Are you looking to invest in short-term rentals in 2023? If you are just getting started, you should find yourself a good Airbnb estimate.

Since you might be asking yourself, “Is Airbnb profitable?” The short answer is yes. An Airbnb rental calculator will be a helpful tool in determining your future profits.

Table of Contents

- How to Find Out How Much an Airbnb Will Make

- What Is an Airbnb Estimator?

- What Airbnb Estimates Does the Airbnb Calculator Provide?

Moreover, becoming an Airbnb host is one of the best ways to make money in real estate. Generally, short-term rentals generate more annual revenue than traditional rentals.

However, it is common knowledge that not all Airbnb properties generate good returns. To earn a respectable Airbnb host income, you need to forecast your potential returns before buying an Airbnb investment property. The best way to do so is to use Mashvisor’s Airbnb estimator.

In this article, we will discuss how Mashvisor’s Airbnb estimator can help real estate investors make better investment decisions and beat the competition in 2023. So, stay with us and continue reading.

How to Find Out How Much an Airbnb Will Make

To determine your Airbnb revenue, you must multiply your annual occupancy rate by your average daily fee. If you charge $100 per night and achieve an 80% occupancy rate, your profit will be roughly $29,200 ($100 x 0.80 x 365) before expenditures and taxes.

Remember that all the above calculations are rough estimates — which can lead to incorrect assumptions, and your estimated earnings may not be correctly computed.

Now, since you would be manually doing the calculations, let’s see a few steps you would be going through.

Guide to Estimating Your Rental Earnings

When attempting to forecast revenue for an Airbnb home, you are confronted with two distinct points of view on Airbnb investment analysis. The first is the monthly revenue generated by your investment. Another factor to consider is your total return on investment over the long run.

Before making a decision as a real estate investor, it is important to consider both kinds of returns.

1. Cash Flow Estimate

You examine your cash flow each month to estimate Airbnb’s income in the short run. Moreover, the money you bring in each month after deducting your costs from your rental revenue is known as cash flow.

What is more, Airbnb fees, property upkeep, property management, electricity bills, and mortgage payments are all examples of expenses. Your unique conditions and your Airbnb investment will determine your actual expenditures.

You must estimate your gross revenues after combining all applicable monthly costs. The figure comprises how much you’ll charge per booking and how frequently your Airbnb will be rented. In addition, setting competitive pricing is critical so your property can remain occupied as often as possible.

You should also choose a rate that will result in a positive cash flow. You may thus estimate Airbnb rental revenue depending on the costs and goal of generating a positive cash flow.

2. Cap Rate Formula

Now, if you’ve determined that you can generate a positive monthly cash flow, you probably think you are ready to buy an investment property.

Well, that is not the case. Long-term gains are as crucial as short-term earnings. Moreover, you want to ensure that your investment generates a reasonable profit over time. So, the cap rate method must be used to estimate Airbnb rental income in this approach.

The cap rate indicates the rate of return on investment throughout time. It takes into account the entire cost of the property. In addition to informing investors about the value of an investment, it can be used to assess the risk of purchasing an Airbnb property.

To estimate Airbnb rental income using the cap rate method, implement the following formula:

Cap Rate = NOI (Net Operating Income) / Property Value

As you can expect, the above formula comes with several shifting factors, and it usually takes a few other estimations and computations before you’re ready to utilize it. You can use it to calculate preliminary rental income earnings based on a cap rate estimate, anticipated costs, and the property’s value.

3. Comparative Market Analysis

A CMA (comparative market analysis) will provide you with the majority of the Airbnb information you need to make estimates. Moreover, you may estimate Airbnb rental revenue using the CMA approach based on Airbnb (or rental) comps.

Rental comps are homes that are similar in size and other attributes to the one you’re looking at. And they’re also in the same neighborhood. Comparables serve as an excellent indicator of the value of the property you are considering obtaining. Airbnb comps provide estimates for the following:

- Airbnb occupancy rate

- Average daily rate

- Property value

Usually, real estate investors will look for homes that meet the requirements for the property they wish to buy. Then, they will manually enter all the data into Airbnb investment analysis spreadsheets. Next, they would start generating estimates to utilize in their calculations.

