need to pay for certain expenses like property taxes, insurance, and maintenance, tenants usually handle other costs like utilities. Also, if there are repair issues that are not part of normal wear and tear, tenants are mandated to cover the costs.

Cons of LTR Investment

Here are the disadvantages of investing in long term rentals:

- Property Management: Being a landlord can be time-consuming, and it typically requires a significant amount of effort. You’ll need to find and screen tenants, collect rent, handle repairs and maintenance, and respond to tenant complaints and emergencies. Understandably, you need to spend more time managing the property.

- Vacancy Risk: There’s always a risk that your property will be vacant for a period of time, which can result in a loss of income. The longer the property stays vacant, the higher your risk of financial loss. Such a risk can be mitigated by setting aside reserves and putting a solid marketing plan in place to attract new tenants.

- Problematic Tenants: While you want your property to get occupied as soon as possible, you don’t want to risk landing yourself with difficult renters. Bad tenants can cause too much stress and possible financial loss. They tend to make late payments or damage the property due to negligence or abusive behavior.

- Legal Issues: Landlords need to comply with various laws and regulations, including fair housing laws, local building codes, and landlord-tenant laws. That’s why you must be familiar with the local laws to ensure that you don’t commit unintentional violations. Failure to comply with these laws could result in monetary and legal consequences.

Pros and Cons of Short Term Rentals

An STR investment is a remunerative investment strategy for those who want the flexibility and advantages of a rapidly growing market. However, not all real estate markets are ideal for investing in short term rentals, so it’s crucial to find the best areas before you buy Airbnb for sale.

To know whether investing in an STR is right for you, you need to consider the following pros and cons:

Pros of STR Investment

Here are the benefits of investing in short term rentals:

- Higher Rental Income: Short term rentals can generate higher rental income than most long term rental properties, especially in popular vacation destinations or areas with high Airbnb demand. You can charge a premium for nightly or weekly rentals, especially during peak seasons.

- Flexibility: As a short term rental owner, you enjoy more flexibility with your property. You can use it for personal vacations or rent it out on short notice to generate income when you’re not using it. You can opt to block off certain dates in your calendar should you decide to not accept guests.

- High Rental Demand: Since the rise of Airbnb and other home-sharing platforms, many travelers prefer to stay in vacation rentals than in hotels. STRs are generally more affordable, and they offer unique amenities that are not available in hotels. That’s why there’s a consistently high demand for STRs in good short term rental markets.

- Tax Benefits: Like long term rentals, short term rentals offer tax benefits too, considering that it is a business. You can take advantage of deductions for your expenses, which include mortgage interest, property taxes, insurance, repairs, and maintenance.

Cons of STR Investment

Here are the drawbacks of investing in short term rentals:

- Seasonality: Short term rentals are highly seasonal, which means you may experience periods of high demand and low demand throughout the year. The fluctuations can make it difficult to generate consistent income year-round. To mitigate the said risk, choose your location carefully and ensure that it sees longer peak seasons than off-peak ones.

- Increased Risk: Short term rentals come with increased risk, including the risk of damage to your property by guests and liability for accidents or injuries that occur on the property. Also, you can only rely on the reviews from other hosts to determine if the prospective guests are responsible and won’t damage your property.

- Higher Expenses: While STRs can generate higher rental income, they also come with higher expenses. You’ll need to cover the cost of cleaning between guests, provide amenities such as towels and linens, and keep the property well-stocked with supplies like toiletries. You also need to spend for aesthetics to stand out among the competition.

- Highly Competitive: Because STRs are lucrative, the short term rental market is highly competitive. There are hundreds of thousands (even millions) of active STR hosts available. To ensure that your property stands out, you need to offer unique amenities and provide extra excellent service. Don’t forget to choose a strategic location with high rental demand.

Which Investment Strategy Is Better?

If you’re a first-time investor, investing in short term rentals may be a good idea, especially if you cannot fully commit to investing in real estate yet. Also, managing an STR property can be a great learning opportunity for new investors. You’ll learn valuable skills in property management, marketing, and customer service that can be applied to other investments later on.

In addition, you can benefit from listing your property on home-sharing platforms, which essentially provide free marketing and exposure to millions of users from around the world. What’s more, there’s a large community of short term rental investors whom you can get inspiration and support from.

In addition, the short term rental market is undeniably strong. As a matter of fact, even with the recent fears of a possible recession, most real estate experts believe that the short term rental industry will continue to thrive. So, if you’re a new investor, it’s a good idea to buy short term rentals for sale as your first investment.

How to Find Your First Profitable STR Investment

Now we’ve established that investing in vacation homes will make a profitable venture. But before you go looking for one, it’s crucial to know the important factors that will affect your profitability as an STR owner. The following tips can help set you up for success:

1. Find the Perfect STR Market

Location is one of the most important factors that can significantly impact your investment. The best locations for investing in short term rentals are frequented by visitors all year. When choosing a location for your STR investment, consider the seasonality of STRs in the area. Make sure to invest in a place with longer peak seasons.

