Is buying a vacation rental property a good investment? Can you make good money with a vacation rental property?

There is a lot of debate over this in the real estate community. While some swear by the cash flow they’ve earned from vacation rentals, others say that buying a vacation rental property is the worst thing you could do.

Let’s put an end to the debate in the best way – by looking at the hard numbers. Mashvisor is an Airbnb analytics software and our vast database holds information on the average performance of vacation rental properties in cities across the US housing market. Below is a small sample of this vacation rental data. It’s a list of the 5 best places for buying a vacation rental property based on Airbnb cash on cash return.

Related: 5 Lies You’ve Heard About Investing in Vacation Rental Properties

5 Best Places to Buy a Vacation Rental Property

This list is based on Airbnb data alone. Be sure to check local Airbnb regulations to ensure that renting out an investment property on Airbnb is legal in the city of your choice.

#1. Greenville, NC

- Median Property Price: $270,335

- Price per Square Foot: $114

- Average Airbnb Daily Rate: $98

- Airbnb Rental Income: $2,713

- Airbnb Cash on Cash Return: 7.0%

- Airbnb Occupancy Rate: 71%

#2. Mesquite, TX

- Median Property Price: $214,285

- Price per Square Foot: $135

- Average Airbnb Daily Rate: $125

- Airbnb Rental Income: $2,528

- Airbnb Cash on Cash Return: 6.5%

- Airbnb Occupancy Rate: 58%

#3. Abilene, TX

- Median Property Price: $277,286

- Price per Square Foot: $133

- Average Airbnb Daily Rate: $153

- Airbnb Rental Income: $3,349

- Airbnb Cash on Cash Return: 6.5%

- Airbnb Occupancy Rate: 60%

#4. Pottstown, PA

- Median Property Price: $284,582

- Price per Square Foot: $143

- Average Airbnb Daily Rate: $116

- Airbnb Rental Income: $2,587

- Airbnb Cash on Cash Return: 6.2%

- Airbnb Occupancy Rate: 55%

#5. San Angelo, TX

- Median Property Price: $329,605

- Price per Square Foot: $144

- Average Airbnb Daily Rate: $130

- Airbnb Rental Income: $4,377

- Airbnb Cash on Cash Return: 6.2%

- Airbnb Occupancy Rate: 70%

Related: The Best Places to Buy a Vacation Home in Texas

So, Is Buying a Vacation Rental Property Profitable?

Looking at the data, there is only one answer and that is: Yes, buying a vacation rental property is profitable.

Now, you might think it odd or even biased to make this call based on a small list of the cities dubbed the best places for buying vacation rental properties. But this vacation rental data does prove something:

There are real estate investors in the US who currently own vacation rental properties and they are making a nice profit for themselves.

But it also proves something else:

Simply owning a vacation rental property doesn’t guarantee profitability. The real estate investors who own vacation rentals in the cities above are making money likely due to a few common factors, one being the location.

Related: What Do I Need to Know About Buying a Vacation Rental Property?

Essentially, buying a vacation rental property can be profitable. It’s been profitable for many in the past, is currently profitable for many now, and can be profitable for you in the future. How? We’ve outlined a quick guide below on how to buy a vacation rental property to ensure profitability.

That way, you will eventually become one of the statistics that proves buying a vacation rental property is, indeed, a good investment.

How to Buy a Vacation Rental Property That Earns You a Profit

We’re focusing on the buying process as the main path to success. That’s because you can easily be an amazing Airbnb host, but if you own a bad vacation rental property in the wrong city, then you’re out of luck.

#1. Choose a Profitable Location for Your Vacation Rental Investment

We’ve already provided you with a great list of cities above where you should consider buying a vacation rental property. You can also check out this list as well: 50 Best Cities for Airbnb Rental Income in 2020.

If you’d rather go hunting for the right location on your own, understand the basics of vacation rental market analysis. This is just a fancy way of saying research the real estate market of your choice. Find out the following:

- Is operating a vacation rental property legal in the city? What Airbnb regulations apply?

- How many tourists visit each year? Are vacation rentals in demand in the city? What is the average Airbnb occupancy rate?

- How much are vacation rental hosts earning in the city?

Want a tip? Consider buying a vacation rental property in Florida. The Florida real estate market is well-known for being Airbnb-friendly and hosts there earn a high return on investment thanks to the large number of tourists that visit every year. Check out The 20 Best Places for Buying a Vacation Home in Florida in 2020.

