To run a successful short term rental business, hosts need to know everything about Airbnb insurance, from what it is to how it works.

Investing in a vacation rental is an exciting endeavor, and in the excitement of the moment, real estate investors sometimes forget the important details. While proper insurance might sound like a minor detail along the journey of making money from Airbnb, it is an important responsibility. You want to know that your property and you are well protected against risks.

Table of Contents

- What Is Airbnb Insurance for Hosts?

- What Insurance Does Airbnb Provide to Hosts?

- How Does Airbnb Insurance Work?

- How to Get Insurance for Airbnb

- How Much Does Airbnb Insurance Cost?

- Getting Started With the Right Insurance for Airbnb Hosts

- Frequently Asked Questions

In this article, we’ll cover all you should know about insurance for Airbnb rentals. Specifically, we’ll look at two types of insurance:

- Insurance tailored for the needs of short term rentals and provided by third-party companies

- Insurance provided by the Airbnb platform itself

We’ll look at what each type covers and what it doesn’t cover, and the advantages and disadvantages of each. We’ll consider the process of getting the best policy and the price of comprehensive coverage.

And for those just getting started in vacation rental investing, we’ll also go through the process of checking if the price of the selected insurance is negatively affecting ROI.

What Is Airbnb Insurance for Hosts?

Airbnb rental insurance refers to special rental property insurance policies specifically designed to cover the needs and requirements of short term rental owners and their houses.

Airbnb insurance is different from homeowners insurance (obtained by primary homeowners), landlord insurance (obtained by long term rental owners), and renters insurance (obtained by landlords). It is also different from travel insurance (obtained by traveling individuals such as Airbnb guests) and from business insurance (obtained by business owners).

Indeed, the best short term rental insurance, which is another name for Airbnb insurance, covers a bit of all the types of protection listed above.

In recent years, many US-based and international insurance companies started offering policies for the increasing number of Airbnb hosts and listings (exceeding 6.6 million globally). Just like other types of insurance, each company provides something a bit different from the rest of its competitors.

Some of the most popular examples of Airbnb property insurance in the US market are:

- Proper Insurance’s Airbnb Insurance for Hosts

- Allstate HostAdvantage

- CBIZ Vacation Rental Insurance

- American Family Short-Term Renters Insurance

- American Modern Vacation Home Insurance

What Insurance Do I Need for Airbnb?

There isn’t one single type of Airbnb insurance for a host. States and cities impose various requirements. Hosts and properties give priority to different things. And each company offers a slightly different policy, which – in most cases – is adjustable through a list of items to choose from.

Nevertheless, generally speaking, Airbnb home insurance aims to protect hosts in case of guest’s or anyone else’s injury that happens on the property. Moreover, it provides protection against property damage by the guest or even by natural disasters or conflict.

When choosing a company and a policy, you should consider the local legal regulations, as well as the climate and the political and social scene.

Some of the best short term rental markets might be located in areas prone to floods, earthquakes, hurricanes, or social unrest. You want to make sure that you, your investment property, and your guests are protected against all the said risks.

What Does Airbnb Insurance Cover?

The insurance for an Airbnb property can cover a wide range of things and scenarios, including:

- Medical expenses due to guest injury

- Guest belongings’ theft or damage

- Property and furniture damages or theft by guests

- Host’s personal property damage

- Damage to the property, the contents, and external structures due to natural disasters or conflict

- Damage to or theft of outdoor equipment or things like boats (for lake homes)

- Loss of rental income

In other words, such a special type of insurance can work as both property insurance and general liability insurance simultaneously. However, each company offers slightly different policy coverage, so Airbnb hosts need to perform diligent research to choose the most appropriate provider for their needs.

What Does Airbnb Insurance Not Cover?

While Airbnb host insurance can be quite comprehensive, there are certain things that remain outside the policy coverage, such as:

- Normal wear and tear

- Weather damage (sometimes)

- Luxury items

Before hiring any Airbnb insurance company, an investor should read through the policy carefully in order to understand what exactly is covered and what is not. In case of any doubt, it’s best to ask a company representative to make sure that everything is fully clear.

After all, there could be hundreds of thousands of dollars at stake in case anything goes wrong with your guests, your property, or its contents.

Does Airbnb Provide Insurance for Hosts?

Yes, the Airbnb platform adds insurance for hosts automatically with each booking. The best thing is that short term rental insurance is totally free as it is covered by the Airbnb host fees. On the flip side, it’s not as comprehensive as the coverage provided by some third-party companies. That’s why it’s a good idea to get additional vacation rental insurance for owners.

What Insurance Does Airbnb Provide to Hosts?

The Airbnb services for vacation rental owners include AirCover for Hosts. It is a two-part insurance that includes both damage protection and liability insurance.