Here are other things that you should look for:

- Safety

- Proximity to attractions

- Recreational activities

- Entertainment options

- Amenities

- Transportation options

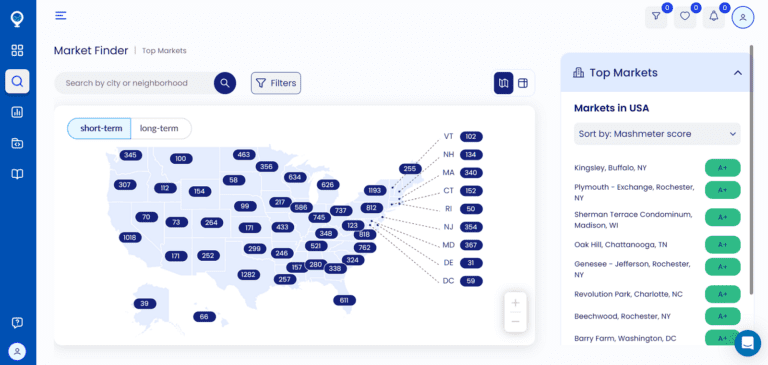

Keep in mind that while a city may be popular, the neighborhood where your investment property is located may not be optimal for STR investing. It’s vital to check the potential of a neighborhood and ensure that it’s ideal for STRs before buying a property. Fortunately, you can do it conveniently through Mashvisor’s Market Finder tool.

Market Finder allows you to zoom in on a city to see which neighborhoods are best for investing in vacation rentals. To start, you can go to Top Markets on the Market Finder page. Then, select the state that you prefer, then see which cities are best for STR investing based on Mashmeter score, rental revenue, occupancy rate, and cap rate, among others.

Once you select a city, you can narrow down your search by choosing the best neighborhoods for an STR investment. This way, you’ll know which areas are optimal for Airbnb and which to avoid.

Mashvisor provides state of the art real estate investment tools to help you make wise investment decisions and walk you through your investment journey. Please sign up here to start analysing the investment opportunities in both short trem and long term rental industry.

You can use Mashvisor’s Market Finder tool to zoom in on a city to see which neighborhoods are best for STR investment.

2. Know the STR Rules and Regulations in Your Chosen Market

While profitability is an important factor to consider when choosing the best STR market to invest in, you also need to ensure that the STR laws in the area are in your favor. Note that some cities impose stricter regulations than others. So, it’s important to do your research first to ensure that the law in the area you choose is favorable to you as a host.

You can use Mashvisor’s short term rental regulations page to determine if a particular city’s STR regulations are positive, neutral, restricted, or negative. As an investor, you must aim for positive or neutral short term rental laws. However, it’s still possible to be profitable in an area with restricted regulations, as long as you know the rules and you strictly abide by them.

3. Conduct a Short Term Rental Analysis

Before buying any Airbnb property, you need to conduct a thorough Airbnb data analysis first to ensure that the property you’re buying will make a good investment. You need to determine the potential cash flow from a particular investment property, as well as its occupancy rate, cap rate, and cash on cash (CoC) return.

The best investment property should provide a positive cash flow and show a high occupancy rate. If you search for properties for sale using Mashvisor’s Property Finder, you will easily access the short term rental data of the property you are interested in. Property Finder is an easy tool to use, you only need to enter your desired location and set the filters to start a search.

Once you find a property that matches your preferences, you just need to click on it and you’ll be directed to a page where you can access the Airbnb data. The information that you’ll see includes the cap rate, occupancy rate, expenses, cash flow, and cash on cash return. What’s more, you’ll see the data for both STR and LTR strategies so you can compare which one is better.

You can also access Mashvisor’s Airbnb calculator so you can set your mortgage details, as well as customize the expenses, occupancy rate, and nightly rate. The calculator allows you to get a better overview of how much you can earn from a particular property when you set the variables. It will give you a more accurate computation based on your plans.

4. Check STR Comparables

It’s also necessary to perform a rental comps analysis to ensure that the computation you get is close to the actual performance of similar properties in the area. By checking out properties with the same type, size, and features as your subject property in the same location, you’ll determine how much they are making.

Additionally, you’ll also know how your competitors are doing, helping you create a strategic plan on how to position your business so you can stay ahead of the competition. If you use Mashvisor, you’ll have access to comparables and neighborhood analysis, making it easier for you to identify which properties are doing best in the neighborhood, and which are not.

5. Compare Properties and Choose the Best One

After conducting your research and analysis for a number of STR investment properties, it’s time to compare the results to see which one is the best. It’s important not to settle on a particular property before you compare it with others, as you might end up choosing a property that will not provide the highest possible returns.

When choosing which investment property will generate the most returns, you have to consider the factors mentioned above. In general, an occupancy rate of more than 50% is good, but the higher the occupancy rate, the better. You also need to ensure that the cap rate and CoC return are more than 2%. Again, the higher, the better, as long as the market is good.

Of course, don’t forget to check the expenses when comparing properties. Some properties may generate a high income, but if their expenses are also high, there won’t be much profit left. Most importantly, you must check the condition of the properties and ensure that they don’t come with major repair issues that may be too costly to fix.

Find Your First STR Investment Using Mashvisor

Investing in real estate may be daunting, especially for first-timers. But if you know what you’re doing and you choose the right investment property for your preferred rental strategy, everything will flow smoothly. Also, with the right real estate investing tools, you won’t need to exert a lot of time and effort researching the best markets and properties available for sale.

Buying a short term rental property as your first real estate investment is a great idea as long as you choose the right STR market to invest in. There are several reasons why you should choose to buy an STR investment rather than invest in long term rentals if you are a new investor. They include its easy entry point and less commitment required.

Keep in mind that not all locations are optimal for investing in short term rentals. If you want to be successful, you need to know the right investment locations and take the guesswork out of the equation. Find a location that is usually visited by tourists and business travelers all year round. Consider the seasonality of the area in your decision-making process.

To easily find the best STR investment in just a few minutes, you can use Mashvisor’s state-of-the-art tools that are tested and proven to help you find a profitable investment. What’s best about Mashvisor is that it doesn’t only give market analysis, but it allows you to search for properties for sale on the platform itself.

Are you ready to experience how Mashvsior works? Schedule a demo now.