The advent of Airbnb has democratized the real estate market to a large extent. Anyone with an extra bedroom stands to make money in real estate, and everyone is jumping on board. For the more serious real estate investor, however, there’s quite a bit of studying up to do. If you intend to purchase real estate for the sole purpose of renting out on Airbnb — a strategy that is rapidly gaining popularity — then you need the right Airbnb statistics on your side.

Airbnb Occupancy Rate

Among the most essential Airbnb statistics that you need to find is the Airbnb occupancy rate in your area. This is crucial because it shows you how much demand there is for overnight stays in your selected neighborhood. No matter how ideal an investment property may be, it can still suffer from low occupancy rates if it is located in a region that is not attractive to tourists or business travelers. Additionally, knowing the Airbnb occupancy rate by city can help you when making the choice of where to invest in real estate.

Furthermore, if you already own an Airbnb investment property, knowing these occupancy rates can inform you how your performance compares to your neighbors. This may show signs that your short-term rental property needs upgrades or potentially a change in pricing. Airbnb occupancy rate data is one of the most crucial Airbnb statistics because of this reason.

Related: What Airbnb Occupancy Rate Can You Expect in 2020?

Airbnb Rental Income

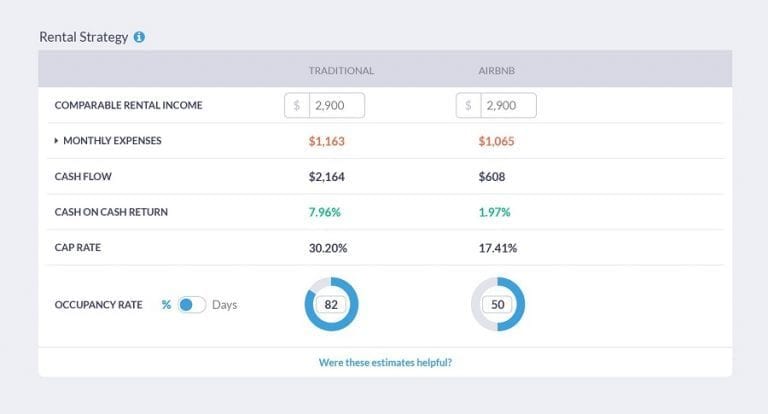

A business can only thrive if it keeps up with its competition. Therefore, you need to know exactly how much Airbnb investors are making in your neighborhood and how much they’re able to charge for rent. This can be a fantastic way to figure out the right pricing for your own rental property and to ensure that your prices are neither too high nor too low. Furthermore, this is a benchmark of how much income you could expect after costs are paid. Airbnb rental data is, therefore, one of the most important things that you need to know.

In general, it is important that you are up-to-date on your Airbnb comps. These are Airbnb listings in your general area, and of similar specifications to yours. These properties can act as a benchmark for your Airbnb’s success, and let you know if your performance is subpar — and why. Your Airbnb comps should be studied in every aspect, but most notably with regards to rental income.

Airbnb Cash Flow

The costs associated with an Airbnb rental property can often pile up. Beyond the mortgage payment, you’ll have to contend with cleaning fees, maintenance fees, utilities, and potentially even property management fees. Once all of this racks up, you may find that your cash flow is a bit lower than expected. Be sure that you’re using the right tools to check your Airbnb cash flow. Using Mashvisor’s Airbnb profit calculator, all you need to do is input your operating expenses, the terms of your financing method, and your income. You’ll be given easy-to-read Airbnb data that show off how well your cash flow is doing, and whether you need to adjust your prices. You can also use this tool to see the cash flow projections for an investment property before you buy it and rent it out on Airbnb. This will ensure you find the most profitable Airbnb investment property.

Airbnb Return on Investment

Investing in an Airbnb property is becoming an attractive idea to more and more real estate investors. People finally see the immense income potential that this property type can bring in. But before you purchase an Airbnb property for investment, you need to check your return on investment. This is contingent on a lot of different factors, such as the cost of a nightly stay in your rental property, your anticipated Airbnb occupancy rate, and the terms of your mortgage. If your return on investment figures look good after all of this has been factored in — meaning you’ll recoup the invested sum plus profit — you’ve found a successful investment property.

Related: Is Airbnb a Good Investment Considering All of the Regulations?

Airbnb Cap Rate

Your cap rate represents the rate of return at which rental income can pay off the purchase price of a property. Because Airbnb real estate investing is still a relatively new phenomenon, there’s a scarcity of resources to find the right Airbnb analytics. Fortunately, finding the right tools is becoming easier (keep reading to find out where to find these tools!).

This Airbnb statistic is especially crucial because it can determine the success of your real estate investment. If your Airbnb cap rate exceeds 10%, then you’ve found yourself an excellent investment.

You will want to look at, not only the cap rate for a rental property but also Airbnb statistics for cap rate in different cities and even neighborhoods. This sort of information can determine which regions would be worthwhile for investment.

Airbnb Cash on Cash Return

The cash on cash return of your Airbnb rental property is one of the most crucial pieces of information you’ll need. It shows you the income earned relative to the cash you invested, and therefore determines the success of an investment. Before making any investment, figuring out this figure is crucial. Looking more broadly at Airbnb statistics for average cash on cash return in different cities will be highly fruitful when choosing a location to invest. A region with generally positive numbers would be a good place to start looking for investment properties.

Related: 20 Most Profitable Airbnb Locations in 2020: Cash on Cash Return

Where Can I Find Reliable Airbnb Statistics?

Finding Airbnb statistics is, thankfully, becoming a lot easier due to a handful of premium online tools. When performing a real estate market analysis, consider using Mashvisor for a holistic view of all the Airbnb statistics you need. Not only will this online resource provide you with useful city stats (which you can find for free on our blog), but also in-depth neighborhood analysis, and finally, investment property analysis.

Airbnb stats are more accessible than ever before thanks to Mashvisor. When buying an Airbnb property, every piece of information counts. The more informed you become, and knowledgeable of the right Airbnb statistics, the more likely you are to find a successful real estate investment.

Meanwhile, if you’re not sure how to register on Airbnb and create your first listing, read our guide on becoming an Airbnb host in 2020.

Bottom Line

Performing an Airbnb investment analysis can have a significant impact on your rental property business. Owning an Airbnb comes with its own set of challenges and unique obstacles, and having Airbnb statistics to back you up can be hugely helpful. Once you’ve taken a wide-scale view of the Airbnb market, you can then make an informed decision about which city, which neighborhood, and finally which investment property to choose.