ARV can help you tell what renovations to make to get the highest ROI, fix and flip homes fast, and grow your real estate portfolio. Here is how.

Table of Contents

- What Is ARV in Real Estate?

- How Does ARV Work?

- What Are the Benefits of Calculating the ARV in Real Estate?

- Who Determines the ARV of a Property?

- What Is the Difference Between After Repair Value and Home Wholesaling Value?

- How to Calculate ARV

- How to Estimate Repair Costs to Calculate ARV

- Limitations of Calculating ARV

- What Are Some Common Mistakes While Calculating After Repair Value?

- What Are Some Best Practices for Using ARV as a Real Estate Investor?

- What’s Next: Get Reliable, Up-to-Date Real Estate Comps With Mashvisor

As a fix-and-flip investor, you hope to make money on every fixer-upper investment. As a homeowner, you may also want to know how different repairs affect the value of your home. Maybe you want to increase its value to sell it soon.

In either case, you don’t want to spend too much on repairs that you’ll have trouble recouping your investment.

Where do you draw the line between smart and unnecessary renovations? What is the maximum amount you should spend when buying real estate investment property in its current state? And at what price should you list it?

This post clarifies the ARV meaning in real estate and why it’s crucial to both house flippers and homeowners. You don’t need to have previous experience in house flipping or as a general contractor to learn and practice the techniques you’ll find here.

Besides what is ARV, we’ll also discuss how to estimate the best price for a fix-and-flip property, how much to spend on repairs, and how much to ask for it when it’s time to sell.

What Is ARV in Real Estate?

ARV, short for After Repair Value, is the estimated market value of a property after upgrades, repairs, and other renovation works are complete. In home flipping, the ARV refers to the market value of a property that has been fixed and is ready for flipping.

You can repair a fixer-upper property in several profitable ways, such as remodeling the kitchen, bathrooms, walls, and ceilings or replacing the flooring, plumbing, and heating.

However, the ARV metric does not account for other costs you would incur when preparing an investment property for sale, such as staging, realtor, adverts, listing, taxes, loan interest, insurance, and closing costs.

How Does ARV Work?

There are three aspects to ARV in real estate investing:

1. Buying the Property in Its Current Condition

Expert flippers and investors often prefer to buy fixer-upper properties at a discounted price, considering the cost of future repairs. These properties may or may not be in distressed condition.

You are more likely to profit after renovating or improving the property when you purchase it at the lowest possible price. But keep in mind that the seller may decline your offer if the pricing is too low.

2. The Cost of Repairs

This refers to the property’s state of repair at the time of purchase. Renovation estimates can be tricky to determine because you may have to repair more areas than you originally planned.

You might have just included siding, flooring, ceilings, and kitchen remodels in your budget. But as you repair the siding, you may find that you also need mold removal services for several walls and the basement.

3. The Selling Price After Repairs

This refers to the actual ARV. Here’s the deal: if you spend too much money on repairs, potential buyers may not be willing to buy the updated property at the high price you may ask. To avoid overpricing, you want your selling price to be within the market value of homes similar to your property, within the neighborhood, city, or region. This can help you quickly sell and recoup a realistic return on investment (ROI).

Related: 4 Effective Home Pricing Strategies for Sellers

These three aspects give you the property’s current value, the estimated value of repairs, and the home’s expected value after remodeling.

What Are the Benefits of Calculating the ARV in Real Estate?

Here are some of the powerful benefits of the After Repair Value approach:

- Know whether investing in a particular property makes economic sense. For example, if the cost of repairing a house and its current value exceeds the ARV of comparable properties nearby, the investment might not be worth it.

- Decide on the maximum price you’ll offer to the seller. The higher the repair costs, the lower you’ll want to bid on the investment property.

- Calculate the dollar value of future repair works needed for you to list the property at your desired sales price.

- Estimate the amount of profit you might make from renovating a property.

- Find out how much rehab loan or financing you can afford for your investment property to help with renovations. Most lenders prefer to finance a rehab loan that is 75% less than the ARV of the property.

- Determine which repairs to prioritize to earn the highest return on investment.

- Get an understanding of the types of renovations that will make your home more attractive in a specific market.

- Understand what offers to accept after completing expected and unforeseen repairs so you can turn a profit.

Who Determines the ARV of a Property?

When you’ve been investing in real estate for a while, you may have picked up several real estate property valuation methods. If you know your market well, you can also determine what types of renovations buyers in your area expect and will pay more for. In this case, you may be able to estimate your own ARV.

If you are new to real estate investing, you can still figure out ARV by working with an experienced real estate appraiser or licensed contractor.

The current market value of similar properties in the area also reveals valuable information. An important detail to remember here is keeping your property investment expenses low lets you resell the property at the current local market price and still make money. We’ll discuss how to do this in more detail later.

Related: When and Why Do You Need a Home Appraisal?

