Florida is one of the best tourist destinations in the US. It is famous for its beach cities like Miami. So, is Miami good for Airbnb in 2023?

Florida will continue to be a desirable tourist destination in 2023. It offers a diverse range of attractions and activities. It is renowned for its white sand beaches, such as Miami Beach, Clearwater Beach, and Siesta Key Beach. These stretches of pristine coastline offer visitors opportunities for Instagrammable photos. It’s best for those seeking relaxation.

Table of Contents

Another great thing about The Sunshine State is that, true to its nickname, it boasts perpetually warm weather that visitors love. This means the state gets to enjoy an influx of tourists all year round. Florida’s warm and sunny climate throughout the year makes it an ideal destination for beach lovers.

In addition to its beaches, Florida boasts a multitude of world-class theme parks and attractions. It is home to world-class theme parks like Walt Disney World Resort. Also, it boasts natural wonders such as the Everglades National Park.

One of the most popular Florida cities that’s frequented by visitors is Miami. Miami is a beach city known for its vibrant atmosphere and diverse cultural experience. Besides that, it is also home to bustling nightlife scenes. It also offers art and cultural experiences and trendy neighborhoods. Visitors love to explore the iconic Art Deco architecture in South Beach.

Miami’s captivating allure attracts tourists worldwide. It perfectly blends beachside tranquility, vibrant atmospheres, and diverse cultural experiences. But the question among real estate investors remains: is Miami good for Airbnb investing in 2023?

Miami Florida Real Estate Market 2023

Do you want to know whether a Miami Airbnb investment will be profitable? Then we should delve deeper into the local Airbnb data of the best Miami neighborhoods for short term rentals. But before we do that, let us first take a look at the city’s general real estate market data. As per Mashvisor’s data as of May 2023, this is Miami’s real estate analysis:

- Median Property Price: $1,042,881

- Average Price Per Square Foot: $736

- Days on Market: 71

- Traditional Listings: 9,552

- Traditional Rental Income: $4,114

- Traditional Cash on Cash Return: 3.06%

- Traditional Cap Rate: 3.09%

- Price to Rent Ratio: 21

- Airbnb Listings: 5,969

- Airbnb Rental Income: $4,018

- Airbnb Cash on Cash Return: 1.94%

- Airbnb Cap Rate: 1.96%

- Airbnb Daily Rate: $264

- Airbnb Occupancy Rate: 42%

- Walk Score: 56

Miami has a magnetic appeal that attracts both tourists and residents alike. Its warm and sunny climate throughout the year is a major draw for people. People seeking an escape from colder regions love to go to Miami. The city’s beautiful beaches, like South Beach and Miami Beach, offer a haven for relaxation. They’re also good for water activities with a vibrant beach culture.

Furthermore, Miami’s multiculturalism is another key factor that draws people to the city. Residents and tourists alike can immerse themselves in Miami’s vibrant and diverse neighborhoods. Its cultural diversity contributes to a dynamic and inclusive atmosphere. It is an attractive destination if you want a cosmopolitan lifestyle and a sense of global connectivity.

Related: 10 Best Rental Areas in 2023 for Cash on Cash Returns

Miami Real Estate Analysis for 2023

Based on the data above, both long term and short term rental investments in Miami earn a lucrative monthly rental income. Yet, the cash on cash return and cap rate show that Miami is better suited for traditional investing. With a traditional CoC return of 3.09% versus its Airbnb CoC return of 1.94%, Miami is more optimal for long term rentals.

In addition, the price to rent ratio of 21 indicates that residents are more likely to rent a home than buy one. In contrast, the occupancy rate for short term rentals is only 42%. It is an indicator that Miami Airbnb may not do as well as its long term rentals. With over 9,500 traditional listings, you can safely say that traditional rental investing is profitable in Miami.

However, it is not to say that Miami Airbnb is not profitable. In fact, there are more than 5,900 Airbnb listings in the city, and the average Airbnb rental income is $4,000 plus per month. In general, Airbnb Miami is still doing well. It’s just that its cash on cash return and cap rate show that it may take a bit longer to realize an ROI from your investment.

Another catch in Miami real estate is that its median property price is over $1 million, which only a few investors may afford. However, keep in mind that this figure is city-wide. There are local Miami markets that offer affordable housing opportunities. You just need to find the best neighborhoods that work for your budget and chosen investment strategy.

