Wondering how to become a landlord? Being a landlord is a lucrative real estate career path. But it’s not as simple as just buying any old rental property in your neighborhood and placing an ad online. If you really want to find success with this type of real estate investment, you need to understand the ins and outs of becoming a landlord. You’ll want to make sure that you understand all the necessary steps and don’t skip any crucial actions.

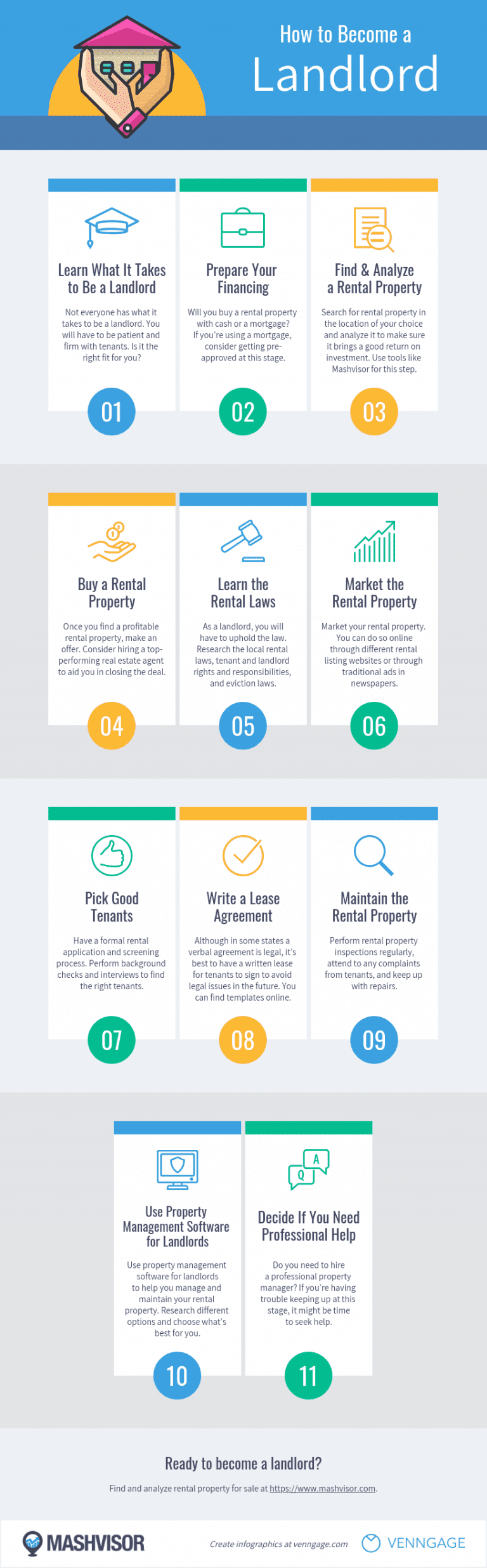

Because this knowledge is important, we decided to put together a How to Become a Landlord real estate infographic for aspiring landlords in the US housing market. Check it out to learn about the 11 steps to becoming a landlord.

This real estate infographic was created by Venngage Infographic and Timeline Maker.

The 11 Steps to Becoming a Landlord

Step #1: Learn What It Takes to Be a Landlord

The very first step involves asking yourself one, important question:

Is being a landlord right for me?

Not anyone can fall into the role of landlord and feel like they’re in their element. Landlords hold a lot of responsibility- you’ll be running a real estate business after all. Your customers will be your tenants and you’ll have to be sure to find the right tenants and keep them happy by offering them all that they desire in a rental property (within reason, of course). You’ll be responsible for the rental property itself, making sure it is well-maintained. And you’ll probably also find yourself dealing with issues like late rent or even evictions that require both firmness and patience. Are you prepared? Do you have what it takes to manage a rental property and all that comes with it?

