Beginner and experienced real estate investors should always look for the best properties for sale to make the most out of their investment. In order to find such income properties, an investor needs to do a number of calculations to evaluate and analyze different properties until he/she finds the best one to invest in.

As you can imagine, analyzing properties upon properties in the housing market will take months to complete, and even then you may not find an income property that suits your needs and goals. To avoid this happening to you, our solution is to buy a rental property calculator. What is this tool? Why do property investors need it? Where can they find one? Keep reading to find the answers.

What Is a Rental Property Calculator?

Also known as an investment property calculator, it’s an online application that provides property investors with an analysis of income properties in their housing market. Essentially, this investment tool eliminates the need for spreadsheets while conducting a real estate market analysis and an investment property analysis.

So, if you buy a rental property calculator, you can more easily determine the profitability of the property you’re looking at for investing purposes. It’ll also allow you to use predictive analytics to estimate or forecast your potential return on investment efficiently and make wise investment decisions.

What Numbers and Data Does This Tool Provide?

1) Cash Flow

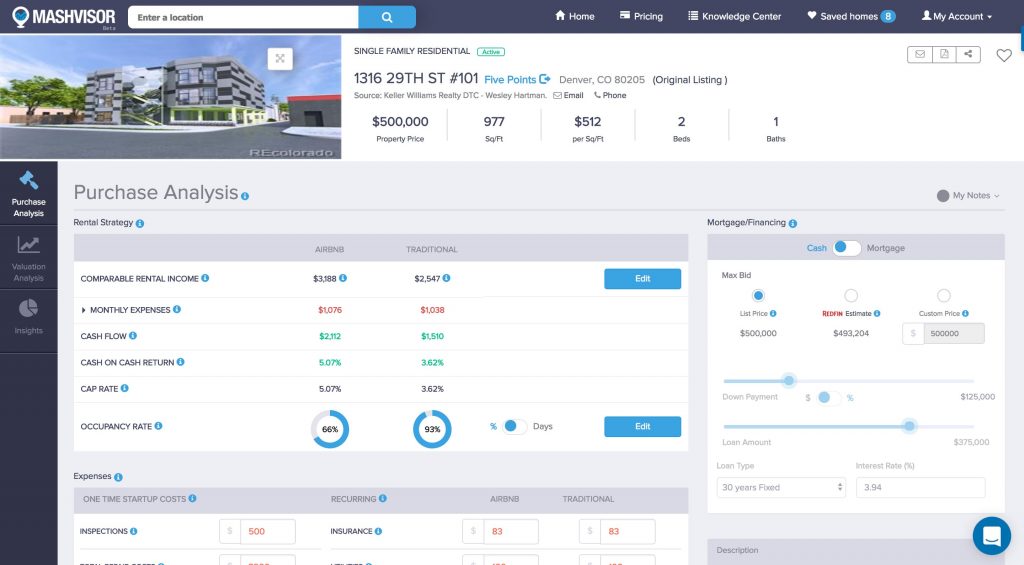

This is the amount of money left after all rental expenses, principal payments, and interest are covered. An advanced investment property calculator will provide real estate investors with these expenses in addition to the potential rental income that the property will generate. The tool will then crunch the numbers and project the property’s cash flow. As a real estate investor, it’s important to estimate your future cash flow as you want to assure buying a positive cash flow income property to make money in real estate.

2) Cap Rate

Short for capitalization rate, the cap rate is the ratio of the net operating income over the property’s value. This is an important real estate metric to calculate before buying an income property because it measures the return on investment or the profitability of an income property. When you buy a rental property calculator, you’ll have access to readily calculated cap rate ratios for thousands of income properties for sale across the US housing market. As a result, you can easily identify the best places to invest in real estate with high cap rates.

