One of the most important metrics for a rental property’s profitability is the capitalization rate. Thus, a cap rate calculator is a must-have.

Cap rates might seem simple and easy to calculate, especially compared to other ROI measures. However, calculating the cap rate becomes complicated when you want to compare several markets to decide where to invest and multiple investment properties to decide which one to buy.

Table of Contents

- What Is the Cap Rate Formula?

- How to Calculate Cap Rate

- What Is a Cap Rate Calculator?

- Why Is the Cap Rate Calculator Important?

- What Does the Best Cap Rate Calculator Do for Investors?

- Cap Rate Frequently Asked Questions

To stay competitive in the real estate investments business in 2023, an online cap rate calculator is a necessary tool. Using an Excel spreadsheet to evaluate ROI before buying a long term or vacation rental property is now obsolete.

Moreover, it does not suffice to gain access to just any online or mobile app. You need to make sure that you use the best cap rate calculator for 2023 to make profitable investment decisions.

In this article, we will show you why Mashvisor offers the top cap rate calculator. Briefly, Mashvisor helps you look for and analyze long term and short term rentals to ensure high ROI before buying. Keep reading to learn more about the tool, as well as everything else you need to know about capitalization rate.

What Is the Cap Rate Formula?

The capitalization rate formula is straightforward and easy to understand, so understanding how to calculate cap rate is not complicated. It is the ratio of the net operating income to the sale price or the current market value of the property. It doesn’t take into consideration whether you take a mortgage loan or pay the property in cash; therefore, your debt payments and the loan interest rate are not factored in.

The cap rate formula is presented in the following mathematical equation:

Cap Rate = Net Operating Income/Sale Price or Current Market Value x 100%

The net operating income (NOI) is the difference between the annual gross rental income that the rental generates and the costs of owning, managing, and renting out the property. To calculate the NOI accurately, the time when the house is vacant should be accounted for. It is because it can directly affect the income the investor makes.

Net Operating Income Formula:

NOI = Gross Rental Income – Operating Expenses – Vacancy Expenses

Meanwhile, the sale price, as mentioned, is usually the price that the real estate investor paid initially for buying the house. However, you may also use the current market value of the rental property instead to keep your ROI estimate more up-to-date.

How to Calculate Cap Rate

Calculating the cap rate for any rental property is done by simply dividing the NOI by the current market value according to the cap rate formula. The result should be a positive number expressed as a percentage. The higher the number, the better the return on investment. Let’s look at an example to fully comprehend how to calculate the cap rate as one of the most popular ROI measures in real estate.

Cap Rate Calculation Example

To understand fully “how do you calculate a cap rate?“ let’s take a look at this example:

Investor A bought Rental Property 1 for $250,000, and he rents it out for $1,000 per month. The cost of managing and operating the rental property is $600 a month, including property tax, property insurance, utilities, and everything else. Investor A is an excellent landlord, so his rental is occupied all the time, leading to a zero vacancy rate.

Step 1: To calculate the capitalization rate of Rental Property 1, first we need to know the net operating income of the house using this formula:

NOI = Annual Gross Rental Income – Annual Operating Expenses – Vacancy Expenses

Based on our example:

Annual Gross Income = Monthly Rental Income x 12 = $1,000 x 12 = $12,000

Annual Operating Expenses = Monthly Operating Expenses x 12 = $600 x 12 = $7,200

Vacancy Expenses = $0

Therefore, the net operating income is as follows:

NOI = $12,000 – $7,200 – $0 = $4,800

Step 2: Use the cap rate formula to calculate the cap rate of Rental Property 1.

Cap Rate = NOI/Current Market Value x 100% = $4,800/$250,000 x 100% = 1.92%

So, after a few simple mathematical calculations, we’ve come to the conclusion that the capitalization rate of Rental Property 1 is 1.92%.

Is this a good cap rate? Or is this a bad capitalization rate? Should Investor A have bought this house as an investment?

