Airbnb rentals are the new hot trend in the real estate investing world. The San Francisco real estate market was listed as one of the most profitable Airbnb cities at the beginning of 2018.

However, “Airbnb San Francisco” may lose the Airbnb part due to the new Airbnb laws. You might be questioning “Is Airbnb legal?” and the answer is yes, it is still legal. The thing is, San Francisco has made the Airbnb process pretty hard, and Airbnb rental listings are being knocked down by the second.

Airbnb San Francisco is a market to look out for as a real estate investor. Here, we give you an overall idea of what to expect from these Airbnb laws, and how to adapt to them the best you can.

Existing Airbnb San Francisco Laws

The line between legal and illegal Airbnb is a thin one. You are likely to run into some close calls. To avoid that, we’ve provided you with a list of the existing Airbnb laws to date.

-

Permanent San Francisco Residents Only

This rule applies to all buildings containing one or more residential units that are owned or rented by individuals who are permanent residents of San Francisco. We stress the word permanent here. A permanent resident, in this case, is an individual that resides in their unit for at least 275 days per year. Basically, you will be considered an absentee if you live in San Francisco for less than 275 days. Therefore, you would not be eligible to take part in Airbnb San Francisco.

-

The 90 Day Rule

This regulation limits rentals where the Airbnb host is not present for a maximum of 90 days a year. This means if you are not present in the property you own, you can not rent your short-term rentals for more than 90 days.

Violators are subject to a daily fine of $484 for first offenders, and up to $968 for repeat offenders. That is a lot of money to go down the drain for violating this rule.

Do your best to avoid it by personally tracking how many days a year a unit is rented and self-report the days on January 1st. This process is bound to give you a headache, we know, but if you are already investing in Airbnb San Francisco, you need to keep up with their terms. Hosted rentals, known as rentals where the host is present in the unit, are not subject to this limit.

-

Only Primary Residence May be Rented

This aims to limit permanent residents to rent out their primary residences, but not locations they do not reside in or vacation homes. Your primary residence is the place you can call home. We say this because this law exists to ensure you reside in the residence you are renting out for more than 275 days a year.

Part of the registration process we will mention below requires you to provide two forms of proof. This documentation should show that the address you are registering is your primary residence.

-

Insurance

Airbnb hosts are required to be covered by liability insurance with a minimum of 500,000 dollars in coverage. Yes, $500,000. As an alternative, Airbnb hosts may offer their units for rent through a hosting service that offers at least this much coverage.

Luckily for real estate investors investing in Airbnb San Francisco, Airbnb automatically provides hosts with $1 million in coverage. Yes, $1,000,000. Airbnb hosts must consent to agree to all applicable city building code requirements to be able to engage in Airbnb San Francisco.

-

Hotel Taxes Must be Paid

Airbnb San Francisco investors have to oblige to paying hotel taxes. The “Transient Occupancy Tax” is the 14% San Francisco hotel tax that must be collected from renters and paid to the city.

It is important to avoid any fees or violations of law as an Airbnb San Francisco real estate investor. Making money in real estate can get tough, so the last thing you need is to find yourself caught in an issue with the law.

Related: Which Are the US Cities with the Most Airbnb Legal Issues at the Beginning of 2018?

The New Airbnb San Francisco Annihilator

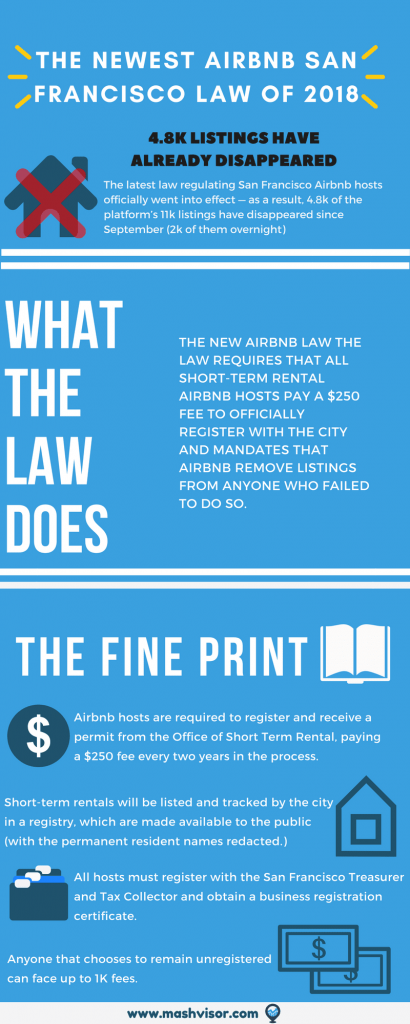

Now, this may sound like we are exaggerating by calling this new law an “Airbnb San Francisco annihilator” but we have our reasons. This law basically squashed thousands of Airbnb San Francisco listings overnight due to its immediate application.

We are all about regarding, respecting, and adhering to laws of course, so we understand where the San Fran lawmakers are coming from. Here are the basics of the new Airbnb law:

Now that you have an overall idea of what the law is and how it affects you as an Airbnb San Francisco investor, you can call the shots. Mashvisor can help you determine whether or not the investment property you have your eye on is worth it.

Short-term rentals can be a good way to start investing in the San Francisco real estate market, but Airbnb San Francisco is where you will need some extra diligence. Our product provides you with analytics that can help you make that critical decision on whether or not to “Airbnb” the property.

To start your 14-day free trial with Mashvisor and subscribe to our services with a 20% discount after, click here

Airbnb rental income, Airbnb occupancy rate, return on investment, and Airbnb cash on cash return are just some of the many metrics we provide you when analyzing a property. With Mashvisor, evaluating your real estate investments has never been easier.

Related: Mashvisor: A Real Estate Investing Tool for All Your Investment Needs

The Big Picture

There are many different types of property investments to choose from when you’re set on making money in real estate. When you consider investing in Airbnb San Francisco, take into account the old and new short-term rental regulations that apply in the San Francisco real estate market. The garden is full of ripe, fresh, fruit to choose from, so do not go for the forbidden fruit without understanding the circumstances.

What we’re trying to say is, don’t put your down payment on an investment property that is intended to be an Airbnb San Francisco rental without knowing just what you’re getting into. Mashvisor is the professional gardener that is ready to help you avoid the poisonous fruits, so keep us by your side. We can come in handy during your real estate investing journey.

Related: The 5 Most Profitable Airbnb Locations According to Mashvisor’s Investment Property Calculator