Step #2: Prepare Your Financing

Investment property financing can really have an impact on your return on investment (ROI). Ever heard of cash on cash return of a rental property? This is an ROI metric that tells you how much profit you’ll make compared to how much cash you actually invest in real estate. Essentially, it depends on your rental property financing. If you pay in cash, your return on investment might be lower. If you manage to land a rental property mortgage, it’s possible your ROI will be higher- it depends. Maybe you don’t even have the cash to buy an investment property and that’s okay. This is the stage where you need to figure out and prepare your financing. Either get together the cash or the cash for a down payment. It’s also a good idea to talk to a mortgage broker or lender and work on getting pre-approved before you start your rental investment property search.

Step #3: Find & Analyze a Rental Property

Now it’s time to start hunting for a rental property for sale.

Choose a Location

Where do you want to invest in real estate? As a first-time landlord, you may want to invest close to home. This will make the DIY management much easier on you as you won’t have to worry too much about traveling back and forth whenever your rental property or tenants need you. Just be sure to do a thorough real estate market analysis first. This type of analysis will help you understand the kind of rate of return on a rental property you can expect in your housing market. If you find that your local real estate market isn’t the best place to become a landlord, then you always have the option of investing somewhere else and becoming a remote landlord.

Learn More: How to Research Real Estate Markets: The Beginner’s Guide

Find a Good Neighborhood for Buying Rental Property

Once you have chosen a real estate market to invest in, you’ll want to narrow down the location to the exact neighborhood before starting your rental property search. It’s best to do this using reliable neighborhood data. Mashvisor’s Real Estate Heatmap provides just that. This neighborhood analysis tool uses predictive analytics to help you find the top-performing neighborhoods in the rental investment market of your choice. All you have to do is set a few filters like Listing Price, Rental Income, Cash on Cash Return, and Airbnb Occupancy Rate. Within minutes, you’ll have found the best neighborhood for buying rental property.

Find and Analyze Rental Properties for Sale

Now it’s time to actually start looking through investment properties for sale in that neighborhood. And you’ll need to analyze them to ensure they provide a good return on investment. Unless you want this process to take months, it’s best to use another real estate investment tool like Mashvisor’s Rental Property Calculator. This is the ultimate rental property analysis tool for anyone wondering how to become a landlord. It allows you to quickly and accurately evaluate rental properties for sale using different metrics like cash flow, cap rate, cash on cash return, and occupancy rate. You’ll also get to see how much rental income a property will generate as well as expense estimates and more. This will help you later determine how much to charge for rent. All of this investment property information is pre-calculated for you and available on Mashvisor to help you find the right rental property- the one that will successfully launch your career as a landlord.

Related: 5 Tools That Will Help You Buy Rental Property in 2020

Step #4: Buy a Rental Property

Found the right rental property? Now it’s time to make an offer and close the real estate deal. You might want to consider enlisting the help of an experienced real estate agent for this step of becoming a landlord. A knowledgable real estate agent will perform a comparative market analysis for you. This will help you figure out how much to offer exactly. From there, your agent will help you negotiate with the property seller to ensure you get the best price possible. He/she will also help put together all the paperwork necessary for closing.

If you’re keen on buying an investment property by yourself, don’t skip out on looking for real estate comps and conducting a comparative market analysis. Here is a helpful guide to get you started: Comparative Market Analysis: A How-To Guide for Real Estate Investors.

Step #5: Learn the Rental Laws

The last thing you want to deal with as a new landlord is legal issues. It’s your responsibility as a new rental property owner to understand the local rental laws in your state and city. You’ll want to look into laws regarding tenant and landlord rights and responsibilities surrounding rental property issues like:

- Rent control

- Tenant applications and screening

- Lease agreements

- Security deposits

- Maintenance and repairs (damage to rental property vs wear and tear)

- Evictions

If you’re unsure about any part of your role as a landlord, consult with a local legal expert for guidance.