Read on to find the answers to the above real estate investing questions.

What Is a Cap Rate Calculator?

The cap rate calculator is one of the must-have omni real estate investment tools in 2023, especially for beginner investors. It is a type of rental property calculator, which calculates cap rates for rental properties quickly and efficiently. The app uses the net operating income and the market value of the house to find the property’s rate of return with no need for manual inputs from the investor.

Calculating the cap rate of a single rental property that you already own is relatively easy. As a responsible real estate investor, you must keep records of your monthly rental income, recurring operating costs, and vacancy rates.

What is more complicated is performing valuation on a number of listings for sale to decide which yields the best ROI so that you can purchase it. That’s where such an omni real estate investing tool becomes particularly useful.

Why Is the Cap Rate Calculator Important?

The goal of every real estate investor should be to constantly add new properties to their investment portfolio. Preferably, you should be buying an investment property every two to three years. That’s where knowing how to calculate cap rate efficiently becomes particularly handy – in deciding which rental property to buy.

At any point in time, there are hundreds of thousands of active listings in the US housing market, including MLS listings, foreclosures, bank-owned homes, short sales, and off market properties.

What is even more overwhelming from the perspective of beginner real estate investors is that they are no longer constrained to the parameters of their location. Online analysis tools and professional long term and short term rental property management have made out-of-state real estate investing feasible. With this, you can earn rental income from various states.

Can you imagine having to calculate the capitalization rates of even just a few dozen of the long term or vacation rentals for sale to choose the best investment property to buy for your particular needs?

To say the least, it will be an extremely difficult and time-consuming process.

It is the reason why using the best cap rate calculator in 2023 to help you compute multiple properties’ cap rates in different markets is recommended. Using a cap rate calculator is not only faster but also more reliable than doing manual computation in an Excel spreadsheet, which is prone to error.

An omni cap rate calculator will take the property value and perform a rent estimate. It will also determine all operating expenses and ultimately calculate the cap rate. It will help you see the rental’s potential income and ROI, not for one but for hundreds of investment properties that you are eyeing.

Related: What Is Included in the Cap Rate Formula?

What Does the Best Cap Rate Calculator Do for Investors?

The best cap rate calculator in 2023 makes the life of real estate investors easier. It turns three months’ worth of research into 15 minutes of work. It works by optimizing real estate market analysis and investment property analysis to provide reliable estimates of the cap rates. Most importantly, it can calculate the cap rates of an unlimited number of rental listings.

All in all, a good cap rate calculator helps investors make profitable real estate investment decisions faster and more confidently, based on big data and reliable figures. If you want to maximize your income from a rental property, it’s crucial to choose a reliable cap rate calculator.

What Information Should a Cap Rate Calculator Provide?

Here are the specific figures and estimates that the best real estate calculator should be able to provide:

Property Price or Current Market Value

The property sale price, or its current market value, is a crucially important factor for calculating capitalization rates. Since the cap rate does not consider mortgage, interest rates, and debt payments, the property price or market value is the key component that is being compared to the NOI.

One-Time Startup Costs

They should include the following:

- Home inspection

- Closing costs

- Repair costs

- Furniture

- Appliances

The above expenses do not factor in the cap rate formula directly. However, they are important information that can help a beginner investor decide whether he/she can afford to buy the property. No matter how good of a return on investment a rental property might offer, if it is beyond your budget, there isn’t much you can do about it.

