Buying an investment property comes with some risks. You see, not all rental properties in the housing market are good for investment. As a real estate investor, running a thorough investment property analysis is crucial to help you assess the potential profitability of an investment property before buying. In real estate, profitability is assessed through real estate return on investment (ROI). This is a measure of the financial rewards you will get from a rental property as a percentage of its costs. This way, you will be able to determine whether or not you should spend your time and money on it.

Every real estate investor should have a good understanding of the real estate metrics and numbers used to estimate return on investment. The two most common real estate metrics used to estimate real estate return on investment are cash on cash return (CoC return) and capitalization rate (cap rate). In this blog, we are going to focus on cash on cash return. So, what is cash on cash return? How do you calculate cash on cash return? How is it different from the cap rate? To get answers to these questions, continue reading.

Cash on Cash Return Definition

CoC return is the most used ROI metric. It is a real estate metric that property investors use to estimate the percentage profit or loss to the total cash invested in an income property, taking into account the method of investment property financing. Therefore, the CoC return formula can be used to compare the performance of an investment property when financed with a loan to how it will perform when purchased fully with cash. In contrast, the calculation of cap rate does not take into account the financing method.

Learn More: Cap Rate vs. Cash on Cash Return

A higher CoC return suggests that the investment property would be worth buying with a mortgage since the returns compare favorably to the total cash invested.

Related: Investment Property Financing: 4 Efficient Methods

Cash on Cash Return Calculation

Knowing the CoC return definition isn’t enough. You should also know how to calculate cash on cash return in real estate. The following cash on cash return formula is used by investors when doing investment property analysis:

Cash on Cash Return = Annual Pre-Tax Cash Flow/ Total Cash Invested

Let’s examine the two variables in the CoC return formula:

-

Annual Pre-Tax Cash Flow

Annual Pre-Tax Cash Flow = Annual NOI – Mortgage Costs

The annual NOI (net operating income) is equal to Annual Rental Income- Annual Rental Costs. Since the cash on cash return calculation takes the method of financing into consideration, debt service (monthly mortgage payments and associated costs) will be included in the formula.

-

Total Cash Invested

In the cash on cash return calculation, the annual pre-tax cash flow is divided by the total cash invested and not the purchase price of the investment property.

Total Cash Invested = Down Payment + Closing Costs + Rehab Costs

Example:

If you are looking to buy an investment property with a purchase price of $300,000 using a mortgage loan with a 20% down payment, $2,500 as closing costs, $15,000 as rehab costs, a monthly mortgage payment of $600, annual rental costs of $4,000, and rent it out for $2,000 a month, the CoC return will be calculated as follows:

Monthly Rental Income = $2,000 – $600 = $1,400

Annual Cash Flow = (12x $1,400) – $4,000 = $12,800

Total Cash Invested = (0.2 x $300,000)+ $2,500 + $15,000= $77,500

CoC Return = ($12,800/ $77,500 x 100)= 16.5%

What Is a Good Cash on Cash Return?

You now have a good understanding of the answer to the question “What is cash on cash return in real estate?” But what is a good cash on cash return? Well, the truth is that there is no specific percentage that is considered to be the best cash on cash return. It is difficult to narrow down what a good cash on cash return in real estate is to a single number. This is because what is considered a good CoC return will vary depending on factors like the location of the investment property, the investment property type, the rental strategy, and more.

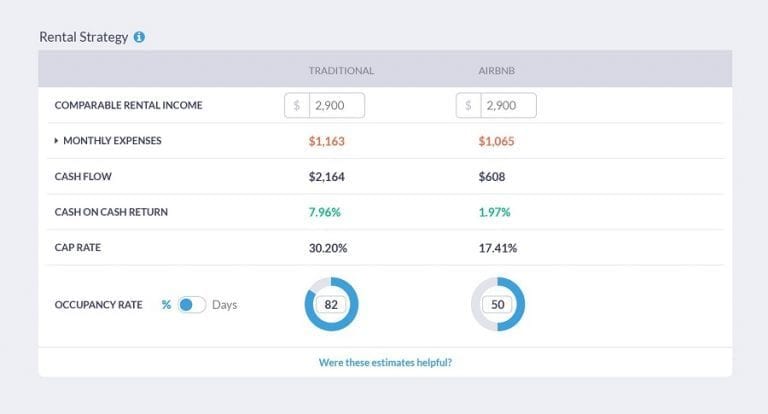

For instance, rural areas generally have higher cash on cash return than urban areas. Airbnb rentals also tend to have higher CoC returns than traditional rental properties. Real estate investors should determine the range of good cash on cash return in their target real estate market. When you know the average cash on cash return by city, you can compare it with that of the subject property. Nevertheless, real estate experts agree that a good CoC return should range from 8% to 12% or more.

Finding Investment Properties with Good Cash on Cash Return

The process of calculating cash on cash return in real estate manually is time-consuming. Now, imagine doing this calculation for multiple investment properties to determine the property with the highest. It can be quite hectic.

If you’re interested in finding the best cash on cash return real estate (both Airbnb and traditional) in the US housing market, you can do it quickly and easily using Mashvisor’s cash on cash return calculator. This calculator computes cash on cash return for rental property in a matter of minutes. You simply key in financing information and relevant numbers and the tool will accurately calculate the expected CoC return. Our real estate investment calculator will also give you the estimates of other real estate metrics like rental income, cash flow, cap rate, and Airbnb occupancy rate.

Because everything is done in a matter of minutes, you can then compare the CoC return of an investment property to that of real estate comps to see how well it is performing in that housing market. This will help you ensure that you are buying the best investment property in the market that fits your budget and criteria.

Apart from the calculator, Mashvisor has other real estate investment tools that investors can use to make informed investment decisions.

Start looking for and analyzing the best cash on cash return real estate properties for sale.

Related: Why Mashvisor Has the Best Cash on Cash Return Calculator 2020

The Bottom Line

Are you aspiring to get into real estate investing? If so, one of the most important questions you should have an answer to is “What is cash on cash return in real estate?” Cash on cash return is an important metric used to estimate the rate of return on a rental property. Therefore, understanding how to calculate cash on cash return is crucial for investors as they can decide the best financing method (mortgage or cash) for the highest rate of return.