In the world of real estate investment, digital tools can offer you significant value and will make your life a whole lot easier. As a property investor (whether you’re just a beginner or one with years of experience), you already know that starting a real estate business requires minding due diligence, calculating numbers, and making smart decisions to guarantee profits. Without real estate tools and investor software, the amount of work you’ll have to put into your business will be ten times more than investors who use them.

But, with so many real estate websites and investment tools available to choose from, you might wonder how to choose the best real estate investment software that you truly need and is worth your money. In this article, we’re introducing you to what we believe is the best software that real estate investors should use in 2020 – Mashvisor. If you’re not already using it, here’s why you should sign up for Mashvisor.

What Is Mashvisor?

Mashvisor is a real estate investment analysis software that provides investors with predictive analytics, property data, and a number of investment tools. You can use Mashvisor to research different housing markets in the US, find properties for sale, and analyze their expected performance and profitability as real estate investments. We pull in data from several reliable sources and organize it to make it easier to crunch the numbers on multiple properties at once. This will not only save your time and efforts, but it also enables you to make the right investment decisions with the confidence you need to succeed in the real estate industry.

Now, if you’re asking what makes Mashvisor different from its competitors and other real estate investor websites, it’s that our real estate investment property software specializes in both long-term and short-term (Airbnb) rental properties. Some sites provide data only for traditional rental property investors and others provide Airbnb data for vacation rental owners.

Let’s say you’re contemplating the idea of renting out a property to make more money in real estate, but you’re unsure which strategy will yield better profits for you. What is the best real estate investment software in 2020 to use in this case? The only software that works as both a traditional and an Airbnb analytics platform and allows you to compare the performance of both strategies on the same investment property to make an informed decision is Mashvisor!

What Mashvisor Does for Real Estate Investors

#1. Real Estate Market Analysis

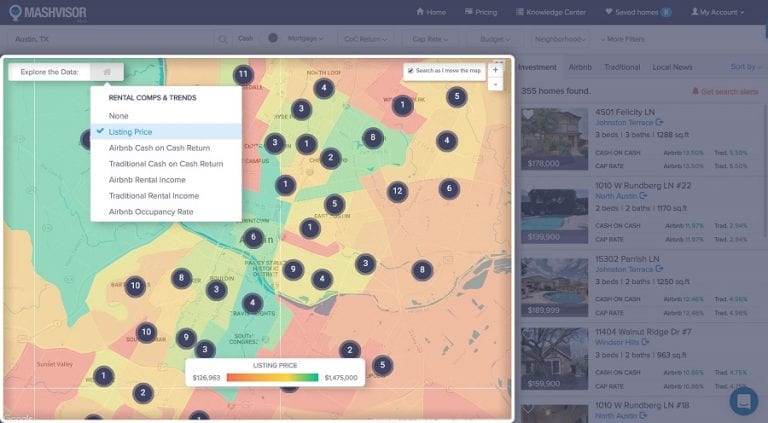

Using Mashvisor to analyze different cities across the US housing market is simple. Once you’re logged in, the first thing you’ll do is enter the location where you’re planning to buy a rental property. You can enter the state, city, neighborhood, or even a specific zip code of your choice. After hitting “Analyze”, you’ll be taken to the first tool that we provide and that is the Heatmap Analysis Tool. At first glance, it looks like a regular map that shows how many properties are available for sale and where they’re exactly located in your selected location. Click on the house icon where it says “Explore the Data”, however, and the real estate heat map will be activated and look like this:

Essentially, it’s a color-coded analysis of the real estate market that shows how well rental properties are performing (green means high while red means low). The worst thing a real estate investor can do is waste time conducting an investment property search in bad locations. Using our real estate investment software by selecting which criteria you want to base your Heatmap analysis on allows you to avoid making this costly mistake. You’ll be able to identify the difference in performance between one area and another. Therefore, when you start searching for properties, you guarantee that you’re in the best places to invest in real estate.

As you can see from the image above, the Heatmap Analysis Tool gives you the following options to choose from as your search criteria:

- Listing Price

- Airbnb Cash on Cash Return

- Traditional Cash on Cash Return

- Airbnb Rental Income

- Traditional Rental Income

- Airbnb Occupancy Rate

Related: How to Perform a Real Estate Market Analysis

Note: If you’re wondering how a certain real estate market is performing, check out our market reports for major cities in the US. Discover the top neighborhoods, the best property type, and the optimal rental strategy for investing in your market of choice based on big data and predictive analytics.

