Are you wondering what’s the difference between Airbnb vs long term rental investing? Read to know which rental strategy is right for you.

There are a lot of speculation about Airbnb vs long term rental investing, especially when it comes to deciding which strategy is the better option. Many real estate investors, especially new ones, are confused about whether to invest in a long term or a short term rental property. To find which strategy is better, you need to consider various factors that will affect your profitability.

Table of Contents

- What Is an Airbnb Rental?

- What Is a Long Term Rental?

- Airbnb vs Long Term Rental: Pros and Cons

- Can You Rent Out a Property on Airbnb for the Long Term?

- How to Find Profitable Properties for Airbnb or Long Term Rental

Typically, the best investment strategy will vary depending on various factors, including the rental market that you are looking to invest in and your personal preferences. In general, both Airbnb and long term rentals are capable of providing lucrative income as long as you choose the right market for your preferred investment strategy.

If you cannot choose between long term rental vs Airbnb rental properties because you don’t know which strategy you prefer, it’s important to first understand the difference between the two. It can help you determine how much commitment you are willing to give for the investment. Knowing your preferred strategy makes it easier to find a market that’s optimal for your choice.

With long term rentals, you deal with semi-permanent residents who will stay in your property for more than a month. Airbnb rentals, on the other hand, refer to short term rentals that cater to guests who will stay in the property for less than a month.

What Is an Airbnb Rental?

Airbnb is a home-sharing platform that connects people who are willing to share a space with guests for money. Basically, you’ll only need to list your room, house, villa, cabin, or even yacht on the website and wait for reservations from guests around the world. Nowadays, there are different platforms like Airbnb that offer vacation rental listings.

When we speak of Airbnb rentals, we actually refer to short term rentals that are listed on various home-sharing sites, not just on the Airbnb platform. To become a successful Airbnb investor, you need to determine the best short term rental markets where there are market high demand and positive profitability projections.

Airbnb rentals are considered a short term rental strategy since the properties are usually rented for up to a month only. Guests staying at an Airbnb property are those who visit the place for the short term, either for leisure, business, or other reasons. Usually, Airbnb rentals offer amenities that make the guests feel at home during their stay, almost similar to hotels.

The best vacation homes for sale are those that are near various attractions and facilities that may appeal to leisure and business travelers. Since your guests are only there for the short period, most of them may not bring their own vehicles during their stay. So, a short term rental property that’s near public transportation options is a great option.

How Do Airbnb Rentals Differ From Hotel Accommodations?

The major difference between a short term rental and a hotel is the ambiance of the property. With an Airbnb rental property, guests are made to feel at home because of the facilities and amenities offered.

In most cases, Airbnb guests will have access to kitchen facilities that allow them to cook and eat at the rental unit during their stay. There are also Airbnb properties that let guests to rent the entire home, which can accommodate families and large groups. And more importantly, Airbnb homes are more affordable compared to hotel accommodations.

In contrast, hotels may offer luxury amenities like a gym, spa, and pool. However, most hotels don’t have kitchen facilities and are only rented on a per-room basis. For families or large groups of guests, they may need to book more than one room so they can all be accommodated comfortably. On top of that, hotel rooms are a lot pricier.

What Is a Long Term Rental?

One of the long term investment strategies for real estate is investing in a long term rental property. In long term renting, a real estate investor buys a rental property in order to rent it out for at least six months. During this period, the tenants will pay rent on a regular basis as agreed upon in the lease agreement.

If you invest in a long term rental, you target semi-permanent residents who will reside in your property for long periods. The renters will live in your rental unit like it’s their home. In return, you will collect monthly rent payments from the tenants until their lease term ends and they move out of the property.

When renting out your property for the long term, you need to decide whether to rent out your home furnished or unfurnished. Some tenants may find furnished apartments or rental units more attractive, especially those who do not plan to stay in the same location for good. Others, however, may be attracted more to unfurnished rental properties.

