One of the most pressing questions on the mind of any real estate investor looking for lucrative opportunities is what Airbnb occupancy rate we should expect in 2021.

2020 was one of the toughest and most unpredictable years for the US real estate market. The Covid-19 pandemic took everyone by surprise and had an immediate effect on the entire real estate industry. The most instant and most sizeable impact was on short-term rentals. Airbnb occupancy rates as well as Airbnb income dropped across the US housing market as soon as the global pandemic was announced. However, the Airbnb business demonstrated its resilience once again as occupancy rates had entered into a recovery mode by September 2020. Moreover, Mashvisor’s Airbnb data analysis shows that it is expected to be back on the path of sustainable growth by September 2021. The rollout of the Coronavirus vaccine and the remote working policies are forecast to turn into the drivers behind the Airbnb growth this year.

But how much exactly are vacation home rentals expected to grow in 2021? Will short-term rentals be one of the most profitable real estate investment strategies once again? One of the best ways to answer these questions is to look at what Airbnb occupancy rate real estate investors can expect in 2021.

Related: 8 Best Cities for Airbnb Investment in 2021

Airbnb Occupancy Rate to Expect in the US in 2021

We at Mashvisor took a look at Airbnb occupancy rate data from the entire US housing market to show you what occupancies you will experience in the major US cities in 2021.

Before we move forward, we’d like to specify that our Airbnb data comes directly from the Airbnb platform and reflects the observed performance of actual Airbnb listings.

- Little Rock, AR: 75.0%

- Bakersfield, CA: 74.2%

- Fayetteville, NC: 71.2%

- El Paso, TX: 68.1%

- Fort Wayne, IN: 67.6%

- Fort Collins, CO: 67.5%

- Riverside, CA: 66.5%

- Chandler, AZ: 65.2%

- Los Angeles, CA: 65.0%

- Tucson, AZ: 64.9%

- Richmond, VA: 64.9%

- Reno, NV: 64.8%

- Raleigh, NC: 64.6%

- Tulsa, OK: 64.3%

- Phoenix, AZ: 64.1%

- Long Beach, CA: 63.9%

- Montgomery, AL: 62.8%

- Springfield, IL: 63.0%

- Colorado Springs, CO: 62.1%

- Santa Fe, NM: 62.1%

- Las Vegas, NV: 61.8%

- Birmingham, AL: 61.5%

- Grand Rapids, MI: 61.5%

- Columbus, OH: 60.6%

- Providence, RI: 60.2%

- Kansas City, MO: 60.1%

- Madison, WI: 59.9%

- Fort Worth, TX: 59.6%

- Bend, OR: 59.6%

- Pittsburgh, PA: 59.5%

- San Diego, CA: 59.3%

- Jacksonville, FL: 59.3%

- Saint Paul, MN: 59.3%

- Memphis, TN: 59.2%

- Charleston, SC: 59.0%

- Cincinnati, OH: 58.8%

- Durham, NC: 58.4%

- Portland, OR: 57.8%

- Dallas, TX: 57.5%

- Cleveland, OH: 57.4%

- Minneapolis, MN: 57.1%

- San Francisco, CA: 57.1%

- San Jose, CA: 56.7%

- San Antonio, TX: 56.6%

- Charlotte, NC: 56.4%

- Honolulu, HI: 55.9%

- Buffalo, NY: 55.7%

- Indianapolis, IN: 54.8%

- Austin, TX: 54.2%

- Baltimore, MD: 54.1%

- Louisville, KY: 54.0%

- Washington, DC: 53.3%

- Augusta, GA: 52.7%

- Houston, TX: 52.5%

- New York, NY: 52.2%

- Orlando, FL: 52.0%

- Milwaukee, WI: 51.9%

- Philadelphia, PA: 51.4%

- Fort Lauderdale, FL: 51.2%

- Detroit, MI: 51.0%

- Tampa, FL: 50.7%

- Virginia Beach, VA: 50.7%

- Scottsdale, AZ: 49.4%

- Key West, FL: 46.6%

- Chicago, IL: 46.4%

- Nashville, TN: 45.4%

- Jersey City, NJ: 45.3%

- Miami, FL: 44.4%

- Atlanta, GA: 41.6%

Related: Where to Get Reliable Airbnb Data in 2021

What Does the Airbnb Occupancy Rate by City Mean?

Now that we’ve had a look at the Airbnb average occupancy rate to be expected in 2021 in some of the major US cities, beginner investors might still find it hard to make sense of all these numbers. So, let’s try to dissect them.

In summary, Mashvisor’s nationwide real estate market analysis reveals that the Airbnb occupancy rate by city will vary from 41.6% in the Airbnb Atlanta real estate market to 75.0% in the Airbnb Little Rock real estate market.

But what is a good occupancy rate for Airbnb?

While this real estate investing question does not have a definite answer because it depends on the city, the neighborhood, and the rental property, generally speaking a rate of 50% or more is considered good.

This basically means that you are able to get Airbnb hosts for at least half of the time for which your short-term rental is actively listed on Airbnb.com or another vacation rental website. Of course, the higher the occupancy rate the better, all else equal. This means that you are able to make more money from your short-term rental property as the Airbnb revenue is the product of the Airbnb occupancy rate and the Airbnb daily rate.

Moreover, Mashvisor’s nationwide real estate data shows that the Airbnb rental industry has been able to start recovering from the initial shock of the Coronavirus pandemic, and the recovery in the Airbnb occupancy rate as well as the Airbnb profitability for investors is expected to continue into 2021. For comparison, Airbnb occupancy rate was expected to vary between 27.0% in the Airbnb Portland real estate market and 71.1% in the Airbnb Honolulu real estate market. The 2021 expectations are in the range of 41.6%-75.0%.

