Want to invest in Airbnb property but not sure how to get started? I’m going to make the assumption that you have some money saved up to either put around 20% down or even pay for an Airbnb investment property for sale in cash. If you don’t, then read this guide on How to Invest in Real Estate with No Money.

So, the next step then is to find the right rental property that’ll become your positive cash flow Airbnb. Because that’s really the answer to how to invest in Airbnb property: Simply find a rental property for sale that will make you a good return on investment when rented out on Airbnb.

From there you’ll have your hands full with learning how to become an Airbnb host. Or you could hire a professional Airbnb property manager. And don’t fret about becoming an Airbnb host. Check out our in-depth guide on How to Become an Airbnb Host.

At this point, you might be thinking “simply find a rental property”? Well, if you follow along with this guide on how to invest in Airbnb property, you’ll see that it’s not as complicated as you may have imagined. There are actually only 5 basic steps: You can also watch our video below to find out the 5 steps to buying a property to rent out on Airbnb:

Step #1: Identify the Best Cities for Airbnb Investment

The key to successful Airbnb investing is knowing how to research real estate markets with short-term rental profitability in mind. Proper Airbnb market research will lead you right to the best cities for Airbnb investment. So what should you be looking for to find the best city to invest in Airbnb property? The following are the most crucial elements.

Airbnb Laws That Permit Non-Owner Occupied Rental Properties

The #1 thing you need to watch out for when investing in Airbnb property is the laws and regulations. In the last few years, lots of popular tourist destinations have come down hard on short-term rental properties.

Some places have completely banned Airbnbs and vacation rentals. Others have banned non-owner occupied rental properties. This means real estate investors cannot buy investment property and rent out the whole unit. Only those living on-site can rent out their homes on Airbnb in such locations. Examples of these areas include the:

- Airbnb Los Angeles real estate market

- Airbnb Las Vegas real estate market

Be sure to research and review the Airbnb regulations in a city before you start your investment property search there. To help move your Airbnb market research along, here are 20 places with no Airbnb legal issues:

- Milwaukee, WI

- Gatlinburg, TN

- Columbus, OH

- Indianapolis, IN

- Memphis, TN

- El Paso, TX

- San Antonio, TX

- Philadelphia, PA

- Kissimmee, FL

- Cleveland, OH

- Phoenix, AZ

- Tempe, AZ

- Mesa, AZ

- Eugene, OR

- Tampa, FL

- Dallas, TX

- Cape Canaveral, FL

- Fort Lauderdale, FL

- Atlanta, GA

- Houston, TX

Find and analyze an Airbnb investment property for sale in any of these top locations.

And if non-owner occupied properties are permitted, dig a little deeper into the Airbnb laws and find out things like:

- Zoning Laws: Some cities only allow you to invest in Airbnb property in certain zones, making it harder to find and buy one.

- Airbnb Taxes: While property taxes should be something every real estate investor prepares for, there are additional taxes when it comes to an Airbnb investment. Find out what they are and how much they will cost you. Will they put your Airbnb business in the red?

- Licenses and Permits: Some cities make it difficult to become an Airbnb host by putting in place different permits and licenses. Typically, these also come with one time and recurring fees.

- Airbnb Occupancy Limits: Certain locations may allow Airbnb rental properties, but limit how often they can be rented out in a single year. Others regulate how many Airbnb guests you can host at one time.

- Rental Property Codes: While these will usually not inhibit your ability to invest in Airbnb property, they are good to know beforehand. For example, Airbnb Arizona hosts may soon have to install noise-monitoring devices in some cities.

Promising Tourism Statistics and Forecasts

Airbnb may be legal in a city, but is there a demand for it? In order to figure this out, you’ll want to investigate the tourism statistics:

- On average, how many tourists visit annually? Has this number been increasing or decreasing over the last few years?

- What does the forecast look like for the local tourism industry?

- Is the demand for short-term rentals subject to seasonality?

Ideally, you want to find an Airbnb market that welcomes lots of tourists, even if certain seasons are hotter than others. Take the Philadelphia real estate market for example. 45 million tourists flood Philadelphia neighborhoods every year! This would make it one of the best places to invest in Airbnb property.

But how will you know if these tourists are staying in fancy hotels or in Airbnbs? The next few factors on this list will help you figure this out.

A High Average Airbnb Daily Rate and Monthly Rental Income

If Airbnb rental properties are actually in high demand as opposed to hotels, then you’ll notice two things about the housing market:

- It will have a high average Airbnb daily rate

- It will have a high average monthly Airbnb rental income

What this means is that real estate investors and Airbnb hosts are able to charge a good rental rate due to demand.

