Those looking to invest in real estate should ensure you pick the best location for investment property. But how do you know what’s a good choice?

In this blog post, we’ll look at the different factors you, as a real estate investor, should consider when choosing a location for your investment property. Read on to find out more!

Table of Contents

- 6 Qualities That Make a Location Great for Investment Property

- 4 Challenges of Buying an Investment Property in 2023

- How to Find the Best Location for Investment Property

- 10 Best Locations for Investment Properties

The search for the best investment property will always point you back to one thing: the location. In the world of real estate investing, the location of a potential investment property matters a lot.

Location is key when it comes to investment properties, as it can determine the success or failure of the investment. It is important to research the area, the local economy, and the local real estate market to determine the best location for the investment property.

We will discuss the things you need to know about choosing the right location for an investment property, as well as give you some tips on finding the right property that meets your needs. We will show you data from Mashvisor of some markets you can consider if you plan to start a rental property business.

Let’s get started!

Related: What Is Real Estate Investing and How Does It Work?

6 Qualities That Make a Location Great for Investment Property

Investing in real estate can provide a steady stream of income through rental payments, but it’s important to pick the right investment property for maximum success.

Many qualities make a city or neighborhood a great place to invest in, such as the following:

1. Financial Stability

Look for cities or neighborhoods with a stable economy and low unemployment rate. Such areas typically offer cash on cash returns that are higher than other areas, making them the best locations for investment property.

You should also consider the value of real estate in the area and look for signs of growth in real estate values. Knowing the cash flow of rental properties in the area can also help you decide if it’s a wise financial decision for the long term. Investing in a cash-flow-filled rental property with low vacancy rates and high cash on cash return can be very profitable in the long run.

2. Quality Schools

One of the things that make a city or neighborhood attractive to families is the quality of schools within the area. Couples with young children looking to relocate are most likely to pick locations with good schools. So, when looking for the best location for potential rental properties, keep this in mind.

3. Access to Public Transport

Easy access to public transportation and transportation hubs is a major asset when looking for good investment properties.

Good public transportation and transportation hubs provide easy travel options to areas such as the city center, various commercial and residential areas, and other cities and towns. It is especially helpful for tenants who commute to work or school, as well as those who need access to recreation and entertainment venues.

A robust public transportation system increases the appeal of a city or neighborhood to renters, making it a great option for property investors looking to maximize their cash flow.

4. Public Amenities

Look for cities or neighborhoods with plenty of amenities, such as parks, shopping, and dining options, which are attractive to potential renters. Meanwhile, amenities can also help your cash on cash return by making your investment property more attractive to potential renters.

A city or neighborhood with plenty of public amenities makes for the best location for investment property. Amenities such as parks, shopping, and dining options can help you attract more potential renters and optimize your return on investment.

5. Low Crime Rates

Look at the crime rate and overall safety of a neighborhood, as it can significantly impact how successful your property will be. When choosing a neighborhood to invest in, we cannot stress enough how important it is to look at the crime rate and overall safety of the area.

A secure and safe neighborhood is often a major factor that can impact the success of an investment property. If you are able to identify such qualities in a city or neighborhood, you might have found a great location for your investment.

6. Income-Generating Potential

A good investment location also offers the potential for appreciation in value over time, allowing you to make a profit from your investment.

Cash on cash return is one of the most important indicators when you’re looking for a good city or neighborhood to invest in. It is essentially the ratio between the cash flow generated by a real estate investment and the cash you need to put into it initially.

For good cash on cash return, look for cities and neighborhoods with growing economies, low crime rates, and plenty of amenities.

Additionally, look at properties with the potential for higher rental income, as they can be more beneficial in the long run and provide more value for your cash.

Related: 20 Best Places to Invest in Real Estate in 2023

4 Challenges of Buying an Investment Property in 2023

If you’re thinking about investing in real estate, the right location is critically important. It can spell the difference between the success and failure of your investment.

Buying an investment property in 2023 can be a great way to build wealth, but it comes with its own set of challenges. One of the biggest challenges is finding the best location for investment property. It’s important to study the local market thoroughly and understand the potential for appreciation before investing in a property.

