Hosting an Airbnb is highly profitable, but it requires a lot of investment. This blog post will discuss how you can get Airbnb financing.

The sharing economy continues to boom as it provides travelers with unique and relatively inexpensive lodging options. In

the past decade, Airbnb has become incredibly popular and continues to present lucrative opportunities for real estate investors looking to diversify their income. In fact, buying Airbnb property is arguably one of the best ways to invest in real estate. Many Airbnb hosts have been able to generate enough Airbnb rental income to afford to quit their jobs. Therefore, if you are thinking of investing in Airbnb, it’s definitely a wise decision.

However, acquiring an Airbnb investment property and preparing it for guests is going to cost you money. The problem is that most of the people who are looking to tap into this rental market usually don’t have enough capital to buy a rental property with cash. As a result, the question in most aspiring Airbnb investors’ minds is usually “Can you finance an Airbnb?”

The short answer is yes. However, financing Airbnb properties is not as easy as most people would expect. Due to their short-term nature, you will typically face a higher level of scrutiny from lenders when trying to secure Airbnb property financing than with standard investment loans for traditional properties.

Therefore, if you are thinking of buying Airbnb property, it’s important that you learn how to obtain financing for Airbnb properties. In this article, I’m going to go over some of the main short-term rental financing options available to investors and some key financing tips.

What Is an Airbnb Loan?

Airbnb financing is any type of loan that an investor avails to buy a residential property that they will use as a short-term rental. While there is no type of loan specifically for Airbnb properties, investors would want to know what options are available for them to finance their short-term rental investment.

Because an Airbnb property gets bookings that last from one night to one month, there may be times when you do not have guests and therefore have no income. Lenders see this as risky, because if you fall short of your target monthly income, you may have trouble paying your mortgage.

Thus, securing a vacation rental loan may have different requirements than a mortgage for buying a primary residence. You may have to put a larger down payment, face higher interest rates, or even apply for non-conventional loans.

What Is Airbnb, and Why Would You Want to Finance It?

Before we go into Airbnb financing, let’s talk about what Airbnb is. The concept of short-term rentals and home-sharing has been around since the 1950s. But when you think of either of these terms, the first thing that comes to mind is usually Airbnb. Airbnb is an online platform that enables both homeowners and travelers to do the following:

- Homeowners can list their rental, confirm bookings, message guests, and withdraw their earnings.

- Travelers can search for and book a short-term rental property, communicate with their hosts, and pay for their booking.

As the service became popular, savvy investors bought houses to put up as short-term rentals. They would then earn three times that of traditional rental income. Since a house is one of the biggest investments one would make, many who would want to get into the industry are looking for short term rental financing.

Why Are Lenders Strict With Airbnb Mortgage?

Generally speaking, it is more challenging to secure vacation rental property loans. Even before COVID-19 became a pandemic and disrupted the travel industry, lenders have been hesitant to approve loans for this type of property because of the risks that go with it.

3 Risks That May Keep You From Securing an Airbnb Loan

1: Liability

When you rent out your property on Airbnb, you are basically letting strangers stay there. Even though you do a background check on your guests by reading their profiles on the website, you are still not 100% sure how things will go during their stay.

So when a guest gets injured while on your property, damages the place, or causes injury to your neighbor, you are liable to resolve these issues, which usually means having to pay. With the right Airbnb insurance, you can reduce your out-of-pocket expenses related to this issue. But unexpected costs like this may make it difficult for you to keep up with your mortgage payments.

2: Vacancy and Cancellations

Because most people book an Airbnb for a night, a week, or a month, there may be times when you do not have guests. This is especially true for short-term rentals located in ski towns and coastal areas. You also face the risk of having a guest cancel their booking at the last minute and Airbnb may still refund their money. Because having no guests means earning zero income, this may affect your ability to pay your mortgage.

3: Secondary Property, Secondary Priority

As an investor, the property you wish to buy and run as an Airbnb will likely not be your primary residence. Lenders consider this risky because should you run into financial difficulties, you are likely to prioritize paying off any bills associated with your primary residence. Secondary homes and investment properties, meanwhile, are usually lower on the priority list, making lenders wary of whom they would loan out to.

Options Available for Airbnb Financing

Depending on your situation, you could use any of these options to finance an investment property that you intend to rent out on Airbnb:

1. Conventional Loans

One of the best Airbnb investment property financing options to consider is a conventional mortgage. You can get them from established lending institutions like national banks or from smaller mortgage lenders like local banks and credit unions.

These investment loans usually have strict requirements including a higher credit score, higher cash reserves, a lower debt to income ratio, and a larger down payment. However, rental property mortgage rates are usually more competitive compared to the rates of some other Airbnb loans.

