As the tourism industry bounces back, let’s perform some Airbnb market analysis to see if 2023 is the best time to invest in vacation rentals.

The COVID-19 pandemic that started in early 2020 did a lot of damage to the global tourism industry. The short term rental industry suffered from the adverse effects of lockdowns and travel restrictions. Fortunately, the Airbnb rental market started to bounce back in late 2021, as authorities lifted lockdowns and many eager travelers started to go on vacation once again.

Table of Contents

- How 2022 Travel Trends Have Affected the Airbnb Market in the US

- 2023 Travel Forecasts That Will Affect the Airbnb Market in the US

- Should You List Your Short Term Rental on Other Platforms?

- How to Analyze the Airbnb Rental Market

- Top 10 Airbnb Markets

In fact, the vacation rentals is now seeing a substantial increase in demand compared to the pre-pandemic levels in 2019. In addition, rental revenues exceed the initial projections. As the US progressively reopens its doors to local and international tourists, we’re seeing better figures in the Airbnb market this year. The question is, will the trend continue until 2023?

This year, Airbnb listings are increasing significantly, given the number of new investors who recently ventured into the short term rental industry. Along with the surge in listings, the occupancy rate remains high. It is due to a steady demand for rentals, especially during peak those vacation months.

In 2023, we can expect to see some fluctuations in the short term rental market. However, some markets will remain as strong as ever. With its comprehensive Airbnb analysis feature, Mashvisor can help you find the best short term rental markets based on concrete Airbnb data across the US.

How 2022 Travel Trends Have Affected the Airbnb Market in the US

The global travel market previously predicted that 2022 would be the year that the tourism and travel industries would rebound after almost a couple of years of disruption. This year, after almost two years in lockdown, many travelers from around the world are hitting the road (or skies) to take more leisure trips.

In addition, since most businesses are back to normal, more people are taking business-related trips. As a result, the Airbnb business is experiencing increased bookings and seeing better returns.

If you’re an Airbnb owner or you’re planning to invest in short term rental properties, it’s important to know the 2022 travel trends and understand their impact on the Airbnb market.

Here are the 2022 travel trends and how they’ve affected the Airbnb market in the US:

People Felt the Need to Travel

Staying at home for almost two years with limited mobility caused a lot of anxiety and mental stress. That’s why when the COVID-19 vaccine became available in early to mid-2021 and the initial scare slowed down, many people felt a new sense of urgency to go on vacation. In fact, many were willing to spend more money on travel than on anything else.

People feel they lost two years to explore and enjoy, so many are desperate to hit the road and get away from their boring routine while in lockdown. Because travel seemed like a necessity instead of a luxury, we now see a growing demand for vacation rentals, not only across the country but all over the world. It’s helping boost the global Airbnb market share.

The Cost of Flights Gradually Going Up

With exceedingly low airline sales in 2020, many airline companies suffered tremendously. In fact, they were among the industries that were adversely hit by the pandemic. Now that people can travel again, fuel prices are surging as a result. Travelers who went abroad for vacation paying more for airline tickets.

The increase in fuel due to the global tensions that happened earlier this year also contributed to the increase in airline tickets. However, it did not deter many leisure travelers from spending more money on vacations than they did in the past. Those who could not afford the expensive flights opted for local travel instead and went to destinations where they could just drive.

More Business Travelers

With most companies adopting the new normal work-from-home setup, we are seeing more business-related trips this year. Global corporations are sending people to their headquarters for meetings and training. As a result, business districts in big cities are getting busier again.

If you’re eyeing solo and business travelers as your Airbnb target market, you may want to consider buying an investment property in an area near business centers. Buying a condo unit located within or close to business districts is an excellent idea so you can attract guests who are traveling for work or business. Make sure to conduct market analysis in the local area first.

Increased Travel to Rural Areas

Due to the pandemic, many travelers preferred to go to rural locations and explore the great outdoors across the US as opposed to busy urban cities. It is because many people still wanted to maintain social distance and stay away from crowded places. In fact, in 2021, rural travel in the US increased by around 28%.

Two years of staying at home made people want to go to open spaces. It is why locations with access to beaches, state and national parks, hiking trails, and mountain resorts became top vacation destinations.