A Good Airbnb Occupancy Rate

How much you can charge for rent in your Airbnb and how much rental income you will earn are not the only factors to look at. You also need to find out the average Airbnb occupancy rate by city. Although you may still be able to earn a good Airbnb profit margin with a high average daily rate and a low Airbnb occupancy rate, ideally you want to find a location where there is a balance.

This would be a place where your Airbnb rental property will be occupied fairly often, allowing you to generate positive cash flow when it is. Just keep in mind that a good Airbnb occupancy rate is not 100%. While that would be great, it’s simply not realistic.

A Good Airbnb Return on Investment

Finally, what it really comes down to is the potential Airbnb return on investment. Try to find out what kind of cap rate you can get when you invest in Airbnb property in a certain city. A good cap rate for Airbnb rental property is between 8% and 12%. To know your potential ROI and revenue on an investment, use an Airbnb calculator.

Where Can You Get All of This Airbnb Data by City?

While Airbnb laws and tourist statistics can easily be found online through a simple Google search, finding Airbnb data on:

- Airbnb Daily Rates by City

- Airbnb Rental Income by City

- Airbnb Occupancy Rates by City

- Airbnb Cap Rates by City

If you want free access to this kind of Airbnb data, you can typically find it on Mashvisor’s real estate investment blog. We have an entire section dedicated to top locations where we list this data to help you pick the best city to invest in Airbnb property.

Step #2: Find the Best Airbnb Neighborhood in a Top City

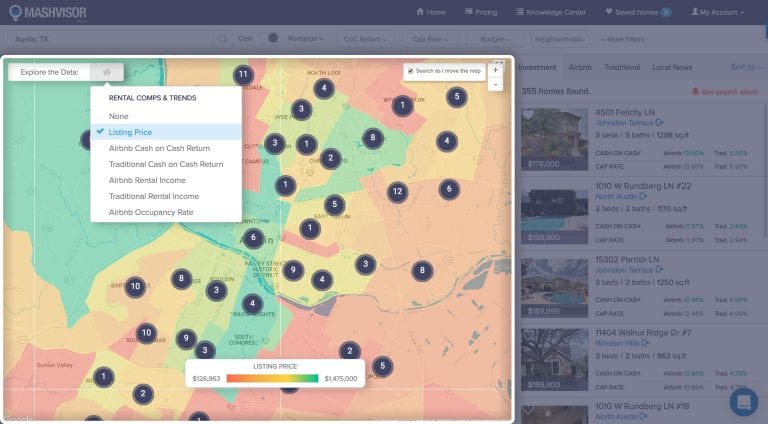

If you’ve checked off everything on the above list of criteria for Airbnb market analysis, you probably have one city in mind. Next, you’ll want to conduct an Airbnb neighborhood analysis. I know that getting to the point of choosing a city may have been difficult. That’s why Mashvisor has removed all the challenges you may face in Step #2 by creating the Airbnb Heatmap Analysis Tool.

This tool will let you quickly find the best Airbnb neighborhood in the city of your choice. It allows you to select a few different filters:

- Listing Price

- Airbnb Rental Income

- Airbnb Cash on Cash Return

- Airbnb Occupancy Rate

For example, if you want to find neighborhoods with a high Airbnb cap rate, select the filter for Airbnb Cash on Cash Return. These two return on investment (ROI) metrics are equal until you factor in your investment property financing (more on this in Step #3).

Neighborhoods with a high cash on cash return will be highlighted in green. Those would be the best places to invest in Airbnb property in this city based on ROI. It works the same for all of the other filters: neighborhoods with a high value for the metric you select will be in green. Those with a low value will be in red.

Conduct Airbnb neighborhood analysis now with Mashvisor’s Heatmap.

Step #3: Find and Quickly Compare a Few Potential Airbnbs for Sale

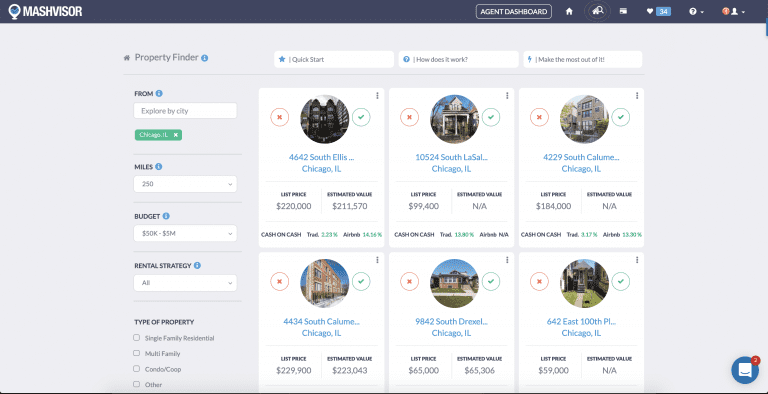

Now it’s time to start your Airbnb investment property search. The fastest way to do this is with Mashvisor’s Rental Property Finder. This tool uses Airbnb analytics to quickly find the investment properties that will generate the highest cap rate.

