Real estate investors around the US are talking about investing in Opportunity Zones. But with over 8,700 designated areas, which are the best Opportunity Zones to invest in real estate? Using ROI data from Mashvisor’s investment calculator, we can show you 21 profitable locations.

But first…

What Is an Opportunity Zone?

Everyone may be talking about the major investment opportunities from this new national program, but that sometimes leads to more confusion on the subject. So, let’s clarify a few things about Opportunity Zones.

The Opportunity Zones Program is fairly new as it was introduced in the Tax Cuts and Jobs Act of 2017. Essentially, it is an investment program aimed at utilizing private capital (rather than tax-payer dollars) to encourage economic development and job growth in low-income communities. With an estimated $6.1 trillion in unrealized capital gain held by US investors, the program stands to make a real difference in distressed communities if successful.

So, what qualifies as an Opportunity Zone or “low-income community” exactly? As you will be investing your money in these locations, it’s helpful to know how they are defined. All census tracts designated as Opportunity Zones were qualified based on poverty levels and median family income compared to the state. Only 25% of census tracts within a jurisdiction could qualify for the label, with an extra 5% qualifying under different terms.

What this resulted in was over 8,700 Qualified Opportunity Zones- almost 12% of all census tracts in the US. Every state in the US has Opportunity Zones, which is why it helps to narrow down the best ones to invest in.

What Are the Tax Benefits of Investing in Opportunity Zones?

In order to encourage investment in Qualified Opportunity Zones, real estate investors are offered tax incentives, specifically capital gains tax incentives. There are three main tax benefits for Opportunity Zone real estate investments. Keep in mind that, to qualify, an investor must reinvest capital gains from a sale on an investment (property or otherwise) within 180 days of the sale.

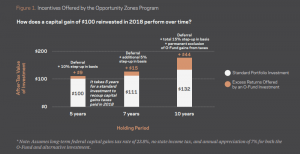

- Temporary Tax Deferral: Tax on capital gains invested in an Opportunity Zone will be deferred through December 2026 or until the investment is sold.

- Step-up in Basis for Invested Capital Gains: If the investment in the Opportunity Zone is held for 5 years, the basis for capital gains is increased by 10%. Another 5% increase is realized if the investment is held for 7 years, for a total of 15% exclusion from taxation of the original capital gains invested.

- Permanent Tax Exclusion: If an investment in an Opportunity Zone is held for 10 years or more, any realized capital gains from the sale or exchange of the investment is permanently excluded from taxation.

Here is an example of how these tax benefits would work for a $100 capital gain investment in an Opportunity Zone vs a typical Stock Portfolio:

Source: Economic Innovation Group

Source: Economic Innovation Group

What you will notice from the tax benefits is that they encourage long term real estate investments in Opportunity Zones. The longer you hold onto an Opportunity Zone investment, the more you stand to benefit. This is to ensure the communities will benefit from the program as well.

Learn more: What Are the Benefits of Investing in Real Estate in an Opportunity Zone?

How Does Investing in Opportunity Zones Work?

The Opportunity Zone Program does include both commercial and residential real estate. However, you must invest your capital gains through what is known as a Qualified Opportunity Zone fund within 180 days in order to realize the tax benefits. The IRS has released specific guidelines for what a Qualified Opportunity Zone Fund is, with plans to release more regulations by the end of this year. However, the basics of these Opportunity Zone Funds are as follows:

- The Qualified Opportunity Zone Fund is a US partnership or corporation

- 90% of the fund’s holdings must be invested in one or more Opportunity Zones

- Each Qualified Opportunity Zone Fund must ensure it follows the set regulations in order to qualify for any tax benefits

These funds invest in Qualified Opportunity Zone Property. In terms of real estate, the qualified property must be a business property which can include multi family real estate that is operated as a rental business. Because the purpose of the investment in the Qualified Opportunity Zone Property is to improve the community, the capital must go towards the development of new real estate property. Alternatively, the investment can be put towards the rehabilitation of an existing property. The cash investment for rehabbing property must be more than the price paid to buy the property. There is also a set time for the rehabilitation or development- it must be completed within 30 months of the purchase.