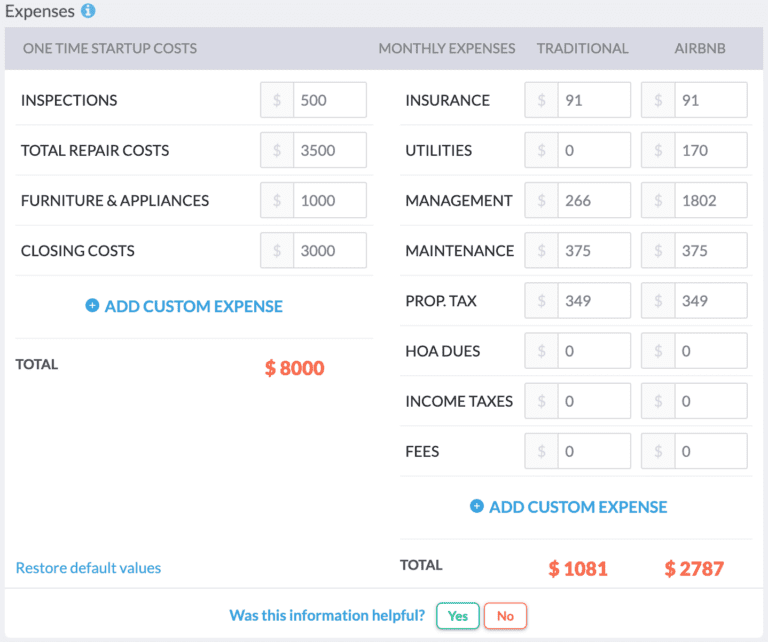

Let’s have a look at the way Mashvisor’s cap rate calculator shows the cost estimates for this investment property:

Mashvisor’s Cap Rate Calculator: Costs

Recurring Monthly Expenses

Recurring expenses include but are not limited to the following:

- Property tax

- Property insurance

- Property management (if hiring a professional rental property manager)

- Rental income taxes

- Property maintenance

- HOA fees (if investing in a condo or a home in an HOA neighborhood)

- Cleaning fees (if investing in a short term rental)

Most of the above figures are needed for calculating the net operating income of a rental property. Some might be easy to figure out, such as the rental income tax rates in different cities. However, other costs, such as property management and property maintenance, might require deeper research. With a cap rate calculator, you can get all the data that you need right away.

Occupancy Rates and Vacancy Rates

Occupancy rates refer to the ratio of the number of days in a month that the property is occupied vs the time it was listed or advertised for rent. It’s crucial to know the vacancy rates of the property and include the vacancy costs in your capitalization rate calculations. It allows you to get the full picture of the investment so that you can make the most informed, evidence-based real estate investment decision.

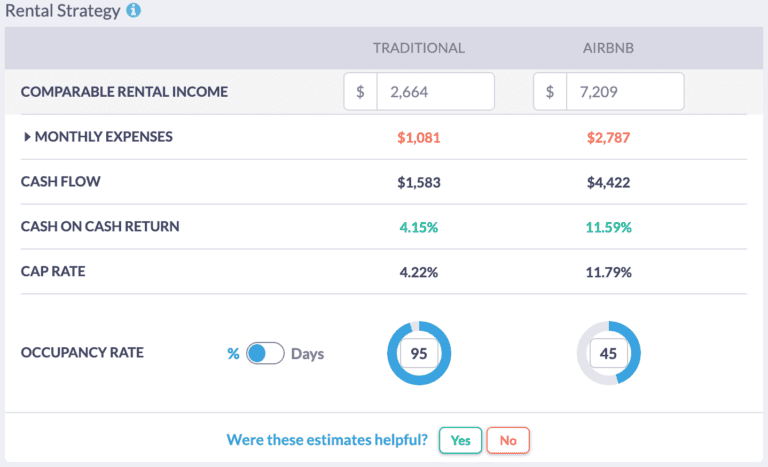

Rental Income: Long Term Rental Income and Airbnb Rental Income

Together with the operating expenses, the rental income is one of the crucial factors for calculating NOI. For long term rentals, it is the monthly rental rate. For short term rentals, it is the product of the daily rate and the Airbnb occupancy rate.

Cash Flow

The cash flow is similar to the net operating income, but it also includes the monthly mortgage payments for your debt if you purchased the property through a mortgage loan. These depend on the loan term and the interest rate.

