Real estate investing is a good way to build wealth and have financial freedom. A key part of successful real estate investing is finding the best real estate deals. When buying an investment property, savvy investors make sure that they are getting a good deal. However, finding a good real estate deal is often not easy, especially for first-time investors. So, how do you know if a real estate deal is good? In this article, we take you through what makes a good deal in real estate. Read on to find out.

What Is a Good Real Estate Deal? 7 Things to Look For

1. A profitable location

Location is the most important factor in real estate investing. The location of a rental property will determine the occupancy rate and rental income. When looking for a good real estate deal, you first have to research the real estate market at both city and neighborhood levels. A great location can make up for some of the limitations of a rental property. However, there is little you can do if you invest in a poor location.

Here are some general features of a good investment location:

- Low crime rates

- Job opportunities

- High population growth

- Nearby amenities like hospitals, restaurants, etc.

- Public transportation

- No zoning issues

- Future developments

- Booming tourism industry

- Safe from natural disasters like earthquakes and floods

Related: How to Identify the Best Places to Invest in Real Estate

2. Low listing price

An investment property’s listing price is crucial when looking for a good real estate deal, depending on your financial capacity. As a real estate investor, you should never buy what you can’t afford. An expensive investment property will typically have high operating expenses too. Buying an investment property below market value could provide you with a higher return on investment.

To know whether the purchase price of an investment property for sale is reasonable, you need to compare it with its fair market value. If the listing price is lower than the fair market value of the property, it would probably be a good real estate investment deal. Consider doing a real estate appraisal to estimate the value of the rental property for sale.

Related: 6 Best Hacks to Finding Homes Below Market Value for Investment Properties

3. High rental income

The main purpose of buying an investment property is to generate income. As a real estate investor, it’s best to find an investment property with a high monthly rental income. If your monthly rental income is high enough to cover your monthly rental expenses, you will be able to generate positive cash flow. And as you know, cash flow is king! Before placing an offer on a property, research the average rental rates of comparable rental properties in the area and estimate its rental income.

One way to find a good real estate deal based on the rental income is to follow the 1% rule in real estate. The 1% percent rule measures the ability of the rental property to generate rental property cash flow. This rule of thumb states that the monthly rent should be equal to or greater than 1% of the total purchase price of an investment property. This rule is used to determine whether the monthly rent from a rental property will be enough to cover its monthly mortgage payments. At the worst, you should break even on the rental property.

4. Low rental expenses

Rental expenses are also important in finding a good real estate deal since they will also affect rental property cash flow. Before buying an investment property, you should find out all costs associated with purchasing and operating it. Expenses may be in the form of repair and maintenance costs, insurance, property taxes, HOA fees, and mortgage payment.

If rental expenses are too high, they will eat into your rental income and possibly lead to negative cash flow. If you are wondering how to determine a good rental property, rental expenses are something that you should definitely take into consideration.

Real estate investors can use Mashvisor’s Rental Property Calculator to get accurate data on the potential rental income, expenses, and cash flow of a rental property. Sign up now.

5. Good cap rate

Cap rate is one of the most important metrics used to find a good real estate deal. This ROI metric is the ratio of the net operating income of an investment property to its purchase price. A good cap rate generally ranges from 8% to 12%. The cap rate of an investment property can be easily calculated using our Investment Property Calculator.

Related: What Is a Good Cap Rate for Rental Property in 2020?

6. Low repair cost

While buying below market value rental properties has its benefits, a beginner real estate investor should be careful about buying a fixer-upper. If a rental property needs a lot of repair work before it can be rented out, it can wash out any profit you may have generated from rental income.

Therefore, when looking for a good real estate deal, you should do a home inspection to know the repairs needed and how much they will cost. A rental property that is in good condition can be rented out right after buying. You don’t have to wait long before you start earning rental income.

However, you can also buy an income property that needs repairs. Just make sure you account for those costs when calculating your return on investment. This will help you know if buying the property is a good deal or a bad real estate deal.

7. Real estate appreciation

Apart from the profitability of an investment property now, an investor should also consider its potential to increase in value over time. Real estate appreciation is usually realized when one is selling a property after an increase in the selling price. To get a good estimate of whether an investment property will appreciate, check local real estate market trends.

How to Find Good Real Estate Deals

Now that you have the answer to the question “what is a good real estate deal”, the next thing is to know how to find real estate deals. With many people getting into real estate investing, it’s becoming even more challenging to find a good real estate deal. As a real estate investor, what can make the difference is using the right tools to do your due diligence in real estate. If you are thinking of how to analyze real estate deals in the best way, consider using Mashvisor.

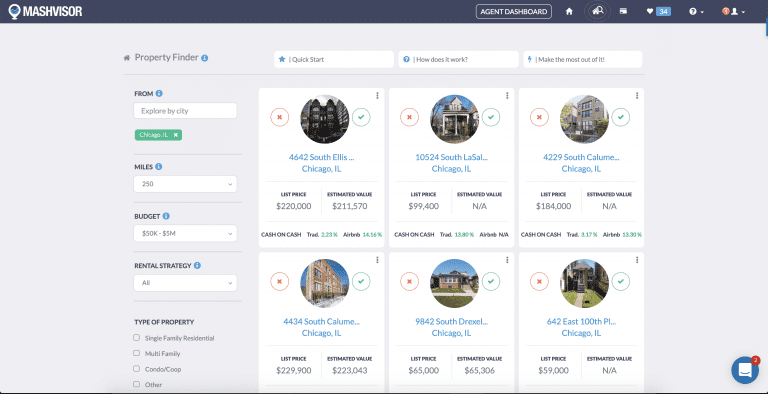

The best way for investors to find good real estate deals in the US housing market is by using Mashvisor’s Investment Property Deal Finder. With this tool, you can search for the best performing investment property in your market of choice that meets your search criteria. The tool allows you to set your search criteria using filters like location, budget, property type, number of bedrooms, and rental strategy.

The Bottom Line

Successful real estate investing starts with knowing how to determine a good rental property. The above features provide the answer to the question “what is a good real estate deal?” So, next time you are looking for an investment property to buy, be sure to consider the above features.