Finding Airbnb statistics is an important part of your investment, whether you’re just starting out or looking for ways to bump up your profits.

The modern-day smart investor doesn’t just work hard. They work smart, too. They know the value of research and analysis when it comes to real estate investing. It’s a numbers game, after all, especially where short term rental properties are involved. For this reason, gathering short term rental data and analyzing them will play a major part in your investing journey.

Table of Contents

- Is Airbnb Still Profitable in 2023?

- What Is Airbnb Data Analytics

- Why Do You Need Airbnb Analytics?

- Where to Find Airbnb Statistics

Many real estate investors today know that there’s a lot of money to be made in short term rentals. With just an extra bedroom in your house, you can list your property on short term listing platforms, such as Airbnb, and start hosting guests for extra income.

Since practically everyone, including their uncle, is jumping on board to become Airbnb hosts, you need some serious studying to do. Smart investment decisions in the 21st century are backed by data and analytics.

In this article, we will discuss the importance of Airbnb statistics and how you can use them to your advantage as a rental property owner and Airbnb host in 2023.

We will also show you how to get Airbnb statistics by city using the right tools and sources to give your business growth and keep the bookings coming. While many real estate platforms exist, we will take a look at how Mashvisor can help you as an investor.

Is Airbnb Still Profitable in 2023?

Most definitely. Although you need to consider several factors to ensure investment success where Airbnb investing is concerned. Let’s take a look at some of the major considerations for short term rental investing:

Location

Location matters in real estate investing. It is one of the very basic things any seasoned real estate professional will tell you. Just because rental properties are in demand does not mean that you will be prosperous and successful in a random neighborhood.

You need to understand that each location has something different to offer rental property investors. Your Airbnb business’ success will greatly depend on what that particular area can offer by way of ROI, rental income, occupancy rate, and other similar factors.

Economy

The local economy’s state and condition are also something you should consider when looking for an Airbnb investment location. Ideally, it should have a thriving economy or one with excellent potential for growth. A location with a booming and healthy economy is great for rental properties.

Tourism

Short term rental properties are typically popular among travelers and visitors. While they are also used by relocating homeowners looking for a temporary place to stay, vacation rentals are mostly targeted toward tourists.

Whenever tourists are involved, we immediately think of attractions, such as amusement parks and fun local activities. But the tourism industry goes beyond them. It includes dining experiences, business and leisure activities, cultural relevance, transportation, and accommodation.

Some locations may not be “visitor-friendly” by way of amusement parks but can be quite attractive to business travelers. It really depends on what the location offers tourists and visitors.

Safety

Safety and security are also important in determining an area’s suitability for short term rental properties. No tourist or visitor would want to stay at a place with a high crime rate or where the environmental risks are grave.

Seasonality

Lastly, the four seasons will significantly affect your Airbnb business. A location’s Airbnb occupancy rate is significantly affected by the state’s seasonality.

For instance, summertime usually means higher tourist volume in coastal areas but might see less than desirable occupancy rates come wintertime. It really depends on the time of year, as well as the geography and topography of the place.

Related: 40 Best Places for Buying Investment Property in 2023

What Is Airbnb Rental Data Analytics?

Airbnb data analytics is the process of collecting big data concerning Airbnb rentals, analyzing it, then organizing it to help investors interpret it. Simply put, the data should help investors understand how they can make their Airbnb investments profitable and achieve ROI growth.

Airbnb industry statistics include the following data:

- Key figures, such as median property price

- Ratios, such as price to rent ratio

- Percentages, such as Airbnb cash on cash return

The above aren’t just basic numbers, as people might think. To come up with Airbnb analytics, we utilize both traditional and predictive analytics. Basically, we factor in past and current market data to predict accurate market trends for 2023 and the future. It helps to see whether a particular market comes with the potential for growth or not.

Why Do You Need Airbnb Analytics?