#2. Investment Property Search

Successful real estate investors know how important it is to be able to find the best opportunities before their competitors. This means your investment property search needs to be quick, but effective. Meaning, you need to be able to find properties that will make money as soon as they hit the market. The best real estate tool in 2020 that enables you to do that is Mashvisor’s Property Finder.

To use this investment property software, all you have to do is simply personalize your criteria using the different filters available. These filters are:

- City: you can find rental properties for sale in up to 5 cities simultaneously

- Miles: the distance that you’d like the rental property to be from the city

- Budget

- Rental Strategy (traditional or Airbnb)

- Type of Property (single-family, multi-family, condo/coop, or other)

- Number of Bedrooms

- Number of Bathrooms

Once you’ve set your search criteria, the Property Finder will utilize the latest machine-learning algorithms to find an investment property that best suits your wants and needs. It’ll look at residential real estate investment properties in the area and then sort them for you according to the highest cash on cash return expected from each property. Our real estate investment software also takes into consideration other real estate investors and buyers who share the same criteria as you in addition to the properties that they were interested in based on your social, financial, and behavioral patterns in order to show you the best investment properties.

Sign up for FREE to give our investor software a try!

#3. Off Market Property Search

The Property Finder Tool is very helpful for investors looking for homes listed for sale. However, investors also know that the best real estate investment opportunities in 2020 are those which aren’t listed for the public to see. These are known as off market properties. These properties are highly sought after as they present hidden investment opportunities that can be very lucrative.

But how can you find off market properties? Traditionally, you would need to count on a real estate agent or word of mouth to lead you towards these properties. Alternatively, you can use Mashvisor – the best real estate investment software for finding off market homes for sale in 2020.

Mashvisor has created the Property Marketplace for real estate investors, allowing them to find thousands of non-MLS properties. These include foreclosed homes, bank owned homes, short sales, and even auctioned homes. Other real estate professionals like agents and property managers can use this tool as well to help their clients find these properties. The best part is that you can use another tool provided by Mashvisor (explained below) to analyze how these off market properties are performing before making a purchase offer. Hence, you’ll ensure finding cheap properties with high potential for generating positive cash flow and a good return on investment.

Related: How Do You Find Off Market Properties?

* Bonus Feature: The Property Marketplace also allows anyone thinking of selling a house to list it on the platform for free. So, whenever you’re thinking of selling your investment property to another property investor, consider listing it on Mashvisor. You’ll reach more potential buyers and close the deal in no time!

#4. Investment Property Analysis

If you’re still unsure of how to choose the best real estate investment software in 2020, the answer is simple: pick the one that comes with an analysis tool! There are too many websites out there that help in performing a property search and give you data that is important for homeowners such as the listing price, school rating, walk score, etc. While investors should also care about such data, there is other (more important) information that some search sites simply don’t offer. If you were using such sites, then you’d need to do even more research and due diligence until you’ve collected all the property data needed to make an educated real estate investment decision. Why go through all of this when you can use Mashvisor to do an investment property analysis?!

