Have you been searching for an investment property and finally feel like you’ve found “the one”? Before going further and making an offer, how can you be sure that you’re buying the property at a fair price? A home’s worth can be difficult to pinpoint, but the best way to value an investment property is by doing a comparative market analysis. This is a term that all real estate investors will come across throughout their investing career. If you’re just getting into real estate investing, running a CMA can be a tough task as it requires a lot of calculations. But don’t worry – this guide will teach you how to do a comparative market analysis like a pro in no time!

What Is Comparative Market Analysis in Real Estate?

A real estate comparative market analysis is an in-depth document that evaluates a home’s current value. For a real estate investor, this is a powerful tool and it’s done by analyzing similar properties in the area that were recently sold and examining their sale prices. By doing this, you’ll get a factual evaluation of home values in your market. You’ll need to know how to do a comparative market analysis whether you’re 1) a seller who needs to determine a listing price or 2) a buyer who needs to decide on an offer amount.

One mistake that beginner real estate investors make is believing that a CMA is the same thing as an appraisal. However, home appraisals and CMAs are actually very different. First, appraisals are requested by banks and mortgage lenders so they can lend the appropriate amount of money after the real estate investor makes an offer. Second, appraisals can only be performed by certified real estate appraisers who follow guidelines established by the Federal Housing Finance Agency. Finally, appraisals are based on the home’s condition, features, location, and the market – it doesn’t account for recent sales data like a CMA.

Why Learn How to Do a Comparative Market Analysis?

Based on the definition of the CMA, there are two reasons and benefits of performing one as a real estate investor before buying an investment property:

1) Justify the Listing Price: To make money in real estate, investors try to buy properties at lower prices so they can sell them later on for higher prices and make profits. Of course, the listing price of properties for sale is not equal to their actual worth – sometimes sellers will list their properties at a higher price. Therefore, running a comparative market analysis helps you in submitting a reasonable offer and protects you from overpaying for an investment property.

2) Know the Housing Market: Taking the time to do a comparative real estate market analysis will make you a more educated buyer. We all know that location is key in successful real estate investing and that the best real estate investments are found in the best locations. Looking at recent transactions helps you understand the housing market where you’re buying. Thus, running a real estate CMA allows you to spot good deals and avoid investing in bad locations.

Now that you know the importance of CMA in real estate, here’s how to do a comparative market analysis in 5 steps:

Step 1: Assess the Neighborhood

After finding an investment property for sale, the first and most important step in a CMA is assessing the neighborhood. The quality of the neighborhood affects the value of real estate there. So, being familiar with the neighborhood and knowledgeable about historical and current sales is important for accurate comparative market analysis.

Start by assessing the overall quality of the neighborhood and identifying the attractive and not so attractive features. Examine its proximity to parks, school districts, and other amenities. Also, look at the curb appeal of homes in the area. Real estate investors can inspect the neighborhood either in person or using Google Street View. However, keep in mind that Google’s images may be out of date, so it’s best to drive through the neighborhood and assess it in person, if possible.

Next on how to do a comparative market analysis is checking the neighborhood’s real estate investment performance. Simply, do a neighborhood analysis to understand what kind of return on investment can you expect from owning a rental property there. To do this, real estate investors use tools like Mashvisor’s Heatmap – it allows you to see how the neighborhood is performing compared to others nearby based on listing price, cash on cash return, cap rate, and other metrics.

To learn more about the Heatmap and other tools we offer to help you make faster and smarter real estate investment decisions, click here.

Step 2: Evaluate and Analyze the Listing

Even though a CMA focuses on the value of real estate comparables, you still need to evaluate your own investment property. After all, you need to know what qualifies another property as comparable. So, once you check out the neighborhood, browse the property’s listing online. This should give you a general idea of what to expect before visiting the property in person. It also allows you to gather information about the property like year built, home size, lot size, construction type, and condition. With this information, you can identify the property’s strengths and weaknesses which give you an advantage in the first meeting with the seller.

A very important step in how to do a comparative market analysis is rental property analysis. Real estate investors know that not any home for sale can make profits as a rental property. A rental property analysis, as the name suggests, evaluates how much profits you can expect from the property in terms of rental income and cash flow. Therefore, doing a rental property analysis helps you make sure that you’re buying a property that will, in fact, make you money. Mashvisor’s Rental Property and Airbnb Calculator makes this step easier for you!