As a short term rental investor, you definitely need to understand and analyze Airbnb statistics. Primarily, the data will help you make sound business decisions with confidence, leading to business growth. It is because the data includes the best real estate markets for Airbnb rentals and the most suitable vacation homes for you in your market of choice.

Since your decisions are backed by data, you minimize the amount of risk that you may expose your business to.

However, one of the biggest advantages of accessing Airbnb statistics is that you get to understand how your rental will perform in the future. That way, you can take various steps to help your investment perform better. It is a very important thing to keep in mind, especially in 2023, with the prevailing economic conditions globally.

Awareness of what a particular real estate housing market can offer Airbnb owners and hosts will lead to well-informed investment and business decisions. Well-informed decisions, in turn, will give you greater chances of investing success.

The above are some of the reasons why using Airbnb statistics will put you ahead of your competition.

Where to Find Airbnb Statistics

Compiling, organizing, and analyzing all the data by yourself can be stressful. As discussed above, you need to access all the relevant information if you want to be a successful real estate investor in 2023 and beyond. You can only make prudent business decisions if you are able to access to the right resources.

However, you can’t just trust any tool or resource. So, which is the best platform to access accurate Airbnb rental data that provides you with a short term rental analysis? Which real estate app will help you make good money as a short term rental owner in 2023?

Mashvisor provides you with a holistic insight into short term rental data. The platform comes with all the information you can possibly think of.

While there are many real estate investor blogs and platforms online, Mashvisor uses advanced algorithms and machine learning tools. They give you comprehensive insights into the markets you’re interested in. Besides, you’ll also get predictive data to help you make wise business decisions for the future.

Mashvisor understands that not all investors are experienced enough to understand all the technical and industry jargon. That’s why we present all the required information in a way that a beginner investor can easily understand. It’s also well-organized so that you can find it easily in a matter of minutes.

What Airbnb Statistics Can You Find on Mashvisor?

You may be wondering, with all the real estate websites out there today, why Mashvisor is so special. What does it offer investors like yourself?

For starters, Mashvisor is known for its massive database that gets updated regularly using highly reputable sources, such as Zillow, Realtor.com, the MLS, and Airbnb itself. As it is regularly updated for relevancy, using Mashvisor’s data for your rental property analysis will give you highly accurate and realistic ROI projections.

What type of data are we talking about here? Here are just some of them:

1. Market Level Data Analytics

Before anything else, you need to find a suitable market for Airbnb investment. Mashvisor organizes such information under market-level Airbnb statistics. It is split into the following categories:

Real Estate Market Data

If you’ve read some tips on real estate investments, you understand that location is one of the key factors that determine how profitable your real estate business will be. When starting out, one of the first questions you ask is; which cities are the best for Airbnb investment?

Why does the location matter? Location in real estate determines how much you’ll need to spend to acquire a property and how to set nightly rates for guests. It also influences the state and local regulations, occupancy rates, and short term rental demand, among others.

Airbnb rental statistics by city are also vital since many cities across the US continuously pass various laws and regulations to regulate Airbnb businesses. Most of the cities are tourist hubs and top choices for short term rental business owners. Although your location choices may be limited at first, you can still find conducive cities for your business on the Mashvisor platform.

Mashvisor Airbnb statistics by city provide you with markets where short term rental regulations allow you to run a non-owner-occupied rental business. You can do a quick search online and see the state of short term rentals in such locations and the level of demand.

While doing your market research, you’ll need the following Airbnb data and analytics:

- Airbnb price statistics

- Number of Airbnb listings

- Monthly Airbnb rental income

- Average Airbnb occupancy rate

- Average Airbnb cash on cash return

- Average Airbnb cap rate

The last two analytics let you know what average return on investment you can expect from your Airbnb business.

How to Acquire Market Information on Mashvisor

You can find the relevant market information in two ways on the Mashvisor platform. Firstly, you can access our Knowledge Center (blog) where you’ll find the latest data analytics for major markets in the US and how to conduct market analysis.