Importantly, Covid-19 has affected different Airbnb locations differently. For instance, the Airbnb Bakersfield real estate market experienced an increase of 15.7 percentage points (from 58.4% to 74.1%) in the expected Airbnb occupancy rate between 2020 and 2021. Meanwhile, the Airbnb Jersey City real estate market faced a drop of 23.8 percentage points (from 69.1% to 45.3%).

Click here to check out what Airbnb occupancy rates by city Mashvisor expected in 2020.

Related: Airbnb Occupancy Rate Up 13% as Market Recovers

Before you decide where to invest in short-term rental properties in 2021, keep in mind that the locations listed above face different degrees of Airbnb laws and regulations. Thus, you should study the short-term rental regulations carefully before making a decision.

Airbnb Occupancy Rate 2021 at the Neighborhood Level

If you’re a savvy real estate investor looking for profitable Airbnb rentals for sale, you’ll know that having the average Airbnb occupancy rate by city is a great start but is not enough to invest with confidence. The neighborhood is another crucially important factor in the Airbnb location that you choose.

That’s why it is important to be able to access Airbnb occupancy rate by zip code or by neighborhood. The traditional way to do that requires conducting diligent rental market analysis in order to collect sufficient reliable Airbnb comps to evaluate what is the average occupancy rate of Airbnb in a specific area.

The advancement of real estate technology, big data, artificial intelligence, and machine-learning algorithms has made this traditional method obsolete. Now you are able to find out the average Airbnb occupancy rate by neighborhood in any US city or town with the help of the Mashvisor real estate investment software.

To begin with, once you identify an Airbnb location which matches your investor expectations at the city level, you can use Mashvisor’s map view, also known as a real estate heatmap, which will show you what Airbnb occupancy rate each neighborhood is able to generate.

That’s not all. Other city-wide metrics relevant to Airbnb houses which you will be able to access immediately include:

- Average real estate listing prices

- Monthly Airbnb rental income

- Average Airbnb cash on cash return

These measures will help you start answering the question is Airbnb profitable in a certain area so that you can locate the neighborhood that is most suitable for you as an investor.

Furthermore, you can deepen your neighborhood analysis by clicking on a certain area and accessing comprehensive data. In addition to the average Airbnb occupancy rate, Mashvisor’s neighborhood pages help you evaluate other crucial aspects of the investment potential of an area when it comes to vacation rentals.

Mashvisor provides state of the art real estate investment tools to help you make wise investment decisions and walk you through your investment journey. Please sign up here to start analysing the investment opportunities in both short trem and long term rental industry.

2021 Airbnb Occupancy Rate at the Property Level

When searching for a profitable Airbnb investment property, you have to go further in your analysis of the Airbnb occupancy rate that you can expect in 2021. After all, seasoned Airbnb hosts know that occupancy can vary significantly from one property to another, even within the same neighborhood, because of property type, amenities, and other factors.

Luckily, accessing detailed Airbnb analytics, including occupancy rate at the property level, is just as easy as accessing Airbnb data at the neighborhood level.

Related: What’s the Best Airbnb Data Analytics Platform?

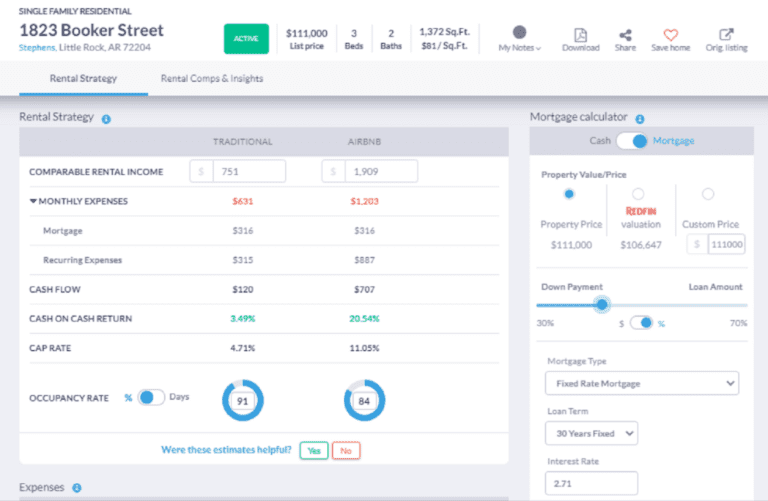

Mashvisor’s Airbnb profit calculator helps you evaluate the expected investment potential of any residential property in the US housing market 2021 when rented out on a short-term basis. You can conduct investment property analysis not only on the MLS listings and off market properties available on the platform but also on any property whose address you enter.

Mashvisor’s rental property calculator will provide you with a reliable estimate of the Airbnb occupancy rate which you can expect based on rental comps in the area. Moreover, you will get access to the expected Airbnb daily rate, monthly Airbnb rent, Airbnb cash flow, Airbnb cash on cash return, and Airbnb cap rate.

Mashvisor’s Investment Property Analysis

Related: The Best Rental Property Calculator for 2021

With the help of the Mashvisor real estate investment tools, you will be able to make profitable decisions quickly and confidently when figuring out how to start an Airbnb business.

Related: The 30 Most Profitable Airbnb Locations in 2021: Cash on Cash Return

Mashvisor provides state of the art real estate investment tools to help you make wise investment decisions and walk you through your investment journey. Please sign up here to start analysing the investment opportunities in both short trem and long term rental industry.