2. Home Equity Loans

A second option for financing Airbnb properties is home equity loans. If you already own property, you can use the equity in your home to take out a fixed-rate home equity loan or a home equity line of credit (HELOC).

Depending on your debt-to-equity ratio, the cost of your Airbnb investment, and other factors, you can borrow funds to cover your down payment and use other Airbnb loans to finance the balance or you can borrow the entire amount required to buy the rental property.

The advantage of using these Airbnb loans is their lower rates and more favorable terms. However, you risk losing your primary residence if you fail to pay down the loan.

Related: Can I Get a HELOC on Investment Property? How?

3. Small Business Loans

Financing Airbnb properties is also possible through small business loans. Due to the rising demand for Airbnb financing, there are many companies that have emerged to offer small business loans to Airbnb hosts.

However, these Airbnb loans are usually harder to secure. This is because most lenders prefer funding businesses with established track records. You also have to be registered as a business entity.

4. Hard Money Loans

Hard money loans are short-term loans from private individuals or institutions. These Airbnb loans are usually a last resort because they require a higher down payment and charge higher interest rates compared to other Airbnb loans.

However, they usually have fewer requirements and have quicker approval. This makes them a great alternative for financing Airbnb properties if you’re not eligible for other Airbnb loans.

Before you go for this financing option, keep in mind that you will need to have a good chunk of money for a down payment, and repay the loan within a short period.

5. Refinancing Example

You bought a home for $180,000 and have already paid off $80,000, with $100,000 left to pay. Over time, your property increased in value by $20,000, bringing your home’s value to $200,000. This means your equity is $80,000 + $20,000 = $100,000.

Let’s say you want to use $90,000 as additional funds to buy an Airbnb property instead of taking out a second mortgage. When you refinance your mortgage, you would then take a part of your equity and then add it to your new mortgage principal. This means your new mortgage would be worth $220,000: the $100,000 remaining from your original mortgage plus the $90,000 you need to take out of your equity to buy a new property.

Tips for Airbnb Loans

Eligibility for loans for Airbnb properties will vary depending on the type of loan and from lender to lender. However, if you have decided to invest in Airbnb, you can increase your chances of qualifying for Airbnb loans and getting the best rates by factoring in some key things. They include:

-

Look for Properties with a High Income Potential

The income potential of the Airbnb property you intend to buy is crucial. If you can prove that the expected Airbnb rental income will be able to cover your monthly repayments, you are more likely to qualify for the loan. You will also be able to secure the most competitive rates.

The best way to find Airbnb properties for sale with a high potential for profits in the US housing market is to use Mashvisor’s tools. With our tools, you can conduct a market analysis, property search, and investment property analysis in a matter of minutes.

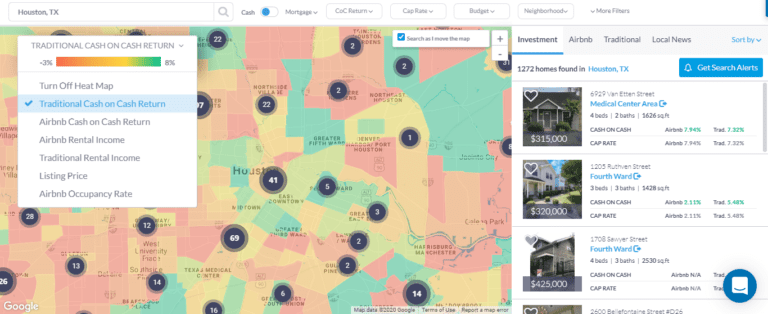

Mashvisor’s real estate heatmap is a great tool for performing neighborhood analysis. You can find top neighborhoods based on real estate metrics like median listing price, Airbnb rental income, Airbnb cash on cash return, and Airbnb occupancy rate.