Secondly, you can also access Airbnb statistics through our Market Reports. The reports give you a comprehensive analysis of any real estate market in major cities in the US.

Additionally, the market reports also include Airbnb investment analysis. This way, you can determine the best Airbnb investment location for you and make sound decisions accordingly.

Neighborhood Data Analytics

Location in real estate investing doesn’t only refer to the city. You need to consider the neighborhood as well. Looking at neighborhood data analytics while looking to invest in an Airbnb is crucial. It is because adjacent neighborhoods in the same city or town can offer different investment potentials and return.

For example, some neighborhoods may not be great for Airbnb investment since they’re not close to tourist attractions, business centers, or learning institutions. Another neighborhood within the city can be different since it’s close to attractions and see high demand from tourists.

Finding neighborhood analytics can be hard for the average investor. However, Mashvisor vacation rental data analytics provides you with everything you need to know.

By looking at the Airbnb statistics, you’ll see the performance of vacation home rentals in a certain area, so you can determine whether starting your Airbnb business there will remain profitable.

Our Airbnb investor blogs also provide you with the above information since we regularly list the best neighborhoods to invest in in different cities.

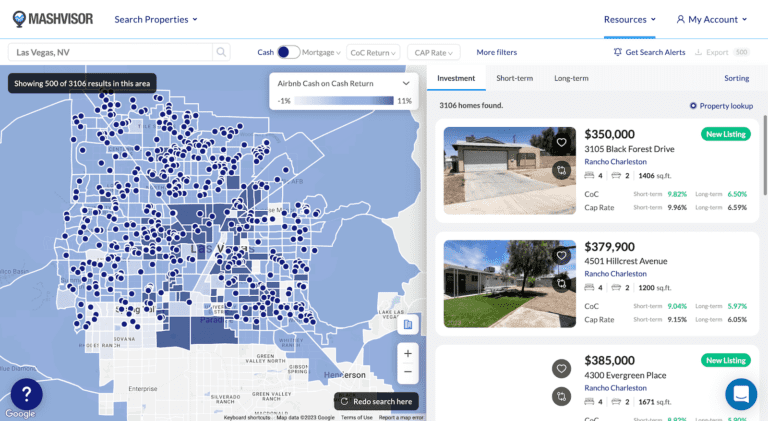

Perhaps, the best way to get Airbnb area statistics on Mashvisor is by looking at our heatmap analysis tool.

Mashvisor’s Heatmap

The heatmap tool allows you to select a few neighborhoods that provide the best balance between the property price and Airbnb cash on cash return. Sometimes, investors make the mistake of focusing too much on the cash return and forget to consider the property price.

Mashvisor’s real estate heatmap helps you check whether the potential return is worth it compared to the property value. Remember, your investment must be affordable in order to access financing and also profitable enough to avoid foreclosure.

2. Property-Level Data Analytics

By this stage, you may have a few suitable locations that you can invest in. It’s now time to look at profitable properties in such locations. Fortunately, you can also find the information on Mashvisor. Our Airbnb Profit Calculator gives you access to the following types of Airbnb statistics:

Airbnb Rental Income

To own a profitable short term rental business, you just can’t set any nightly rate. Remember you have competitors whose rates can be more favorable to your target audience. You don’t want to see a low occupancy rate just because you’ve set your expectations too high.

A good Airbnb pricing strategy factors in occupancy rates, local rental listings, and property expenses. It can be problematic analyzing all the said data by yourself. With the Airbnb calculator, you can save yourself from the hassle.

Among the data you get from the Airbnb calculator is rental income. The tool analyzes data from all listings and provides you with an estimate of what you can expect. Keep in mind that the results you see aren’t exactly what you get. They’re estimated figures that you can use to decide for yourself.