Additionally, you need to consider the cost of the property itself, as well as any potential repairs or renovations that may be needed. Another challenge is finding a reliable tenant and managing the rental property.

It’s important to understand the local rental laws and make sure you’re up to date on all the necessary paperwork. Lastly, financing can be a challenge. You need to consider the best loan option for you and make sure you have enough cash to keep your operations going.

Let’s take a quick look at these bumps in the road.

1. Understanding the Context of the Local Market

Knowing the actual market conditions of a particular market can be quite challenging, especially if you’re an out-of-town or out-of-state investor. Investing in your own backyard is already challenging as it is, but going beyond it is a different ball game.

As an investor, it will require you to log in more hours of research and analysis to ensure you’re getting the right information and data needed to make a wise investment decision. To get a better understanding of a particular market, you need to either go there physically or connect with a local real estate professional or investor.

2. Financial Costs of Buying an Investment Property

It comes as no surprise that real estate investing is generally expensive. Although there are still a few other avenues that allow you to invest in real estate with little to no money, buying an income property is generally costly.

Aside from the property prices (which can either go up or down, depending on the market conditions), you also need to factor in rehabilitation costs, closing costs, taxes, rental property insurance, and other fees and expenses.

3. Rental Property Management

If you’re in the market for rental properties, you also need to consider how you will manage them. Taking care of your own home is challenging enough. Managing a rental property and keeping it in tip-top shape is an added responsibility that not everyone can handle.

Some landlords and vacation rental owners who own properties near their places of residence have an easier time compared to those with investments outside their backyards.

A practical solution to this dilemma is working with a rental property management company to do the legwork for you. Although their services aren’t exactly cheap, they might be worth your while as they will free you up from doing the day-to-day tasks that come with rental property management. This gives you more time for other equally important pursuits.

Related: Top 8 Property Management Companies in 2022

4. Local Rules and Regulations on Rental Properties

Lastly, you need to find out what the limitations and restrictions are on rental properties in the area of your choice. Certain rules and regulations are put in place to protect both landlords and tenants. While counties and states may be lax with long term rentals, a lot of them have different rules when it comes to short term rentals.

If you’re intent on owning a vacation rental, knowing the different short term rental regulations will help you avoid any legal issues that may arise.

How to Find the Best Location for Investment Property

A desirable location with access to amenities and transportation will attract tenants and provide the potential for appreciation. That’s why it’s important to look for certain qualities when choosing an investment property in a city or neighborhood.

Public transportation, schools, shopping, and employment opportunities are all desirable features that make a city or neighborhood an ideal place to invest in a property. Additionally, property values tend to appreciate more quickly in areas with low crime rates, quality infrastructure, and well-maintained buildings.

When assessing the potential of an area and its ability to increase the value of your investment property, be sure to also look at any upcoming developments that can potentially bring more jobs and benefits to the area.

Knowing the key qualities of a desirable city or neighborhood can help investors make smart decisions relating to their property investments.

High rental demand in the area is also a key factor to consider when investing in a property. Areas with high rental demand will usually bring higher cash on cash return, which is attractive to potential landlords. You should also look for an area with low turnover rates and plenty of opportunity for tenant retention.

Due Diligence Is a Must

Doing your research prior to investing in a property can help you find an area that offers both high rental demand and cash on cash returns. When looking for the perfect city or neighborhood to invest in, you should take into consideration the cash on cash return, rental demand, and tenant retention rates.