Finally, in order to determine their Airbnb profit, they will need to do all of the computations by hand. But, of course, there is an easier way. With Mashvisor’s Airbnb estimate, you can forecast your revenue in 10–15 minutes.

What Is an Airbnb Estimator?

An Airbnb income estimator is a variation of the investment property calculator (also known as a rental property calculator) that helps investors conduct Airbnb investment property analysis. Mashvisor’s Airbnb rental calculator uses reliable Airbnb data and analytics to accurately analyze the profitability of Airbnb investment opportunities in the US housing market.

The Airbnb data provided by the Mashvisor real estate investment tools comes straight from the Airbnb website. So, you don’t need to spend weeks gathering Airbnb data and making projections on spreadsheets.

All the critical Airbnb data and analysis you need to make smarter Airbnb investment decisions can be found using Mashvisor’s Airbnb estimator in a matter of minutes.

The Airbnb estimator on Mashvisor will quickly provide you with the following:

- Cash on cash return

- Airbnb comps

- Airbnb occupancy rate

- Estimated expenses

- Cash flow

- Cap rate

- Projected rental income

Our tool will also calculate the optimum real estate investment strategy for the property you’re looking at. Some homes may do better as short-term rentals, while others may generate more money than long-term rentals.

What Airbnb Estimates Does the Airbnb Calculator Provide?

Before discussing the exact features that Mashvisor provides, it is necessary first to discuss the data, where it originates from, and how accurate it is.

Mashvisor obtains its data from reliable sources that provide us with up-to-date and reliable real estate data for the majority of areas throughout the US. Our sources include many MLS from various states, which is the industry’s standard and most trustworthy source of real estate data.

Furthermore, because Mashvisor specializes in long-term and short-term rentals, we collect data from Airbnb to give reliable and up-to-date short-term property statistics and analytics.

Of course, every data collected goes through a procedure to minimize errors and increase the quality of the insights presented.

Mashvisor’s Airbnb estimator provides investors with the Airbnb statistics and data they need to make the greatest short-term rental investment. The calculator determines your projected income, cash flow, rental comparisons, and the best financing solution for you.

Moreover, the Airbnb estimator can give you a wide range of big and complete short-term rental data and Airbnb analytics that you need, which other tools may lack. Here is a list of the Airbnb data and analytics you can access with our Airbnb calculator.

1. Airbnb Occupancy Rate

For you to generate a steady rental income and become successful as an Airbnb host, you need to ensure that your occupancy rate stays high throughout the entire year.

Vacation rentals tend to experience booking fluctuations due to seasonality, which is usually unique to each short-term rental market. It is crucial if you’re doing rental arbitrage, where long-term vacancies can burn a large hole in your pocket.

Therefore, to determine the expected Airbnb rental income of an investment property, it’s crucial to know the Airbnb occupancy rate through an Airbnb rental property calculator. The higher the Airbnb occupancy rate, the more Airbnb rental income you’ll be able to generate each month. If you’re looking to boost your occupancy rate, there are several ways to do so.

You can start by optimizing your rental rates, which means adjusting them according to the season. Moreover, when demand is high, you can raise your rates during the peak season. Conversely, you can charge less during the lean months to attract hesitant vacationers and travelers.

In addition, you can highlight the best amenities of your rental property to convince even the sophisticated traveler to book a stay. Adding professional photos to your listing also goes a long way toward attracting potential guests.

Lastly, don’t forget to leverage social media marketing by sharing useful and engaging information about your Airbnb rental on Facebook, Instagram, Twitter, and more.

A high Airbnb income will ensure that you are covered during the off-season and avoid cash flow problems. Mashvisor’s Airbnb estimator provides investors with Airbnb occupancy rate estimates based on the performance of comparable rental properties in the area.

2. Airbnb Rental Income

Mashvisor’s real estate rental property analytics website is among the finest in the market. It provides in-depth insights and analytics in a straightforward and efficient manner.

