How to calculate ROI on rental property is one of the first things on real estate investors’ minds concerning investment properties.

The ROI, or return on investment, is an important aspect of real estate investing. Investors use it to gauge if a property is worth purchasing or not. When projecting the ROI of a particular investment, you must consider several factors before you can come to a conclusion.

Table of Contents

- What Is ROI in Real Estate?

- Why ROI Matters to Real Estate Investors

- How to Calculate ROI in Real Estate

- What’s the Best Way to Calculate ROI on Rental Property?

Below, we will discuss how to calculate ROI on rental property, why doing so is important, and what factors one should consider when computing property profitability.

Making money in real estate is the primary reason why business-minded people choose to invest in rental properties. Their goal is to not just break even but to actually make a decent profit.

To make sure that a certain property helps them meet their goals, investors do their digging to find out if it can give them a positive cash flow and generate good investment returns.

In this article, we will not only show you the ROI’s importance but teach you how to go about computing it in the most efficient way possible, with the help of a rental property calculator. And while there are several online calculators available to you out there today, we will show you why Mashvisor’s investment property calculator is the best one for the job.

What Is ROI in Real Estate?

ROI in real estate is a metric that enables investors to determine whether to proceed with the acquisition or purchase of a property. ROI, or return on investment, provides an estimate of the profit margin as a percentage of the cost. It’s important for us to understand what ROI is before we proceed.

In business ventures, your investment is the resource you put into either making an acquisition or improving an organization or company. In most cases, the resources include, but are not limited to, time and money. The profit from a particular business or financial venture refers to the return on investment.

Return on investment is the monetary value calculation of an investment against its cost. It’s how much money your investment will make for every dollar you put in. One can compute the ROI using the following formula:

ROI = (Profit – Cost)/Cost

For instance, you made an initial investment of $1,000 and earn $10,000 from it. Using the formula above ($10,000 – $1,000/1,000), your ROI is 900%. Or, let’s say you invested the same amount and realized a net profit of $600 afterward. With the same formula, you’ll end up with 60% as your ROI.

As a more realistic example, let’s say an investment opportunity allows you to grow your money by 15% per annum. You decide to put in $10,000 as your initial investment. If things go well, after a year, your $10,000 investment will have grown to $11,500.

A 15% ROI is already considered exceptional under normal circumstances. Stocks typically gain around 10% annually. On the other hand, rental property investments in the US go between 8.6% and 10.6% in terms of ROI.

Why ROI Matters to Real Estate Investors

The concern now on people’s minds aside from how to calculate ROI on rental property is why it actually matters to real estate investors.

Just like any other type of investment, investing in real estate is something that people get into in the hope of creating an additional income stream. The ultimate goal of any investor is to make money from their investment.

Thus, calculating the yield on rental property investments is crucial as it gives them an idea of how much they can make from the money they put into it. It makes one an informed investor.

Knowing the potential ROI on a property allows one to estimate the costs and expenses associated with it, as well as the potential rental income based on rental comps. In such a way, whatever rental property types investors are considering, it makes it easier for them to conduct a proper investment property analysis.

Factoring in Specific Challenges in Computing ROI in 2023

We survived COVID-19 and are now in a post-pandemic era, where things are going back to normal. While the pandemic disrupted the real estate industry, certain benefits came with it, such as lower property prices and record-low mortgage rates.

With COVID-19 out of the way, we are now facing different challenges in 2023. Knowing how to calculate your ROI on investment properties given such challenges will come in very handy.

It is especially important in 2023, given the economic instability we went through the past year. While the overall US real estate housing market is cooling down, median property prices are still high. In 2022, we saw mortgage rates peak at a little over 7%. Experts and analysts agree that we will not see mortgage rates hit record lows like in 2021.

In addition, inflation rates are also high currently. With the Fed’s aggressive anti-inflation stance, owning and maintaining a long term or short term rental property will cost more than before.