The best investment property for a long term rental strategy is one that’s near various amenities and essential services. You also need to consider your target market when choosing a profitable long term rental. For instance, if you plan on renting out to families with kids, selecting a property that’s near schools is an excellent idea.

Airbnb vs Long Term Rental: Pros and Cons

While both Airbnb and long term rental strategies are great options, both also have their own benefits and drawbacks. As an investor, you need to know and understand the pros and cons of each investing strategy to help you decide which one is best for you. Knowing the pros and cons of long term rental vs Airbnb rental properties is crucial to your decision-making process.

Advantages of Investing in Airbnb Rentals

Investing in Airbnb rentals is a great way to earn substantial income, especially if you know how to choose the right short term rental market. And because most travelers prefer to stay in vacation rentals rather than in expensive hotels, you can take advantage of high market demand and more bookings.

Here are the advantages of owning a short term rental property:

1. Flexible Income

With an Airbnb rental investment, you won’t be tied up with a fixed income. In fact, you can adjust your short term rental rate based on the seasonality of the business and how high the rental demand is. So, how will this benefit you, you ask?

It’s pretty simple—by being able to adjust your rental estimate, you can control how much you can possibly earn depending on the market demand. The higher the demand is, the higher the rental rate you can charge. Since you’re not tied to earning a fixed income, it’s possible that you’ll earn a higher income with Airbnb compared to investing in a long term rental.

2. Less Maintenance Required

Since you’re renting out your property to guests only for the short term, you can expect a delay in wear and tear. After all, most short term rental guests don’t really stay at the rental unit the whole day. Most Airbnb renters are only there to sleep at night since they usually go out sightseeing and visit other attractions during the day.

It means that your property won’t be overused, and so less maintenance is required. You don’t need spend too much on fixing damages and issues caused by normal wear and tear. In contrast, long term rentals are used on a regular basis since tenants stay there for the long term. This means that long term rentals require more maintenance and repairs.

3. Control

Short term rental owners have control over how they want their properties to be used. They may or may not allow their guests to cook at the rental unit. As owners, they can control how many people should stay at the property at a time. They can even block certain dates if the owner wants to use the property for himself/herself.

4. A Chance to Meet New People

Well, if you’re the type of person who loves to meet new people all the time, then renting out your investment property as short term rental is for you. Since Airbnb rentals are based on short term stays, you can enjoy having a new guest every few days. On the other hand, with long term rentals, you will have the same tenants for a long period of time.

5. Host and Guest Reviews

After each reservation, both the Airbnb guests and Airbnb hosts get to write a review about each other. As a host, getting reviews from your Airbnb guests provides excellent benefits. A good review will bring you more reservations along the way. It could also help you find the right renters, as hosts get to write reviews about the guests as well.

Through reading reviews about the guests, you can prevent having to deal with bad renters. With long term rentals, however, there is a chance you will land into bad tenants. They can create headaches and unnecessary stress for you. Though you can avoid it by running a background check on them before signing the lease agreement, still, it will take a long process.

6. Free Listing Platforms Available

Of course, everybody likes free stuff! That is exactly what Airbnb and other home-sharing platforms provide. You get to create an account and list your property for rent—free of charge. The only fees that apply are the service fees on each booking. Free listings on home-sharing platforms mean you get to market your rental property for free.

On the other hand, if you compare it to long term rentals, marketing costs a lot of money. You will have to do proper and extensive marketing in order to get your long term rental property rented out. Usually, marketing your long term rental property involves expenses, which can significantly impact a huge portion of your budget.

Risks Related to Investing in Airbnb Rentals

As with all kinds of investment, Airbnb rentals are not without risks. Before you decide to buy vacation rentals for sale, it’s important that you are aware of the risks that you are about to face to determine if you are willing to take such risks or not.

Here are the common risks related to short term rental investments:

1. Seasonality

Before anything else, you must remember that short term rentals are fairly seasonal. It means that there are times when the demand is high, and there are times when the demand is low. That’s why it’s crucial to choose a location that attracts visitors almost all year round so you can earn a continuous stream of income.

