With interest rates up, the number one question on the minds of real estate investors is what the best investment property lenders are.

Buying the best investment property entails a lot of different steps and considerations, and one of the most important ones is what lender and what loan you will use. Such factors will affect both the affordability and return on investment in the short and long term. That’s because the cost of financing a rental is present in most ROI formulas, including the cash on cash return calculation.

Table of Contents

- 3 Best Investment Property Lenders

- How to Find a Profitable Investment Property You Can Afford

- How to Get Approved for a Loan to Buy an Investment Property

- Getting Started With the Best Investment Property and Lender

Deciding how to finance your investment property has never been easy. It became even more challenging in 2022 when mortgage rates skyrocketed, crossing the 7% threshold for the first time since 2002. Thankfully, analysts anticipate that mortgage rates will remain stable throughout 2025, with the 30-year fixed rate expected to stay in the mid-6% range.

Despite this good news, investors in long-term and short-term rental properties still need to put extra effort into finding the best lenders for their property type and financial situation. To help you get started in real estate investing, in this article, we’ve ranked the three best investment property lenders for different types of investors in the coming year.

Moreover, we will show you how to get approved for a loan and find the best investment properties for sale in the US market. Mashvisor will prove exceptionally useful in this last regard as it turns three months of research and analysis into 15 minutes.

3 Best Investment Property Lenders

We at Mashvisor conducted a nationwide online real estate market analysis to find the three best lenders for the specific needs of investors in long term and short term rentals for sale. We focused on their standing and reputation, mortgage interest rates, types of property they finance, and customer reviews.

However, as an investor, you should keep in mind that the question “What loan is best for an investment property?” does not have a single, universal answer. What is good for one investor might not be for another. Indeed, the best loans for investment property depend largely on the specific situation and needs of the borrower.

Nevertheless, it’s worth checking out the three best lenders for investment property below as they promise some of the most beneficial terms throughout the US market. Moreover, they boast a well-established online and offline reputation among millions of homebuyers and rental property investors.

1. Citibank: Best Investment Property Lender for Single Family Homes

Our online research and analysis show that Citibank is one of the best possible lenders for investing in a single family home property in the US market.

Citibank offers loans for:

- Buying an investment property

- Refinancing

- Using a home equity line of credit (HELOC)

Citibank provides several different mortgage and refinance calculators that can help investors calculate exactly how much home they can afford and how much it will cost them to finance it.

Moreover, currently, the lender is running a promotion that offers borrowers $500 off the closing costs when applying for a mortgage. In addition, existing Citibank customers might qualify for lower mortgage interest rates and closing cost credit.

Citibank Loan Terms

Like most other conventional mortgage loan providers, Citi offers a range of different loans. The most popular ones are 15-year fixed and 30-year fixed-rate mortgages (FRM), as well as some adjustable-rate mortgage (ARM) options.

At the time of writing this article, Citibank has the following interest rates:

- 6.0% interest rate and 6.312% APR for 15-year fixed

- 6.75% interest rate and 6.958% APR for 30-year fixed

Wondering, “Is it harder to get a mortgage for an investment property?”

Citibank imposes slightly stricter requirements for real estate investors than for homebuyers because the former are seen as riskier borrowers than the latter. After all, if you get in a bad financial situation, you’re more likely to cover your home payments first and your investment property payments second. But this is the standard with most mortgage loan lenders.

Regarding a down payment, the minimum requirement is 20% of the rental property price. But if you can pay more, you will likely get better terms on your loan.

Citibank Loan Application Process

In terms of process, investors should go through the following steps:

- Calculating what they can afford (online calculators can help with this)

- Getting pre-approved to look like a more trustworthy buyer to real estate agents and home sellers

- Applying for a loan

A lot of the above steps can be done online. Nevertheless, investors are advised to start applying for a loan early. It guarantees they have financing figured out when they find the best investment property.

Like most other conventional mortgage lenders, Citibank requires a minimum credit score of 620. So, it is not an optimal choice for real estate investors with a shaky credit history. However, at the same time, it’s worth seriously considering if you should invest in a rental property if you cannot maintain a good credit rating, which requires a lot of financial stability.

Citibank Loan Pros and Cons

Although it’s one of the best investment property lenders, Citibank loans have advantages and disadvantages.