A wise investor will take all of the above things into consideration to ensure that whatever amount they put into a particular investment property will be recovered and will grow. It is why knowing how to calculate your ROI will help you make more informed decisions. It is particularly helpful for you as a real estate investor, especially if you’re taking up a mortgage.

How to Calculate ROI in Real Estate

Computing for an investment return is easy as long as you know the ROI formula real estate investors use. We’ve already given the basic ROI formula earlier. Here are some formulas on how to calculate ROI on rental property:

Cash Transaction ROI

Computation for ROI will depend on the type of transaction made. Knowing how to calculate ROI on rental property becomes more accurate if you consider the kind of purchase made. The transaction can be either paid for in cash or by means of financing.

For cash transactions, let’s take a look at a sample scenario to give you an idea of how to calculate ROI on rental property:

Let’s say you paid $100,000 for a real estate property in cash. In addition, you also shelled out $1,000 for closing costs and another $9,000 for home improvements. They bring your investment total to $110,000 for the said rental property.

You decide to rent out the property to a tenant for one full year at a rate of $2,000 per month. After a year, you collected a total of $24,000 from your rental property. However, during the entire year, you needed to cover a few expenses, such as property taxes, insurance, and other costs.

The expenses ate up around $2,400 for the year or $200 per month. It means that your annual return for the investment property is $21,600 ($24,000 – $2,400).

To know your ROI for your investment, you should divide your annual return by the total amount of cash invested in the property. By tweaking the formula given earlier, here is what we get:

ROI = Profit – Expenses/Cash Investment Cost

ROI = $24,000 – $2,400/$110,000 = 0.196

In this case, the return on your $110,000 investment is 19.6%.

Financed Transaction ROI

Now, since not every investor holds enough cash to expand their real estate portfolio, a few need to take mortgages and other financing options to get into the real estate market.

Computing for ROI on mortgaged investment properties is slightly different from properties purchased with cash. They can be a bit more involved. Here’s another example to understand better how to calculate ROI on mortgages and other costs with financed properties.

Let’s assume that you decided to purchase the same property for $100,000. However, you decided to take out a mortgage instead of paying in cash. You will need to consider the down payment for the mortgage on top of the closing costs and costs for repairs.

Let’s say that the mortgage you took out required 20% of the purchase price as a down payment. If the property costs $100,000, 20% of it is $20,000. And since you took out a mortgage, expect closing costs to be higher, which is quite typical for almost all mortgages.

Instead of paying just $1,000 for closing costs, you are asked to shell out $2,500 upfront. You then spend $9,000 to repair and remodel the property to make it suitable for your needs.

How to Calculate ROI on Mortgaged Properties

To know what your out-of-pocket expenses are, you need to get the sum of your down payment, closing costs, and home repair costs. In this case, your total out-of-pocket expenses were $31,500 ($20,000 + $2,500 + $9,000).

Since you went with a mortgage, you also need to factor in the ongoing costs associated with it.

Assuming you took a standard 30-year fixed-rate mortgage with 6.47% interest (the standard rate as of this writing, according to Bankrate), your monthly payments (principal + interest) for the $80,000 you borrowed would be $787.41.

You will still need to consider your monthly expenses, so we’ll add another $200 per month (or $2,400 a year), bringing your monthly expenses up to $987.41.

You decide to get the property rented out for a year at $2,000 monthly. It means you end the contract with $24,000 to your name. The next thing you need to do is deduct your expenses from your income to determine your cash flow.

Monthly Cash Flow = $2,000 (Rental Income) – $987.41 (Monthly Expenses)

Based on the given information and the formula above, your monthly cash flow is $1,012.59 or $12,151.08 for one whole year.

To know how to calculate ROI on rental property that is financed, divide your annual return by the total amount of cash (out-of-pocket expenses) it cost to purchase the property.

ROI = Annual Cash Flow/Out-of-Pocket Expenses

ROI = $12,151.08/$31,500 = 0.385

It brings your annual ROI, in terms of percentage, to 38.5%.

You can use the same formula for short term rental properties but you’ll just need to tweak it a bit since the monthly income for short term rentals varies according to season.