For instance, if you are renting your investment property that is located on the beach, then there is less chance to rent it out during the winter. It means that there are seasons when you won’t have guests and, therefore, you won’t earn any rental income. However, there are ways to balance out your income, and one of them is to adjust your rental rates accordingly.

2. Airbnb Laws

Short term rentals are regulated by local laws, which may vary from one city to another. In most cases, all Airbnb properties need to be registered. It’s worth noting that in some cities, short term rental laws are quite rigid, and there are several restrictions that may greatly affect your profitability. What’s worse, some cities prohibit the operation of short term rentals altogether.

Cities like New York and Santa Monica have the strictest Airbnb regulations. In Santa Monica, for instance, Airbnb hosts are required to live on the property during the entire duration of the guest’s stay. Plus, they also need to collect a 14% occupancy tax from renters, which will be payable to the city.

3. Uncooperative Guests

While you can check reviews about the guests before you accept their bookings, there’s still a risk that you may land yourself with uncooperative guests. If you encounter renters who are difficult to work with, they might end up giving you bad reviews. It can significantly affect your reputation in the home-sharing platform, and it may turn away other prospective guests.

Also, if you end up with guests who are careless and clumsy, they may cause damage to your property due to accidents. There are no security deposits with Airbnb, and even though there are rules about damages caused by renters, sometimes, they can hide the damage and you won’t notice it until it’s too late.

Benefits of Investing in Long Term Rentals

When you invest in long term rentals, your target market is residents who don’t have a house of their own yet. Similar to investing in an Airbnb business, you also need to choose your location carefully to be a successful long term rental property owner. The best long term rental markets demonstrate a high demand for housing and a good potential for income.

Here are the benefits of renting out your house for the long term:

1. Steady Income Flow

Most long term rentals come with a lease term of at least six months, sometimes even more. After the tenants sign the lease, they are bound to pay the rent until the lease term ends. It means that you will receive a steady income stream during the duration of the tenancy, without having to worry about high and low peak seasons.

2. Fewer Restrictions

Similar to short term rentals, there are landlord-tenant laws per state that long term rental owners must adhere to. However, unlike short term rentals, long term rental regulations have fewer restrictions. In fact, long term rentals are not really affected by as many regulations as Airbnb properties. Plus, it’s a lot simpler and easier to establish a long term rental property.

3. No Seasonal Fluctuations

One of the major differences between Airbnb vs long term rental properties is that the former must deal with the seasonality of the vacation rental business, while the latter is not affected at all. As a long term rental owner, you don’t need to worry about seasonal fluctuations as long as you invest in the right market. After all, a house is a necessity, while going on vacation is a luxury.

4. Lower Turnover Rate

Because tenants stay for the long term, it would take a while before you turn over the property to another renter. It is beneficial to your bottom line because you are less likely to experience prolonged vacancies. In fact, if your rental property is located in a prime area, the average lease term is three years or even more.

5. Lower Operating Expenses

In most cases, long term rental agreements require tenants to pay their own utility bills. Without utility expenses, you will incur lower operating costs, so you get to keep a large portion of your income as profits. In addition, you may charge cleaning fees to tenants after they move out, especially if they didn’t leave the premises in the same condition as it was when they moved in.

6. Protection Against Property Damage

Long term rental property owners are usually allowed to collect security deposits from tenants. The security deposits will serve as protection against unpaid rent, unpaid utilities, and property damages that are beyond normal wear and tear. It means that if tenants caused any damage to the property due to neglect or an accident, you can charge it against their security deposit.

Drawbacks of Investing in Long Term Rentals

Just like renting out your property on Airbnb, there are also disadvantages to long term rental investments. If you want to be a long term rental property owner, it’s crucial to be aware of the risks associated with such an investment strategy. To minimize the risks, it’s vital to choose the best place to buy rental property.

