“How much can I make on an Airbnb rental by using a calculator?” This is a question that most prospective vacation rental owners ask themselves.

It is crucial to ask yourself such a question before you go diving head-first into rental property investment. Each investment opportunity has different things to offer real estate investors. Before making any final decisions, you should have a general understanding of what you’re getting into and how much you can benefit from it.

The high inflation rates are slowing things down for everyone in real estate investing. Just like we did at the height of COVID-19, many people are already making the necessary adjustments to navigate the situation and keep their heads above water.

Despite many companies shutting down in the past two years, business and travel are now back in full swing. With the easing of travel restrictions, local vacation rental hosts are slowly and steadily regaining their lost momentum.

Airbnb is now a staple on many travelers’ checklists. The platform provides them with more affordable alternatives to the more expensive hotels and business inns when out on a trip. The pandemic drove more travelers to short-term rental owners’ doors, which made a lot of people consider getting into the vacation rental business.

Plenty of would-be Airbnb hosts and real estate investors are now going online looking for the right property investment tools and asking themselves, “How much can I make on Airbnb using a calculator like Mashvisor’s?”

Read on to learn how to calculate how much can I make on Airbnb.

Everything You Need to Know About Running an Airbnb Business

If you’re thinking of starting a short-term rental or Airbnb business, you have a lot of things to know before setting it up. To help you, we answered the most frequently asked questions that aspiring vacation rental hosts have about this lucrative investment strategy:

What Is Airbnb?

Airbnb is a global company that provides travelers with cheaper accommodation alternatives. The platform connects them with property owners who have their houses listed as short-term vacation rentals on their site. Simply put, Airbnb is an inexpensive but pretty decent substitute for hotels and resorts when you’re on a business trip or vacation.

Is Airbnb Legal and Safe?

The short answer to both questions is yes. Airbnb is very legal and quite safe. Generally. Let’s talk about the latter before we get into the former.

As a traveler, staying at an Airbnb rental comes with nearly the same safety standards as that for bigger hotels and resorts.

Airbnb maintains high standards for applicants wishing to get their properties listed on the platform. Even before a property is listed as a vacation rental, property owners must go through a rigorous checklist of safety requirements. It is to ensure travelers get the best possible experience during their stay.

Responsible hosting is what they call it, and they expect every host to implement their health and safety guidelines strictly. So, if you’re second-guessing whether to book an Airbnb rental or not, it is safe to say that each rental property listed on the platform adheres to strict health and safety guidelines.

On the other hand, property owners are subject to the following risks when registering their properties as vacation rentals: liability risks, renting out to squatters, changing short-term rental legislation, and canceled bookings.

As far as legal issues are concerned, different states and counties impose different short-term rental regulations and legislations.

Over the past few years, many states and cities doubled down on Airbnb and other vacation rentals. They worked to protect their communities from the potentially negative effects of such types of properties on property values and the locals.

Some of the most common challenges rental property owners may face include stricter requirements to get their business off the ground. Others include limitations on the number of days a property can be rented out.

How Do I Become an Airbnb Host?

Given how most people almost always need an extra source of income, several business-minded individuals are considering becoming Airbnb hosts. It is especially true for owners with extra room or two to spare on their properties.

Generally, it’s easy to become an Airbnb host. In fact, almost anyone can become a host. However, Airbnb is looking for potential hosts willing to play by their rules and uphold certain industry standards.

According to Airbnb’s website, hosts are required to:

- Respond to inquiries

- Accept requests

- Avoid cancellations

- Maintain a high overall rating

While the above requirements may seem very easy to meet, the website can check how your performance would stack up against all the hosts’ averages on the platform. In addition, because of COVID-19, Airbnb’s upped the ante on its health and safety standards and expects all hosts to meet and maintain said standards.

How Much Can I Make on Airbnb?

The question “How much can I make on Airbnb?” is actually the main concern potential vacation rental owners ask. You can make a profit off a real estate property by converting it into a short-term rental home and getting it listed on Airbnb and other similar websites.

“So, what’s my place worth as an Airbnb rental?” you may ask. This question is quite similar to “How much can I make on Airbnb?” in the sense that the answers depend on several factors. Even if you use the best Airbnb calculator, if your property is located in a market where short-term rentals aren’t doing very well, you will be disappointed.

Smart investors will always consider the different factors and variables surrounding rental property investments, such as short-term rental data, acquisition and overhead costs, and other things that could affect the property’s performance in the rental market.

Investors asking themselves, “How much can I make on Airbnb using a calculator?” should first determine what the market is like before arriving at an Airbnb estimate. It is the part where due diligence comes into play.

A wise investor knows how to fully utilize all the resources available to him, including pertinent real estate market information and data. Acquiring the necessary market information will allow you to come up with a rental property analysis that will give you realistic results.

