We took a closer look at BiggerPockets Rental Property Calculator. Find out what we liked about it and what alternative tools you can use.

Before buying a property, real estate investors need to know whether it is worth investing in. To do that, they need tools that provide a proper investment property analysis, which can come in the form of a calculator.

An investment property calculator determines whether a property is profitable. To get the analysis, you have to input the following details:

- The property’s selling price

- Mortgage amount and terms, as well as interest rate, if any

- One-time expenses such as closing costs and rehabbing

- Expected monthly rental income

- Property appreciation rate

- Running expenses such as maintenance, management fees, and HOA

It then calculates important metrics such as the cash on cash return, cap rate, cash flow, and more. Investors can use these results to make their decision on whether to buy it or find a different property. One such tool is the BiggerPockets Rental Property Calculator.

In this article, we will review its features and see how BiggerPockets property analysis works. We will then lay out what we liked and did not like about it and then discuss an alternative tool. If you are thinking of using their calculator, read this first to find out if it is right for you.

What is BiggerPockets?

BiggerPockets is an online resource for real estate investors in the US. Aside from offering content and tools, they are well-known for their community of over 2 million members who engage with each other to offer advice, valuable tips, and partnership.

Instead of reviewing the platform as a whole, we will focus on the BiggerPockets Rental Property Calculator. To use this calculator, you must first create an account with the platform. Signing up is easy: provide your name and email address and set up your password.

Once you finish signing up, you can start using the BiggerPockets Rental Property Calculator as well as other tools like:

Other BiggerPockets Calculators

- Mortgage Calculator: Determines the loan amount you can afford

- Fix & Flip Calculator: Estimates your potential house flip profit

- House Wholesaling Calculator: Calculates your largest allowable offer when selling

- BRRRR Calculator: Evaluates the profitability of a potential fixer-upper

- 70% Rule Calculator: Determines the highest buying price for a property that you are considering based on the 70% rule of thumb

- Rehab Estimator Calculator: Estimates remodeling costs

- Airbnb Calculator: Powered by AirDNA, provides insights into an Airbnb property’s profitability

How BiggerPockets Rental Property Calculator Works

To start, here is an overview of the BiggerPockets Rental Calculator:

- Calculates the profit potential of a property if you rent it out

- Estimates potential monthly and annual cash flow

- Creates PDF reports to share with lenders or partners (available for pro members only)

- Estimates your returns on investment over time, up to 30 years

This tool is perfect for analyzing any rental property deal. For example, there is a particular house that you have been eyeing and want to know if it will make a good rental home. You can use the BiggerPockets Rental Property Calculator to find out. To do this, you must first enter the street address of the property you want to analyze. Then you will have to add information in each of the first four stages.

Stage 1: Purchase

In this stage, type in the values for the following:

- Property price: How much it is selling for or how much you are willing to pay

- Total closing costs: Fees and charges outside of the property price due at the end of the transaction. Users can also provide amounts for each fee in this category

- “I will be rehabbing this property”: If you are going to renovate this house before renting it out, check the box. This will let you enter the amount you plan on spending for this expense

- Property value growth (optional): The number (in percent) by which the property’s value increases over time

Stage 2: Loan Details

The next stage involves entering your Loan Details. But if you plan to buy with cash, check the box for “Cash purchase?” so you can skip this part. For those using financing, you need to include the following mortgage information in your calculations:

- Loan amount: How much you are borrowing from your lender

- Interest rate: The percentage of your loan balance that you pay for each month along with the loan repayment

- Points charged: Fees that you pay the lender in exchange for a lower interest rate

- Loan term: How long you will have to repay the loan, usually 15 or 30 years

Stage 3: Rental Income

After that is the Rental Income stage, which will ask you to enter the following details:

- Gross monthly income: Your total rental income before deducting expenses and taxes. Pro members have access to BPInsights, which lets them view comps and get an idea of the rent in the area they are looking at

- Income breakdown (optional): Use this if you will have more than one source of monthly income out of that property

- Income growth (optional): Forecasted increase in income over time

Stage 4: Expenses

Finally, there is the Expenses stage. You will need to type in the numbers for the following information:

- Property taxes: BPInsights usually has this; can be set to annual, quarterly, or monthly payment

- Insurance: Payments to protect your property and rental income such as private mortgage insurance or landlord insurance. It can be set to annual, quarterly, or monthly payment

- Repairs and maintenance: How much you will need to maintain the property

- Vacancy rate: The time that your property is not occupied by a tenant can cost you; type in what % out of a year you think it will be vacant

- Capital expenditure: How much you will be spending on improving your property’s value such as remodeling or upgrading

- Management fees: The amount you expect to pay a property manager to oversee this particular house

- Utilities such as gas, electricity, water, sewer, garbage, and HOA fees; keep it blank or $0 if you will have your tenant pay for these

- Other expenses: Add the amount of any other costs not previously mentioned; you may also add a breakdown of such fees by clicking “Advanced: provide expense breakdown”

Stage 5: Results

Once you are done and have verified the accuracy of the information you provided, click “Finish analysis” to view your results. The first part of BiggerPockets analysis shows an overview containing:

- Monthly cash flow

- Total monthly income

- Total monthly expenses

- Cash on cash returns

- 5-year annualized return

- Monthly mortgage payments

Below this section, you will find a recap of the details you input. If you have to edit any of the numbers displayed, you could adjust the slider under the value you want to change, and the results will update automatically.