Related: Where to Find the Most Profitable Rental Properties in the USA

What Are the Best Neighborhoods to Invest in Airbnb Miami?

So, based on the Airbnb data analysis above, are you still asking the question: is Miami good for Airbnb investments in 2023? The short answer to this is YES—but you need to know which neighborhoods to invest in to be successful.

City-wide, the short term rental market in Miami may not look as profitable compared to its long term rental counterpart. But, there are local neighborhoods that generate good Airbnb returns. If you want to invest in a vacation rental in Miami, find an Airbnb for sale in these areas.

We have included areas with a median property price below $1 million. They have at least 100 Airbnb listings and above $2,000 Airbnb rental income. We only considered markets with a cash on cash return of over 2% and at least 50% Miami Airbnb occupancy rate.

Using the above criteria, here are the four neighborhoods that are optimal for Airbnb in Miami:

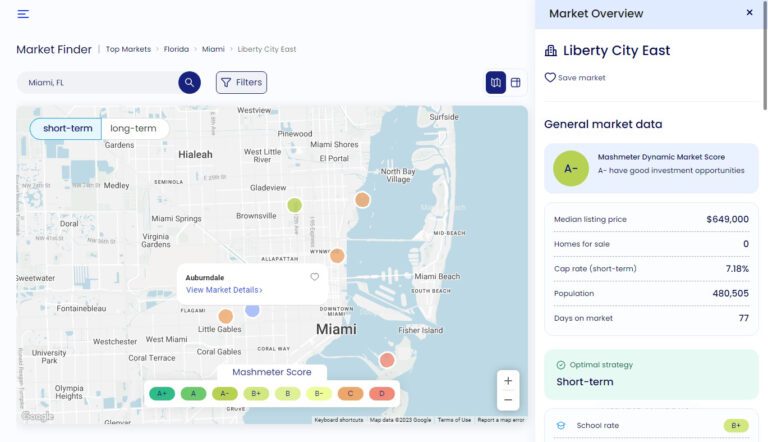

Liberty City East, FL

- Median Property Price: $392,213

- Average Price Per Square Foot: $1,101

- Airbnb Listings: 773

- Airbnb Rental Income: $3,123

- Airbnb Cash on Cash Return: 4.45%

- Airbnb Cap Rate: 4.52%

- Airbnb Daily Rate: $211

- Airbnb Occupancy Rate: 53%

- Walk Score: 58

Liberty City East boasts a strategic location within the larger Miami metropolitan area. This location offers proximity to popular tourist destinations, such as South Beach, Magic City, and downtown Miami. Because of this, you can expect a potential for high Airbnb occupancy rates.

Additionally, Liberty City East benefits from a rich cultural heritage and vibrant community. It attracts visitors who seek an authentic experience beyond the traditional tourist spots. The area allows for diverse rental options, catering to various budgets and preferences.

Plus, the area is an attractive prospect for property appreciation and long-term growth. It is due to its ongoing revitalization efforts and infrastructure development. It also offers the convenience of nearby amenities and transportation links. Generally, Liberty City East has the potential to yield favorable returns for Airbnb investors.

Overtown, FL

- Median Property Price: $944,758

- Average Price Per Square Foot: $568

- Airbnb Listings: 1,641

- Airbnb Rental Income: $3,784

- Airbnb Cash on Cash Return: 3.73%

- Airbnb Cap Rate: 3.79%

- Airbnb Daily Rate: $227

- Airbnb Occupancy Rate: 55%

- Walk Score: 73

Overtown is also close to popular tourist destinations, like downtown Miami, Wynwood, Coconut Grove, and the Design District. This strategic positioning ensures a steady flow of potential guests. It also increases the likelihood of high occupancy rates.

Additionally, Overtown offers diverse community and local events. Its music festivals and cultural celebrations contribute to its appeal as an Airbnb destination. It also offers convenient transportation links and easy access to major highways. This is why the area is suitable for both tourists and business travelers.

Overtown Airbnb properties hold the potential for favorable returns and long-term growth. With numerous redevelopment projects underway, investors will enjoy potential appreciation in home values.