Each analytics page also contains a rental calculation and a mortgage calculator. Both calculators are fully customizable and interactive, enabling you to further adjust the insights, data, and computations displayed on the page.

And, since Airbnb income is an important figure for investors because it determines the potential cash flow and returns on investment — Mashvisor’s calculator comes in handy.

Let’s say there is a property listed on the Mashvisor online property marketplace platform or any off-market property. When you enter the property’s address, our revenue estimator will provide accurate estimates of potential Airbnb income.

The rental estimate is based on the Airbnb daily rate and occupancy rate of comparable short-term rental listings in the neighborhood (Airbnb rental comps).

Apart from calculating Airbnb cash flow and return on investment using the Airbnb rental income calculator, investors can use the said data to determine how much to charge for rent. Our rental income calculator also provides rental income estimates for traditional properties.

Moreover, the tool allows you to compare the profitability of the two rental strategies easily. Also, it helps determine the optimal rental strategy in terms of rental income.

3. Airbnb Rental Expenses

When it comes to real estate investing, spending money is a must. You need to spend money to make money. Moreover, obtaining an estimate of expected Airbnb rental costs will help you prepare before you buy an Airbnb property. The estimates are also useful in calculating expected cash flow and return on investment.

Mashvisor’s Airbnb rental calculator provides you with a list of the major one-time startup costs related to owning an Airbnb property, including repairs and inspections. In addition, you can factor in monthly recurring rental expenses, such as insurance and HOA dues.

You can also add personalized expenses to customize your computation further. Mashvisor will show a total for each of the categories.

Airbnb rental expenses that are readily available on Mashvisor’s Airbnb estimator include the following:

One-Time Startup Costs

- Inspections

- Closing costs

- Total repair costs

- Furniture and appliances

Monthly Expenses

- Property tax

- Rental income tax

- Insurance

- Property management

- HOA dues

- Property maintenance

- Cleaning fees

- Utilities

As an Airbnb owner, you’ll typically incur more recurring costs than a traditional rental owner or a landlord. Some of the expenses may not be included in the Airbnb rental calculator. The good thing about our rental income calculator is that it allows you to modify the provided expenses and add custom costs as you see fit.

4. Airbnb Cash Flow

Airbnb cash flow is the difference between monthly Airbnb rental income and monthly expenses. As a beginner real estate investor, it is recommended that you focus on positive cash flow properties. Moreover, a positive cash flow property will pay for itself and provide you with a consistent monthly income stream.

To ensure you only invest in a positive cash flow property, conducting a cash flow analysis is important before making a purchase. Our Airbnb profitability calculator provides you with readily calculated Airbnb cash flow estimates for any property you analyze.

Furthermore, Mashvisor is the finest real estate investing app since all the tools and features are linked to providing the most reliable insights and computations.

Mashvisor’s Property Search function, for example, is linked to the rental calculator, allowing you to search for homes based on return on investment (ROI) metrics such as the cap rate.

Mashvisor’s Airbnb Estimator

5. Airbnb Cap Rate

Capitalization rate is a return on investment metric that real estate investors use to quickly compare the profitability of investments without considering the financing method. It helps investors analyze a rental property’s ROI compared to its value.

The cap rate formula is fairly simple. However, calculating the Airbnb cap rate can be time-consuming and tedious if you analyze several income properties for sale simultaneously. Fortunately, you can access readily-calculated cap rate estimates on our Airbnb estimator.

Moreover, a rental calculator can help you determine the risk level of your investment. The higher the percentage displayed by the investment calculator, the riskier the investment.

There is no specific standard, although a cap rate of 4% to 10% is widely considered “safe.”

6. Airbnb Cash on Cash Return

The common “rate of return” in real estate is usually used to estimate the cash income earned on the investment property — in this case, a rental. Simply defined, cash on cash return is the annual return on investment.

A rental calculator can help you evaluate your house’s cash on cash return. While there is no specific number for good cash-on-cash return, investors often consider returns between 8% and 12% acceptable.