Start by entering your location of choice. Next, set the filters that will help to narrow down your property search:

- Miles (How far should the Airbnb rental property be from the city?)

- Budget

- Rental Strategy (Select the Airbnb rental strategy)

- Type of Property (Do you prefer condos, single family homes, multi family homes?)

- Number of Bedrooms and Bathrooms

Immediately after setting these filters, you’ll see a list of the best Airbnb for sale. You’ll also get a quick analysis which includes the listing price and the Airbnb cash on cash return. That way, you can start to eliminate Airbnb properties as potential investments.

Step #4: Carry Out Airbnb Investment Analysis

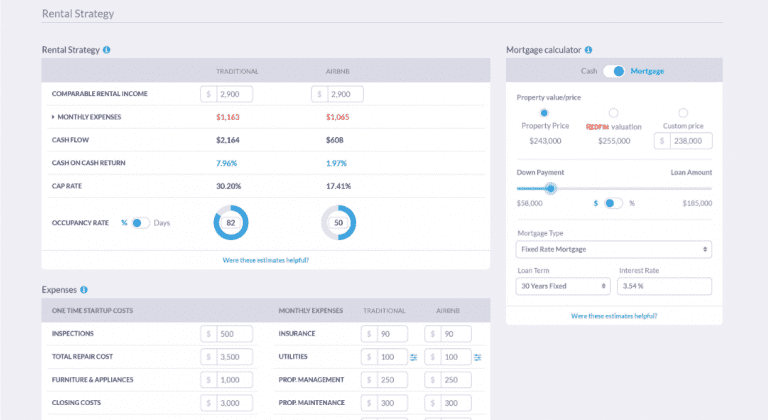

Before you can move forward with buying Airbnb property, you’ll want to analyze your options in-depth. While the image of complicated Airbnb analysis spreadsheets may have just popped into your head, that is not what I am suggesting. Rather, you should continue using Airbnb real estate investing tools. The one needed for the task of investment analysis is the Airbnb profit calculator.

Mashvisor’s Airbnb profit calculator is the most reliable one. Our Airbnb data is compiled from top sources like the MLS and Airbnb and it reflects the performance of actual Airbnb listings over the last 12 months. In addition to this, all of the Airbnb data is verified using figures from real hosts.

The best part? You don’t have to do much. Just click on any property that looks promising to you and you’ll be taken to the Property Analysis Page. Here, the Airbnb profit calculator will prominently display the following:

- Comparable Airbnb Rental Income

- Estimated Airbnb Costs

- Airbnb Cash Flow

- Airbnb Cap Rate

- Airbnb Cash on Cash Return

- Airbnb Occupancy Rate

- An Airbnb vs Traditional Rental Strategy Comparison

Regarding the cash on cash return, if you want to see the true value that is unique to your investment property financing, be sure to use the integrated Mortgage Calculator. Either select the Cash or Mortgage option. If you’re using a mortgage to buy an Airbnb property, be sure to provide the following information:

- Down Payment

- Mortgage Type

- Loan Term

- Interest Rate

This will ensure the Airbnb estimator displays a distinct cap rate and cash on cash return.

Step #5: Make an Offer Based on a CMA

Once you’ve carried out a complete Airbnb investment analysis, you’ll want to figure out how much you should offer. While a real estate agent can help you with this, you can get a head start by looking at Airbnb comps and doing your own comparative market analysis (CMA).

Mashvisor’s Airbnb profit calculator will provide the right comps and you can use this guide to learn how to do a CMA: Comparative Market Analysis: A How-To Guide for Real Estate Investors.

At this point, you can start working with a real estate agent who will help you get in touch with the seller and make an offer. Find a top-performing real estate agent in the city of your choice here.

Ready to Start Investing in Airbnb Property Today?

Mashvisor provides state of the art real estate investment tools to help you make wise investment decisions and walk you through your investment journey. Please sign up here to start analysing the investment opportunities in both short trem and long term rental industry.