This year, the Airbnb market in many suburban areas is seeing substantial growth in rental demand and occupancy rates. If you plan to rent out to adventure-seekers and outdoor-goers, it’s best to find a vacation rental property investment near such destinations.

Increased Travel to Family-Friendly Destinations

Family travels became a priority, so family-friendly destinations welcomed an influx of travelers. Places that feature kid-friendly attractions like zoos, museums, and theme parks saw an increase in bookings from family vacationers this year. Some families, especially with older kids, prefer to go to rural areas and are booking longer stays.

According to a survey conducted by the Family Travel Association (FTA), 85% of parents were inclined to travel with their children in 2022 and in the coming year. Moreover, 45% of the respondents plan to travel with other relatives who are not immediate members of their families. We can expect the trend to continue up to 2023.

2023 Travel Forecasts That Will Affect the Airbnb Market in the US

The increase in fuel prices and the prediction of a mild recession in the coming months are reasons why Airbnb owners wonder if the short term rental market will remain strong in 2023. Fortunately, despite a possible economic downturn, people are still willing to spend money on leisure travel. Additionally, we can also expect more demand from business travelers.

Although we might see a slight slowdown in demand for vacation rentals in general, it will not significantly impact the market. In fact, many real estate experts believe that amid the scare of a possible housing crash in 2023, the short term rental market will remain the more lucrative rental strategy.

Here are the top three travel forecasts that will impact the Airbnb market in the US in 2023:

1. Many Travelers Will Choose to Stay Closer to Home

Due to the rising prices of airline tickets, many travelers prefer to stay closer to their home city or state. According to conversation intelligence platform Invoca, in 2023, 59% of US travelers plan to stay in the country, while 58% would rather travel by car than by plane. Family travelers also prefer to stay stateside while exploring other cities or rural areas they haven’t been to yet.

2. Travelers Are Longing for Better Customer Experience

A number of factors cause travel frustrations, such as flight delays and cancellations, resulting in too much stress and headaches for people who just want to relax and unwind. As a result, more travelers are longing to experience the best customer service than before. It is something at the top of their list that they consider when booking a place to stay.

According to the same Invoca report, 63% of travelers are willing to pay more for a place that offers a better customer experience and amenities. If investing in short term rentals is something you consider, be prepared to think out of the box on how to provide better customer service to your guests. It can help you stand out among the vacation rental properties on various home-sharing platforms.

3. People Prefer to Get Close to Nature

In 2023, outdoor travels and travels to rural destinations are expected to remain strong. It is because most people still want to stay away from crowded places, while others just want to try new experiences. It is why campsites received plenty of bookings in 2022, and the demand for campsites is expected to continue throughout 2023 and beyond.

People who want to stay close to nature but do not want anything to do with camping prefer to go to rural and suburban areas for vacation. Destinations like beaches are the best options for those who want to experience water activities. In addition, some travelers who enjoy outdoor activities such as hiking can go to places with mountain parks and hiking areas.

Should You List Your Short Term Rental on Other Platforms?

To get the most out of your short term rental investment, it’s best to list your property on multiple vacation rental platforms so it can get more exposure. Becoming completely dependent on one particular vacation listing platform like Airbnb can be detrimental to your short term rental business.

There are many reasons why you shouldn’t stick to one platform only, such as the following:

- Limited earning potential: If you stick to one platform only, you risk not being able to maximize your bookings and improve your Airbnb earnings.

- Limited exposure: No matter how famous your home-sharing platform is, it is not guaranteed that all people are using it. You won’t be able to reach customers who are not using the platform that you use.

Using different short term rental platforms provides many benefits. For one thing, you can get maximum exposure for your vacation rental. Moreover, you’ll enjoy a wider audience reach because you’ll be able to advertise to those who do not use the other platforms.

However, it’s essential to choose the right platforms and know where to list your short term rentals besides Airbnb. It allows you to diversify your rental revenues, reach a wider range of audiences, and protect your business in case the main listing platform you use encounters any issues.

Airbnb’s Top 5 Competitors

Many investors believe that Airbnb is the most popular vacation rental platform being used globally. It is because most travelers often go to Airbnb’s website or mobile app to search for short term rental properties if they prefer not to stay in a hotel.

However, Airbnb is not the only listing platform available. In fact, you can find many Airbnb competitors online, making it a lot easier for travelers to find a property to book.