What Is AirCover for Hosts?

A couple of years ago, Airbnb launched the relatively new AirCover for Hosts, which built on the previous Airbnb Host Damage Protection. In a sense, it is free insurance for an Airbnb rental offered by the vacation rental website itself that comes with each booking.

What Does AirCover for Hosts Cover?

According to the Airbnb insurance policy, AirCover for Hosts covers:

- $3,000,000 in damage protection: Refers to damage caused by guests and includes art and valuables, auto and boat, pet damage, income loss, and deep cleaning.

- $1,000,000 in liability insurance: Refers to a guest getting hurt or their belongings getting damaged or stolen. Liability covers the host plus co-host, property managers, cleaners, and other helpers.

Moreover, AirCover offers:

- Guest identify verification, including name, address, government ID, and more

- Reservation screening using proprietary technology to block bookings with a high risk for disruptive parties and property damage

- 24-hour safety line with specially trained safety agents

The last three points above make Airbnb home insurance very proactive, as it takes specific steps in order to prevent damage and liability instead of simply paying to cover the loss.

What Does AirCover for Hosts Not Cover?

While AirCover includes the basics expected from a good short term rental insurance, it misses some important points. That’s why most hosts choose to opt in for additional coverage or even standard homeowners insurance provided by third-party companies.

In specific, AirCover does not cover:

- Normal wear and tear

- Damage from natural calamities and events

- Mold damage

- Property damage happening outside bookings

- Bodily injury and property damage above the policy coverage limit

- Liability and property damage when the rental is booked through another platform such as Vrbo, Booking.com, etc.

Referring to the last point, other short term rental websites offer their own insurance. For instance, the Vrbo insurance coverage includes $1,000,000 in liability, just like the Airbnb policy. However, Vrbo Host Insurance does not provide protection against property damage.

Similarly, Booking.com offers $1,000,000 in liability protection under the Partner Liability Insurance but no rental property damage coverage.

What Are the Pros of AirCover for Hosts?

Our reviews of different short term rental property insurances reveal some important benefits of the policy provided by the Airbnb platform, including:

- It’s free.

- It’s automatic, so hosts don’t need to do anything to be eligible.

- It comes with a comparable liability protection limit.

- It offers an above-average property damage protection limit.

- It works in all US markets and with all property types.

- It is relatively easy to claim.

What Are the Cons of AirCover for Hosts?

At the same time, AirCover fails to deliver some important advantages that other providers of home insurance for Airbnb bring, such as:

- It doesn’t work with bookings outside the Airbnb platform, meaning that hosts are left without coverage when their property gets rented out on Vrbo, for example.

- It doesn’t protect the investment property while it’s vacant or between bookings.

- It doesn’t pay for regular maintenance and repairs that happen when a property is being rented out on a short term basis.

How Does Airbnb Insurance Work?

Each company that offers Airbnb insurance coverage has different requirements and processes. What is covered and what is not can vary widely, and the liability and property damage protection limits can be very different.

But the way they work is more or less the same. Hosts pay an annual premium that is calculated based on the location, the property, and the coverage.

In case something happens, the investor needs to file a claim for approval. In most cases, it is done online or through the insurance company’s website, which means that it can be done at any time of the day, fully remotely. Some providers require claims to be filed within 24 hours, so it’s best to act fast.

The company will ask for details and documentation to know what happened, whether the cost is eligible, and how much it should pay. Processing a claim can range from a few hours to a couple of weeks.

How to Get Insurance for Airbnb

Here is a step-by-step guide to getting Airbnb insurance:

1. Shop around

The first step in getting homeowners insurance for Airbnb is shopping around. As mentioned above, Airbnb insurance companies offer different terms and conditions and different pricing structures and ranges. Thus, investors need to ask for a quote from a few providers to know which one gives the best coverage for the optimal price.

2. Perform short term rental property analysis

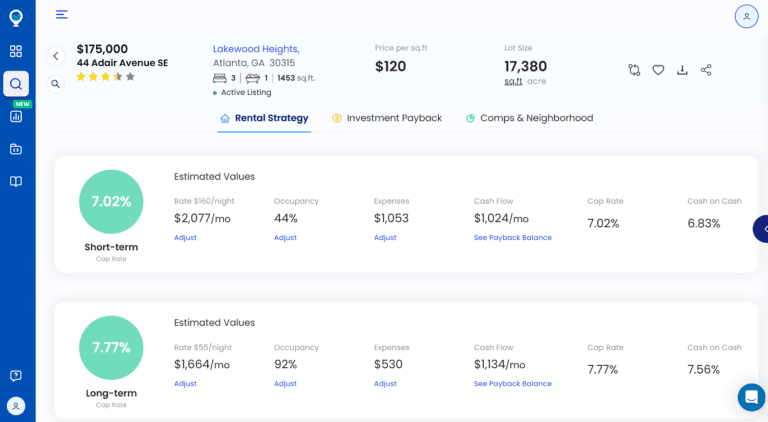

Second, a savvy host should conduct diligent Airbnb rental property analysis to know how the Airbnb insurance cost will affect their bottom line. The most effective way to do so is by using Mashvisor’s Airbnb Calculator.