What Is the Difference Between After Repair Value and Home Wholesaling Value?

While the ARV real estate meaning is the estimation of the future sales price of a repaired property, house wholesaling value refers to the price of reselling an undervalued property from a real estate wholesaler to a real estate investor — often on a business-to-business model.

Wholesaling is also different from flipping in several other ways:

- A wholesaler functions as an intermediary between the actual homeowner and the buyer of distressed properties. The buyer is often a real estate investor looking to fix the property and flip it for a profit or add it to their investment portfolio.

- Wholesalers do not purchase or sell the property themselves. Instead, they receive a finder’s fee for connecting the property owner with the real estate investor. ARV involves investors buying a property, renovating or improving it, and then reselling it for a profit.

- When buying or selling a property, flippers need to calculate the After Repair Value and the Maximum Allowable Offer (MAO). Wholesalers do not need to do this because they sell the right to sell the property (via double closing or assignment of contract).

How to Calculate ARV

Calculating ARV is straightforward enough. The formula is:

ARV = Current Property Value + Value of Repairs

The ARV formula adds the current dollar value of the distressed property in its unrepaired state to the dollar value of the improvements you make.

It is possible to end up buying the property at the neighborhood’s current property value. But this is not always the case, and we’ll share a formula you can use to estimate how much to pay for a fixer-upper property later in this article.

How to Estimate Repair Costs to Calculate ARV

Accurately estimating repair costs is both an art and a science. It is not a good idea to underestimate the costs of renovations or overestimate the value of repairs because it would hurt your profits. This makes it more important to estimate the costs to repair an investment property accurately, thoroughly, and realistically.

-

- Compare the home to similar properties nearby that it will resemble after repairs are done. Look for properties that have recently sold in the same neighborhood or nearby, with similar size, features, and other factors such as the same or nearby school districts.

- Ask your appraiser to provide you with comparables if you hired one to assess the home’s value. Otherwise, you may need to gather the information on your own.

- Get repair and renovation quotes from professional real estate contractors. Some of the details you could get from them are the cost of building materials, labor, duration, taxes, and renovation regulations in that area. Also, talk to several contractors to get competitive estimates.

- Use real estate comparables data from an active MLS or real estate agent to understand the local market. Robust real estate comps can help you estimate how much value buyers in that area attach to particular renovation works so you can prioritize the most valuable remodels.

- Use the 70% Rule of house flipping. The rule states that investors should strive to pay a maximum of 70% of a property’s After Repair Value, minus the expected costs of repairs. The 70% Rule helps real estate investors determine an offer price lower than market value while still being competitive enough for the seller to accept it. The formula for the 70% rule is: Maximum Purchase Price Target = (ARV x 70%) – Estimated Repair Costs

- Use a robust real estate comparables tool. Besides helping you find lucrative investment property in an area, an advanced Comparative Market Analysis solution like Mashvisor can help you identify several fix-and-flip investments with similar features or ARV that have sold in that neighborhood, city, county, or state in the last two to four months.

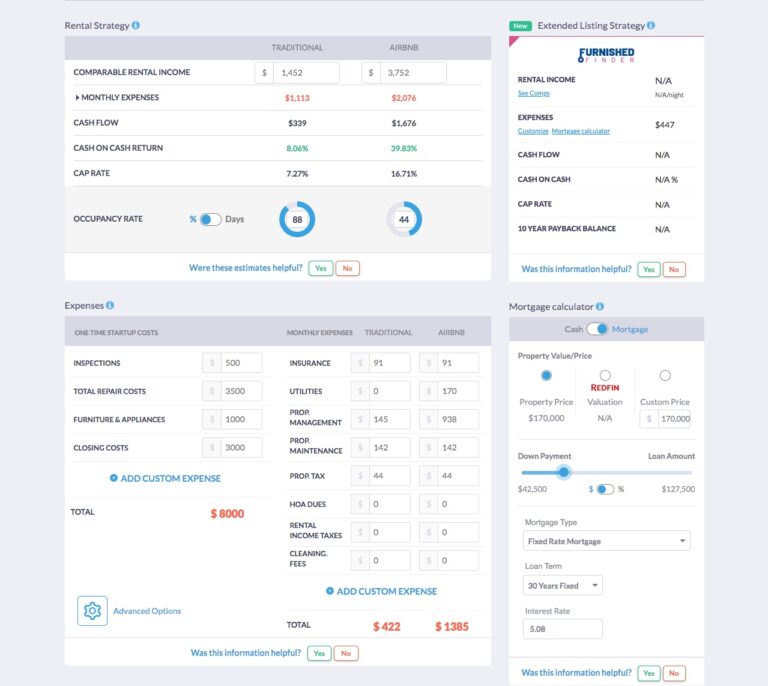

Mashvisor’s investment property calculator gives you an idea of what costs and expenses you may have to spend on the property and the potential return you might recoup.