Here are the top five alternatives to Airbnb:

1. Vrbo

Vrbo is the shortened form for “vacation rental by owner.” The platform features all types of vacation rentals, including houses, condos, apartments, villas, and more. It allows homeowners to post their property listings and advertise to renters.

The major difference between Vrbo and Airbnb is that Vrbo only offers standalone vacation homes. Unlike Airbnb, it does not typically offer shared spaces like private rooms or options like cabins or campsites. Moreover, as more listings can be found on Airbnb, the Airbnb market is bigger compared to Vrbo.

2. HomeToGo

HomeToGo.com is one of the largest property search engines, with around 18 million listings available in more than 200 countries worldwide. HomeToGo integrates other listing platforms, including Airbnb, Vrbo, Booking.com, TripAdvisor, and Expedia.

HomeToGo differs from Airbnb in a way that it does not list properties directly from owners. It is a metasearch engine that pulls listings from other vacation rental platforms. On the other hand, Airbnb is a marketplace where rental properties are directly listed by Airbnb owners or their property managers.

3. Booking.com

Booking.com is a close competitor of Airbnb. It is an online travel agency that lists hotel accommodations, as well as vacation rentals. It features over six million private homes and apartments for rent on its platform.

So, how does Booking.com differ from Airbnb? Booking.com does not exclusively list vacation rentals; it was originally created as a search engine for hotels. With Booking.com, short term rentals are listed together with hotel inventory. On the other hand, while Airbnb also lists a few hotels, the Airbnb market mostly covers short term rentals.

4. Trip.com

Trip.com is a Singapore-based online travel agency with around 400 million users worldwide. It features over 1.2 million hotels and vacation rentals in 200 countries and regions.

Trip.com differs from Airbnb as the former boasts a large user base in Asia. It is a good option if you want to target international travelers as well. Also, while Airbnb allows stays over 30 days, properties listed on Trip.com can only be booked for a maximum stay of 30 days.

5. FlipKey

FlipKey is another Airbnb alternative that offers around 300,000 vacation rentals around the world. While Airbnb offers a variety of listings, including entire units, cabins, and single or shared rooms, FlipKey only lists apartments, villas, and beaches. Similar to Vrbo, it does not offer shared room listings.

Bonus: Airbnb Plus

You may also want to consider getting your property listed with Airbnb Plus instead of just the regular Airbnb. According to Airbnb’s website, Airbnb Plus hosts provide a higher level of hospitality on top of an extraordinary space.

If you believe your property can meet the high standards required for Plus certification, getting listed with Airbnb Plus can add more value to your business. However, Airbnb Plus is currently only open to selected Airbnb locations.

Are you ready to search for the most exceptional property for your next Airbnb investment? Mashvisor’s investment property search can help you find the perfect investment property based on your budget and location preference.

How to Analyze the Airbnb Rental Market

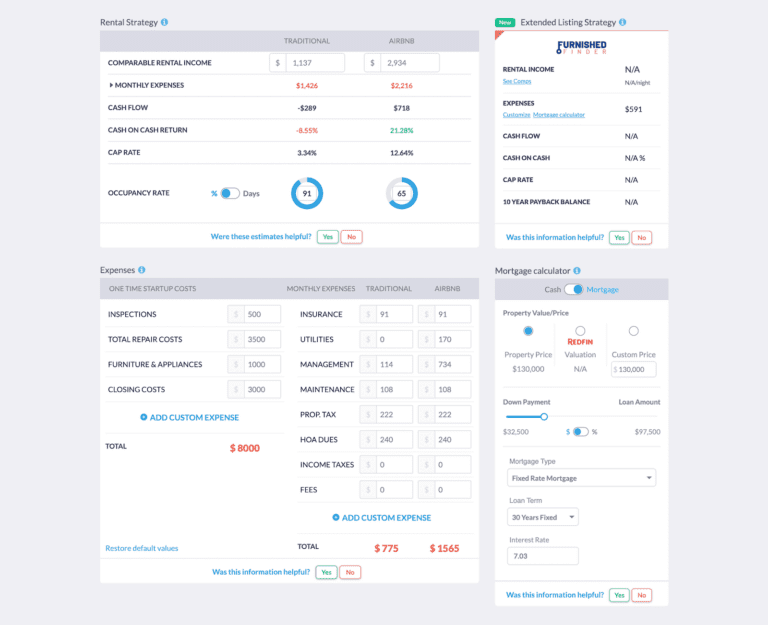

Before you invest in short term rentals, you should first conduct an in-depth Airbnb market analysis to ensure that the property can become a profitable investment. You need to find critical information about a particular property, like the Airbnb cash on cash return, cap rate, occupancy rate, average daily rate, and more.