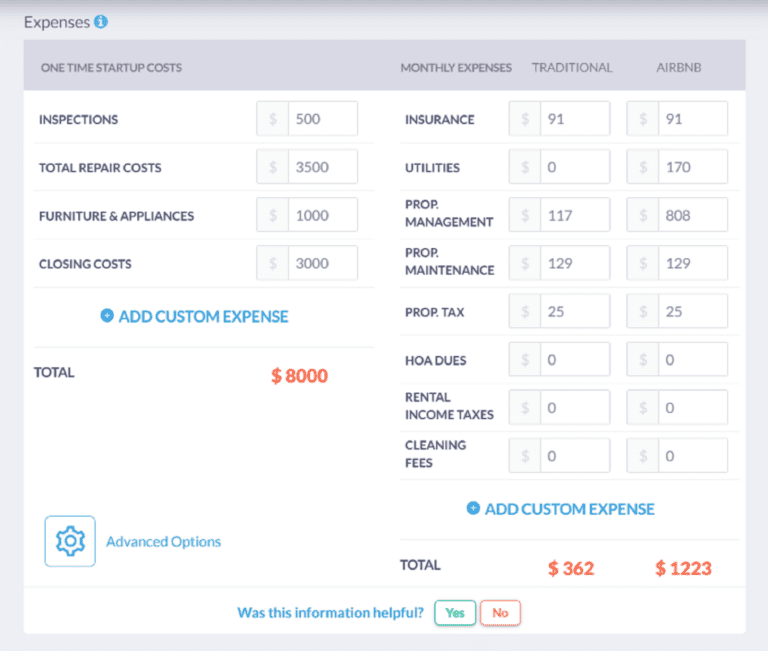

Airbnb Cost & Fees

Many people forget to factor in the expenses involved with running a short term rental business. It’s much like running a traditional rental business in that it can be expensive. Some expenses that come with running an Airbnb rental include:

- Tenant turnover

- Property management expenses

- Property insurance

- Taxes

- Utilities, such as the internet

- Marketing

When setting your nightly rate, you need to take all the above costs into account. You don’t want to run a business that will end up making losses and eventually shut down. Fortunately, the data analytics provided by the Mashvisor platform will ensure you avoid such pitfalls.

Mashvisor’s profit calculator shows you estimates of expenses and fees you can expect from your Airbnb property.

In addition, the interactive investment tool further analyzes the estimates and lets you adjust the costs based on market research. You can also add any extra costs, whether one-time or recurring, that may only be unique to your Airbnb. The tool will then recalculate the ROI metrics so that you can understand how your expenses affect your Airbnb income.

Airbnb Cash Flow

The only way to make money from real estate is by investing in positive cash flow properties. When we refer to cash flow, we mean the rental income minus the expenses. The amount left is the profit you get in your pocket or take to the bank. As such, you should ensure that you only invest in properties where the income outweighs the expenses.

While there’s so much data needed to calculate the Airbnb cash flow, you don’t need to worry when using the Mashvisor Airbnb Property Calculator. You simply click on a listing that looks interesting to you. The tool runs all the numbers for you so you can tell whether it offers the rental potential to make positive cash flow as a vacation home rental.

Airbnb Occupancy Rate Data

The Airbnb occupancy rate is one of the core factors that determine whether your Airbnb business is profitable or not. The occupancy rate is calculated by looking at the ratio of time your rental is occupied and comparing it to the amount of time it’s vacant.

If the occupancy rate is low, you need to charge lower rates so that you can encourage more guests to book with you. If your rates are not competitive, you will likely get lower bookings and run a negative cash flow business. To avoid running such a business, you first need to understand factors that affect occupancy rates. They include:

- Location

- Seasonality

- State of the Airbnb rental property

- Airbnb reviews

The best way to understand the occupancy rate is by looking at the Airbnb occupancy statistics on Mashvisor. Every listing on the platform includes such data. Mashvisor gets the information by analyzing the listing. It also looks at calendar bookings, host information, reviews, and information for the past five years.

With the above data, Mashvisor can then calculate the occupancy rate for daily and monthly bookings over the past year. It means that you’ll get monthly and annual Airbnb booking statistics.

