For any landlord or property investor, generating a profit is the main goal of real estate investing. Therefore, it is vital to know how much you’ll make on a rental property. But the question is, how do you figure that out? The answer is through rental yield. What is rental yield? Where can you find a rental yield calculator? In this blog, we’ll answer these questions and many more!

What Is Rental Yield?

Rental yield, also known as return on investment (ROI), is a metric used to quantify rental property profitability. Rental yield uses rental income, property expenses, market value, and other variables to determine how profitable an investment property is. There are three forms of rental yield that are best suited for evaluating real estate investments. These include return on investment, cash on cash return, and cap rate. The latter two metrics are variations of the standard ROI.

How to Calculate Rental Yield

Using a rental yield calculator is the best way to compute these metrics. However, it is still important for real estate investors to know how to calculate rental yield. Here’s how to calculate each ROI metric:

-

Return on Investment

To work out your rental yield, the standard ROI formula never fails.

ROI = (Annual Rental Income – Annual Rental Expenses ÷ Property Price) × 100%

Return on investment is a very reliable way to compute income property profitability. Let’s analyze the variables to see why. Annual rental income refers to rent collected in a year. To account for the net profit, the ROI formula also uses the rental expenses paid during that time. This difference is then divided by property price. The result measures the amount of profit generated relative to the purchase price. With ROI, real estate investors are able to find out if their rental properties are truly money-making machines.

-

Cash on Cash Return

The standard return on investment formula is a must-know for investors. However, it is not exactly perfect. For starters, the rental yield calculation lacks any financing variables. As a result, another real estate yield formula is often used: the cash on cash return (abbreviated as CoC return) formula.

CoC Return = (Annual Pre-Tax Cash Flow ÷ Total Cash Invested) × 100%

As you can see, CoC return heavily depends on the amount of cash invested into a real estate investment. It also considers financing costs. This is seen when we break down the annual pre-tax cash flow:

Annual Pre-Tax Cash Flow = Net Operating Income – Debt Service

Net operating income (NOI) is the difference between rental income and maintenance costs. Debt service, from loan financing, is deducted from this number to measure annual pre-tax cash flow. As a result, CoC return projects profitability with financing considered.

-

Cap Rate

Last, but not least, of the ROI metrics is cap rate. Short for capitalization rate, the cap rate is similar to CoC return in calculation.

Cap Rate = (Net Operating Income ÷ Fair Market Value) × 100%

The main difference with cap rate is that it projects profitability regardless of how investment property is financed. So, whereas CoC return uses the difference between NOI and debt service, the cap rate only uses NOI. In addition, cap rate only focuses on an investment property’s market value in its denominator. As a result, the cap rate is equal to the cash on cash return when a real estate investor buys an investment property with cash.

Related: Is Cap Rate or Cash on Cash Return the Better Real Estate Metric?

Mashvisor provides state of the art real estate investment tools to help you make wise investment decisions and walk you through your investment journey. Please sign up here to start analysing the investment opportunities in both short trem and long term rental industry.

Where Can You Find a Rental Yield Calculator?

As you have seen, using a rental yield formula is fairly straightforward. However, what if you are analyzing multiple rental properties for sale at once? At this point, computing rental yields becomes tedious. So, what’s the solution? Using a rental yield calculator! By using a rental yield calculator, real estate investors can quickly and efficiently calculate the net rental yield of any property. But, where can you find the best calculator today? Look no further! Mashvisor’s yield calculator for rental property is all you need. It can calculate the cash on cash return and cap rate of any rental listing in the US housing market.

Related: Mashvisor’s Rental Property Calculator: A Guide for Beginner Investors

How Does Mashvisor’s Rental Yield Calculator Work?