As of now, it is not clear how/if the IRS will regulate these funds in terms of distribution of cash flow from the operation of any real estate property after development/improvement. And while the tax benefits are clear, the main reason investors choose to invest in real estate is the annual cash flow. Looking at real estate appreciation of the locations is important of course. But it’s also important to understand the potential cash flow if the Qualified Opportunity Zone of your choice invests in a rental property business. That’s why we have selected the best counties with Opportunity Zones based on the annual return on investment from residential properties.

To help you decide: Should You Invest in a Qualified Opportunity Zone Fund in 2019?

21 Best Opportunity Zones to Invest in Real Estate

The following data from Mashvisor is for counties. Counties can have several census tracts. However, this will give you a good idea of how residential real estate property will perform if rented out within the census tracts of a general county.

1. Hall County, Texas

Median Property Price: $125,000

Traditional Cash on Cash Return: 10.5%

2. Bolivar County, Mississippi

Median Property Price: $59,900

Traditional Cash on Cash Return: 9.8%

3. Monroe County, West Virginia

Median Property Price: $170,250

Traditional Cash on Cash Return: 9.2%

4. Wilcox County, Alabama

Median Property Price: $69,000

Traditional Cash on Cash Return: 8.5%

5. Wilbarger County, Texas

Median Property Price: $60,000

Traditional Cash on Cash Return: 8.3%

6. Chickasaw County, Mississippi

Median Property Price: $140,000

Traditional Cash on Cash Return: 7.7%

7. Morehouse County, Louisiana

Median Property Price: $155,000

Traditional Cash on Cash Return: 7.5%

8. Blaine County, Oklahoma

Median Property Price: $53,000

Traditional Cash on Cash Return: 7.4%

9. Breathitt County, Kentucky

Median Property Price: $100,000

Traditional Cash on Cash Return: 7.1%

10. Hidalgo County, New Mexico

Median Property Price: $112,500

Traditional Cash on Cash Return: 7%

11. Dallas County, Alabama

Median Property Price: $65,000

Traditional Cash on Cash Return: 7%

12. Taliaferro County, Georgia

Median Property Price: $66,200

Traditional Cash on Cash Return: 6.9%

13. Renville County, Minnesota

Median Property Price: $122,400

Traditional Cash on Cash Return: 6.4%

14. Huerfano County, Colorado

Median Property Price: $75,000

Traditional Cash on Cash Return: 6.3%

15. Polk County, Minnesota

Median Property Price: $94,500

Traditional Cash on Cash Return: 6.3%

16. Starke County, Indiana

Median Property Price: $97,400

Traditional Cash on Cash Return: 6.2%

17. Evans County, Georgia

Median Property Price: $224,450

Traditional Cash on Cash Return: 6.1%

18. Pope County, Illinois

Median Property Price: $179,000

Traditional Cash on Cash Return: 6%

19. Rio Blanco County, Colorado

Median Property Price: $326,500

Traditional Cash on Cash Return: 6%

20. Concordia County, Louisiana

Median Property Price: $97,250

Traditional Cash on Cash Return: 6%

21. Lafayette County, Florida

Median Property Price: $191,250

Traditional Cash on Cash Return: 6%

To start analyzing ROI for different neighborhoods where you wish to invest in Qualified Opportunity Zone Funds, click here.

The Next Step

Now that you know where the best performing Opportunity Zones are in terms of residential property, it’s time to start looking for a Qualified Fund to invest in. Be sure to research potential funds well and understand how they plan to handle your investments as well as cash flow distribution to their investors.

The Opportunity Zone Program will hopefully prove to be beneficial to both investors and communities in need. Investing in Opportunity Zones can be a great way to make money, enjoy tax benefits, and give back to local communities. Consider investing in a fund in 2019 in order to realize the full benefits.