Buying rental property remains one of the best ways to build your wealth and secure your financial future through consistent cash flow.

With that being said, property investing doesn’t always generate positive returns. Before you invest your hard-earned money, it’s important to be well-versed with the things to consider when buying a rental property to maximize return. How effectively you purchase your income property will determine whether or not you’ll see excellent returns in the long run.

If you are looking to buy a rental property, here are 6 important tips that will help you maximize return.

1. Work With a Real Estate Agent

If you are buying your first rental property, it is highly recommended that you hire a real estate agent when buying rental property. An experienced buyer’s agent usually has the extensive market knowledge, knows what to look for, and will help you in negotiating the best deal. They also have good real estate networks and, therefore, have access to off-market listings.

Basically, a good real estate agent will guide you through the whole process of finding and buying a profitable rental property. With their real estate knowledge and experience, you will be able to avoid costly mistakes that many beginner investors make when buying rental property.

2. Find a Profitable Location

“Location, location, location” is a popular real estate mantra that emphasizes the importance of location when investing in real estate. Before you begin your rental property search, the first thing you should do is find a profitable location. You want to invest in a location with good infrastructure, a growing job market, reasonable property taxes, access to public transportation, public amenities, and low crime rates. Such a market is likely to have a larger pool of potential renters and growing rental rates.

Finding the best places to buy rental property requires a thorough rental market analysis. Mashvisor makes the work easier for you as it gives you access to accurate real estate data for cities and neighborhoods in the US.

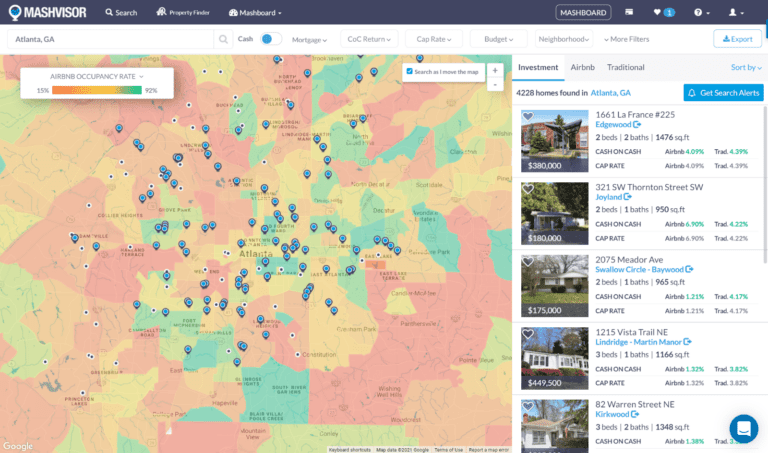

To find the best-performing cities in the US housing market, go over some of Mashvisor’s location blogs. After you have selected a city to invest in, you can conduct a neighborhood analysis using Mashvisor’s real estate heatmap. This real estate investment tool will help you locate the best-performing affordable neighborhood in the city using filters such as average property price, cash on cash return, Airbnb occupancy rate, and rental income.

3. Run the Numbers

When buying rental property, you should always base your decisions on numbers and not emotions. Conducting a comprehensive rental property analysis is the only way to determine if a rental property for sale will generate positive cash flow and a high return.

With Mashvisor’s rental property calculator, you can get a full analysis with the click of a button. It does this by using the latest machine-learning algorithms and predictive analytics.

The calculator provides you with a wide variety of useful property data and analytics including:

- Rental income

- One-time startup costs

- Monthly recurring expense

- Airbnb cash flow

- Traditional cash flow

- Airbnb occupancy rate

- Real estate comps

- Real estate payback balance

4. Choose the Optimal Rental Strategy

Another thing to make sure of when buying a rental property to maximize return is choosing the optimal rental strategy. Different locations usually yield a different return on investment for Airbnb properties and long-term rental properties. Therefore, when you buy a rental property for sale, it’s important to determine which rental strategy will be more profitable.

If the location is right, buying a vacation rental property might be the right move for you. In other cases, investing in long-term rentals will make more sense. The key here is to always base investment decisions on reliable comparative real estate data. Fortunately, Mashvisor’s rental property calculator provides performance data for both Airbnb and traditional rentals. This makes it easier for investors to compare and determine the optimal rental strategy. All the numbers are based on the performance of actual Airbnb and traditional rental comps in the neighborhood.

5. Select the Right Investment Property Financing Method

You have a myriad of options when it comes to financing your real estate investment. While conventional mortgages are the most common financial method for investors, you may not always qualify for the loan you want. In some cases, the long processing time of conventional loans may not be ideal for your situation. This is why you need to do thorough research to choose the financing option that suits your needs and investment goals.

Take time to check rental property mortgage rates and shop around to compare different investment property loans and lenders. This will increase your chances of finding the best deal for your financial situation and investment goals. You can save a lot of money in financing costs by simply picking the right investment property loan. In turn, this will increase the return on your income property.

If you are a first-time real estate investor and you aren’t sure which financing option is ideal for you, consider speaking to an experienced mortgage broker. They have access to different investment loans and can help you pick the financing option that suits you best.

6. Conduct a Thorough Home Inspection

While it’s important to know what to look for when buying a rental property, it’s equally important to know what to avoid. While a property may be selling below market value, you should take into account how much money and time it would cost to make the house ready for tenants.

A rental property that is old and in poor condition will need a lot of repair and renovation work. Regular maintenance for such properties can be costly and might negatively affect your rental property cash flow. Such rental homes should be avoided, especially if you are a first-time real estate investor.

It’s advisable to hire a professional home inspector to thoroughly inspect the property for potential problems. Never make the mistake of buying rental property before doing an inspection.

The Bottom Line

While buying rental property is a lucrative business, it’s not a get-rich-quick scheme. In fact, if you aren’t cautious enough, you might find yourself stuck with a rental property with a negative return. Your rate of return can vary depending on a number of factors such as the property’s location, how you’ve financed the property, the condition of the property, and your rental strategy.

To optimize the performance of your property investment over the long run, you need to use the right strategies and tools when searching and buying a rental property. If you use the tips we’ve given you in this article whenever you are buying a rental property, you’ll be able to maximize your rate of return. Be sure to use Mashvisor’s real estate investment tools to find profitable locations and rental properties in the US housing market.

To get access to our real estate investment tools, click here to sign up Mashvisor today.