Remember to always search for positive cash flow properties to invest in, as this is the only way to make money from real estate. A negative cash flow investment property, even for just a month or two, means that you are losing money in real estate. No investor wants that.

Financing Data

While the method of financing, the interest rate, and the mortgage payments do not affect the cap rate as they are not present in the formula, they are still very important factors for an investor. A good cap rate calculator allows a property investment buyer to adjust their method of financing: cash vs mortgage loan.

If you plan to take on debt through a mortgage to finance the investment, you should be able to set the loan term and other necessary conditions on the calculator. Therefore, the best cap rate calculator should allow the investor to customize the length and type of mortgage to get more personalized and accurate results.

The following numbers should be present:

- Down payment

- Interest rate

- Loan term

- Mortgage loan type

Related: 7 Best Loans for Investment Property in 2023

Capitalization Rate: Long Term Rental Cap Rate and Airbnb Cap Rate

Mashvisor’s Cap Rate Calculator: Long Term and Short Term Rental Cap Rate

Obviously, a good cap rate calculator (and not just the best one) should provide a reliable estimate of the capitalization rate that a rental home is expected to generate. In 2023, this number should be based on rental comps and accurate data reflecting the performance of comparable rentals in the local market.

Cash On Cash Return: Long Term Rental Cash on Cash Return and Airbnb Cash on Cash Return

Although we are focusing on using cap rates as a measure of return on investment, the best cap rate calculator will also be able to supply real estate investors with a cash on cash return value. The cash on cash return as a metric of ROI takes into account how the property is financed, including the down payment, the monthly mortgage payments, and the interest rate..

The cash on cash return is a good measure if you take on debt or a loan to purchase the property. It is also a necessary measure that can help investors make educated, confident, and more profitable investment decisions.

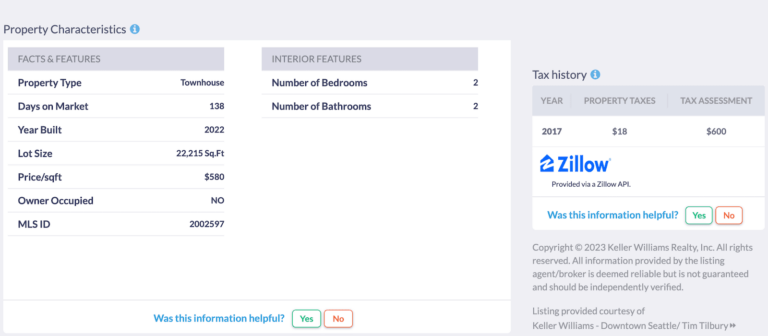

Other Information

Furthermore, an investment property calculator needs to provide some qualitative data about the rental property, such as:

- Address of the property

- Property description

- Property type (single family home, multifamily home, townhouse, condo, or other)

- Lot size

- Year built

- Number of bedrooms

- Number of bathrooms

- Type of heating

- Type of cooling

- Type of listing

Mashvisor’s Cap Rate Calculator: Property Characteristics

To sum up, the best cap rate calculator in 2023 will be able to tell investors how much money they should have available in order to afford a certain rental for sale. It will also help investors figure out the best method of financing for this particular property.

In addition, the best capitalization rate real estate calculator will show them what rate of return to expect. Last but not least, this omni real estate investing tool will help you choose the optimal rental strategy for each house.

While some investment properties make more money when rented out on a long term basis, others are more profitable as vacation rentals. It is essential to customize your rental strategy based on the house you are buying in order to maximize your income and return on investment.

Where to Find the Best Cap Rate Calculator for 2023

The best cap rate calculator in 2023 is Mashvisor’s omni rental property calculator. It uses rental comps from actual long term and short term rental properties. The comps are obtained through neighborhood analysis and predictive analytics. It also uses machine-learning algorithms to calculate the cap rate of any income property in the US housing market based on the performance of similar properties around.