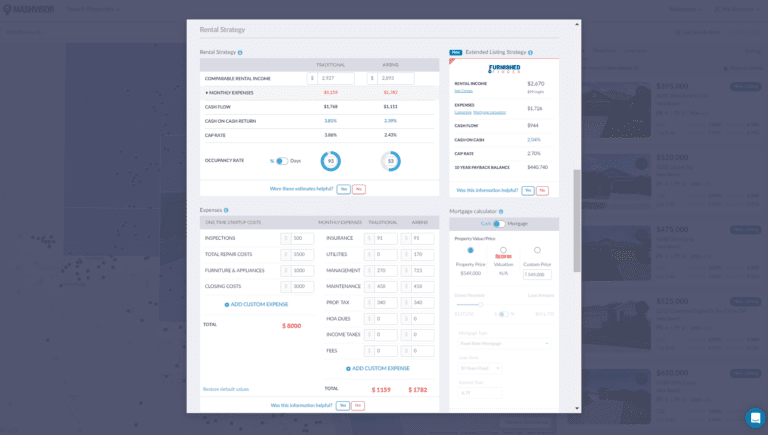

That said, one of the best ways to speed up the research process is to use a real estate platform like Mashvisor. Mashvisor specializes in helping real estate investors find investment properties in the most profitable locations of their choice. As a subscriber, you will be given access to real estate investing tools that will make the journey a lot easier for you.

For one, you will be given access to Mashvisor’s massive database that covers almost every area in the 2022 US housing market. It is regularly updated and uses data from reliable sources like Zillow, Realtor.com, the MLS, and Airbnb. Getting access to high-quality data will give you greater confidence in investing in 2023.

Mashvisor also comes with certain helpful features, like its Property Search tool that allows you to find any property in the US real estate market. Its real estate heatmap function helps you customize your search to highlight properties that match your investment criteria and goals.

Crunching numbers is also a lot easier with Mashvisor’s investment property calculator. Its calculator makes investment property analysis a lot easier to do. Finding the best location for investment property has never been easier.

Mashvisor provides state of the art real estate investment tools to help you make wise investment decisions and walk you through your investment journey. Please sign up here to start analysing the investment opportunities in both short trem and long term rental industry.

To find the best location for investment property and analyze it easily and quickly, you can use Mashvisor’s investment property calculator.

10 Best Locations for Investment Properties

Below is a list of some of the best markets for rental properties. If you’re looking for the best location for an investment property, you might want to check out the following cities.

5 Best Cities for Long Term Rentals in 2023

First up are the five best locations for long term rental properties. We went over Mashvisor’s huge database to narrow down the following list of the best long term rental markets for those interested in becoming landlords.

We prepared the list below using the following criteria:

- Each market should have a median property price of no more than $1,000,000

- Each market should have at least 100 active long term rental properties

- Each market should have a minimum of $2,000 in monthly rental income

- Each market should have a cash on cash return of 2% and above

- Each market should have a price to rent ratio score of 20 and higher

Based on Mashvisor’s December 5, 2022 location report, here are the top five markets for long term rentals:

1. Vero Beach, FL

- Median Property Price: $734,654

- Average Price per Square Foot: $339

- Days on Market: 94

- Number of Long Term Rental Listings: 658

- Monthly Long Term Rental Income: $2,592

- Long Term Rental Cash on Cash Return: 4.30%

- Long Term Rental Cap Rate: 4.36%

- Price to Rent Ratio: 24

- Walk Score: 78

Start searching for profitable long term rental properties in Vero Beach, FL.

2. Fountain Hills, AZ

- Median Property Price: $868,372

- Average Price per Square Foot: $357

- Days on Market: 92

- Number of Long Term Rental Listings: 122

- Monthly Long Term Rental Income: $3,600

- Long Term Rental Cash on Cash Return: 4.16%

- Long Term Rental Cap Rate: 4.20%

- Price to Rent Ratio: 20

- Walk Score: 39

3. Naples, FL

- Median Property Price: $992,412

- Average Price per Square Foot: $529

- Days on Market: 88

- Number of Long Term Rental Listings: 1,660

- Monthly Long Term Rental Income: $3,986

- Long Term Rental Cash on Cash Return: 3.62%

- Long Term Rental Cap Rate: 3.66%

- Price to Rent Ratio: 21

- Walk Score: 29

4. North Miami, FL

- Median Property Price: $771,038

- Average Price per Square Foot: $421

- Days on Market: 60

- Number of Long Term Rental Listings: 269

- Monthly Long Term Rental Income: $3,155

- Long Term Rental Cash on Cash Return: 3.43%

- Long Term Rental Cap Rate: 3.47%

- Price to Rent Ratio: 20

- Walk Score: 52

5. Lantana, FL

- Median Property Price: $903,306

- Average Price per Square Foot: $439

- Days on Market: 69

- Number of Long Term Rental Listings: 112

- Monthly Long Term Rental Income: $2,672

- Long Term Rental Cash on Cash Return: 3.35%

- Long Term Rental Cap Rate: 3.41%

- Price to Rent Ratio: 28

- Walk Score: 65

Start looking for the most profitable investment properties in any area of your choice with Mashvisor today.