The most important benefits include the following:

- Solid online and offline history, presence, and reputation with many satisfied customers

- Competitive mortgage interest rates and APR

- Multiple online mortgage calculators to help you get started

- Access to different financing options like buying an investment property, refinancing, and HELOC

- Current $500 discount on closing costs

- Preferential terms for existing Citibank customers

Meanwhile, the main drawbacks of Citibank loans include the following:

- Access to conventional mortgage loans, which are not always optimal for all investors

- Requires a minimum down payment of 20%

- Requires a minimum credit score requirement of 620

- Currently, elevated interest rates that are in line with the general state of the US mortgage market

When we evaluate the pros and cons, Citibank emerges as one of the best conventional mortgage loan providers, especially for single family homes.

2. Rocket Mortgage: Best Investment Property Lender for Various Rental Property Types

Another best lender for investment properties worth considering is Rocket Mortgage. Unlike Citibank, Rocket Mortgage is suitable for single family homes, condos, townhouses, and multifamily real estate investing.

It offers loans for:

- Buying an investment property

- Refinancing

However, you cannot take out a HELOC with this lender, which somewhat limits the options of real estate investors. Overall, Rocket Mortgage provides access to conventional mortgage loans, FHA loans, and VA loans as long as borrowers qualify for them.

Rocket Mortgage Loan Terms

Similar to other best investment property lenders, Rocket Mortgage offers a mix of different loan types, including both fixed-rate and adjustable-rate mortgages, as well as some other options.

Currently, the interest rates for loans for investment property stand at:

- 6.99% interest rate and 7.425% APR for 20-year fixed

- 7.25% interest rate and 7.551% APR for 30-year fixed

- 5.99% interest rate and 6.24% APR for 30-year jumbo fixed

- 6.49% interest rate and 7.382% APR for FHA 30-year fixed

- 6.49% interest rate and 6.919% APR for VA 30-year fixed

Wondering, “What is a good APR for an investment property?”

Rental property investors usually face higher APR (annual percentage rate) than homebuyers, averaging 0.50% to 0.75% more. So, at the moment, rates of 6.87% to 7.62% can be expected. Rocket Mortgage APR is within the said average rate range.

About other mortgage loan requirements, Rocket Mortgage expects a minimum down payment of 20% for an investment property and a minimum credit score of 620. Such requirements make it comparable to other top lenders in the US market.

Rocket Mortgage Loan Application Process

The process of applying for a loan from Rocket Mortgage includes:

- Applying online

- Getting approved

- Closing the loan

- Managing the mortgage online

Investors can use the online mortgage calculator to understand how much home they can afford to buy. There is also an option to fill in an online form to talk to Rocket Mortgage representatives to help you comprehend the best available options for your particular situation.

Rocket Mortgage Loan Pros and Cons

Before choosing the best lender, you should evaluate the advantages and disadvantages of different options.

The pros of borrowing from Rocket Mortgage include the following:

- Solid online and offline reputation as part of a company with 35 years of experience in the real estate market and the mortgage industry

- Truly digital online experience

- Access to loans for different investment property types

- Access to FHA loans and VA loans

- Online mortgage calculator to evaluate your financial situation and capabilities

Meanwhile, Rocket Mortgage loans pose the following cons:

- No access to HELOC

- Access to conventional mortgage loans only

- Minimum down payment of 20%

- Minimum credit score requirement of 620

- Higher interest rates and APR than other best lenders for investment property

In general, Rocket Mortgage is a good option for real estate investors with a solid credit history and who can put down 20% of the price of long term and vacation rentals for sale.

3. PennyMac: Best Investment Property Lender for Buyers With Good Credit Score

PennyMac is another one of the best investment property lenders, particularly for investors with a good credit score.

The lending institution’s loans can be used for:

- Buying an investment property

- Refinancing

Just like Rocket Mortgage, PennyMac does not offer HELOC options. It somewhat limits the opportunities for investors in rental properties who already own equity in a home or another property.

PennyMac loans can be used to purchase a single family home, condo, townhouse, or multi-family home. In addition to conventional mortgages, this lender also provides access to FHA loans and VA loans for borrowers who qualify for them.

PennyMac Loan Terms

Like other investors, the lender’s portfolio includes a range of mortgage loan products with both fixed and adjustable rates, as well as different terms. FHA and VA loans are also available for eligible borrowers.