Here are the common drawbacks of long term rental investments:

1. Fixed Rental Rate

Unlike Airbnb rentals, where you can adjust your rental price depending on the market demand, long term rental owners are usually tied to a fixed rental rate. After the lease agreement is signed, you will receive the same amount of monthly rental income until the lease term ends. However, some states may allow owners to increase their rent without or with prior notice.

2. Difficult Tenants

One of the most common problems many long term rental property owners encounter is dealing with problematic renters. Bad tenants are those who fail to pay their rent on time, cause damage to the property either due to negligence or abusive behavior, and deliberately violate the terms of the lease. Bad tenants can cause a lot of stress and financial loss to the owners.

Note that you can prevent bad tenants with proper tenant screening. Before you accept any long term renters into your property, make sure to verify their background, including their financial resources, credit records, criminal records, and rental histories. It allows you to eliminate potentially difficult tenants, but it won’t guarantee that you won’t end up with one.

3. Costly Upkeep

Since long term tenants really live in the rental unit, your property will experience quick wear and tear. It is another major difference between Airbnb vs long term rental investing. To maintain the condition of your rental property, you need to perform regular inspections so damages from normal wear and tear will be addressed early on.

Having to maintain the property on a regular basis can be costly and this can greatly affect your overall bottom line. Most landlord-tenant laws require long term property owners to shoulder the repairs that are due to normal wear and tear. And the longer the tenant stays at the property, the more damage from wear and tear you can expect.

Airbnb vs. Long Term Rental: What Do They Have in Common?

Airbnb and long term rental properties share one thing in common: property value appreciation. It is one of the few common advantages when analyzing the similarities between Airbnb vs. long term rental investments.

Appreciation is basically the increase in a property’s market value over time, which means your property may be worth double (or even more) its current value after a few years. If you decide to sell it in the future, you can gain a huge sum of income due to value appreciation. It applies to both Airbnb and long term rentals.

For it to happen, it’s crucial to choose the right market for your real estate investment. Make sure that the location where you’re investing has a high appreciation rate.

Can You Rent Out a Property on Airbnb for the Long Term?

With the rise of remote work arrangements, many travelers prefer to “staycation anywhere.” It is one of the reasons why Airbnb launched its long term rental option known as Airbnb monthly rentals.

Long term Airbnb rentals allow guests to rent an Airbnb property for more than 28 consecutive days. Often, listings for this type of rental property would show a monthly fee instead of a nightly fee. Usually, the owner or host requires the renter to make an advance payment for the first month, with a fixed fee for every succeeding month booked.

Pros and Cons of Airbnb Long Term Rentals

Renting out your property as Airbnb long term rental can be beneficial to you as an investor. Airbnb long term rentals are becoming the preferred option for a growing number of individuals, attracted by the constant flow of income from rental properties. Once you find a tenant, you can expect a steady inflow of cash for a considerable period of time.

When it comes to marketing your property, Airbnb takes care of putting up your listing for all prospective guests out there. The platform’s longstanding success and growing popularity are surefire ways to attract people who are looking for accommodation.

While it comes with a few benefits, there are some drawbacks to getting into Airbnb long term rentals. First, such types of properties may be subject to a different set of laws compared to their short term rental counterparts. Everything from eviction laws to rent controls can be interpreted and applied differently in the case of Airbnb long term rentals.

Second, owners may be compelled to change and adapt their Airbnb pricing strategy in order to attract tenants for long durations. Still, longer tenant stays may be enough to offset the lower long term rental rate and help provide a steady cash flow despite lean periods.

Things to Consider When Running Airbnb Long Term Rentals

Before renting out your property as an Airbnb long term rental, keep in mind a few things:

- Check your local Airbnb regulations: Long term rentals are subject to local laws, which vary depending on your property’s location. In some states, guests who stay for more than 28 days are protected by local tenancy laws. To be on the safe side, check the local laws in your location or seek the counsel of a landlord-tenant lawyer.