Mashvisor’s real estate investment tool will provide you with absolutely all the must-have features that we listed above. Whether you are investing in rental properties as long term rentals or vacation homes, you will be able to find all the real estate analysis that you need.

One of the best things about Mashvisor’s cap rate calculator 2023 is that investors are not limited to the long term and short term rentals for sale listed on the platform. Indeed, they can input the address of any real estate property in the US to get readily available analytics with just a few clicks.

Mashvisor provides state of the art real estate investment tools to help you make wise investment decisions and walk you through your investment journey. Please sign up here to start analysing the investment opportunities in both short trem and long term rental industry.

Frequently Asked Questions: Cap Rate Calculator

We’ve established that calculating the cap rates can help investors determine which rental property offers the highest income potential. And using the best cap rate calculator on the market can significantly improve the real estate investing process, both for beginners and those with decades of experience.

Nevertheless, you might still have some questions related to the said ROI metric. You may be ready to invest in real estate. Check the following FAQs for more information:

What Is a Cap Rate in Real Estate Investing?

The capitalization rate, or cap rate, is one of the most popular metrics that measure the rate of return on rental properties in real estate investing. Traditionally used for commercial real estate, the cap rate has established itself as a key profitability measurement for residential rentals as well.

Another way to look at the cap rate is to perceive it as a measure of the level of risk that a real estate rental property carries. After all, all investments are associated with some risk due to interest rates and other factors. To understand how the cap rate works, let us first discuss the cap rate definition.

Cap rate refers to the ratio of the annual net operating income (NOI) of an investment property to the purchase price or current market value of the house. While some investors prefer to use the sale price of a rental property to calculate the return on investment (ROI), others stick to its present market value.

When learning how to calculate cap rate, it’s important to note that this metric does not take into account the way the property is financed. The ratio of cap rate remains the same regardless of whether you purchase the property entirely in cash or by taking out debt or mortgage. This is an important consideration in the current situation of quickly changing interest rates on mortgage loans.

What Is a Good Cap Rate?

Most real estate experts agree that a good cap rate ranges between 8% and 12% for both long term rental properties and Airbnb rentals. It is the perfect balance between the rate of return on a rental property and the level of risk that it brings.

If we look at capitalization rates as a metric of return on investment only, then it is logical to aim for as high a value as possible. After all, investors look for the best way to make money in real estate – and the more money they make, the better.

However, we should not forget that at the same time, cap rates in real estate also measure how much risk is involved in buying and owning a certain investment property. Investors are naturally averse to risks. It implies that lower cap rates are considered acceptable, depending on the location and the property type (single family vs multifamily).

Another reason to avoid properties with excessively high cap rates is that it might be a sign of poor property management. Sometimes, the capitalization rates are too big because the investor doesn’t spend enough money on maintaining and managing the rental. It could result in the need for major fixes, which could cost thousands of dollars and harm the overall return on investment.

Do you now see how properties with high cap rates could indicate a high risk?

Real Estate Issues Most Investors Are Concerned About

Reaching a consensus on most real estate investing issues is hard, if not impossible. Some questions that many new (and even seasoned) real estate investors need an answer to include the following:

- Which is better when it comes to real estate investing: out of state or close to home?

- Which property type is the better real estate investment: single family or multifamily real estate investing?

- Should you invest in long term or short term rentals? Which rental strategy provides the highest rental income and ROI?

- When gauging a rental property, should you conduct its valuation using the cap rate or the cash on cash return?

- What is the best cap rate return?

Well, for once, real estate professionals are in agreement on the last question mentioned above. The best cap rates for rental properties in 2023 are in the range of 8% to 12%.

Related: The Beginner’s Guide to Rental Property Analysis

Why Is 8% to 12% a Good Cap Rate?

What makes a cap rate good depends on several factors, and the factors may vary from one location to another. Although there is no concrete number for a good cap rate, many real estate professionals agree that a good cap rate ranges from 8% to 12%. However, it does not mean that lower cap rates are not good.