5 Best Places for Short Term Rentals in 2023

Just like the list for long term rental markets, the list below is also filtered to give you the best locations to choose from. We used the following criteria to come up with the following list:

- Each market should have no more than $1,000,000 in median property price

- Each market should have a minimum of 100 active Airbnb properties

- Each market should have at least $2,000 in monthly rental income

- Each market should have a minimum of 2% cash on cash return

- Each market should have a 50% or higher short term rental occupancy rate

According to Mashvisor’s December 5, 2022 report, here are your top five vacation rental locations:

1. Harpers Ferry, WV

- Median Property Price: $399,075

- Average Price per Square Foot: $265

- Days on Market: 59

- Number of Vacation Rental Listings: 107

- Monthly Vacation Rental Income: $4,315

- Vacation Rental Cash on Cash Return: 7.77%

- Vacation Rental Cap Rate: 7.88%

- Vacation Rental Daily Rate: $220

- Vacation Rental Occupancy Rate: 57%

- Walk Score: 0

Start searching for profitable short term rental properties in Harpers Ferry, WV.

2. Schiller Park, IL

- Median Property Price: $284,199

- Average Price per Square Foot: $221

- Days on Market: 29

- Number of Vacation Rental Listings: 132

- Monthly Vacation Rental Income: $3,643

- Vacation Rental Cash on Cash Return: 7.64%

- Vacation Rental Cap Rate: 7.79%

- Vacation Rental Daily Rate: $165

- Vacation Rental Occupancy Rate: 57%

- Walk Score: 71

3. Columbia Heights, MN

- Median Property Price: $255,662

- Average Price per Square Foot: $139

- Days on Market: 49

- Number of Vacation Rental Listings: 327

- Monthly Vacation Rental Income: $3,175

- Vacation Rental Cash on Cash Return: 7.52%

- Vacation Rental Cap Rate: 7.68%

- Vacation Rental Daily Rate: $158

- Vacation Rental Occupancy Rate: 57%

- Walk Score: 82

4. Harvey, LA

- Median Property Price: $252,088

- Average Price per Square Foot: $160

- Days on Market: 80

- Number of Vacation Rental Listings: 799

- Monthly Vacation Rental Income: $2,868

- Vacation Rental Cash on Cash Return: 7.37%

- Vacation Rental Cap Rate: 7.53%

- Vacation Rental Daily Rate: $181

- Vacation Rental Occupancy Rate: 57%

- Walk Score: 61

5. Northlake, IL

- Median Property Price: $321,543

- Average Price per Square Foot: $204

- Days on Market: 59

- Number of Vacation Rental Listings: 118

- Monthly Vacation Rental Income: $4,013

- Vacation Rental Cash on Cash Return: 7.29%

- Vacation Rental Cap Rate: 7.42%

- Vacation Rental Daily Rate: $168

- Vacation Rental Occupancy Rate: 54%

- Walk Score: 33

Go to Mashvisor now to start looking for and analyzing the most profitable short term rental properties in any location of your choice.

Wrapping It Up

When it comes to investing in real estate, it is important to choose the best location for investment property. Consider factors such as rental demand, cost of living, long-term appreciation potential, taxes, and local amenities.

Doing thorough research on the area you plan to invest in can help ensure that you make a smart decision and find a property that will yield a good return on your investment. With the right planning and expertise, investing in real estate can be an excellent way to reach your financial goals.

It’s also a plus if you have the right tools to work with, such as the ones that Mashvisor offers its subscribers. Each user is given access to a massive database and several handy investment tools like a real estate heatmap and an investment property calculator.

Doing your due diligence with Mashvisor will make the entire research and analysis process a lot easier and faster compared to conventional methods.

Learn more about how Mashvisor can help you find the best deals in the most profitable markets by scheduling a demo now.