Choosing the right investment property is key to your success in the real estate business. While there are many metrics that investors use to compare rental properties for sale, the most common one is capitalization rate (cap rate). This is a return on investment metric that is typically used before taking the financing method into account. The cap rate formula is the ratio of net operating income (NOI) to the current market value of the property. Basically, it represents your potential percentage return on an all-cash purchase.

For you to find high cap rate properties for sale, you should learn how to calculate cap rate effectively. For a long time, real estate investors have been using a cap rate spreadsheet to calculate cap rate. However, with technological advancement, a cap rate spreadsheet has essentially become obsolete. If you want to be competitive in the current real estate industry, you need a more advanced alternative – the cap rate calculator.

If you are still using a real estate investment analysis spreadsheet in this day and age, you are actually doing a disservice to yourself. To maximize your rate of return, you have to change with the times. Read on to learn about Mashvisor’s cap rate calculator and why it’s a better alternative to a cap rate spreadsheet.

Why Should You Use a Cap Rate Calculator Instead of a Cap Rate Spreadsheet?

As a real estate investor, you need to analyze numerous rental properties for sale in your target housing market so that you find the best investment opportunities you can get.

While Excel spreadsheets have been the go-to tools for calculating cap rates for rental properties for years, that’s no longer the case. A cap rate spreadsheet has some major drawbacks that make your analysis less effective. Fortunately, with the emergence of the cap rate calculator, one of the revolutionary real estate investment tools offered by Mashvisor, most of these drawbacks can be eliminated.

Here are the major reasons why you should cast aside your cap rate spreadsheet and replace it with the cap rate calculator:

Related: Why an Investment Property Calculator Is Better Than Spreadsheets

1. Faster Calculations

Being able to identify lucrative opportunities ahead of your competition is key to achieving great returns in real estate. However, using a real estate spreadsheet is typically time-consuming. Collecting property data, creating formulas in Excel, and keying in data may take you several weeks.

With the cap rate calculator, this time can be reduced significantly. You can analyze multiple rental properties for sale in a matter of minutes and make faster decisions.

2. Easier to Use

If you are new to cap rate spreadsheets, you’ll first need to learn how to program them. In contrast, anyone can easily use a cap rate calculator even if they are a complete beginner. The tool is user-friendly and you only need to key in a few details about your target property. The tool will then do the rest of the work. You don’t require any training to use the cap rate calculator. It’s simple and straightforward.

3. Dynamic

Mashvisor’s calculator provides up-to-date property data and so you don’t have to enter all of it yourself or continue updating it with time as you would with a cap rate spreadsheet. This allows you to react quickly to any crucial changes in the housing market.

4. More Accurate

Mashvisor’s cap rate calculator guarantees accuracy when computing cap rate and other metrics. It produces accurate estimates because it uses historical and comparative data from reliable sources.

Moreover, the calculations are less prone to error. Spreadsheets usually multiply errors due to transfers through Excel formulas and copied cells.

5. Allows for Easy Mobile Access

In this digital age, being able to access information quickly from anywhere and using a variety of gadgets makes life easier. One drawback of using a cap rate spreadsheet is that accessing it through a smartphone is quite inconvenient. However, a cap rate calculator allows you to enjoy this flexibility.

6. Calculates More than Just Cap Rate

While real estate cap rate is a key metric for comparing real estate investment opportunities, it’s not wise to base your investment decisions on cap rate alone. There’s a lot more that needs to be taken into account when assessing the profitability of an investment property.

Unlike a cap rate spreadsheet that only calculates what you provide for it, the cap rate calculator can be used to do a quick comprehensive investment property analysis. This involves evaluating several aspects of an investment property that play a role in its profitability. Such an in-depth analysis can’t be done efficiently with a cap rate spreadsheet.

Apart from calculating cap rate, here are some of the most important things you can do with the cap rate calculator:

-

Calculate Cash on Cash Return

Cash on cash return is another key return on investment metric that investors should consider before buying an investment property. It measures the total amount of cash earned from an investment property (annual pre-tax cash flow) relative to the total cash invested. This ROI metric is particularly significant when you are financing an investment property using a mortgage loan.

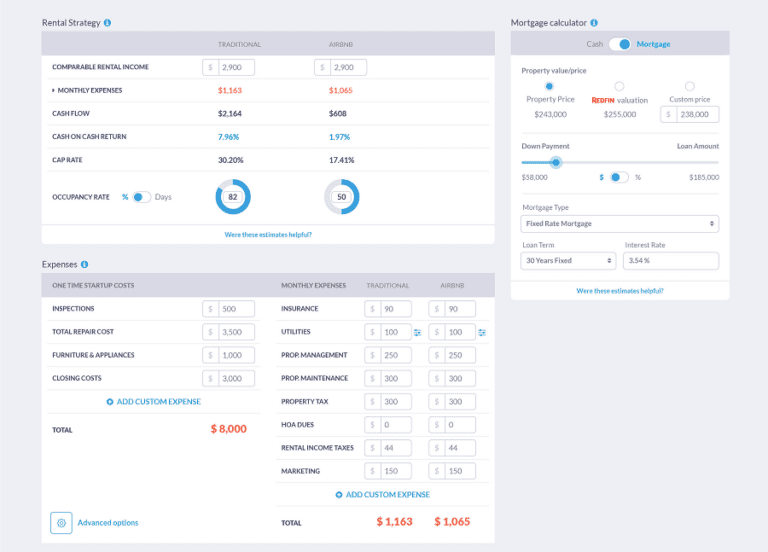

By altering mortgage details (down payment, mortgage type, loan term, etc.) on the cap rate calculator, you can estimate how different loan terms affect your property’s ROI. This will help you identify the best investment property financing method.

Related: Cap Rate vs. Cash on Cash Return

-

Analyze Cash Flow

Cash flow is another important real estate metric to take into consideration when investing in rental properties. This is the difference between your monthly rental income and rental expenses.

Generally, it is recommended that you invest in positive cash flow properties. The higher the cash flow, the better. The cap rate calculator provides readily calculated cash flow data for investment properties on our platform.

-

Determine Optimal Rental Strategy

For each of the key metrics provided by the cap rate calculator, you’ll get values for both Airbnb and traditional rental strategies for each property. This way, it will be easier for you to choose the optimal rental strategy.

-

Find Real Estate Comps

Determining the fair market value of a rental property for sale will help you figure out the right price to offer and prevent you from overpaying. The fair market value of an investment property for sale is usually determined by looking at other recently sold comparable properties in the area (real estate comps).

You can easily find real estate comps for properties in the US housing market using Mashvisor’s cap rate calculator. If you are using a cap rate spreadsheet, you’ll need to do a lot of research or ask your real estate agent to find these real estate comps.

Related: Comparative Market Analysis: A How-To Guide for Real Estate Investors

The Bottom Line

Cap rate is one of the most important metrics in real estate investing. As such, it needs to be calculated using the best real estate investment tools. On a basic level, a cap rate spreadsheet performs the same task as a cap rate calculator (calculating cap rate). However, the cap rate calculator is remarkably superior and should be your go-to tool for calculating cap rate and Mashvisor, your go-to calculator!

To get access to our cap rate calculator, click here to sign up for Mashvisor today and enjoy 15% off.