Auburndale, FL

- Median Property Price: $673,887

- Average Price Per Square Foot: $950

- Airbnb Listings: 814

- Airbnb Rental Income: $3,350

- Airbnb Cash on Cash Return: 3.05%

- Airbnb Cap Rate: 3.08%

- Airbnb Daily Rate: $163

- Airbnb Occupancy Rate: 55%

- Walk Score: 70

Auburndale is located in the western part of the city, near the Everglades. The neighborhood is home to a variety of businesses, schools, and parks. It is also home to some historical sites, including the Auburndale Historical Museum and the Auburndale Train Depot.

Auburndale is a relatively safe neighborhood. The crime rate is lower than the national average, making it a secure place for tourists. There are many parks and playgrounds around the community. Plus, it is an excellent place for investors looking for a more affordable place to invest.

It is home to Auburndale Trail, which is a great place for those who love to hike or bike. The Auburndale Town Center is also a great place to go shopping and enjoy a meal. In general, the area offers a more affordable option for investors looking to enter the Miami short term rental market.

Alameda-West Flagler, FL

- Median Property Price: $717,606

- Average Price Per Square Foot: $639

- Airbnb Listings: 584

- Airbnb Rental Income: $3,280

- Airbnb Cash on Cash Return: 2.08%

- Airbnb Cap Rate: 2.10%

- Airbnb Daily Rate: $158

- Airbnb Occupancy Rate: 54%

- Walk Score: 74

Alameda-West Flagler offers enticing opportunities for Airbnb investing. Its proximity to both Ocean Drive and Coral Gables is one of the reasons why. Being situated in the Miami metropolitan area, this place benefits from Miami’s robust tourism industry.

With Ocean Drive‘s renowned beachfront and vibrant nightlife just a short distance away, visitors are drawn to the area for its architecture, entertainment, and dining. This proximity to popular tourist hotspots significantly enhances the potential for high occupancy rates and rental demand.

Additionally, Alameda-West Flagler’s proximity to Coral Gables adds another layer of appeal for Airbnb investors. Coral Gables is known for its upscale residential areas, tree-lined streets, and historic landmarks. The city’s atmosphere, boutique shopping options, and fine dining establishments draw visitors in.

Airbnb hosts in Alameda-West Flagler can attract guests who desire a more tranquil and residential setting. This is all while having easy access to the amenities and attractions of Coral Gables.

Mashvisor provides state of the art real estate investment tools to help you make wise investment decisions and walk you through your investment journey. Please sign up here to start analysing the investment opportunities in both short trem and long term rental industry.

What Licenses Do I Need for an Airbnb in Miami?

If you want to operate a vacation rental in Miami, you need to obtain the following permits:

Certificate of Use (CU) From Miami-Dade County

This certificate is issued by Miami-Dade County and is required for all short-term rentals in the county. You can apply for this certificate online or in person at the Miami-Dade County Inspection Center. The fee is $36.70 per certificate.

When you apply for a CU, your property also needs an inspection. You need to pay an inspection fee of $89.97 plus a surcharge of $9.50.

State Vacation Rental Dwelling License

This license is issued by the Florida Department of Business and Professional Regulation (DBPR). You need this license if you are renting an entire dwelling unit. You can apply for this license online or by mail. There is a one-time application processing fee of $50. You’ll also need to pay a license fee, depending on the number of listings.

Business License From the City of Miami

If your Airbnb is within the city limits of Miami, you will need to obtain a business license from the city. You can apply for this license online or in person at the City of Miami Administration Building. The fee for this is $82.50.

You may also need other certificates to operate an Airbnb in Miami. These include a fire inspection certificate, a health inspection certificate, and a noise permit. The specific requirements vary depending on the location of your short term rental. Check the updated local ordinances and stay in compliance to avoid any issues.

Visit the guide for operating short term rentals in Miami for more information.

Is Airbnb Profitable in Miami?

Based on the Miami Airbnb analytics above, the profitability of Miami Airbnb depends on the neighborhood you invest in. Not all areas in Miami are optimal for investing in vacation rentals. Also, Miami has generally expensive housing. This is another factor that can significantly affect your profitability as an investor.

In addition, not all properties are suitable for short term rentals. As an investor, you need to identify which properties will make a good investment. Fortunately, the availability of online real estate platforms like Mashvisor makes this easier.

With Mashvisor’s streamlined real estate system, you can easily determine if a particular property works as a vacation rental investment. Also, Mashvisor’s real estate tools and features can help you find the best short term rental markets in any US location.