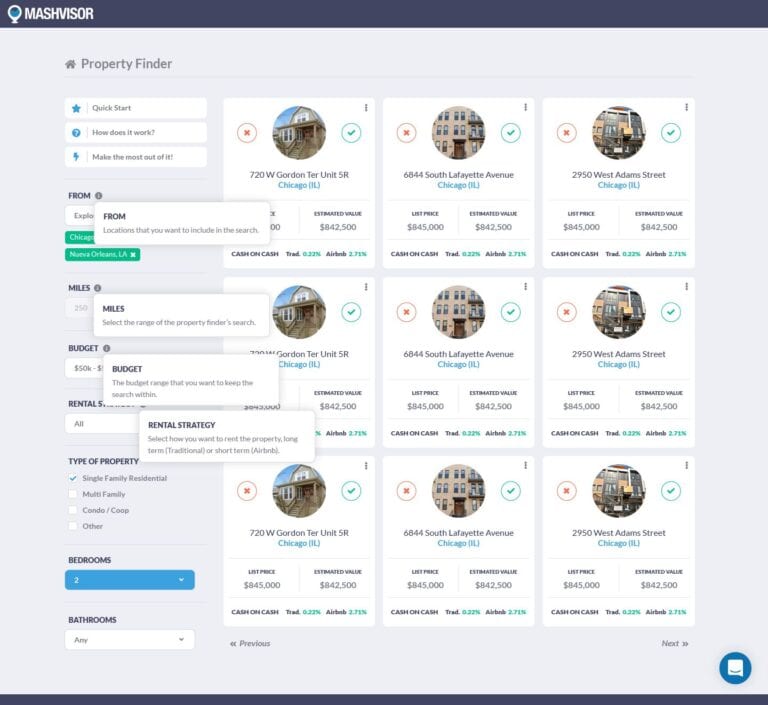

Once you have a promising neighborhood in mind, you can then use Mashvisor’s Property Finder to search for potentially profitable Airbnb for sale that matches your criteria in the area.

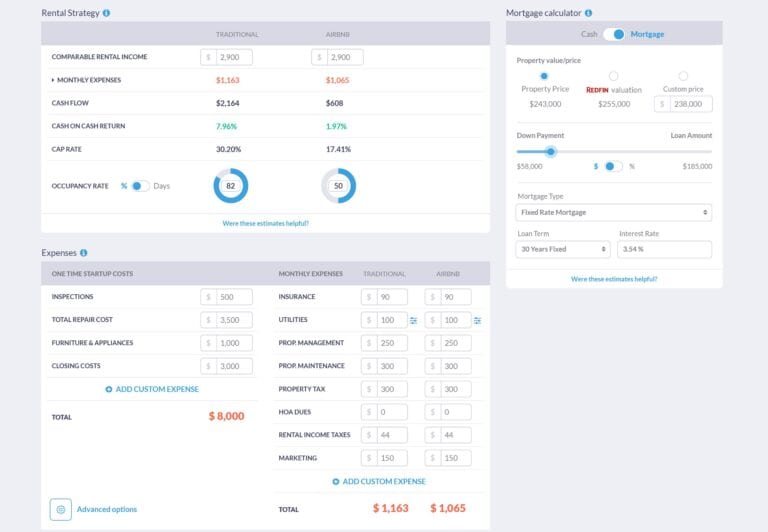

Finally, you can use Mashvisor’s Airbnb rental calculator to do an in-depth investment property analysis to find the best one. The tool quickly and accurately calculates key real estate metrics such as Airbnb rental income, Airbnb cash on cash return, Airbnb cap rate, and Airbnb occupancy rate.

-

Check Your Credit History (and Work On It If Needed)

Unless you are planning to borrow from a hard money lender, you need to make sure that your credit score meets lenders’ requirements. The better your score, the easier it is to get loan approval at a high amount and low-interest rate. If you need to improve your credit score, here are some things you can do:

- Review your credit reports to see what is helping and hurting your score.

- Avoid late payments at all costs.

- Keep your credit cards’ total outstanding balance at 30% or less of your total credit limit.

- Avoid applying for a new credit card or other types of loans for a while.

- If you have a thin credit file, “fatten” it up by using programs that calculate your other financial data—like banking history and utility payments—into your credit score.

-

Put Down a Larger Deposit

The minimum deposit amount will vary depending on the type of loan and the lender. However, if you can afford it, it’s always better to place a larger down payment.

The larger your deposit size, the better the interest rate you’ll get. Lenders prefer a larger deposit because it provides them with more security. It also shows them that you are more financially stable.

Paying down more upfront also means you’ll have a shorter repayment period or smaller monthly payments.

-

Work to Have a Low Debt-to-Income Ratio

Lenders will also take into account your DTI when assessing your ability to repay the loan. Before you begin shopping for Airbnb loans, you want to make sure that your DTI is as low as possible.

Getting Airbnb Financing Is Possible With the Right Investment Property

Even though there are no loan types specific for Airbnb financing, you still have several options to choose from. However, because of the risk that comes with running a short-term rental, you may have to provide proof of profitability and excellent financial standing. If you are not able to secure a loan, you can still start investing in short-term rentals with the following options:

- Rent out a portion of your primary residence.

- Start an Airbnb rental arbitrage.

- Buy a second home then rent it out part-time.

- Buy a multifamily property then live in one of the units and rent out the others.

Whichever property you end up renting out on Airbnb, you must first make sure that it will generate enough profit to help you achieve your investment goals. To do that, you need a reliable real estate investment tool.

Mashvisor provides state of the art real estate investment tools to help you make wise investment decisions and walk you through your investment journey. Please sign up here to start analysing the investment opportunities in both short trem and long term rental industry.