In a matter of minutes, you will gain investment insights into the Austin real estate market. You will know why the Austin

housing market is one of the best places to invest in real estate in 2021. More importantly, we’ll be listing some of the best neighborhoods for buying traditional and Airbnb rental properties in Austin.

Overview of the Austin Real Estate Market 2021

Austin is not just the administrative capital of Texas, it is the cultural capital as well. The weather is warm, comprising the perfect destination for tourists. Meanwhile, the city is growing into the leading hub for high-paying tech jobs, making it easier for residents to afford the increasing home prices. The city is generally known for its balanced economy, which has pulled more businesses, developing it into a metropolitan area.

Austin is home to more than three million residents, making it the 11th largest city in the United States. The rapid economic growth is not just driving businesses: it is also great for millennials and better life enthusiasts. Ripe with opportunities and the promising provision of a substantial quality of life, Austin is a grand center for prospective businesses and a serene location for new people looking to settle down and start a family in a city gushing with opportunities.

The Austin real estate market is also appealing because it is one of just nine states in the United States of America that do not charge income tax to its residents. This is also contributing to the city’s real estate appreciation over the years, which has averaged 5.13% over the past 10 years, according to NeighborhoodScout. As a result, the prices of Austin homes for sale are appreciating at a rate exceeding the Texas average as well as the nationwide average.

Austin housing market projections indicate that it will expand more in 2021 and 2022, as more companies and investors pick up more private spaces. The ripple effect of this is that the Austin real estate market will become an even more attractive investment proposition for investors.

Read more: Why Texas Real Estate Has Always Been Sexy for Investors

Austin Real Estate Market 2021 Latest Trends

So, what is 2021 looking like for the Austin real estate market? Here are some of the trends we have discovered based on Mashvisor’s real estate data:

Pricing

- Median Property Price: $544,550

- Price per Square Foot: $350

- Real Estate Listings for Sale: 314

Granted, the average cost of a house in the Austin real estate market is much higher than most places, but you will quickly realize that the buying power of Austin residents is quite stronger than in other locations. Coupled with an active renting population, this makes it easier to get good returns on your Austin investment property, regardless of the current home values.

Traditional Rental Properties

- Traditional Rental Income: $1,998

- Traditional Cash on Cash Return: 1.01%

- Price to Rent Ratio: 31

The ideal cash on cash return is around the 8 -12% range, but the number here is just the city level. And generally, investors are still able to find great investment opportunities in Austin.

Airbnb Rental Properties

- Airbnb Rental Income: $3,905

- Airbnb Cash on Cash Return: 2.93%

- Airbnb Occupancy Rate: 56%

Evidently, Airbnb rentals generate more income and cash on cash return than traditional rentals in the Austin real estate market. As a real estate investor, this should probably be your property investment strategy if you’re looking at this location.

Why Should You Invest in Austin Real Estate?

The growing demand for comfort in Austin has fueled lots of interest in the Austin real estate market 2021, and there are more houses up for sale at a considerable price. As one of the first housing markets to emerge strong from the Coronavirus pandemic, it has become a target for many investors.

Here are some of the major reasons you may also want to consider investing in the Austin housing market in 2021:

The Cost of Living Is One of the Reasons Why People Are Moving to Austin

The conversation around the cost of living in Austin, TX may be a little tricky, and perspective is required. It’s not the among the cheapest places to live in the U.S., but the wages earned here are comparably higher and go a long way to balance the cost of living.

For instance, according to ValuePenguin, the median rent in Austin is about 30.4% of the monthly median income, which is almost the same average as in the Texas housing market, and much less than the national average of 34.4%.

This makes the Austin rental market a much more affordable option for most people and perhaps a better investment decision for real estate investors.

Read more: Best Places to Invest in Based on Cost of Living

A Massive Student Population Drives Austin Rental Investment

Many people choose to invest in Austin rental properties because of the large student population, which would pay a premium for properties that are within easy commuting distance of the University of Texas at Austin campus. There are over 40,000 students at this school alone. About the same number of students attend Austin Community College. The city is also home to Huston Tillotson University, Saint Edward’s University, and the National American University.

Austin’s Demographic Momentum Is Positive: Approximately half of the Austin metro population is between the ages of 18 and 44, though the large student population distorts this number. Many college graduates choose to remain in the area because of the well-paying jobs and, so, are always looking for homes for rent in Austin, TX. After all, the city has the highest employment per capita of any Texas city. This helps to understand why the housing market in Austin is rising at the fastest pace of any major Texas region. Many of these young adults are starting families in Austin, indicating a strong future demand for housing in the city.

As a real estate investor, you can choose to focus on this demographic when buying houses for sale in Austin, TX.

Goldmine Is Found in the Rental Market Statistics: Do you know that the average rent in Austin was increasing at a rate of 5% per year before the pandemic? Moreover, renters account for 48% of Austin households, a sizable proportion of the city’s population. Combined together, these two factors mean that rental demand is strong, and rental rates are on the rise. All this translates into positive perspectives for return on investment on traditional rental properties in the coming years.

People Will Come to Austin, The New Silicon Praire

Because of the large number of high-tech companies that are flocking to Austin, Texas, the area has been dubbed Silicon Hills and Silicon Prairie. As a result, the upscale Austin real estate market is thriving. Austin’s GDP, which has increased by 117% in the last 20 years, has aided in the recovery of the real estate sector.

Silicon Valley, which grew its GDP by 99% during the same period, was the closest metro to see this form of development. IBM, Amazon, Apple, Cisco Systems, and several semiconductor manufacturers are among Austin’s major employers. In the Austin, TX real estate market, there are more than 3,300 tech firms and more than 100,000 tech employees, all making up a potential target population for your Austin real estate investments.

