As a real estate investor, you need to learn how to calculate property value as this can aid you in making informed decisions. Knowing the value of an investment property can help you determine whether it will make a good investment, as well as its overall profitability.

This comprehensive guide is designed specifically for real estate investors who seek to master the art of property valuation. In this article, we will discuss why it is important to know how to calculate property value accurately, the factors that influence an investment property’s value, and the different property valuation methods.

Key Takeaways:

- Property value is the current market value of an investment property.

- Investors need to calculate property value to determine an investment property’s profitability.

- A property value estimate is typically determined using its assessed value, appraised value, and/or fair market value.

- You can use a cap rate calculator to value income-generating properties.

- Property value is influenced by certain factors like location, market trends, property condition, and legal considerations.

- You can calculate property value using different methods: comparative market analysis, income approach, cost approach, and sales comparison approach.

Introduction to Property Valuation in Real Estate Investment

Property valuation is an important component in real estate investment as it helps assess the profitability of a property. Note that the value of a property fluctuates with market conditions and other factors that affect real estate prices. As an investor, you should do your own research to calculate property value accurately before making any investment decision.

What Is Property Value and Why Does it Matter?

Find out what property value is and why it’s crucially important for investors

Property value generally refers to the current estimated fair market value of a real estate property and is a critical aspect of a comprehensive real estate analysis. It is essentially the ideal selling price for a property when it is listed in the market today.

As an investor, knowing how to calculate property value correctly is crucial because it helps you determine whether or not it will generate gainful returns. Finding the correct property market value can help you maximize your profits by making the right decisions for your investment.

For example, if you’re buying a rental property, knowing the property value can assist you in setting the correct rental rate. It can also tell you whether or not repairs are needed to help increase its value and consequently push up your rental price and occupancy rate too.

If you’re planning to buy a property for future resale, finding the house market value tells how much profit you can possibly earn. It also shows the appreciation rate of the property, helping you decide the best time to sell and how much you should sell it for to gain profits, allowing you to maximize your returns.

The Basics of Calculating Property Value for Investors

Knowing how to calculate home values can influence your investment strategies, potential profitability, and investment decisions regarding buying, selling, renovating, or renting properties. To do this, investors need to do thorough research, gather necessary real estate data, and conduct proper real estate investment analysis.

Here are tips to gather real estate data:

- Utilize Online Real Estate Platforms: You can use websites like Zillow or Redfin to gather real estate data. But if you want extensive data on property listings, sales, neighborhood comps, rental strategies, and market trends, Mashvisor is your best option.

- Check Public Records: Property sales, tax assessments, and deeds are public records often available online through local government websites.

- Network with Local Real Estate Agents: Agents have firsthand market knowledge and access to Multiple Listing Service (MLS) data.

- Join Real Estate Investment Groups and Forums: These can be valuable sources for shared experiences and local market data.

- Analyze Economic and Demographic Data: Understand the broader economic environment, including job growth, population trends, and development plans in your area of interest.

When gathering data, make sure to avoid these common pitfalls:

- Not Choosing the Right Online Data Source: Some online data can be outdated or inaccurate. Make sure that your online source is reliable and updated. When in doubt, use Mashvisor – this real estate analytics platform provides the most accurate and updated real estate data, helping you make right investment decisions.

- Ignoring Local Market Specifics: Real estate markets can vary greatly even within the same city. Understand local dynamics.

- Overlooking Property-Specific Issues: Don’t ignore factors like property condition, legal disputes, or zoning changes.

- Neglecting Historical Data: Current trends are important, but understanding historical market patterns is also crucial.

- Failing to Regularly Update Data: Real estate markets change quickly. Regularly update your data to ensure it reflects current conditions.

Performing real estate valuation manually can be time-consuming and tedious. Fortunately, there are real estate valuation tools you can use to help calculate property value correctly.

Mashvisor offers all the necessary information related to a particular investment property. It provides real estate tools (including the property value heat map) that are useful for both new and experienced real estate investors. This helps investors decide where and what property to invest in, what investment strategy to use, and how to improve their returns.

