Buying rental property can be a lucrative way to make money in real estate and build wealth. However, not everyone who buys a rental property generates good returns. The best way to ensure success is to conduct a rental property analysis before buying an investment property. This is the only way to determine if your investment property will be profitable.

However, gone are the days of needing to fully rely on real estate professionals to find you a lucrative investment. Nowadays, there are many tools that provide real estate investors with numbers and calculations needed to properly evaluate an investment property.

If you are looking to buy a residential property for investment in 2021, there’s only one real estate investment tool you need to make the best investment decisions and be ahead of the competition – Mashvisor’s rental property calculator. Read on to learn why this is the best rental property calculator in town for 2021.

Why Do You Need a Rental Property Calculator?

The rental property calculator, sometimes referred to as the investment property calculator, is a digital tool that provides real estate investors with crucial numbers and insights needed to make smart investment decisions after inputting some basic data about income property.

Before rental property calculators came along, real estate investors would spend several weeks gathering data on the housing market and rental properties. They would then make calculations manually or use a rental property analysis spreadsheet to analyze rental data. Apart from being time-consuming, this method is prone to error.

Mashvisor’s rental property calculator enables you to do your rental property analysis accurately in just a matter of minutes. By using our rental property calculator, you can save lots of time and effort. The calculator uses traditional and predictive analytics to provide accurate results and eliminate the risk of making poor investment decisions due to wrong calculations.

What Does Mashvisor’s Investment Property Calculator Compute?

Mashvisor’s rental property calculator will provide you with the following key real estate metrics:

1. Rental Expenses

The first step in conducting an investment property analysis is to estimate the potential costs. This is because how much you spend on your investment property will have a huge impact on cash flow and rate of return.

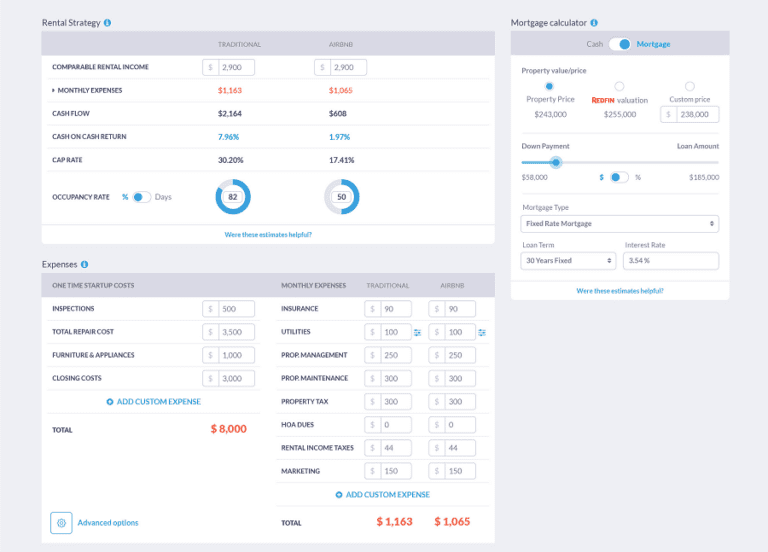

Our calculator helps investors to estimate the costs associated with buying and managing a rental property with just a click of the button. This includes one-time startup costs as well as the recurring monthly expenses. Here is a list of some of these rental expenses:

One-Time Startup Costs

- Home inspection

- Closing costs

- Furniture and appliances

- Repair costs

Recurring Monthly Expenses

- Property insurance

- Property tax

- Rental income tax

- Property maintenance

- HOA fees

- Utilities

- Cleaning fees

- Property management

2. Rental Income

It’s also crucial to determine how much your potential investment property will be making. The traditional way of getting this rental data is locating comparable properties in that neighborhood and finding out how much rental income they generate.

However, Mashvisor’s rental property calculator provides readily available accurate rental income estimates for you as well as nightly rates. The estimates provided are based on a detailed analysis of comparable rental properties in the area.

Related: The Top 6 Strategies to Boost Your Rental Income as a Real Estate Investor

3. Occupancy Rate

Rental demand is one of the key factors that determine the rate of return on a rental property. This can be measured through occupancy rates. Mashvisor’s rental property calculator forecasts the potential traditional and Airbnb occupancy rates for rental properties for sale in the US housing market.

4. Cash Flow

As a real estate investor, you should always go for positive cash flow properties. This means that the monthly revenue exceeds the expenses and, thus, you’ll be making money from your rental each month instead of losing money. With Mashvisor’s calculator, you’ll get readily available estimates of rental cash flow.

Related: How to Find Positive Cash Flow Properties

5. Return on Investment

It’s crucial that you buy an investment property with a good return on investment. With Mashvisor’s rental property calculator, you’ll be able to forecast your rental property ROI in terms of cap rate and cash on cash return.

The calculator also has a built-in mortgage calculator that shows you how your investment property financing method affects the rate of return on your rental property.

What Makes Mashvisor’s Rental Property Calculator Unique?

Apart from providing key numbers, our calculator also provides the following special features:

1. Optimal Rental Strategy

When buying an investment property, it’s important that you choose the right rental strategy if you want to maximize profits. In most real estate markets, renting out your income property as a traditional rental property or an Airbnb rental property will generate different revenues and ROI. Therefore, regardless of your personal preference, it’s imperative to look into both options to determine the optimal rental strategy.

Mashvisor’s rental property calculator helps you select the best way to rent out a rental property by providing you with rental data for both strategies. This way, you can quickly and easily compare them.

Related: Real Estate Investing: Traditional vs. Airbnb Investments

2. Real Estate Comps

Another important part of your rental property analysis is determining the fair market value of a rental property. This will help you assess whether the selling price is reasonable so that you avoid overpaying.

You can determine this by searching for what comparable properties in the area have sold for recently. Our calculator provides investors with real estate comps for rental properties for sale in the US.

Related: Real Estate Comparables: The Best Way to Find Them

3. Investment Payback Balance

The rental property calculator also provides the payback balance of buy and hold rental properties in the US. It forecasts the potential profit for a 10-year period.

The Bottom Line

In 2021, you don’t need to do your rental property analysis manually. Mashvisor’s real estate investment software has a rental property calculator that does all the work for you. With our calculator, you can make smart investment decisions quickly and easily.

To get access to Mashvisor’s rental property calculator, start out your 7-day free trial now.