For more details, read: The Best Comparative Market Analysis Tools for Beginner Investors

Step 3: Select and Assess Comparable Listings

The next step of doing a CMA is to find and choose the best three or four comparable properties. For an accurate analysis, the best comparable properties should be similar in terms of:

- Location: Selected comps should be as close to the investment property as possible. It’s best if they’re in the same neighborhood, subdivision, school district, or within one mile of the property.

- Main Features: Particularly the number of bedrooms and bathrooms, square footage, lot size, construction type, and architectural style.

- Date of Sale: Choose properties with a date of sale as recent as possible – ideally within the prior few months. Pending listings can also give a good idea of what similar homes are selling for.

- Amenities: For example, if the home has an in-ground pool, comparing it to other homes with an in-ground pool will yield much better results.

- Price: Comparable properties should also be similar in sale prices as well as the price per square foot (more on that in a bit).

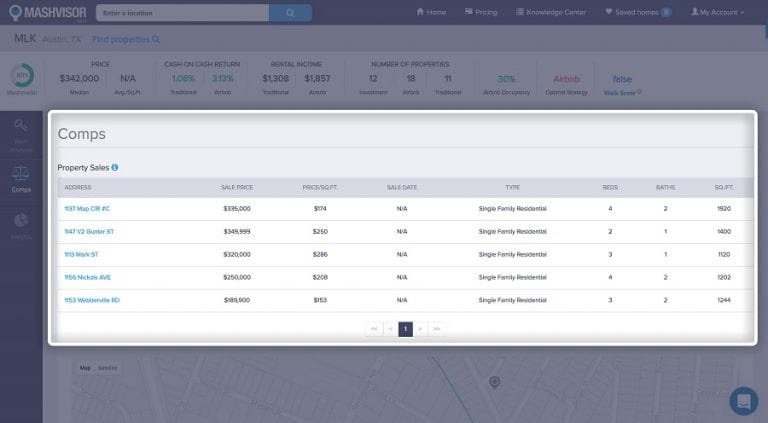

Fortunately for real estate investors, finding real estate comps isn’t as tough as it used to be. For example, property details and tax information are open to the public, so you can simply search for your city’s database and look up the most recent sale price of similar properties. Also, there are websites where you can find what you need in minutes to get the job done. When searching for investment properties on Mashvisor, for example, you’ll get a list of comps along with their information ready for use!

Sign up for Mashvisor to find profitable investment properties for sale with readily available comps!

Step 4: Check the Property Value

When you have a list of comparable properties in your hand, the next step in how to do a comparative market analysis is to do the math. All you have to do is take the selling prices of the comparable homes and divide each by their square footage to calculate the price per square foot for each property. Then, find the average price per square foot of the comparables and multiply it by the square footage of the rental property you’re looking to buy and you’ll have your price or the current market value! For example, say the square foot of your target property is 2000 and you have a list of four real estate comps:

- Property 1: $400,000 sales price, 2100 square feet, $190 price per square foot

- Property 2: $390,000 sales price, 2000 square feet, $195 price per square foot

- Property 3: $410,000 sales price, 2200 square feet, $186 price per square foot

- Property 4: $395,000 sales price, 2050 square feet, $192 price per square foot

Based on this data, you’ll have an average price per square foot of $190. Now, by multiplying $190 x 2000, you’ll have $380,000. And that’s a fairly accurate market value for the investment property you’re doing a comparative market analysis for.

There are other ways to find the market value of investment properties. Check out the 3 Main Property Valuation Methods for Real Estate Investors.

Step 5: Assess the Property in Person

After doing all this work, you should now have a good idea of what the home is worth. As mentioned, this will give real estate investors an advantage in negotiations with the seller. However, this is not the last step of how to do a comparative market analysis. You still need to personally visit the investment property to discover any hidden issues that could affect the sales price. You should also take this opportunity to ask about any recent repairs or upgrades.

If there are any major issues that you didn’t consider in your initial investment property research, such as old siding, cracks in the foundation, or other hidden issues, you might need to make a few adjustments to your CMA. In this case, you should search for new comparables that better fit the property in its current state or adjust the price per square foot to reflect the differences.

The Bottom Line

Once you understand the basics of how to do a comparative market analysis, you’ll eventually be able to master it and perform it like a pro. If you find it tough to run a CMA on your own, a local real estate agent can do it for you. Agents view doing a comparative market analysis as a way of starting a relationship with a client and most don’t even charge. Remember, if you’re looking for a reliable source for data about investment properties for sale and real estate comps, Mashvisor’s got you covered!

To start looking for and analyzing the best investment properties in your city and neighborhood of choice, click here.