Different Types of Property Valuations

To calculate property value, investors and real estate experts often consider these three main types of property valuation:

- Assessed Value

The assessed value of a property is the dollar valuation assigned by local tax assessors for the purpose of calculating property taxes. This figure can change as the property’s market value appreciates or depreciates. However, it is often lower than the actual market value at which the property could sell.

For instance, a home might have a market value of $500,000 based on current real estate trends, buyer demand, and its features. However, the local tax assessor may determine its assessed value to be $400,000, reflecting a range of factors including historical values, general market conditions in the area, and specific assessment rules.

- Appraised Value

The appraised value of a property is the estimated worth determined by a professional home appraiser through the process known as investment property appraisal. This value is based on various factors such as the property’s size, location, condition, features, amenities, any upgrades it may have, and the sale prices of comparable homes in the area.

A home appraisal is crucial in the property buying process, as mortgage lenders typically require it before approving a loan to ensure that the property is worth the amount being borrowed. This value can influence the loan amount, terms, and even the viability of the purchase.

For example, if you’re looking to buy a house listed at $350,000, the lender will commission an appraisal to verify this value. The appraiser might assess the home’s value at $340,000 based on the sales prices of recently sold homes with similar features in the same neighborhood, state of repair, and amenities. In most cases, lenders will approve a loan amount based on the appraised value.

- Fair Market Value (FMV)

In real estate investing, the fair market value of a property is the price that a willing and informed buyer would pay and a willing and informed seller would accept under normal conditions in an open and competitive market.

This value is influenced by various factors, including the local housing market’s condition, the property’s size, location, condition, and any unique features. You can use an online fair market value calculator to determine the current fair market value of the property.

For example, consider a house in a sought-after neighborhood with excellent schools and amenities. If similar houses in the area have recently sold for around $450,000, and this house is in comparable or better condition, its fair market value would likely align with this range.

However, if the local real estate market is experiencing a downturn, with fewer buyers and decreasing home prices, the FMV might be lower than expected, reflecting the current market state. FMV is a crucial concept in real estate transactions, providing a realistic estimate of what the property could sell for at any given time.

Understanding the Importance of Calculating Property Value Accurately

Accurate property valuation is essential for a successful real estate investing, as it directly impacts several aspects of your investment, including:

- Assessing Your Potential Return on Investment (ROI)

Investors should learn how to calculate market value of property accurately to make profitable decisions about purchasing, selling, or renting out real estate assets.

One of the best ways to determine an investment property’s ROI is its cap rate, which is the rate of return that takes into account the property’s net operating income and current market value.

- Securing Financing

You need to calculate property value accurately to secure financing, as lenders rely on property valuations to determine the loan amount they are willing to offer.

In general, a property appraised at a high value can lead to more favorable loan terms and higher borrowing limits. An accurate appraisal also protects lenders by ensuring the loan amount does not exceed the property’s worth, mitigating their risk in case of default.

- Determining the Purchase Price

If you calculate property value accurately when you’re buying an investment property, you will know if the asking price is fair enough based on the home’s actual value.

Similarly, if you’re planning to sell your home, an accurate property valuation helps you determine the right listing price without compromising your opportunities to maximize your profits.

How Property Valuation Affects Your Investment Strategy

When you calculate property value precisely, you can estimate the potential income a property might generate through rent or its future resale value, providing you with a clear vision on its ROI. This assessment helps in formulating the right investment strategies that maximize profits and minimize risks.

Using the property value, you can determine the best investment strategy by calculating the cap rate of an investment property. Cap rate, or capitalization rate, is the rate of return of a property based on its estimated net income and present market value. To calculate the cap rate, you need to divide the net operating income by the property’s current market value.