Currently, real estate investors can expect the following mortgage rates and APR on PennyMac loans:

- 5.250% interest rate and 6.673% APR for conventional 15-year fixed

- 6.624% interest rate and 7.035% APR for conventional 20-year fixed

- 6.990% interest rate and 7.418% APR for conventional 30-year fixed

- 6.25% interest rate and 6.461% APR for jumbo 30-year fixed

- 6.125% interest rate and 7.015% APR on FHA 30-year fixed

- 6.125% interest rate and 7.123% APR on FHA 20-year fixed

- 6.125% interest rate and 6.526% APR on VA 30-year fixed

- 6.125% interest rate and 6.656% APR on VA 20-year fixed

The above rates are more affordable than what other best lenders like Rocket Mortgage offer.

Wondering, “What credit score is needed for investment property?”

The minimum credit score requirement for a conventional mortgage loan for PennyMac is 620, like other lenders. However, borrowers are recommended to have a credit score of at least 680 when taking out such a loan. That’s why we ranked PennyMac as the best investment property lender for investors with solid credit scores.

With PennyMac, the required down payment for conventional mortgages used for investment properties can reach as low as 15%, especially for single family homes. Multi-family properties usually require a 25% down payment.

PennyMac Loan Application Process

The process of getting a PennyMac mortgage loan consists of the following:

- Learning online about different types of loans and using an online mortgage calculator to estimate how much you can afford

- Getting pre-approved for a mortgage

- Applying for a mortgage

- Completing the loan process

- Finishing the underwriting process

A lot of the steps can be completed online, in line with the best practices of most investment property lenders in recent years.

PennyMac Loan Pros and Cons

It’s essential to evaluate the pros and cons of a lender before deciding if they are the best option for your particular situation.

The major advantages of borrowing from PennyMac to buy an investment property include the following:

- Solid online and offline presence and reputation

- Over 14 years of experience in the mortgage industry

- Access to loans for different types of investment properties

- Access to FHA and VA loans

- Online mortgage calculator to analyze your individual financial situation

- Minimum down payment of 15% on single family homes

- Lower interest rates and APR than other best lenders for investment property

On the flip side, the main disadvantages of using a loan from PennyMac include the following:

- No access to HELOC

- Access to conventional mortgage loans only

- Recommended minimum credit score requirement of 680

- Higher interest rates and APR than other best lenders for investment property

- Minimum down payment of 25% on 2-4 unit multi-family homes

All in all, real estate investors with credit scores of 680 and above who can afford a down payment of 15%-25% should look into PennyMac loans.

How to Find a Profitable Investment Property You Can Afford

Finding the best investment property lenders is one step of the process of finding and buying a long term or short term rental property that fits your budget and your ROI expectations. To help out beginner investors, we’ve outlined the main steps in this process:

Step 1: Set Up an Investment Property Budget

You should evaluate your financial situation and how you expect it to change in the coming years to decide how much you can afford to spend on an income property. Consider the down payment, as well as the monthly mortgage payments.

Step 2: Decide on the Best Loan and Lender

Once you know your financial standing, research the best investment property loans and lenders and talk to them. You need to find out the most appropriate one for your particular investment needs.

Step 3: Get Pre-Approved for a Mortgage Loan

It’s important to get pre-approval as it will make you look like a more reliable buyer. In a tough market like the one we’ve had in the last couple of years, it’s crucial to stand out from the crowd of homebuyers and real estate investors.

Step 4: Find the Best Market for Real Estate Investing

You need to conduct a nationwide rental market analysis to find the best long term or the best short term rental markets, depending on your preferred strategy. The Mashvisor real estate blog can provide an up-to-date ranking of the best places to invest in real estate based on various criteria.

Step 5: Select the Top Neighborhood for Your Rental Strategy

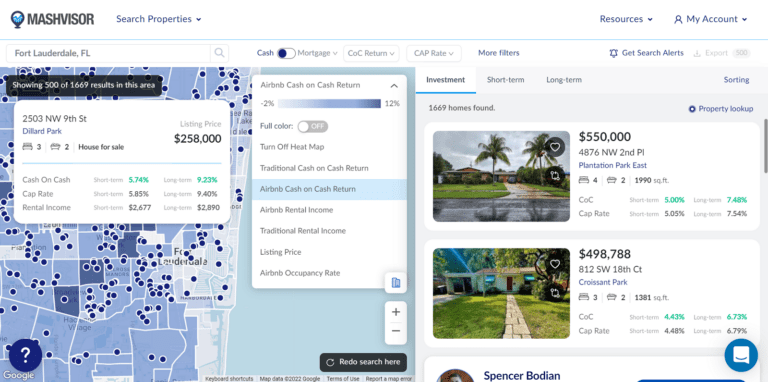

Choosing the right neighborhood is as important as choosing the correct city. The Mashvisor real estate heatmap can help you look for the best areas for long term and short term rentals. You can use property prices, rental income, cash on cash return, and Airbnb occupancy rate as search filters.