Cap Rate vs Cash on Cash Return

Two terms that are used interchangeably are cap rate and cash on cash return. While they may seem similar, there is a whole world of difference when determining ROI and profitability. Investors should know the difference between the two so they know which metric works best on how to calculate ROI on rental property.

The cap rate formula is fairly simple to understand. It just takes a property’s net operating income and divides it by the property’s purchase price. While it is a good way of projecting ROI, it doesn’t take into account financing methods. It can be a problem for those who intend to take out a loan or mortgage.

On the other hand, cash on cash return is a metric used to determine ROI that considers the financing method used to acquire the property. It takes your pre-tax net profit and divides it by the total amount of cash used to buy the property.

A lot of investors use cash on cash return as their main metric to determine investment profitability. It is particularly helpful when they need to go with a financing option or take out a mortgage to purchase real estate.

What’s the Best Way to Calculate ROI on Rental Property?

The smart investor will always look for the best real estate strategy that will get them the best returns. It can only be done with accurate market data and the right real estate investment tools.

What Is Mashvisor?

Mashvisor is a website intended to make real estate investment a breeze for all types of investors, whether they’re veterans or newbies.

Investing in real estate is a matter that should be taken seriously. It is not a get-rich-quick scheme. Real estate investing takes plenty of hard work and commitment to pull off. It entails countless hours of research and due diligence.

Market research, property analysis, number verification, and all sorts of information and data-gathering methods take too much time and lots of money to accomplish. It is especially true if an investor is considering out-of-state properties.

Doing it all manually in today’s modern world is such a waste of time and money. Websites like Mashvisor were created to make research and real estate market analysis easier and faster. The websites allow investors to look for the best possible deals in a fraction of the time.

One of Mashvisor’s strengths, on top of its massively accurate real estate database that covers almost all markets across the US, is its property analysis feature. With its wide coverage and up-to-date database, real estate analysis has never been easier.

While Mashvisor allows investors to search for properties in different states, its investment property calculator is quite useful for those who want to calculate ROI on rental properties.

How Does the Investment Property Calculator Work?

So, let’s say you’re an investor looking for a rental property and you use Mashvisor’s Search Page to find several properties that are publicly listed on the MLS. You use its filters and zoom in on a particular market and neighborhood. In a matter of minutes, the website will give you a list of potential investment properties that match your criteria.

After identifying the properties that interest you, you go to the Property Analytics Page, or the investment property calculator, to crunch the numbers and make sure the math checks out.

Unlike typical calculators, Mashvisor’s online real estate investment calculator helps investors identify which among their prospects is the most profitable choice.

In line with our topic on how to calculate ROI on rental property, Mashvisor’s investment property calculator comes with a number of features. They allow investors to see if a property is good enough to generate a handsome return and cash flow.

Financing Calculator

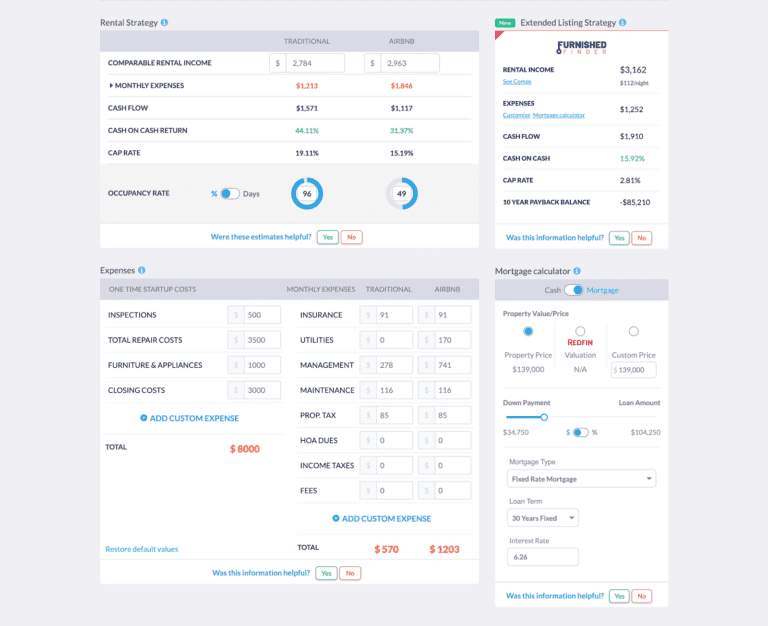

For those who plan to purchase an investment property through financing, Mashvisor’s mortgage calculator is very helpful as it is highly interactive.