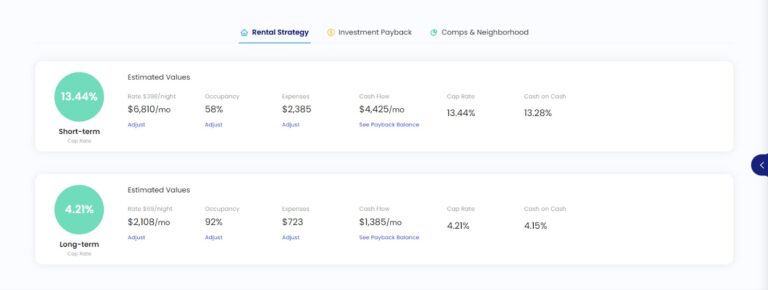

While calculating cap rate manually is feasible, this can be prone to error. Fortunately, you can use Mashvisor’s cap rate calculator, which provides accurate real estate data that can help you find the best rental strategy for a particular investment. This helps you decide whether the property is best for long term or short term rentals.

Mashvisor Cap Rate Calculator

Mashvisor provides state of the art real estate investment tools to help you make wise investment decisions and walk you through your investment journey. Please sign up here to start analysing the investment opportunities in both short trem and long term rental industry.

Risks of Overestimating Property Value

Overvaluation can lead to paying too much for a property, resulting in lower returns or even losses. As an investor, you need to calculate property value accurately to avoid several risks, such as:

- Inflated Purchase Prices: Overestimating a property’s value can lead to paying more than it’s worth, affecting your potential ROI. This becomes problematic if the market drops, potentially resulting in a property valued lower than its purchase price.

- Financing and Refinancing Difficulties: Loans are typically based on the property’s appraised values. An overestimated value may secure a larger loan, but this could lead to challenges in loan repayment, especially if the property’s real value is lower (which means your rental rate could also be lower). It can also adversely affect refinancing options if the property is later valued lower.

- Higher Property Taxes and Insurance Premiums: Property taxes and landlord insurance costs are often linked to the assessed value of a property. Overestimation can lead to unnecessarily high taxes and fees, burdening the property owner financially.

- Misaligned Investment Strategies: Investors may make suboptimal decisions, like missing profitable opportunities or holding properties based on inflated valuations. This can disrupt investment portfolios, leading to reduced liquidity and higher market risk exposure.

Key Factors That Influence Property Value

Several factors influence property value, affecting its overall worth. As an investor, you need to take these factors into account when you calculate property value to ensure you get an accurate figure.

Here are the things that you should consider:

Location: The Prime Determinant of Property Value

The old adage “location, location, location” still holds true, especially when finding the best investment property. Location is the primary factor that determines the value of a property as it dictates desirability and accessibility.

Properties situated in desirable locations, such as city centers, affluent neighborhoods, or scenic areas, typically command higher prices due to their increased demand. Also, properties in these locations have high appreciation rates – meaning, you can benefit from high returns should you decide to sell the property in the future. In addition, since prime locations tend to have higher rental demands, you can charge high rental rates too.

Conversely, properties in less favorable locations, possibly due to high crime rates, poor infrastructure, or lack of nearby facilities, tend to have lower values and low appreciation rates. These areas also have lower demand for rentals, which can adversely affect your occupancy rate as well as your rental income.

The Role of Market Conditions in Valuing Real Estate

Market trends provide a broader picture of how property values change in real estate. When there are more people looking to buy homes than there are homes for sale (high demand and low supply), property prices usually go up. In contrast, if there are many homes available but fewer buyers (high supply and low demand), prices tend to drop.

Interest rates also matter – lower rates can make buying homes more affordable, increasing demand and prices, whereas higher rates can have the opposite effect. In short, the balance of supply and demand, along with the overall economic environment, are essential factors to consider when you calculate property value.

Physical Characteristics and Their Impact on Value

The physical characteristics of a property, like its size, age, layout, and condition, greatly impact its value. A home with bigger square footage and more bedrooms and bathrooms usually costs more than a smaller one.

Similarly, newer properties or those that have been well-maintained or recently renovated are typically valued higher because they require less repair and upkeep. Unique features like a modern kitchen, a spacious yard, or a swimming pool can also increase a property’s appeal and price. In simple terms, the better a property looks and functions, the more it’s usually worth.