In fact, some investors prefer to invest in properties with lower cap rates, depending on their risk tolerance. So, the 8% to 12% figures are only ballpark numbers that serve as a basis for good cap rates. They are not set in stone. What makes a cap rate good can vary from the situation and personal preferences of one investor to another.

Is a 3% Cap Rate Good?

Most real estate experts would consider a 3% cap rate to be too low and, thus, not good. However, if you’re not after quick profit but are for long term real estate investing, it might be a good cap rate for you. It means stable, safe investments. Just make sure you’re still able to generate positive cash flow so that you don’t lose money from your long term or short term rental property.

Is a 5% Cap Rate Good?

A 5% cap rate is below the value recommended by most experienced investors. However, it might be a good cap rate for those who are just starting out and would not want to take on unnecessary risk.

What Does 7.5% Cap Rate Mean?

A 7.5% cap rate or lower means a property might be in an area with a better chance of appreciation. Low cap rates can be related to a high property value, which can be beneficial for investors. Also, remember that maintenance and repair costs may affect the cap rate. It means that properties with lower cap rates might mean that they are well-maintained.

A property with a 7.5% cap rate (or lower) is ideal for investors who want to earn stable passive income. Remember, properties with low cap rates may come with lower risks compared to those with high cap rates.

How Is the Cap Rate Related to Risk?

The cap rate doesn’t just calculate the ratio of the NOI to the property’s price or market value. It is also used to measure risk. A higher cap rate means the investment could be riskier compared to an income property with a lower cap rate.

In general, an investment with a higher return potential ratio is also associated with higher risks. For example, in a highly developed real estate market, the population usually keeps rising and inventory remains low. There, the value of properties will surely increase at a faster rate. A high property value can result in a low cap rate.

However, since the property value appreciates quickly, it means that investing in such a location is less risky. After all, investors will benefit from high real estate appreciation rates. It would mean their properties will increase in value over time.

In contrast, a high cap rate could mean that a property may be valued low. The demand for housing might be low, and the inventory may be high. If the investment is in an area with a small population, no one might rent your property. Thus, sometimes, a high ratio of cap rate is associated with a higher risk.

Do Capitalization Rates Increase With Interest Rates?

Generally, if loan interest rates increase, the ratio of capitalization rates will also increase. When interest rates are low, many people will want to buy a house. It will increase the demand for housing, which can also result in an increase in the value of properties. As mentioned, when the value of homes is high, the cap rate will be low.

On the other hand, if interest rates increase, more people won’t be able to pay for the high loan/debt cost. And thus, they will opt out of buying a new home. When people cannot take on a debt to purchase a property, it can result in low demand for real estate. When the demand is low, more listings will sit in the market for a long time.

Lower demand for housing could affect the value of the properties. When the property value is low, the cap rate will rise. It’s because the cap rate formula is the ratio of the NOI versus the property’s price or current market value.

However, you should keep in mind that the interest rate is not directly involved in the cap rate formula. The cap rate doesn’t look at the method of financing. Because of this, the loan term and the interest rate don’t affect it.

Where Does the Real Estate Data Come From?

Mashvisor’s cap rate calculator gets real estate data from various reliable sources, including the MLS, county offices, government websites, different real estate websites like Redfin and HotPads, and Airbnb. The big data is entered into our machine-learning algorithms to calculate cap rates for rental properties all across the US.

No matter how well-developed and sophisticated a capitalization rate calculator is, it is simply useless unless it has the right data and information to evaluate.

Our investment property calculator looks at the rental rates and the occupancy rate of comparable rental properties in a neighborhood. It allows us to calculate the metrics by the type of property (single family home, multifamily home, townhouse, or condo) and the number of bedrooms.

The neighborhood analysis is able to produce comparable rental income and the average occupancy rate for any investment property in the area. Finally, the cap rate – as well as the cash on cash return – is calculated based on all of the factors above.