- Get your guests to sign a rental agreement: A rental agreement that lists all the “house rules” serves to protect yourself against any issues in the future. Get your guests to sign the agreement and ensure that they understand the terms and conditions of their stay.

- Screen your potential guests thoroughly: Since your potential guests, who may be total strangers to you, will be staying at your rental property for a long period of time, it’s important to do a background check on them. By screening your future tenants thoroughly, you are likely to avoid those who could become problematic later on.

- Offer monthly and weekly discounts: With monthly and weekly discounts, your guests are more likely to extend their stay. With longer bookings and fewer guest turnovers, you can expect a more predictable rental income, higher occupancy rate, and a hedge against seasonality.

How to Find Profitable Properties for Airbnb or Long Term Rental

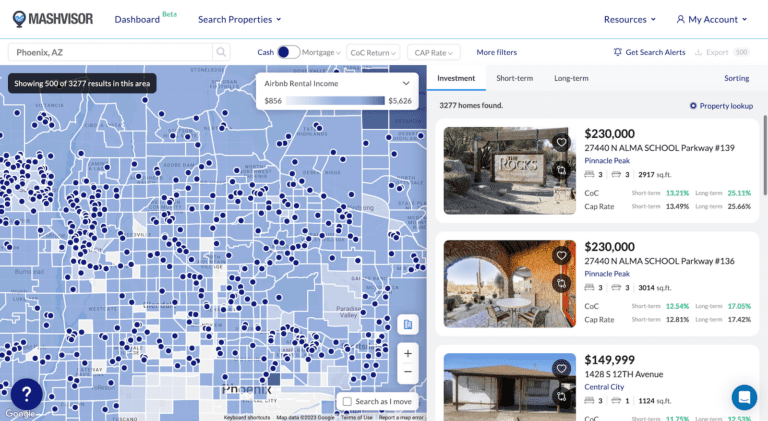

One of the best ways to find a profitable rental property for either short term or long term investment strategy is through a reliable real estate analytics platform like Mashvisor. Mashvisor provides a thorough rental analysis that compares the potential of the property for both long term and Airbnb rental strategies.

With Mashvisor, you can access several real estate tools that are useful for helping you make an informed decision, such as:

- Property Search: Mashvisor allows you to easily search for listings for sale. You only need to input your desired location and set some filters like your budget and preferred rental income. Then, the system will generate results based on your custom filters.

- Real Estate Data and Analytics: Once you find a property that you’re interested in, you can click on it to see its data and analytics. Mashvisor provides all the necessary information, like rental income, expenses, cap rate, cash on cash return, and occupancy rate. You can compare the data and analysis for Airbnb vs long term rental strategies.

- Rental Property Calculator: With Mashvisor’s rental income calculator, you can compute how much income you can potentially earn from a particular investment property. You can compare the income for both short term (using an Airbnb calculator) and long term rental strategies.

Experience how Mashvisor can help you find the most profitable investment property. Start your 7-day free trial today.

Mashvisor’s Investment Property Search engine has a heatmap tool that quickly shows which parts of a city are more profitable.

What’s the Best Rental Strategy?

Deciding between Airbnb vs long term rental investing can be challenging. The best rental strategy will depend on various factors, including the market that you’re planning to invest in, your personal preferences, and your level of experience. It’s important to study the market thoroughly before you decide which rental strategy to choose.

If you’re new to rental property investing, we recommend that you start with Airbnb rentals. It is one of the best real estate investment strategies, especially for beginner investors. If you consider all the pros that we’ve mentioned, then you will know why Airbnb is so popular. You may also consider listing your property as an Airbnb long term rental for a steady income flow.

To achieve success as an Airbnb rental property owner, make sure to use a dependable real estate analytics platform like Mashvisor. The platform provides valuable tools that can help you in searching for a property, analyzing data, and calculating rental income.

Are you ready to find the best investment property in your chosen location? Schedule a demo today to find out how Mashvisor can help.