They say that buying a house is one of the biggest expenses – if not the biggest – one will ever have in his or her entire lifetime. If that’s the case, then real estate investment properties are some of the biggest investments any regular investor can ever make.

And as much as real estate investment in itself is almost always rewarding, a lot of people who invested in real estate, especially rental properties, did not get the return on investment – commonly known as ROI – they expected. Several factors could have affected the actual ROI. Perhaps it’s a bad case of expectation vs reality or maybe they just failed to use the right investment tools and resources, such as accurate data analysis and good cash on cash return calculator.

Whatever it is, an investor can only go so much on a property’s mere face-value potential. To guarantee optimum yet realistic results, one should always have the right strategies and tools to make the entire investment journey satisfying and rewarding.

One of the most crucial tools any investor will need is a cash on cash ROI calculator. While you can easily find a cash on cash calculator online, calculating cash on cash return using the best available cash on cash return calculator can mean the difference between night and day with your investment.

That being said, let’s see how Mashvisor’s investment property calculator helps an investor get the most optimum cash on cash return rental property.

A Review of Mashvisor’s Investment Property Calculator (2022 Edition)

Any investor worth his or her salt will never go into an investment venture without knowing the basics of what he or she is getting into. Whether it’s investing in stocks or the 2022 housing market, a good investor will always ensure that he or she knows enough about the subject to properly manage expectations.

So before we jump right into the discussion about what is good cash on cash return and how Mashvisor’s cash on cash return calculator is better than the others, let’s talk about the basics first so we’re all on the same page.

Definition of Terms

If you’re a newbie investor and it is your first time to consider getting into real estate investment, we have outlined a few basic terms you should be familiar with.

Capitalization Rate

A capitalization rate, often shortened to cap rate, is one of the measures investors and industry insiders use to determine a property’s profitability. It can be computed by dividing a property’s net operating income (or NOI) by its current market value.

Capitalization Rate = Net Operating Income (NOI) x 100

Asset’s current market value

For instance, let’s say a property is estimated to bring in $1,000,000 worth of income over a ten-year period. Now let’s assume that the property is being sold for $2,375,000. Using the formula above, we arrive at a cap rate of 36.36%

Now a lot of investors might think that the higher the cap rate, the more profitable the property, right? Not exactly. While a 36% cap rate doesn’t sound so bad compared to 12% or 15%, a good cap rate is subject to an investor’s comfort level. There are times when a higher cap rate does not bode well for property owners.

Keep in mind that a cap rate is only one of several metrics used to determine profitability and should not be the sole basis of any investment decision.

Cash Flow

Let’s set this straight. Cash flow is not synonymous with profit. They are two different things. Where profit represents the difference between the capital and amount earned, cash flow refers to the cash moving into and out of a business at a given time. It can be positive or negative. A positive cash flow means that more money is coming into the business compared to all the operating expenses. On the other hand, a negative cash flow means that the amount of money being spent on operations outweighs the cash coming in.

Cash on Cash Return

Cash on cash return is a term used in real estate investment property analysis to determine a property’s rate of return. Simply put, it is the measure of the annual return made on a property relative to the amount of money invested in it. Experts agree that good cash on cash return rate is 8% to 12%, however, not all investments and properties are created equal. Different investments offer different return rates so it is still best to calculate cash on cash return for each property you are considering.

Median Price

Not to be confused with average price, a median price is simply the midpoint in real estate property prices. Median prices are determined by getting the middle value of all observations, the value where half are larger and half are smaller.

Real Estate Comps

Real estate comparables or comps is an appraisal term for similar properties you’re considering in a specific market. These comparable properties are used to determine a specific property’s value based on how much they sold.

Rental Income

Rental income is simply the revenue property owners earn by leasing out properties to tenants. They can come from either traditional (long-term) rental properties or vacation homes (short-term rentals) such as Airbnb.

Return on Investment

Return on investment or ROI is a performance measure used to rate an investment’s efficiency and profitability. In this case, real estate investors are always on the lookout for properties that have the potential to offer high ROIs. This is why having reliable cash on cash return calculator along with accurate market data is very important.

Why Should You Use Mashvisor’s Investment Property Calculator?

Now that we’ve gone over the basics, let’s take a closer look at Mashvisor’s investment property calculator, including the cash on cash return calculator, and how it can help investors make well-informed decisions.

Locating the Right Property Suited to Your Investment Goals

Mashvisor’s investment property calculator is one of the many tools and features offered on the site that makes finding the right investment properties faster and easier.

There are three major keys to ensure success in real estate investment:

- The right location

- The right property to invest in

- The right rental strategy that lines up with your circumstances and goals

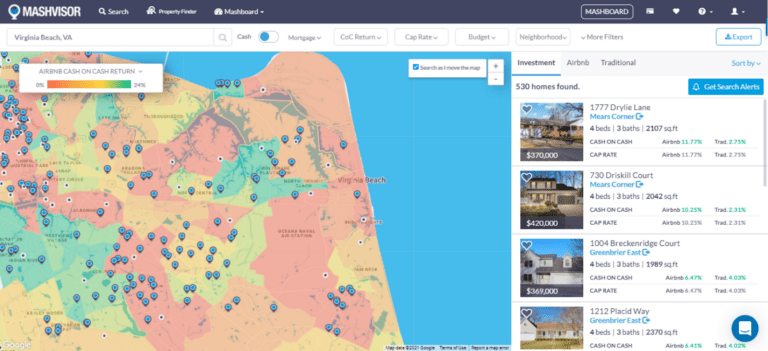

Using Mashvisor’s cash on cash return real estate calculator allows investors to achieve these three keys as it enables users to locate and analyze the property that’s right for them in a market of their choice. It is easy to use as users only need to input certain basic information in line with their investment standards and criteria. The outcome is quite reliable as all of the available data on the platform come from actual real estate comps and industry insiders. The tool also uses traditional and predictive analytics which makes it very user-friendly.