Pros and Cons of Using Cap Rate for Rental Properties

The capitalization rate metric comes with many benefits, but it’s not perfect by any means. If you’re a beginner real estate investor, you might be wondering about the pros and cons of using a cap rate over other real estate return on investment measures.

Here are the benefits and drawbacks of using the ratio of capitalization rates as a means to measure returns:

Benefits of Using Cap Rate

- Easy to calculate: All you need to know is the net operating income and the value of the property (you can use either the sale price or current market value).

- Straightforward comparison between different markets and a few rental properties.

- Used in both commercial and residential real estate investing.

Drawbacks of Using Cap Rate

- No consideration of the method of financing: The major disadvantage of using the capitalization rate is that it doesn’t factor in the way in which the house is bought: either through cash or with a debt/mortgage loan. How to calculate cap rate looks at the price of the house or its current market value, but not at how much initial capital the investor put down.

- Payments for debt/mortgage are not factored in: The cap rate ignores the monthly mortgage/debt payments when calculating the net operating income. As most new real estate investors need to take on debt, relying on the capitalization rate alone might be misleading. It can overestimate the actual return on investment that a rental property will generate.

10 Best Markets With High Cap Rates in 2023

Are you planning to invest in rental properties but don’t know where to begin? You can start by checking the best markets with high cap rates in 2023. We listed below the best US cities for long term and short term rentals with good capitalization rates.

The ranking is based on nationwide real estate market analysis conducted by Mashvisor at the end of January 2023. We focused on markets with median property prices below $1,000,000 to ensure affordability. Moreover, we only included places with more than 100 active rental properties so that investors can benefit from strong rental demand.

Top 5 Locations With High Long Term Rental Cap Rates in 2023

The best locations for long term rentals come in all shapes and sizes. That’s why it’s important to look at the entire US housing market when choosing where to buy a property to rent out on a long term basis. The main factors to consider are affordable prices, strong demand, good rental income, and above-average ROI.

Based on Mashvisor’s January 2023 data, here are the top five cities for long term cap rate in 2023, arranged from those with the highest to the lowest cash on cash return:

1. Lantana, FL

- Median Property Price: $848,514

- Average Price per Square Foot: $447

- Days on Market: 78

- Number of Long Term Rental Listings: 123

- Monthly Long Term Rental Income: $3,149

- Long Term Rental Cash on Cash Return: 4.26%

- Long Term Rental Cap Rate: 4.33%

- Price to Rent Ratio: 22

- Walk Score: 65

2. Saint Petersburg, FL

- Median Property Price: $716,060

- Average Price per Square Foot: $412

- Days on Market: 144

- Number of Long Term Rental Listings: 1,342

- Monthly Long Term Rental Income: $2,914

- Long Term Rental Cash on Cash Return: 3.96%

- Long Term Rental Cap Rate: 4.01%

- Price to Rent Ratio: 20

- Walk Score: 42

3. Williamsburg, VA

- Median Property Price: $610,186

- Average Price per Square Foot: $640

- Days on Market: 85

- Number of Long Term Rental Listings: 186

- Monthly Long Term Rental Income: $2,529

- Long Term Rental Cash on Cash Return: 3.63%

- Long Term Rental Cap Rate: 3.68%

- Price to Rent Ratio: 20

- Walk Score: 85

4. Charleston, SC

- Median Property Price: $868,907

- Average Price per Square Foot: $906

- Days on Market: 87

- Number of Long Term Rental Listings: 446

- Monthly Long Term Rental Income: $3,311

- Long Term Rental Cash on Cash Return: 3.61%

- Long Term Rental Cap Rate: 3.65%

- Price to Rent Ratio: 22

- Walk Score: 40

5. Fayetteville, AZ

- Median Property Price: $507,480

- Average Price per Square Foot: $245

- Days on Market: 98

- Number of Long Term Rental Listings: 896

- Monthly Long Term Rental Income: $2,068

- Long Term Rental Cash on Cash Return: 3.59%

- Long Term Rental Cap Rate: 3.64%

- Price to Rent Ratio: 20

- Walk Score: 57

Start searching for profitable long term rentals across the US market with the help of the best cap rate calculator in 2023.