Related: Should You Buy a Short Term Rental in Miami in 2023?

Here are the tools that can help you find top-rated properties that are optimal for vacation rentals:

Market Finder

The first tool that you need is Mashvisor’s Market Finder. It lets you type the city of your choice and select an investment strategy. Then you can see the top neighborhoods by Mashmeter score, cap rate, rental income, or crime rate.

The Mashmeter score is a rating Mashvisor gives an area based on the overall market health for a particular rental strategy. Factors such as average returns and occupancy rate are taken into account when giving a score to a specific neighborhood.

Market Finder allows you to find the best neighborhood based on the filters you choose. You can also see an overview of these neighborhoods, including details like Airbnb regulations and occupancy rates.

Is Miami good for Airbnb? Let Mashvisor’s Market Finder help you decide. It gives you a general market overview to help you make informed investment decisions.

Property Finder

Once you have determined the right market for short term rentals, the next step is to find a property to invest in. Fortunately, you can also do this through Mashvisor’s platform. Property Finder is a tool that lets you search for properties for sale in your chosen neighborhood. Plus, you can set different filters to customize your search results.

You can set your desired budget, property type, size, and rental strategy. You can also set the number of bedrooms and bathrooms that you prefer. Then you will see a list of properties for sale that match your custom filters. Simply click on a property that interests you, and you will see the general overview of the property’s investment potential.

You will find the important details about the property. Information such as the cap rate, Airbnb occupancy rate, nightly rate, expenses, and cash flow are accessible. Plus, you’ll also see the analysis for long term rentals. It allows you to easily compare the metrics to determine which investment strategy is best for a specific property.

Investment Property Calculator

Another essential tool Mashvisor offers is the Airbnb calculator. This tool allows you to identify how much you could earn from the property when you rent it out as a short term rental. Also, you can adjust the values for expenses, nightly rates, and occupancy rates to see what happens to your income.

On top of that, you can also use it as a mortgage calculator. It allows you to set your financing strategy to have a more personalized result based on your funding plans. Just choose your mortgage type, then type in the loan amount, interest rates, term, down payment, and closing costs.

Airbnb Rental Calculator

Bedrooms

Bathrooms

Heat Map

The real estate heatmap tool allows you to explore other locations in Miami that may be good for short term rentals. The heat map tool lets you find areas that match your preferred criteria. To set your criteria, just select the heat map filters, such as:

- Cash on cash return

- Rental income

- Occupancy rate

- Listing price

Depending on your preferred metric, you can easily find which area matches your specifications. For example, if you choose Airbnb occupancy rate as your filter, colors will highlight the map based on the percentage of occupancy rates. Red is the lowest, green is the highest, with orange and yellow in between.

So to find an area with a high occupancy rate, you must choose the areas on the map highlighted in green or yellow. Also, you will see blue dots around the heat map. These dots represent properties for sale. So if you want to find a property for sale in a certain area with a high occupancy rate, just choose the blue dots on the yellow or green highlighted area.

Mashvisor provides state of the art real estate investment tools to help you make wise investment decisions and walk you through your investment journey. Please sign up here to start analysing the investment opportunities in both short trem and long term rental industry.

Should You Invest in Miami Airbnb?

If you’re still asking, “Is Miami good for Airbnb in 2023?” —the short answer is it depends. Some areas can be profitable locations for Airbnb. Other sites may not be as good.

You need to know how to find the best Miami Airbnb markets to ensure that you can earn positive cash flows and gainful returns. Using the Mashvisor tools mentioned above is a great way to find the right Airbnb investment in Miami.

Since Miami has a high median home price, you may also try doing an Airbnb arbitrage Miami. It means you find a property to rent, then rent out a room or the entire unit as a vacation rental. It will give you an opportunity to earn an Airbnb income without having to buy a property. Just make sure to obtain approval from your landlord if you plan to do this.

If you decide to invest in short term rentals in Miami, check the Airbnb laws and regulations thoroughly. Stay in compliance with the law to avoid any legal issues. Remember, owning a vacation rental can be exhausting. So you may find a Miami Airbnb management company to help you manage your vacation rentals.

But if you want to save on cost, you can easily manage your Airbnb on your own with the help of Mashvisor. Our Dynamic Pricing tool will help you price your property correctly so you can maximize your booking and income potential.

Do you want to know how Mashvisor works? Schedule a demo now.