However, finding the most accurate and up-to-date data for Airbnb properties can be laborious and time-consuming. To be successful in the Airbnb business, you also need to analyze your competitors and understand the Airbnb market trends. You can do them by using market research tools from trusted real estate data analytics platforms like Mashvisor.

How Can Mashvisor Help With Your Airbnb Analysis?

Aside from providing access to thousands of available listings, Mashvisor features a unique application programming interface that collects data from several public sources. With Mashvisor, you can easily access the most current Airbnb market research and analysis to help you determine whether or not a certain property will be a good investment.

Mashvisor makes it easy for investors to access real estate market analysis and data. You just need to enter your preferred location. Then, choose a property that interests you and click on it. You will see an overview of the property analytics, neighborhood analysis, and rental comps. You’ll also find a comparison of different rental strategies and insights.

Additionally, Mashvisor has an Airbnb calculator where you can input your financing information and custom expenses to get a more personalized computation of the property’s potential income.

In general, Mashvisor’s comprehensive Airbnb data and analysis let you gain a deeper understanding of the Airbnb market so you can use it to your advantage.

Start your 7-day free trial with Mashvisor to get a first-hand experience of its real estate data and analysis tools.

Mashvisor’s Investment Property Calculator can help you analyze the profit potential of a property listing if it was used as an Airbnb rental.

Top 10 Airbnb Markets

If you’re ready to become an Airbnb host, we’ve gathered the top 10 Airbnb markets with a median property price of below $1 million, Airbnb rental income of over $2,000, and an occupancy rate of 50% or higher. In addition, we only considered the Airbnb markets with at least 100 Airbnb listings available.

We also took into consideration the cash on cash return and only included markets with cash on cash return of at least 3%. Cash on cash (CoC) return is the ratio of the net operating income to the total cash investment. The rate will vary depending on how you financed your purchase—whether you purchased your property in cash or with a mortgage.

The cash on cash return helps determine whether the property is profitable or not. The higher the CoC return, the more profitable the investment property would be. Most real estate experts agree that good average cash on cash return in a market is usually 8% or higher. However, in some areas, CoC returns ranging from 2% to 3% or higher are acceptable.

Mashvisor gathers its Airbnb market data from the Airbnb website, based on historical and active listing information. Using our unique algorithms and analysis, we are able to make our calculations and projections.

According to Mashvisor data as of November 2022, the top 10 cities for Airbnb rentals based on the above-mentioned criteria include the following:

1. Schiller Park, IL

- Number of Airbnb Listings: 110

- Monthly Airbnb Rental Income: $3,853

- Airbnb Cash on Cash Return: 7.85%

- Airbnb Cap Rate: 8.10%

- Airbnb Daily Rate: $155

- Airbnb Occupancy Rate: 59%

- Median Property Price: $280,389

- Average Price per Square Foot: $208

- Days on Market: 54

- Walk Score: 71

Search for profitable Airbnb properties in Schiller Park, IL.