It means that depending on the values entered, the calculator makes the necessary adjustments and recomputes the projected ROI on rental property. It allows users to fiddle around with the numbers. They can see which mortgage type, down payment amount, and loan amount will yield the most profitable results.

Mashvisor’s financing calculator allows investors to make the necessary adjustments and recompute the projected ROI on a rental property, depending on the loan amount, down payment amount, and mortgage type.

Rental Strategy

Another very helpful feature of the investment calculator is that it also gives investors an idea of which rental strategy works best for a particular property. It will give you a side-by-side comparison of what investors can expect depending on their chosen rental strategy.

After comparing the rental strategies, investors can decide which steps to take moving forward.

Expenses

The investment calculator also takes into account overhead expenses involved in the property purchase. The expenses include both one-time startup costs and recurring expenses. Generally, the expenses drawn by the system are based on rental comps and local rates for both long term and short term rentals.

For a more accurate calculation, we recommend that investors do their own research on the local rates. Once the user’s entered all the necessary information, the calculator will do the math for you.

When it’s done, it will not only show you an estimate of the possible expenses but also give you an estimate of how long it will take to recover your investment. Basically, it will give you a projected monthly and annual performance.

How to Use Mashvisor to Calculate ROI on Rental Property

All that said, it is fairly easy to use Mashvisor to calculate your ROI on any rental property investment. As mentioned above, even newbies can use it and not have a hard time.

Step 1: Go to Mashvisor.com

All you need to do is go to Mashvisor.com, enter a location of your choice in the search field, and click Start Analyzing.

It will then take you to a page that shows you a map of the area. Every available property listed on the MLS is represented on the map with a pin. Hover your pointer over one to get a summary of what the property offers. If you click on it, you will get a pop-up window that will show you a more detailed description of the property.

You will also notice that the other half of the page contains three tabs labeled Investment, Long-term, and Short-term. When you click on each of the tabs, you will see all the available properties listed on the market under each category.

Step 2: Choose a Property to Analyze

Once you’ve chosen a property, you may then start analyzing it and its potential returns using the Investment Property Analysis feature of the website. Based on the information given by the system on each property, you may calculate the associated costs and expenses. You can then compare them against the neighborhood’s average rental income and cash on cash return.

Mashvisor uses actual rental comps in its database so you can come up with the most accurate and realistic ROI projections when you do your rental property analysis.

Step 3: Repeat as Needed

The excellent thing about using Mashvisor is you can analyze up to five different properties simultaneously. But if you need to analyze more potential investment properties, you can easily go through the entire process again.

Mashvisor provides state of the art real estate investment tools to help you make wise investment decisions and walk you through your investment journey. Please sign up here to start analysing the investment opportunities in both short trem and long term rental industry.

Final Words

When discussing how to calculate ROI on rental property, it is very important for investors to always make sure all the bases are covered. You can do so by performing thorough research and extensive due diligence.

You need to take into account the type of purchase, whether it’s an all-cash transaction or financed. Also, make sure to factor in all the costs and expenses associated with purchasing and operating a rental property business.

Doing so increases the accuracy of your calculations. Of course, it also helps when you use the right tools to help you perform your rental market analysis. This is where Mashvisor comes in.

Mashvisor can help you calculate your ROI on a potential rental property investment. It can point you to the right property in the most profitable neighborhoods.

Learn more about how Mashvisor can help you find the best deals in the most profitable markets by scheduling a demo now.