Legal and Economic Factors in Property Valuation

Legally, things like zoning laws, property rights, and any restrictions on property use can affect a property’s potential and, therefore, its value. For instance, a property zoned for both residential and commercial use might be more valuable than one zoned for residential use only.

Economically, factors like the overall health of the economy, employment rates, and inflation can influence property values. A strong economy with high employment typically leads to higher property values as more people can afford to buy homes. In contrast, during economic downturns, property values may decrease as fewer people are buying homes.

These legal and economic factors combined help determine how much a property is worth.

4 Different Methods to Calculate Property Value

Here are 4 methods to calculate property value

Real estate investors can use any of the following methods to calculate property value:

Comparative Market Analysis

Comparative market analysis is a technique used to calculate property value by comparing it with similar properties that have recently been sold. This method looks at key features like location and features.

The comparable properties should be located in the same neighborhood, or at least within the same area or city. In addition, to make a more accurate property valuation, you also need to consider the comps’ features, like amenities, whether they are furnished or not, size, and the properties’ condition and age.

Mashvisor’s comparative market analysis tool helps you check neighborhood comps so you can see how much similar properties within the same area are worth. Not only that, but you can also see how much they rent for based on your chosen rental strategy (either for short term or long term rentals).

Income Approach

The income approach is a real estate valuation method that calculates a property’s value based on the income it generates. It’s especially useful for commercial and residential properties that earn rent. Here’s how it works:

- Estimate Gross Income: Determine the property’s expected yearly income from rent.

- Account for Vacancies and Losses: Subtract estimated losses from vacancies and other factors.

- Subtract Operating Expenses: Deduct costs like maintenance, homeowners insurance for rental property, and utilities to find the net operating income (NOI).

- Determine Cap Rate: This is the expected return rate from the property, calculated as the discount rate minus the property’s growth rate.

- Calculate Property Value: Divide the NOI by the cap rate.

For example, imagine a long term rental property that could make $50,000 annually from rent. If there’s a 10% vacancy rate plus other estimated losses and operating expenses are $12,000, the NOI would be:

NOI = $50,000 – ($50,000 x 10%) – $12,000 = $33,000

If the desired return on investment is 10%, the property’s value would be:

Property Value = $33,000 / 0.10 = $330,000

This method is useful for investors to estimate the worth of income-generating properties and their potential returns.

Cost Approach

The cost approach will calculate property value by estimating what it would cost to build the house again from scratch using today’s construction standards and costs. This includes the cost of the land, labor expenses, construction costs, cost of building materials, and legal and insurance costs.

For example, if rebuilding a house would cost $200,000 for materials and labor, and the land is worth $50,000, then the property’s estimated value using the cost approach would be $250,000. This method is particularly useful for new or unique properties where comparable sales data might not be available.

Sales Comparison Approach

The sales comparison approach values a property by looking at the prices of similar properties recently sold in the same area. It uses the mean or median value of these prices as a guide. This method also takes into account details like the property’s size, number of rooms, amenities, condition, and other important features.

For example, if three similar houses in a neighborhood sold for $300,000, $320,000, and $350,000, the approach might use the median price of $320,000 as a basis to calculate property value of comparable houses (real estate comps) in the same area. This method is helpful to understand what buyers are willing to pay for similar properties.

Making Smart Real Estate Investments with Accurate Property Value Calculations

To be a successful real estate investor, you need to know how to calculate property value accurately so you can make well-informed decisions. You can check the assessed value, appraised value, and fair market value of the property to know how much it’s really worth.

Use the comparative market analysis, income approach, cost approach, or sales comparison approach when evaluating an investment property. Make sure to consider the key factors that affect the property value when choosing an investment as these factors can also greatly impact your overall profitability.

Mashvisor provides state of the art real estate investment tools to help you make wise investment decisions and walk you through your investment journey. Please sign up here to start analysing the investment opportunities in both short trem and long term rental industry.