Simply put, an Airbnb estimate is a property’s earning potential that is computed by factoring in all the Airbnb dataset for a certain property. An investor can easily do this by using a short-term rental calculator found online.

Find Out How Much You Can Make on Airbnb Using This Calculator

Mashvisor’s Airbnb calculator helps investors estimate their income and expenses if they choose to invest in a certain property and area.

One of the most reliable Airbnb calculators that investors and hosts use is Mashvisor’s investment property calculator. With the calculator, investors can come up with a realistic Airbnb estimate for almost any property that’s publicly listed on the MLS, as well as off-market properties. The tool covers a wide range of markets all across the US.

The site’s investment property calculator allows you to do the math on properties from multiple markets. The tool’s multimarket feature is an absolute timesaver as it permits users to perform property searches and data analytics in a fraction of the time.

Mashvisor uses reliable and relevant Airbnb data gathered from several reputable sources, including Airbnb.com.

Investors no longer need to spend weeks combing through all the different listings on Airbnb and working on an Airbnb profit calculator spreadsheet. All they need to do is go to Mashvisor and start using the different tools and data that are readily available to its subscribers.

Signing up for its services can help you get the answer to the question, “How much can I make on Airbnb using a calculator?”

Mashvisor’s Airbnb Calculator

Masvhvisor’s Airbnb calculator allows investors to avoid the guessing game when it comes to the profitability of short-term rental properties. The tool uses Airbnb data and analytics to come up with a projected revenue before you buy a property. As the name suggests, it calculates how much money a certain property can make as a rental listed on Airbnb.

Measuring Profitability

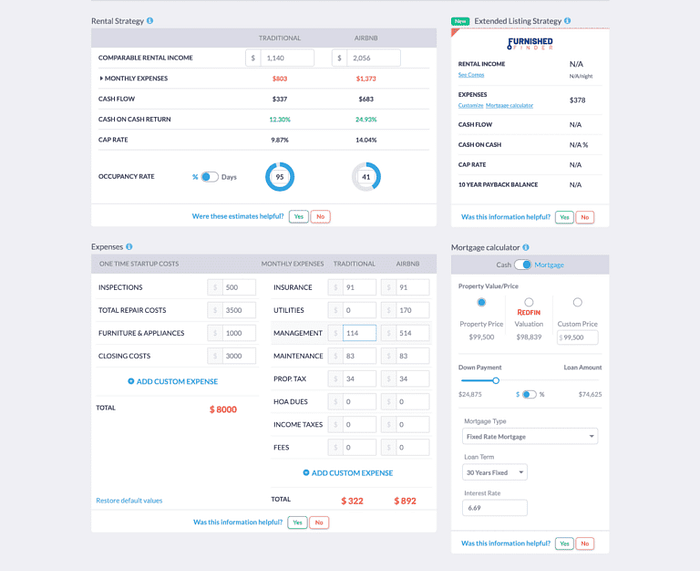

Mashvisor uses the following factors to determine a property’s profitability:

- Airbnb occupancy rate. The Airbnb occupancy rate determines the rate at which a property is booked or vacant. Mashvisor does not just provide data for cities, but it also zooms in on all the neighborhoods in a given city. It makes searching for properties a lot more efficient.

- Airbnb cash on cash return. Cash on cash return is one of two important factors that affect a property’s profitability. The metric is calculated by taking a property’s net operating income and dividing it by the investor’s total cash investment.

- Airbnb cap rate. A property’s cap rate measures the expected rate of return on investment. It is handy because it allows investors to compare properties in a given market and gives them an idea of the potential investment risks.

- Airbnb rental income. The site provides users access to market-specific information about monthly and daily Airbnb rental rates.

- Airbnb rental comps. Rental comps, or rental comparables, are data used to compare similar properties in a specific market.

- Airbnb rental expenses. Another feature of the site is its accurate projection of rental expenses associated with a given short-term rental market, including Airbnb fees. It generally utilizes rental comps to give users an idea of the associated expenses of Airbnb properties in a specific location.

- Airbnb cash flow. The metric shows whether a certain property can generate a positive or negative Airbnb cash flow.

- Financing method. The financing method an investor chooses will significantly impact the property’s cash flow and profitability.

How Does One Use Mashvisor’s Airbnb Calculator?

To answer the question “How much can I make on Airbnb using a calculator?” one only needs to turn to the right investment property calculator. And Mashvisor offers one of the best out there today.