In addition, you can use the interactive Airbnb Profit Calculator to adjust the occupancy rate and see how it would affect your return on investment. It can be extremely helpful if you’re thinking of buying a property performing badly and increasing the occupancy rate.

Airbnb Return on Investment

The short term rental return on investment is perhaps the most important data analytics that Airbnb investors need. In the initial stages of investment property search, it can be hard to calculate the property’s return on investment since the process can be tedious.

Firstly, you need to ensure the data you’ve gathered is accurate. Afterward, you need to run the numbers by carrying out various calculations to get the cash on cash return and cap rate. For someone doing them manually, it’s easy to mix everything up and get the wrong result. Errors often lead to inaccurate business decisions.

Mashvisor data analytics tools help you calculate the ROI formula easily without much effort. The Airbnb Profit Calculator uses predictive real estate data to give you accurate cash on cash returns and cap rates for any property. The numbers help you determine how profitable the property will be as a short term rental.

The cash on cash return is the rate between your total cash investment on the property and the cash flow. With the built-in mortgage calculator, you can adjust your total investment, including the down payment, closing costs, and renovation costs. The cap rate is the ratio between cash flow and purchase cost.

With Mashvisor tools, you can use the above data to compare the property’s return as a traditional rental vs the return as an Airbnb rental. It will help you see whether renting it out as an Airbnb makes financial sense. In simpler terms, you’ll see whether it’s better to invest in it as an Airbnb or a traditional rental.

Airbnb Rental Comps

Airbnb comps data is important when determining a property’s market value and when setting the nightly rate. Gathering Airbnb comparative statistics by yourself is hard since you need to analyze data from every Airbnb rental similar to yours in the market. Organizing the data into spreadsheets may also cause problems and lead to errors.

Luckily, Mashvisor’s data analytics also provides you with Airbnb comps. The data is readily available on any listing your click on the platform.

Airbnb Reviews Data

We’ve already mentioned that Airbnb reviews are some of the core factors that determine your rental occupancy rates. Basically, positive reviews will lead to high occupancy rates, while negative ones will negatively affect your occupancy rate. However, how many positive reviews do you actually need to boost your occupancy rate?

You can only get the information through Airbnb statistics from Mashvisor. When using the Mashvisor Profit Calculator to analyze vacation homes, the predictive analytics will let you see how many positive reviews you need to experience a positive occupancy rate.

Airbnb Investment Payback Balance

The above data analytics metric lets you see how much profit your investment will make in the future based on the current Airbnb statistics. You can use both the monthly and annual calculations to see how your property will perform in one year or 10 years.

Mashvisor takes the following factors into account to give you the investment payback balance:

- Gross revenue

- Total expenses

- Airbnb net income

- Airbnb taxes

- Cash flow

- Startup expenses

The above information helps you see whether your investment will be making you profits or losses, as well as the amount of time it will take to generate any amount you desire.

Mashvisor provides state of the art real estate investment tools to help you make wise investment decisions and walk you through your investment journey. Please sign up here to start analysing the investment opportunities in both short trem and long term rental industry.

Access Airbnb Statistics Today

From the above, we saw how important Airbnb statistics are for proper data analytics. More importantly, we also discussed how important it is for you to access the right source for such statistics. Real estate investing is a numbers game where accuracy will play a big part in determining whether your investment succeeds or fails.

As a real estate investor, you need the right tools to gather high-quality data and information, as well as calculate your ROI projections. Mashvisor is one of the best real estate platforms– if not the best – out there today.

The site allows you to look up potential investment properties in profitable areas that will help you achieve your investment goals. Its tools also allow you to come up with a proper rental analysis that will give you realistic ROI projections to minimize miscalculations.

Simply sign up for Mashvisor today to access all the important data and set yourself up for a successful short term rental business.

Mashvisor provides state of the art real estate investment tools to help you make wise investment decisions and walk you through your investment journey. Please sign up here to start analysing the investment opportunities in both short trem and long term rental industry.