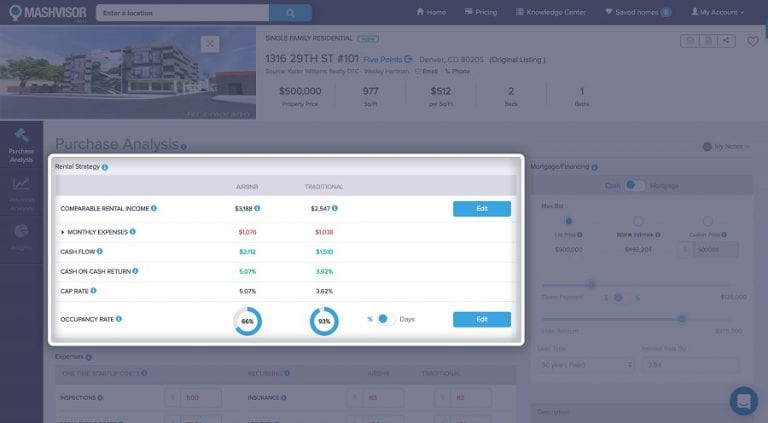

Mashvisor’s rental yield calculator uses a variety of data for its rental property analysis. For starters, it uses the most up-to-date MLS data for US markets as well as property data from many other sources to ensure users have all the information they need. It also uses predictive analytics to project future property trends. The calculator requires user input for financing costs. Then, it uses all of this information to compute the two main rental yield metrics, cash on cash return and cap rate. The rental yield calculator is also interactive. As a result, investors can adjust certain factors like investment property expenses to understand and change the forecast. This interactive component allows real estate investors to know what is a good rental yield for their investment properties.

What Other Features Does Mashvisor’s Calculator Offer?

Mashvisor’s rental yield calculator is not limited to ROI data. It also computes unique forms of data for any rental property for sale.

-

Optimal Rental Strategy

Choosing a rental strategy can be difficult. With Mashvisor’s calculator, however, this isn’t the case. The calculator provides comparative traditional and Airbnb data for each rental property. Unique data for each strategy, such as the Airbnb occupancy rate, is also computed. The rental yield calculator provides real estate investors with a statistically-based answer for which strategy to pursue.

-

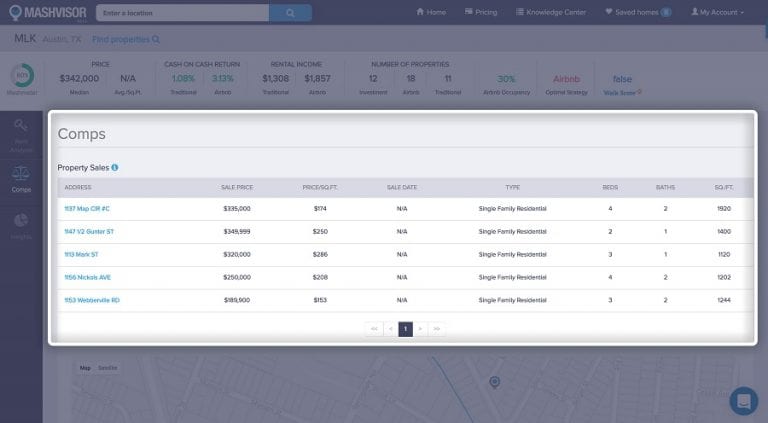

Real Estate Comps

Part of the purchase process is comparing rental properties. For a landlord, this is impossible to do without the calculator. Whenever you use the calculator, it automatically selects the best real estate comps for a property. As you would expect, Mashvisor provides comps for both traditional and Airbnb properties.

Related: How to Find Real Estate Comps in 2020

-

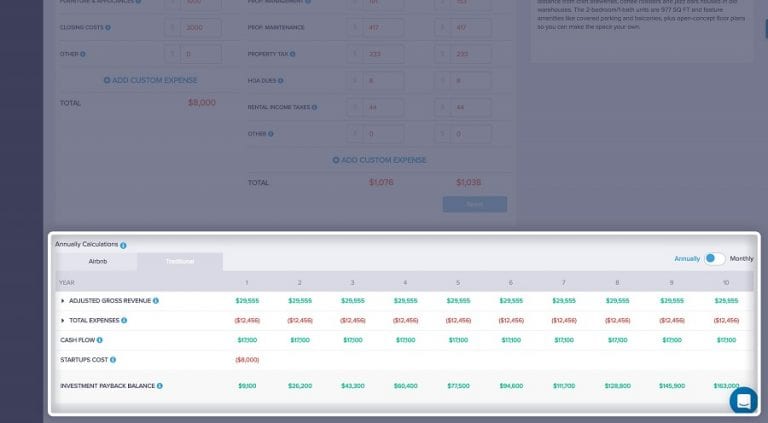

Investment Payback Balance

Mashvisor’s calculator also estimates an investment property’s payback balance. Investors can learn about the 10-year profit forecast of a property based on its data. With this feature, real estate investors can identify how to maximize and maintain a high rental yield.

Mashvisor’s rental yield calculator is the best tool for both experienced and beginner real estate investors. With this tool, investors can fully understand the profitability forecast of properties at any given time.

CLICK HERE to start your FREE trial with Mashvisor’s cash on cash return and cap rate calculator!