Step #6: Market the Rental Property

Once your rental property is ready and you have reviewed and understood the local rental laws, it’s time to start looking for tenants. You’ll want to market the rental property using a few different strategies. Consider posting rental ads on some of the most popular rental listing websites. But don’t discount traditional real estate marketing strategies. Placing ads in newspapers and other traditional media can still be effective. It is also a good idea to find out how local landlords are advertising their rental properties. This will give you some insight into where your target tenants are going to find a rental property.

Be sure to put together an attractive rental listing to use wherever you plan to advertise. Use well-lit photos that put your rental in the best light. Again, looking at the local competition will help you figure out how to put together an attractive listing and an appealing description to go along with it.

Step #7: Pick Good Tenants

Wondering how to become a landlord and succeed? A big part of this has to do with finding good tenants. Being a landlord for the first time becomes that much easier if you manage to find the right tenants. These are tenants who will take care of your rental property as if it was their own, who will pay rent on time, and who, hopefully, will renew the lease when the time comes so you can enjoy a consistently high occupancy rate and a steady rental income.

In order to find such tenants for your rental property, you’ll need to set up a good screening process and have a rental application to gather the information you need. Carry out background checks, credit checks, talk to previous landlords and sit down face-to-face with potential tenants to gauge if they are the right fit. To learn more about how to screen tenants, you can read: How to Screen Tenants for a Rental Property: 7 Steps.

Step #8: Write a Lease Agreement

Because being a landlord doesn’t mean you can predict the future, it’s always best to protect yourself and your rental property from future issues with tenants by having a written and signed lease agreement. It’s true that in some locations, a verbal lease agreement is sufficient by law. However, owning a rental property can be risky and you want to mitigate risks as much as you can. So having a written lease to refer to when issues arise is best. You can either consult with a real estate attorney or simply look up templates online.

Step #9: Maintain the Rental Property

Once you have a tenant in place, there is still work to be done. Your new investment property will require regular maintenance to keep it running smoothly and to ensure your tenants are safe and happy. Maintenance will also help to ensure your investment property’s value doesn’t suffer any major drops, barring real estate market fluctuations.

It’s best to have a plan of when you will perform rental property inspections. This should be included in the lease so that your tenant knows when to expect a visit. Enlist the help of contractors and handymen as well who will be able to pinpoint issues and help you solve them quickly. Do your best to not put off any repairs that could end up getting worse and costing you more. Remember Step #2 of How to Become a Landlord? It’s best that at that stage, you also prepare cash reserves and a budget for repairs. This way, you won’t have to defer maintenance on your rental property.

Step #10: Use Property Management Software for Landlords

Want to stay organized and run your rental property business as efficiently as possible? In 2020 and beyond, landlords should be using property management software to help them run their rental properties. There are tools available today to help with everything from collecting rent online to communicating with tenants and coordinating maintenance repairs with contractors to rental property accounting! Do your research and sign up for a few free trials when available to test out the different software for landlords on the market. Find what works best for you and your business.

Step #11: Decide If You Need Professional Help

As mentioned before, becoming a landlord is not for everyone. If you’ve come this far but feel that you either need a little help or that you just want to sit back and earn passive income from your rental property, then it could be time to hire a professional property manager.

There are plenty of great property management companies out there who will take on all the responsibilities of a rental investment property to ensure you’re generating positive cash flow. You can start your search for a property manager online and check out reviews and testimonials. Be sure to find out exactly what services a property management company offers and what you’ll be paying for them. Property management fees will most likely be a percentage of the monthly rental income, upwards of 8-10%. So it’s important to also conduct a rental property cash flow analysis to ensure you can cover these costs and still have positive cash flow at the end of every month. You can use Mashvisor’s Rental Property Calculator for this step.

Finally, interview potential property managers. Here are the questions you might want to ask when hiring a property management company.

Ready to Get Started?

Mashvisor provides state of the art real estate investment tools to help you make wise investment decisions and walk you through your investment journey. Please sign up here to start analysing the investment opportunities in both short trem and long term rental industry.