After the Dot-Com boom layoffs, the Austin real estate market took a hit. They wanted to address the issue by enticing medical and biotech firms to move to the region as well. There are also 85 biotech and pharmaceutical firms in Austin as of today.

The Active Tourism Scene Is Helping the Vacation Rental Business

Airbnb Austin is an excellent investment. As the demand for short-term rentals in the city is rapidly appreciating, so should business-minded individuals spread their investment tentacles. The city hosts several cultural events, festivals, and conferences, including the SXSW conference.

Airbnb rentals in Austin also aid the real estate appreciation of the city, making it an ideal real estate investment location. Tourists pouring into Austin every day need short-term rentals during their stay. As a result, we are seeing more investors put their money on Airbnb rentals.

Learn more on how to use Mashvisor’s Airbnb calculator to predict short-term rental profits here.

Best Austin Neighborhoods for Traditional Rentals

Although we know that it is cheaper to rent homes than buy them in the Austin, Texas real estate market, what are the best locations for real estate investors? We’ve discovered the best neighborhoods for investing, using data from Mashvisor’s investment property calculator. These places reflect the performance of actual rental comps.

1. Chestnut

- Median Property Price: $169,950

- Price per Square Foot: $317

- Monthly Traditional Rental Income: $1,817

- Traditional Cash on Cash Return: 4.75%

2. Coronado Hills

- Median Property Price: $259,800

- Price per Square Foot: $146

- Monthly Traditional Rental Income: $1,281

- Traditional Cash on Cash Return: 3.48%

3. MLK 183

- Median Property Price: $337,500

- Price per Square Foot: $291

- Monthly Traditional Rental Income: $1,257

- Traditional Cash on Cash Return: 3.13%

4. Riverside

- Median Property Price: $775,000

- Price per Square Foot: $345

- Monthly Traditional Rental Income: $2,076

- Traditional Cash on Cash Return: 2.20%

5. Franklin Park

- Median Property Price: $352,900

- Price per Square Foot: $216

- Monthly Traditional Rental Income: $1,356

- Traditional Cash on Cash Return: 2.16%

Best Neighborhoods in Austin for Airbnb Rentals

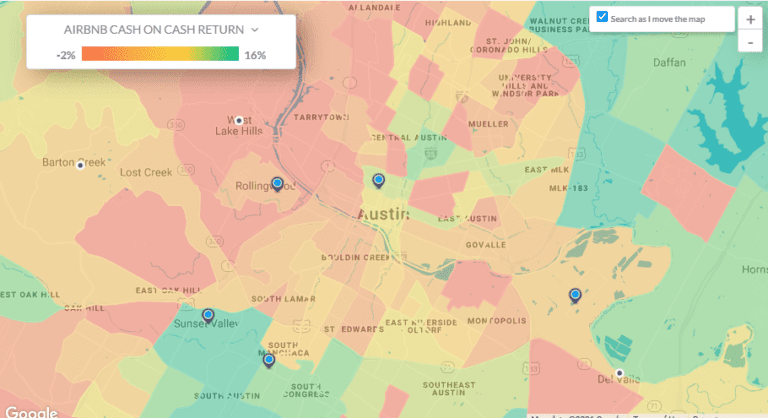

Mashvisor’s real estate heatmap shows the Austin neighborhoods with the highest Airbnb cash on cash return.

Airbnb rentals clearly make more money than traditional rentals in the Austin real estate market. However, what you really want to know is the most profitable income property locations.

Here are the top 5 neighborhoods for Airbnb investments based on Mashvisor’s data:

1. MLK 183

- Median Property Price: $337,500

- Price per Square Foot: $291

- Monthly Airbnb Rental Income: $3,402

- Airbnb Cash on Cash Return: 10.00%

- Airbnb Occupancy Rate: 72%

2. Windsor Hills

- Median Property Price: $349,999

- Price per Square Foot: $192

- Monthly Airbnb Rental Income: $3,728

- Airbnb Cash on Cash Return: 8.86%

- Airbnb Occupancy Rate: 69%

3. Wells Branch

- Median Property Price: $440,000

- Price per Square Foot: $233

- Monthly Airbnb Rental Income: $3,985

- Airbnb Cash on Cash Return: 5.91%

- Airbnb Occupancy Rate: 54

4. University Hills

- Median Property Price: $600,000

- Price per Square Foot: $365

- Monthly Airbnb Rental Income: $3,204

- Airbnb Cash on Cash Return: 5.85%

- Airbnb Occupancy Rate: 66%

5. Sweet Briar

- Median Property Price: $450,000

- Price per Square Foot: $232

- Monthly Airbnb Rental Income: $3,441

- Airbnb Cash on Cash Return: 5.42%

- Airbnb Occupancy Rate: 63%

What Are the Airbnb Laws in the Austin Real Estate Market?

Austin, Texas operates the same short-term rental laws as most states in the U.S., which is requiring hosts to obtain an operating license. The short-term rental, according to the state government, is a residential dwelling unit that is leased out for a consecutive period of 30 days or less.

Unlicensed short-term rental owners who advertise their property are subject to a $2,000 daily fine as the city’s new short-rental ordinance has set requirements for occupancy limits and advertising. Otherwise, the process for getting a license is pretty straightforward.

Read more: How to Evaluate Vacation Rental Potential Before Buying

Tap into This Investment Opportunity Now

Becoming a successful real estate investor requires that you have insight into the data that could aid your investment. And as you plan on becoming one of the successful Austin real estate investors, you might be interested in knowing that all the data above was collected using Mashvisor’s Investment Property Calculator. The tool gives insight into data on the best real estate investments. You will make faster, more precise, and smarter Austin real estate investment decisions.

To get access to our real estate investment tools, click here to sign up for a 7-day free trial of Mashvisor today, followed by 15% off for life.