Then you will see the Returns section, which shows the following metrics:

- Net operating income (NOI): Rental income minus operating expenses (excluding mortgage)

- BiggerPockets cash on cash return: How much you earned back from the amount you spent in one period; if paying with a mortgage, you divide your annual income by the total mortgage payments you made in a year

- Pro forma cap rate: Measured by dividing your annual NOI by the total acquisition cost (purchase price plus rehab expenses)

- Purchase cap rate: Measured by dividing your annual NOI by the purchase price

The results page will also show the 50% rule, which is allocating 50% of your monthly income to your monthly expenses. If the expenses you input exceed 50% of your income, then you might see a negative cash flow.

At the bottom, you will see a line chart containing the change in property value, equity, and loan balance over the duration of your loan. This section also shows a breakdown of your cash flow, mortgage payment, profit if sold on that year, and annualized return for each year. These will help you decide when it would be a good time to resell the property.

Stage 6: Sharing

Once you are satisfied with the results, you could save your changes so you can access the report again later. You could also share the link to the results page, while pro members would be able to export it into PDF format.

What We Think of the BiggerPockets Rental Calculator

There are a few things that we liked about the calculator and a few key features that we think could be improved.

What We Liked

Overall, we think that the BiggerPockets Rental Property Calculator provides a complete analysis for investors who already have a property in mind. Including property value appreciation and income growth in their calculations also offers a more accurate estimate. The results page is neatly laid out, making it easy to understand and shareable to lenders or partner investors. You can also save the report for later in case you want to access it again.

Showing the change in property value, equity, and loan balance over time is a great feature as well. It would help investors better plan their next steps, like for how long they will keep the house before selling it.

What Could Be Improved

If you are still in the property search phase and would like to access the analytics while you browse houses in your area of interest, using this tool might be inconvenient. For example, you are still looking for a property, so you will have one browser tab open for your preferred property marketplace. Then you will need to have another tab open for the BiggerPockets ROI Calculator.

It also does not automatically provide estimates for income and expenses on the calculator, forcing you to input all of the data yourself. This may be a hindrance for beginners who are not yet familiar with these amounts. Although there are links that provide more information about each metric, you will be spending more time reading up on them instead of using average amounts in the area.

Another thing we noticed is that the Loan Details stage does not ask you whether you are availing of a fixed-rate or an adjustable-rate mortgage. By default, the calculator assumes that you will be getting a fixed-rate loan. But if you end up getting an adjustable-rate mortgage, then your initial projections may be off.

Alternative Tool: Try the Mashvisor Investment Property Calculator

BiggerPockets Rental Property Calculator is a good tool, and there is no doubt that their platform has provided a great community for real estate investors to network with each other and learn more about the industry. However, its calculator’s limitations might make you want to look for an alternative. Mashvisor can help you with that.

Our calculator is included in every property listing page on our website to help you determine whether the home is worth investing in as you search. You do not need to open multiple tabs to refer to different tools. Everything you need to analyze the property is on the listing page.

We have also entered amounts in certain variables using the average amounts used in the area where your property of interest is located, but you are also free to edit these numbers. And every time you change a variable, the results will automatically update; no need to refresh the page.

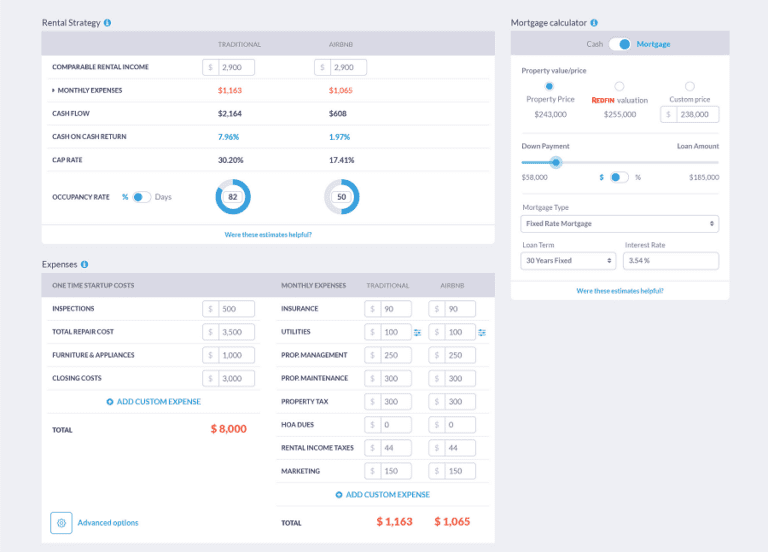

Another thing, the BiggerPockets Rental Property Calculator is mainly for analyzing traditional rental investments. If you want to calculate your potential Airbnb income on the same property, however, you will have to use a different calculator. Mashvisor’s calculator provides analysis for both rental strategies at the same time and on the same page. This way, you can make quick comparisons and decide on which strategy to go for.

Aside from getting an accurate property analysis, you can also use our platform for every phase of your purchase: from searching for a rental home to contacting the seller.

To get access to our real estate investment tools, click here to sign up for a 7-day free trial at Mashvisor today, followed by 15% off for life.