#2. Find the Right Neighborhood

Once you’ve found a good city for buying a vacation rental property (based on data), it’s time to identify a good neighborhood. For this, it’s best to turn to a neighborhood data provider like Mashvisor. Not only can Mashvisor give you the data and analytics you need on a specific neighborhood you’re interested in, but the real estate investment software actually helps you compare areas across a city and find the best neighborhood.

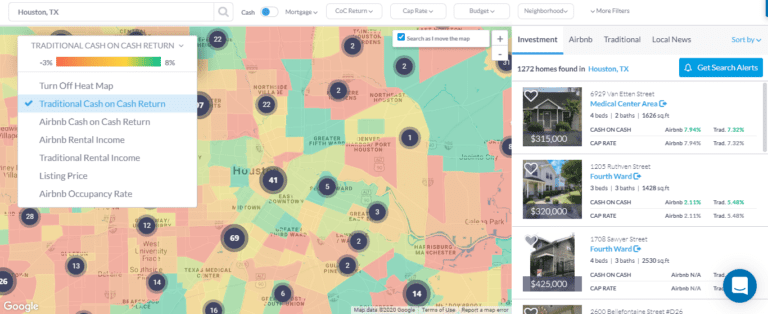

Check out Mashvisor’s Real Estate Heat Map:

As you can see from the image above, there are filters you can use to conduct your neighborhood analysis. The ones you will want to take advantage of are the listing price, Airbnb rental income, Airbnb cash on cash return, and Airbnb occupancy rate. Selecting each of these will allow you to find a great neighborhood that hits all four metrics.

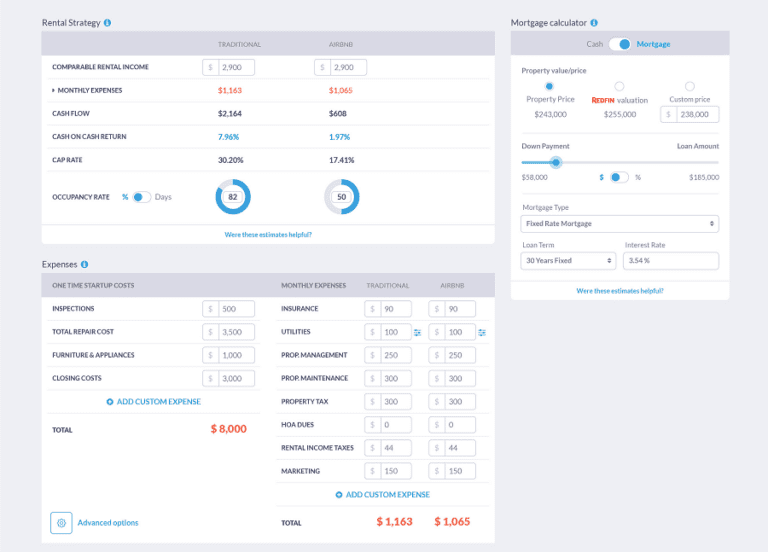

#3. Carry Out a Vacation Rental Property Analysis

Remember, you’re buying a vacation rental property as an investment. Many people fail with these rental properties because they look at it as a “vacation home” and not a “vacation rental”. What I mean is they don’t look at the numbers of the deal:

- What kind of vacation rental income will you generate? Will it cover mortgage payments?

- Will the investment property be a negative or positive cash flow property?

- What kind of return on investment will you get?

- How much are the vacation rental management fees?

You have to ask these kinds of questions and get answers for every vacation rental property for sale that interests you. The easy way to do this is with a vacation rental income calculator. This powerful real estate investment tool will let you know how much rental income, cash flow, and cash on cash return you’ll earn. You’ll also get to see figures like the cap rate and rental comps for every vacation rental property for sale you analyze using this tool.

Try Mashvisor’s Vacation Rental Income Calculator by signing up for a 7-day free trial today.

The Verdict: Yes, It Can Be Profitable

To sum up, yes vacation rental properties can be profitable real estate investments. You just have to be sure you’re approaching the strategy in the right way. While you may be able to enjoy your new vacation home from time to time, never forget it is an income-producing asset and should be treated as such during the buying process. If you keep this in mind, you are sure to reap the profits.