Top 5 Locations With High Airbnb Cap Rate in 2023

The best short term rental markets vary, including both hot tourist destinations and popular business locations. In general, you should aim for places that are affordable, benefit from strong rental demand, with good Airbnb income, and offer high ROI.

Furthermore, you need to ensure that non-owner occupied short term rentals are legal and unrestricted in your chosen market. You can check out the Mashvisor short term rental regulations page for a quick starting point with links to more detailed resources.

According to Mashvisor’s January 2023 data, the following are the best places for starting an Airbnb business in 2023, ranked from those with the highest to the lowest cash on cash return:

1. Asbury Park, NJ

- Median Property Price: $903,252

- Average Price per Square Foot: $545

- Days on Market: 119

- Number of Airbnb Listings: 122

- Monthly Airbnb Rental Income: $5,711

- Airbnb Cash on Cash Return: 3.95%

- Airbnb Cap Rate: 3.99%

- Airbnb Daily Rate: $412

- Airbnb Occupancy Rate: 50%

- Walk Score: 91

2. Annapolis, MD

- Median Property Price: $729,747

- Average Price per Square Foot: $906

- Days on Market: 109

- Number of Airbnb Listings: 418

- Monthly Airbnb Rental Income: $4,935

- Airbnb Cash on Cash Return: 4.51%

- Airbnb Cap Rate: 4.55%

- Airbnb Daily Rate: $366

- Airbnb Occupancy Rate: 50%

- Walk Score: 83

3. Neptune, NJ

- Median Property Price: $491,114

- Average Price per Square Foot: $339

- Days on Market: 69

- Number of Airbnb Listings: 454

- Monthly Airbnb Rental Income: $5,103

- Airbnb Cash on Cash Return: 6.64%

- Airbnb Cap Rate: 6.72%

- Airbnb Daily Rate: $351

- Airbnb Occupancy Rate: 50%

- Walk Score: 63

4. Gatlinburg, TN

- Median Property Price: $824,353

- Average Price per Square Foot: $454

- Days on Market: 141

- Number of Airbnb Listings: 748

- Monthly Airbnb Rental Income: $4,958

- Airbnb Cash on Cash Return: 4.41%

- Airbnb Cap Rate: 4.45%

- Airbnb Daily Rate: $332

- Airbnb Occupancy Rate: 53%

- Walk Score: 62

5. Penn Yan, NY

- Median Property Price: $427,166

- Average Price per Square Foot: $235

- Days on Market: 293

- Number of Airbnb Listings: 140

- Monthly Airbnb Rental Income: $3,989

- Airbnb Cash on Cash Return: 6.30%

- Airbnb Cap Rate: 6.41%

- Airbnb Daily Rate: $324

- Airbnb Occupancy Rate: 54%

- Walk Score: 77

Start searching for profitable Airbnb rentals across the US market with the help of the best cap rate calculator in 2023.

Alternatives to the Capitalization Rate in Real Estate

The most important residential real estate return on investment metrics – besides capitalization rate – include the cash on cash return ratio, rate of return, and internal rate of return. Looking at all the said measures is the best way to find a positive cash flow property with high profitability in 2023.

For instance, the cash on cash return considers how you finance the purchase of the property. If you purchased the property through debt or mortgage, the down payment, the interest rate, and the loan term will affect the value of the ratio of the cash on cash return.

However, despite the one disadvantage of capitalization rate, it doesn’t mean that real estate investors in residential income properties should totally ignore it. What it means instead is that the capitalization rate should be used together with the other metrics to measure a property’s rate of return.

Investors should gather as much information and data as possible and perform as much investment property analysis before deciding which property to buy. It’s best to do it using a reliable rental property calculator, specifically a cap rate calculator.