Mashvisor’s Investment Property Calculator does not only help you estimate repair costs for your ARV. It also projects the rental income, monthly expenses, cash flow, occupancy rate, and returns that you can expect with a certain property.

See these Mashvisor features in action by scheduling a free demo.

Is the Cost to Repair the Same As the Value of Repairs?

The cost of repairing an investment property is not the same as the value the renovations add. Renovation can add more value than the actual cost of repairs, which is the ideal situation. But remodeling is economically beneficial up to a point, then it stops making sense.

According to Remodeling’s 2022 cost vs. value report, replacing a garage door, installing a manufactured stone veneer, and completing minor kitchen remodels are some of the renovation projects that recoup the most dollar value at resale.

On the other hand, upscale bathroom renovations, major kitchen remodels, and master suite additions recouped only around half of their original costs. The value these types of remodels add to your After Repair Value is not as high as those above.

However, the ARV metric is not perfect.

Limitations of Calculating ARV

Some top limitations of using ARV in real estate investing are:

- Whether you make a significant profit or loss depends on how accurately you estimate the value of future repairs. But circumstances change. The house might need additional repairs after you purchase it, which would require more money, time, and effort than you had expected.

- Property values may also change while renovations are underway, reducing your margin.

- Despite its simplicity, a property’s After Repair Value relies on accurate estimates of all repairs. Yet, estimating the cost of building materials, fixtures, labor, contractor fees, taxes, and even homeowner association fees can be challenging before remodeling.

- Low appraisal values can severely harm returns. Knowing the local and overall market conditions is crucial whether you work with an appraiser or real estate agent.

- Often, unforeseen repairs add to a property’s renovation costs without raising its market value in that neighborhood, city, county, or state.

- The ARV metric ignores other significant costs in real estate investing, such as closing and staging costs and sales taxes, which affect the profit you can expect.

Combined with the following common ARV mistakes, these limitations can lead to costly mistakes for a beginner in real estate investing.

What Are Some Common Mistakes While Calculating After Repair Value?

You’ll want to avoid these potentially costly mistakes when calculating the after-repair value of your investment property:

- Calculating an accurate ARV may seem like a lot of work. So, it is tempting to overlook details in good-looking properties and purchase them at face value.

- Some real estate investors avoid working with contractors or professional home inspectors to avoid consultation fees. If you purchase a property without their help, you may discover it requires additional repairs later. The result: a rise in repair costs that could wipe out your profit.

- Using inaccurate or inadequate real estate comps data may lead to overestimating the ARV. As a result, you may overspend on repairs, only to find that recouping the investment will be difficult.

- Investors tend to focus on the property’s specific characteristics rather than consider the general trend of the local economy, national real estate market, and local culture as well. Yet, market conditions, supply, and labor costs can fluctuate both up and down in a few weeks.

So, how can you avoid these ARV mistakes as a real estate investor?

What Are Some Best Practices for Using ARV as a Real Estate Investor?

ARV and the house flipping market present a few important factors to consider before making a purchase, some of which are already discussed in the article. Here are some of the key ones:

- Because the after-repair value is based entirely on estimates, it is subject to change over time, affecting your return on investment.

- Take the time to inspect and appraise the property with an experienced, licensed professional. The appraiser is crucial to arriving at the After Repair Value of a property you intend to purchase.

- Know the local market, including what improvements, repairs, and upgrades the property will need for you to sell at a profit.

- Get at least three to five estimates for repairs and renovations. You want to ensure that you get the most competitive prices to protect your margin.

- Follow the rule of 70 formula in most cases. You do not want an investment property whose cost to repair exceeds 70% of the ARV.

- Use a trustworthy real estate comps platform. You’ll get reliable real estate insights to help you find a lucrative investment property.

What’s Next: Get Reliable, Up-to-Date Real Estate Comps With Mashvisor

It’s challenging to determine an investment property’s After Repair Value or ARV. You might not know what repairs you need until you’ve committed and purchased the property. Yet, you don’t want to lose lucrative investment properties to others who can act faster. So, what do you do?

Using Mashvisor, you get the most recent real estate comparables from active MLS services, real estate platforms, and our partners, right down to your desired neighborhood.

You can also:

- Search anytime, from wherever you are, so you’ll never miss an opportunity to grow your portfolio

- Cut down your search time from days to minutes.

- Reduce moving across multiple locations in search of the right fixer-upper

- View the right fix and flip investment property for your budget, investment style, cash-on-cash return goal, cap rate, etc., in a single platform

- View the estimated expenses you’ll need to foot for each property before you commit to buying it.

- Compare up to 10 investment properties side-by-side to speed up your search.

To get access to our real estate investment tools, click here to sign up for a 7-day free trial of Mashvisor today, followed by 15% off for life.