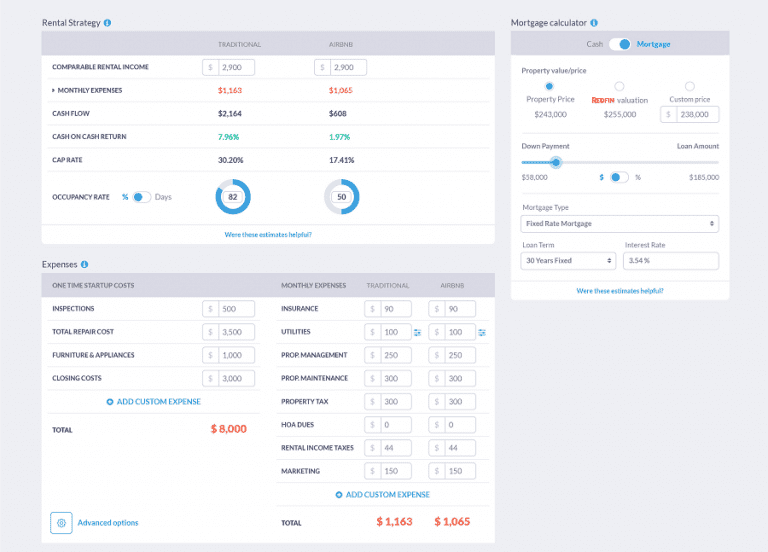

After finding a rental property that interests you for real estate investing (whether with the Property Finder Tool or in the Property Marketplace), click on the property listing to access Mashvisor’s ultimate investment tool – the Investment Property Calculator (also called the Airbnb Profitability Calculator). This is the ultimate tool because it includes everything investors need to perform an investment property analysis. Here’s a breakdown of each section in the tool and how to use it:

A) Rental Strategy Comparison

The first section you’ll see is what makes Mashvisor stand out from other real estate investor software. Here, you can analyze how a rental property is expected to perform as a traditional (long-term) rental vs. an Airbnb (short-term) rental. Doing this comparison is very easy because the expected rate of return on a rental property from both rental strategies is pre-calculated using big data and predictive analytics. Meaning, once you’ve selected your investment property, you’ll immediately see which rental strategy allows you to make higher profits in terms of:

- Comparable Rental Income

- Monthly Expenses

- Cash Flow

- Cash on Cash Return

- Cap Rate

- Occupancy Rate

B) Financing/Mortgage Calculator

Your method of financing a rental property is an important factor that affects your rate of return on investment. Real estate investors know that you can make higher profits when buying a property with a mortgage rather than fully in cash. However, not all investors finance properties in the same way. This is why we’ve included this section in the calculator. It allows you to insert specific information about your financing like your down payment, loan amount, loan type, (15 years or 30 years fixed), and the interest rate on the mortgage. Once you do that, the Investment Property Calculator will re-calculate the projected ROI immediately! Meaning, you can see what return on investment to expect based on your own financial situation. This interactive feature makes Mashvisor the best real estate investment software in 2020.

C) Expenses

Owning an investment rental property comes with numerous costs to take into account when performing an investment property analysis. Instead of creating spreadsheets, you can use the Investment Property Calculator to fine-tune your costs and view the newly calculated returns. Not only can you enter your own numbers, but some expenses are pre-calculated based on local rates and rental comps for traditional and Airbnb rentals in the area the property is located in. These include maintenance costs, interest rate, property tax, and more.

As for the costs that the calculator allows you to enter/change, they include one-time startup costs (expenses you’ll only have to pay when buying rental property) as well as recurring costs (expenses you’ll have to pay on a monthly or annual basis to keep the property running). When you make any changes to the expenses, the real estate investment analysis software will, again, recalculate the metrics of return on investment just like it does in the mortgage section.

D) Valuation Analysis & Insights

On the Valuation Analysis tab, you’ll get a list of comparable rental listings (or rental comps) as well as their property data. Basically, these are properties that are similar to the one you’re analyzing that are located in the same area. You’ll get to see information like their address, occupancy rate, rental income, and more. Getting this type of information and data is important for real estate investors as they help them better understand how the targeted rental property is expected to perform in comparison to other rentals in the area. Of course, you’ll be provided with both traditional and Airbnb rental comps.

Related: Airbnb vs. Long Term Rental: Which One Is the Better Real Estate Investment Strategy for You?

Lastly, our real estate investment software will also list recent sales of similar properties along with more information like the sale price, sale date, days on market, square footage, and the price/square foot. This should help you perform a comparative market analysis. In turn, this will help you understand the market better and know how to spot the best real estate deals on the market. Moreover, analyzing recent sales of similar properties is a great way to justify the property’s listing price and protects you from overpaying for investment properties for sale. If you don’t want to waste time searching for recent sales, rental comps and their data, simply use Mashvisor where they’ll be handed over to you with a click of a button!

To Sum Up

If you’re looking for a reliable real estate investment software to begin or to grow your business, you’re at the right place. Start out your 7-day free trial with Mashvisor now to fulfill your needs whether it’s to:

- Perform a real estate market or neighborhood analysis

- Search for profitable investment opportunities

- Search for off market properties

- Perform an investment property analysis

To learn more about how Mashvisor can help you and how to use the platform, schedule a demo!