Moreover, cash on cash return — also referred to as CoC return, cash yield, or equity dividend rate — shows the potential earnings an investor can expect from a property. The CoC formula is given below:

Cash on Cash Return = (Net Operating Income / Total Cash Invested) x 100

But unlike the Airbnb cap rate, the CoC return metric considers the financing method. If you are financing your purchase with a real estate loan, your Airbnb property analysis is incomplete without calculating Airbnb cash on cash return.

In addition, if you don’t know how to calculate it, don’t worry. With our Airbnb income calculator, you have it pre-calculated for you.

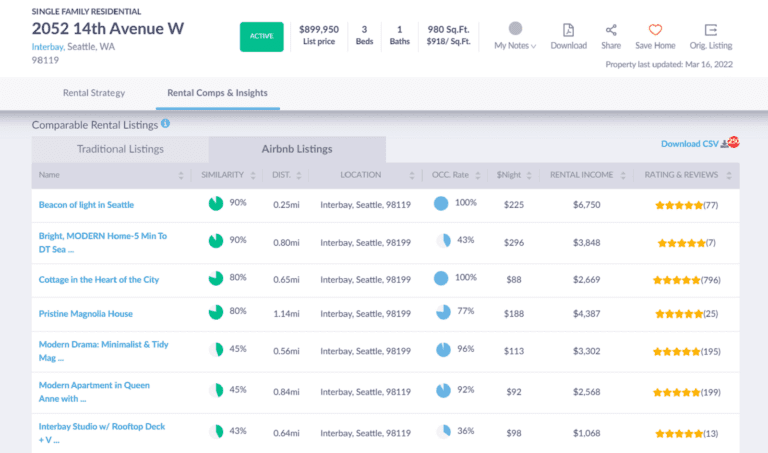

7. Airbnb Rental Comps

When you decide to invest in an Airbnb property, one important question to answer in order to maximize your rate of return is, “How much should I rent my house for?” To answer the question, you need to conduct a detailed rental market analysis.

It involves running Airbnb rental comps, which means Airbnb rentals in the area that are as similar as possible to the one you are considering buying or already own.

While there are different ways to find rental comps, the easiest and fastest way is to use Mashvisor’s Airbnb price estimator. The tool provides a list of active Airbnb rental comps for each property on the platform.

In addition, you’ll be able to see how the rental comps are performing in terms of nightly rate, rental income, occupancy rate, and rating.

With the information from the Airbnb rental price calculator, you can determine how much you can charge in terms of Airbnb rent to maximize your occupancy rate and rental income. If you want to be competitive in the local Airbnb rental market, running Airbnb rental comps is a must in 2023.

Conducting a detailed rental market analysis involves running Airbnb rental comps and helps real estate investors become competitive in the local market.

8. Financing Method

Before purchasing an Airbnb rental property, you should remember that your financing method will significantly impact your cash flow and return on investment. Therefore, it is crucial to understand your different financing options and determine which method works best for your investment property.

The monthly payments will be an important consideration if you take out a mortgage as a means of financing. Mortgage payments must be handled with precaution, which is one of the many reasons why an Airbnb calculator is necessary.

If you want to know if your method of financing will yield a good ROI, our Airbnb estimator comes with an inbuilt mortgage calculator. You start by simply entering your mortgage details in the Airbnb ROI calculator. Then, you’ll be able to see how the size of the down payment, the loan type, and the interest rate affect your Airbnb cash flow and Airbnb cash on cash return.

To learn more about how Mashvisor can help you find profitable investment properties, schedule a demo.

The Bottom Line

Airbnb hosting can be lucrative in 2023, but only if you purchase the right property and rent it out at the right rate.

If you want to make the best investment decision, one of the most important Airbnb tips is to run the Airbnb estimate using the best short-term rental calculator available in the market.

Mashvisor’s rental property calculator includes several features that may provide investors with all the information they need when evaluating a short-term rental. It allows users to determine the cap rate, mortgage payments, cash on cash return, and other variables.

As a result, by utilizing our calculator, you can be confident that you are receiving accurate data, saving time, and reviewing reliable forecasts. Furthermore, utilizing the calculator is quick and effortless.

To get access to our real estate investment tools, click here to sign up for Mashvisor today.