2. Reading, OH

- Number of Airbnb Listings: 171

- Monthly Airbnb Rental Income: $2,874

- Airbnb Cash on Cash Return: 7.85%

- Airbnb Cap Rate: 8.14%

- Airbnb Daily Rate: $117

- Airbnb Occupancy Rate: 53%

- Median Property Price: $225,180

- Average Price per Square Foot: $139

- Days on Market: 40

- Walk Score: 80

3. West Saint Paul, MN

- Number of Airbnb Listings: 320

- Monthly Airbnb Rental Income: $3,367

- Airbnb Cash on Cash Return: 7.70%

- Airbnb Cap Rate: 7.86%

- Airbnb Daily Rate: $151

- Airbnb Occupancy Rate: 62%

- Median Property Price: $268,376

- Average Price per Square Foot: $169

- Days on Market: 35

- Walk Score: 75

4. Bellwood, IL

- Number of Airbnb Listings: 152

- Monthly Airbnb Rental Income: $3,677

- Airbnb Cash on Cash Return: 7.45%

- Airbnb Cap Rate: 7.69%

- Airbnb Daily Rate: $161

- Airbnb Occupancy Rate: 64%

- Median Property Price: $257,900

- Average Price per Square Foot: $198

- Days on Market: 54

- Walk Score: 82

5. Richmond Heights, OH

- Number of Airbnb Listings: 234

- Monthly Airbnb Rental Income: $2,958

- Airbnb Cash on Cash Return: 7.45%

- Airbnb Cap Rate: 7.63%

- Airbnb Daily Rate: $136

- Airbnb Occupancy Rate: 51%

- Median Property Price: $229,130

- Average Price per Square Foot: $131

- Days on Market: 108

- Walk Score: 23

6. Clawson, MI

- Number of Airbnb Listings: 298

- Monthly Airbnb Rental Income: $3,185

- Airbnb Cash on Cash Return: 7.18%

- Airbnb Cap Rate: 7.42%

- Airbnb Daily Rate: $167

- Airbnb Occupancy Rate: 52%

- Median Property Price: $256,732

- Average Price per Square Foot: $219

- Days on Market: 30

- Walk Score: 69

7. Luray, VA

- Number of Airbnb Listings: 192

- Monthly Airbnb Rental Income: $4,183

- Airbnb Cash on Cash Return: 7.00%

- Airbnb Cap Rate: 7.10%

- Airbnb Daily Rate: $239

- Airbnb Occupancy Rate: 54%

- Median Property Price: $416,415

- Average Price per Square Foot: $222

- Days on Market: 67

- Walk Score: 52

8. Robbinsdale, MN

- Number of Airbnb Listings: 335

- Monthly Airbnb Rental Income: $3,387

- Airbnb Cash on Cash Return: 6.94%

- Airbnb Cap Rate: 7.13%

- Airbnb Daily Rate: $166

- Airbnb Occupancy Rate: 56%

- Median Property Price: $303,400

- Average Price per Square Foot: $159

- Days on Market: 36

- Walk Score: 73

9. West Allis, WI

- Number of Airbnb Listings: 112

- Monthly Airbnb Rental Income: $2,437

- Airbnb Cash on Cash Return: 6.86%

- Airbnb Cap Rate: 7.05%

- Airbnb Daily Rate: $119

- Airbnb Occupancy Rate: 70%

- Median Property Price: $238,308

- Average Price per Square Foot: $156

- Days on Market: 23

- Walk Score: 54

10. Columbus, GA

- Number of Airbnb Listings: 268

- Monthly Airbnb Rental Income: $2,187

- Airbnb Cash on Cash Return: 6.63%

- Airbnb Cap Rate: 6.94%

- Airbnb Daily Rate: $120

- Airbnb Occupancy Rate: 59%

- Median Property Price: $237,116

- Average Price per Square Foot: $121

- Days on Market: 93

- Walk Score: 35

Subscribe to Mashvisor to Invest in Airbnb

In 2023, the short term rental market is expected to remain strong. It is despite the possible recession that might happen in the next few months. However, since airline ticket prices are also rising, many travelers prefer to travel near where they live, while others would rather drive instead. Despite such challenges, the demand for vacation rentals will continue to grow.

If you are planning to invest in vacation rentals, make sure to conduct a thorough Airbnb market analysis to ensure you’re investing in the right location. Keep in mind that location is a key factor that can either make or break your investment. Also, it’s essential to know the travel trends in a certain area and prioritize the most frequented tourist destinations.

When doing your short term rental analysis, remember also to dig deeper and understand the Airbnb market trends in a particular city before you decide to buy an investment property. Fortunately, real estate data and analysis are easily available to you when you work with Mashvisor.

Mashvisor can help you find the most valuable properties for short-term rental investing. Our database contains thousands of available listings from several MLS sources. With our in-depth Airbnb market research and analysis, you will get an overview of how a particular property will perform based on your preferred rental strategy.

To find the best Airbnb investment property, just type your chosen location in our property search tool. You can also filter your results based on your preferred budget, cash on cash return, cap rate, number of bedrooms and bathrooms, and property type.

Once you click on a property that interests you, you’ll be directed to a page where you will see all real estate data related to the property, including the Airbnb market analysis.