Here’s a quick step-by-step guide to using Mashvisor’s Airbnb calculator:

Step 1: Choose a Specific Investment Property Using the Property Search Tool

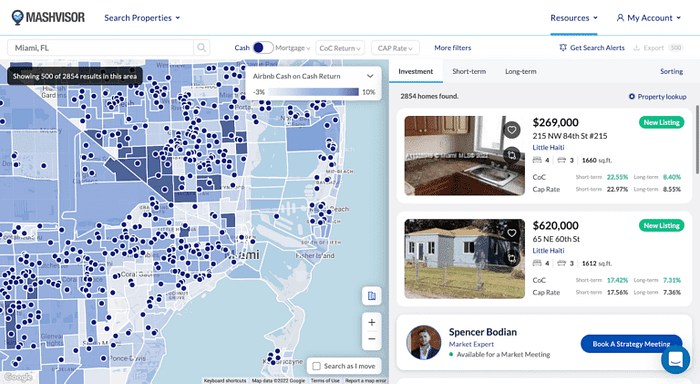

The real estate heatmap on Mashvisor’s Property Search tool gives users an overview of which neighborhoods in a city have the highest or lowest Airbnb rental income.

First things first. Before you make any calculations, you need to find a particular property to analyze. Mashvisor’s Property Search feature is fairly simple to use. Whether you’re looking for a traditional rental property or a vacation home, the site’s investment property search tool is your friend.

All you need to do is put in the name of the city of your choice, and the site will bring you to a heatmap of the city that will show the list of all available properties in every neighborhood. If you want to be more specific with your search, you can use the different search filters on the site.

Now let’s say you already own a property but want to see if it can bring in a significant amount of money as an Airbnb rental. In order to do so, just enter your address on the search bar and some basic information. The site will then come up with a list of rental comps to help make your Airbnb estimate as accurate as possible.

Step 2: Determine How You Want to Go About With the Financing

Financing is one of the most important aspects of real estate property acquisition. Without sufficient funding, looking for a property that aligns with your investment goals will be difficult. However, as an investor, you need to understand how you choose to finance your Airbnb project will significantly impact your cash flow and return on investment.

Understandably, not everyone can pay in cash. Potential investors must consider other financing options to fund their purchases.

One good thing about Mashvisor’s Airbnb calculator is that it also comes with a mortgage calculator, with the financing method set to cash by default but can easily be changed to a mortgage option.

Step 3: Come Up With an Estimate of Costs and Expenses

Another cool feature of Mashvisor’s investment calculator is it also gives investors a list of all expected rental expenses and costs. The values set in this particular section are all based on the average numbers in the property’s neighborhood.

However, as helpful as the defaults may be, we highly recommend that investors perform their due diligence. They must find out what other possible numbers may be so they can modify the calculations accordingly. It brings greater accuracy to the property analysis.

Rental property expenses and costs comprise two categories. They are the one-time costs and recurring expenses.

One-time startup costs include the following:

- Inspection fees

- Home improvements and repairs

- Furniture

- Appliance

- Closing costs

On the other hand, recurring expenses include, but are not limited to, the following:

- Insurance

- Maintenance

- Utilities

- Property management fees

- Taxes (including rental income taxes)

- HOA dues

- Cleaning fees

Step 4: Find Out the Rental Strategy Comparisons

The next step to answering the question “How much can I make on Airbnb calculator?” is to find out which rental strategy you should go with. The site’s rental strategy comparison section will show you all the important numbers and indicators to see how profitable a rental property could be.

ROIs will be shown for both traditional long-term and short-term rental strategies. The calculator will display the following comparative information:

- Monthly income

- Monthly expenses

- Cash flow

- Cash on cash return

- Cap rate

- Occupancy rate

It will help you make a well-informed decision about whether to go the traditional rental route or take a chance with an Airbnb rental.

Step 5: Check the Site’s Rental Comps and Insights Section

Mashvisor’s Rental Comps & Insights section presents a list of comparable homes in the area and investment insights to help you decide on whether to acquire the listed property.

Lastly, to get the most accurate prediction on an investment property’s profitability, see how other similar properties are performing in the same market. The Rental Comps and Insights section will show active comparable rental property listings, the most recent sales of similar properties, and other essential neighborhood information.

The section also shows other properties’ data like nightly rates, occupancy rates, rental income, and even ratings of similar rental properties in the area. Access to such type of data leads investors to estimate how much they can earn.

Give Mashvisor’s Airbnb calculator a try, as well as other real estate investment tools, by signing up today.

The Bottom Line

Knowing how profitable an investment property is as an Airbnb rental is always a good thing to do before going all-in. Always perform your due diligence and use the right tools as you go on your real estate investing journey.

If you dedicate yourself to putting in the work and getting the best online tools to help you locate the best deals in the most profitable markets, you are already one step ahead of the competition.

With Mashvisor’s Airbnb calculator, investors can gain access to a wide range of rental properties across the country, along with updated and accurate data for all markets. Using the tool will help investors answer “How much can I make on Airbnb using a calculator?” and other related questions.

So, how much money can you really make on an Airbnb investment? It really depends on the property location and the neighborhood data associated with it. If you know exactly what you’re looking for and you play your cards right, you may be on the verge of uncovering a potential gold mine.

Learn more about how Mashvisor can help you find the best deals in the most profitable markets by scheduling a demo now.