Mashvisor’s investment property calculator has made weeks-long feasibility studies, creating and tabulating spreadsheets, and crunching numbers repeatedly a thing of the past. What used to take weeks for real estate investors to accomplish years ago can now be done in a matter of minutes with astounding accuracy.

Sure, there are several great investment property calculators easily accessible online but, according to users and reviewers, the best and most user-friendly cash on cash return calculator today is Mashvisor.

Analyzing Crucial Data and Information Relevant to Your Goals

Mashvisor’s property analysis tools, like its cash on cash return calculator, are designed as mathematical models that will ultimately benefit residential real estate property investors. It is designed with ease of use in mind, considering how daunting a task it is to gather and analyze market data, especially to those who don’t work often – or well – enough with Spreadsheets.

Data analysis plays a major role in real estate investments because everything rides on getting the accurate and correct information. Most calculation errors occur because of insufficient and inaccurate data. Mashvisor pulls all of its market data from rental comps in its database. The availability of such data minimizes the chances of erroneous calculations which in turn increases an investor’s confidence in making the best decision possible about a specific property.

Market and Neighborhood Analysis

One of two things that involve extensive analysis before deciding to pull the trigger on a rental property investment is the market and neighborhood analysis.

Analyzing a market manually may not be impossible to do nowadays but it will take too much of a person’s time, energy, and resources to complete. The site’s cash on cash return calculator along with its other types of property calculators saves investors tons of time and money by allowing them to locate the best markets and neighborhoods to buy rental properties.

The Real Estate Heatmap tool shows the reds (cold markets) and the greens (hot markets) of a certain city in the US. Once you have narrowed down a good neighborhood to invest in, the investment property calculator can help you analyze the different data needed to come up with the best possible options.

You will find the following data on the Neighborhood Analytics page:

- Median price

- Average price per square foot

- Average Airbnb and traditional rental income

- Average Airbnb and traditional cash on cash return

- Average Airbnb occupancy rate

- Optimal rental strategy

- The optimal number of bedrooms

- Optimal property type

- Number of traditional and Airbnb properties for sale

- Walk Score

- Mashmeter Score

- Real estate comps

On top of having access to this valuable data, users can also download the full neighborhood report in Excel format, including every listed property and its stats. You can go over it for further study and examination and you can show it to your real estate agent to ask for his or her opinion.

Investment Property Analysis

Once you have already identified your neighborhood of choice, you may now look for the most ideal property that fits your budget and investment goals. Finding out a property’s profitability potential requires analyzing multiple properties and choosing which one works best for your situation.

Users can use Mashvisor’s Property Finder to locate the top properties that match their search criteria and offer promising ROI potentials. Once you have narrowed your list down, the site’s different calculators, including its cash on cash return calculator, can help you analyze each prospective property in greater detail.

Among the highly useful information you will need in your investment venture are:

- Rental Expenses. Running a rental property business comes with different expenses. You have your start-up costs to think of as well as your regular recurring operating expenses. Start-up costs cover home repairs and rehabilitation, furniture and appliances, home inspection fees, and closing costs. Monthly operating expenses, on the other hand, include utilities. maintenance, homeowners’ association dues, property insurance, property taxes, rental taxes, and property management fees, to name a few.

- Rental Income. Mashvisor’s investment calculator also serves as a rental income calculator because it provides users with rental income estimates based on rental comps data.

- Monthly Cash Flow. Remember our discussion on cash flow earlier? This is where it comes in. Your monthly cash flow can be computed using a direct or an indirect method. But you no longer need to do it manually as Mashvisor’s cash flow calculator will already provide you with the necessary accurate data based on real estate comps. If you’re a beginner investor, it is highly recommended for you to only put your money in properties with positive cash flows.

- Return on Investment. This is the bottom line of any investment property analysis. Investors want to generate good ROIs with their ventures. Using Mashvisor’s cash on cash calculator and its cap rate calculator will help investors analyze the profitability of multiple properties simultaneously. While having the right cash on cash return formula increases one’s chances of better property analysis, there are fewer errors when one uses the site’s calculator.

- Real Estate Comps. These are highly important when it comes to analyzing a property’s profitability as investors need to examine similar properties that were recently sold in the neighborhood. The site’s investment property calculator also lists different comps for investors to check out and study.

The Bottom Line

Overall, Mashvisor’s investment property calculator, specifically the cash on cash return calculator, allows investors to identify which properties are best suited for their situation and investment goals. It gives them a better idea of what their ROI might be like, especially when used hand-in-hand with the cap rate calculator.

To find out more about Mashvisor’s investment property calculator and its other tools, sign up for Mashvisor now.