3) Cash on Cash Return

This is another real estate metric to measure the return on investment from income properties. However, it equals the net operating income over the amount of cash actually invested. Thus, the cash on cash return takes into account the real estate investor’s down payment, closing costs, repair costs, etc. Calculating all these expenses manually is likely to end in error, but if you buy a rental property calculator, the tool will do the calculation for you leading to more accurate results. Similar to cap rate, property investors also get readily calculated CoC returns of income properties.

To further understand the difference between these two real estate metrics, read “Cap Rate vs. Cash on Cash Return.”

4) Interest Rate

An advanced investment property calculator will also offer various options for the type of mortgages that real estate investors take to buy investment properties and the interest rates associated with each type. A real estate investor needs to determine the best mortgage loan to take with reasonable interest rates. This is because mortgage payments are a huge portion of the rental expenses associated with owning an income property which could affect positive cash flow. When you buy a rental property calculator, you can determine the best type of mortgage with interest rates that you can afford.

What Is This Tool Used For?

Neighborhood Analysis

The first use of the data from an investment property calculator is to find the best areas to invest in. Location, as you should know, plays a key role in successful real estate investing. By location, we mean both the city and neighborhood of your income property. Real estate investors who buy a rental property calculator can use the different filters of this tool to analyze different neighborhoods. For example, you can see which neighborhoods have higher rental rates, cap rates, cash on cash return, or which offer more affordable rental properties for sale. Consequently, the real estate investor can identify which neighborhood will provide better investment opportunities.

Property Analysis

After selecting your neighborhood of choice, the investment property calculator becomes more detailed, allowing you to narrow down your property search. The property analysis will start off by showing you the listing price, square footage, monthly rental income, cash on cash return, and the cap rate of each income property for sale in that neighborhood. Moreover, it’ll show you the optimal type of property to buy for real estate investing – yet another reason to buy a rental property calculator.

An advanced investment property calculator also shows property investors a comparison of how the property will perform as a traditional rental vs an Airbnb rental. For example, you can see which rental strategy generates higher rental income, cap rate, and cash on cash return. This, in turn, allows you to determine the optimal rental strategy that’ll yield a higher return on investment.

Another reason to buy a rental property calculator is the tool’s financing/mortgage feature. This is the section that allows a real estate investor to choose the best investment property financing method (cash or mortgage). If you’re going for a mortgage, the tool allows you to adjust the loan type, loan amount, down payment, and interest rate. Not only will this help you have a better understanding of future cash flow but it’ll also help you set your budget and the amount of down payment you can afford to pay.

The final part of property analysis that is made easy after you buy a rental property calculator deals with the rental expenses. There are one-time costs (like inspections, repairs, furnishing, etc.) and recurring costs (insurance, utilities, property management, property tax, etc.). A real estate investor can edit both costs using the investment property calculator to see how a change in any of them will affect cash flow and overall return on investment.

Where Can You Buy a Rental Property Calculator?

So now you understand what a rental property calculator is and why a real estate investor needs to buy one. The only question that remains is where can I buy a rental property calculator. Well, there are a number of platforms that offer this investment tool for property investors. However, not all of them offer the same features. The only calculator that offers everything described in this blog post is Mashvisor’s rental property calculator!

When you sign up with Mashvisor, you’ll get access to other great investment tools – like the Property Finder and Heat Map – that’ll surely boost your real estate investing career.

To start looking for and analyzing the best income properties in your city and neighborhood of choice, click here.

The Bottom Line

The main advantage you’ll get when you buy a rental property calculator is efficiency as it helps investors save a lot of time and work. Property investors who use this tool also make smarter and wiser investment decisions that maximize their return on investment and boost their careers. Finding the most profitable income properties in the housing market becomes easier after you buy a rental property calculator! So, what are you waiting for? Click here to start your 14-day free trial with Mashvisor and enjoy a 20% discount after!

To learn more about how we will help you make faster and smarter real estate investment decisions, click here.

Have you tried using a rental property calculator to invest in real estate? What did you think of this tool?