Investors can use Mashvisor’s real estate heatmap to search for the most profitable locations for long term and short term rental properties.

Step 6: Search for Profitable Investment Properties for Sale Within Your Budget

You should look for several investment properties for sale within your budget to choose the best one. You can use the Mashvisor investment property search engine to find MLS listings and off market properties based on your market, budget, financing method, rental income, and return.

Step 7: Analyze a Few Rental Properties for Sale

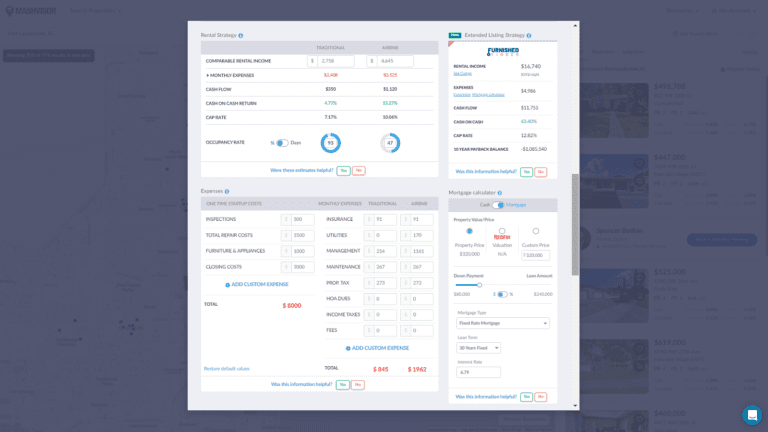

Performing detailed investment property analysis on your selected properties is crucial. You can use the Mashvisor online rental property calculator to speed up the process while getting accurate estimates based on reliable data and the performance of rental comps. Our real estate investing app offers a side-by-side comparison of properties rented out long term and short term.

Notably, the Mashvisor platform comes with an in-built mortgage calculator that helps you evaluate which mortgage loan fits your budget and results in the best investment outcomes. You can test various mortgage loan terms, durations, types, and interest rates.

Investors can use Mashvisor’s online rental property calculator to conduct investment property analysis on their preferred long term or short term rental.

Step 8: Finalize the Mortgage

You need to close the loan process and the underwriting process once you know the specifications of your exact investment property. If you’re already pre-approved, the process will be easier and shorter. It will help ensure you don’t miss out on the best investment opportunity you’ve located.

Step 9: Buy the Property

Last but not least, you need to buy your investment property. If this is the first time you invest in real estate, we’d strongly recommend hiring a top agent in your local market. They will be able to close the deal quickly and with the best possible terms for you.

Mashvisor provides state of the art real estate investment tools to help you make wise investment decisions and walk you through your investment journey. Please sign up here to start analysing the investment opportunities in both short trem and long term rental industry.

How to Get Approved for a Loan to Buy an Investment Property

Getting approved for an investment property loan depends on several different factors. However, the process is more or less the same for most of the best investment property lenders.

It includes the following steps:

- Using an online mortgage calculator (like the Mashvisor one) to determine what down payment and monthly mortgage payments you can afford. Consider what cash on cash return it will lead to.

- Choosing the best investment property lender for your financial situation and investing aspirations.

- Preparing all necessary documentation, such as bank statements, W-2 statements, federal tax returns, and financial information about the property you’d like to buy.

- Submitting your mortgage application online or in person.

Meanwhile, it’s essential to have worked on a solid credit history and credit score throughout. It is a basic requirement for most lenders.

Getting Started With the Best Investment Property and Lender

Citibank, Rocket Mortgage, and PennyMac are the three best investment property lenders for single family homes, different investment property types, and investors with good credit scores. Depending on your investment plans and financial situation, you can decide which of the three lending institutions matches your needs.

Meanwhile, you should make sure that you give enough consideration to the other steps in the process of buying a profitable investment property. Choosing a top lender is crucial. Selecting the right market, the best neighborhood, and a property with a high potential for your preferred rental strategy is equally important.

If you need help finding the best markets and the best long term and short term rental properties for sale, make sure to check out Mashvisor. Our tools will help you locate and analyze top-performing investment properties within your budget. Our mortgage calculator will assist you in setting up the best financing option, too.

To learn more about how Mashvisor can turn into your best friend in the real estate investing journey, schedule a free consultation with our consultants.