The calculator is an AI-based tool that uses data from the MLS and Airbnb to analyze the investment potential of residential properties across the US market when rented out on a short term basis. All that is needed is to enter the property’s address and specifications to get an accurate estimate of all the most important data points, including:

- Property price

- Startup costs

- Monthly rental income

- Recurring expenses

- Cash flow

- Cash on cash return

- Cap rate

- Airbnb occupancy rate

The Mashvisor Airbnb Calculator helps even beginners find profitable investment opportunities that will provide positive cash flow and good ROI regardless of the cost incurred for insurance.

3. Finalize the purchase

Third, once you make sure that the insurance price will not impact your profitability negatively, it’s time to sign the policy, make the payment, and be assured that your property is protected.

Mashvisor’s AI-based Airbnb calculator allows real estate investors to analyze the investment potential of residential properties across the US market.

How Much Does Airbnb Insurance Cost?

The price of insurance for Airbnb properties can be very different. It depends on multiple factors, including but not limited to the company, the market, the property itself, and the required policy coverage.

While AirCover for Hosts, provided by Airbnb, is free of charge, other short term rental insurances usually cost a few hundred dollars per year. Nevertheless, the said cost is entirely worth it so that hosts and their properties can be protected against liability and damage, as well as loss of rental income.

Getting Started With the Right Insurance for Airbnb Hosts

Getting Airbnb insurance for hosts is not a luxury. It is a must for savvy investors in order to rest assured that they and their properties are well protected. The Airbnb platform offers good coverage under AirCover for Hosts, but there are some important situations that are excluded. Thus, investors need to get additional coverage through a third-party insurer.

Still, no company protects against absolutely everything that can go wrong with your short term rental and your guests. But the best Airbnb insurance options cover the majority of imaginable unfortunate situations. They include bodily injury to guests, structural damage to the property and its contents, and loss of short term rental income.

To find the most appropriate policy for your particular property, remember to shop around.

To get started with your search for the best Airbnb rental properties, sign up for Mashvisor today.

FAQs About Airbnb Insurance

Here are the questions that Airbnb hosts ask themselves most frequently when it comes to required insurance:

What Insurance Do You Use for Airbnb?

You need to get special Airbnb insurance, also called short term rental insurance, when you rent out your property on Airbnb, Vrbo, Booking.com, and other similar websites. The best insurance for Airbnb covers both personal liability and property damage.

The Airbnb platform supplies hosts with AirCover, which includes $3,000,000 in damage and $1,000,000 in liability, but it doesn’t cover all possible scenarios for a host. Thus, additional coverage provided by third-party insurance companies Proper Insurance, Allstate, CBIZ, American Family, and American Modern is highly recommended.

Is It Worth Getting Insurance on Airbnb?

Yes, getting Airbnb host protection insurance is absolutely worth it for investors in vacation rentals. While it adds up to the operating expenses of running an Airbnb business, it provides hosts with peace of mind. It can also save them a ton of money if an injury or damage happens during a guest’s stay.

However, when choosing the best insurance for Airbnb hosts, you should consider the cost and include it in your investment property analysis. You should select a company and a policy that offers enough coverage at a price that results in positive cash flow and a good return on investment for your business endeavor.

How Much Is Airbnb Host Insurance?

The price of Airbnb homeowners insurance varies widely. AirCover for Hosts, in specific, is free as the cost is covered by the fees that rental property owners pay to the platform.

With regard to other companies, as a general rule, third-party insurers do not list the price or even the pricing range on their websites. Short term rental property investors need to provide the insurance companies with the specific details of their property to get a quote.

The pricing depends on the market, the property type and size, the property contents and outdoor amenities, and the required coverage.

In any case, investors can expect to pay a few hundred dollars per year for a standard property (nothing too small and nothing too big or luxurious). The cost is totally worth it as it can save owners up to millions of dollars in liability and property damage should anything go wrong during a guest stay.

Can I Get Insurance Through Airbnb?

Yes, Airbnb provides AirCover for Hosts automatically, complimentary, free of charge with all bookings through the platform. The insurance offered by the Airbnb platform includes $3,000,000 in property damage protection and $1,000,000 in bodily injury liability.

However, Airbnb insurance does not provide protection when a property is rented out through another platform, when a rental is not booked, or when normal wear and tear happens. Thus, investors should get additional property insurance for full coverage.