Due to the effects of the COVID-19 pandemic on the economy, many Americans have lost jobs or have had their income reduced. Consequently, there has been a need for people to adjust their lifestyles and limit their budgets. With more people now working remotely, one way that renters are trying to cope with the situation is to cut costs by moving from their current locations and finding the cheapest places to live in the US. But what does this trend mean for real estate investors? Read on to find out.

What Does a Future of Remote Work Mean to Real Estate Investors?

With more people now working remotely, the cheapest places to live in the USA have become more desirable. For keen real estate investors, this trend may be an opportunity. But how?

Before the COVID-19 pandemic, most full-time employees worked primarily in their offices and would need to live near their work places. However, the pandemic has seen remote work being embraced more and more. Many companies are realizing that remote work doesn’t really hurt productivity and even leads to significant time and cost savings. More companies are actually expanding their remote work policies. Therefore, reversing the work-from-home trend would be difficult even after COVID-19 is under control.

With remote work expected to become the new normal (especially for white-collar jobs), location will be a less important requirement for workers. Thus, in 2021, more white-collar workers may relocate from the expensive work centers like New York City, San Francisco, Boston, and Los Angeles and move to cheaper places away from the major US cities. The result will be a spike in rental demand in these primary and tertiary real estate markets. This means that the cheapest places to live in the US may also be great places to invest in traditional rental properties at the moment.

If you’re thinking of investing in real estate, we’ve compiled a list of the cheapest cities to live in in the USA. These are cities with low costs of living and good amenities as well as numerous attractions, as highlighted by ExtraSpace Storage. However, low costs of living alone won’t guarantee a good rate of return. For this reason, we’ve also added Mashvisor’s city-level data for each of these cities so that you can see how investment numbers look.

Cheapest Places to Live in the US

1. Buffalo, NY

Buffalo Real Estate Market

- Median Property Price: $200,985

- Price per Square Foot: $106

- Price to Rent Ratio: 16

- Monthly Traditional Rental Income: $1,043

- Traditional Cash on Cash Return: 3.9%

2. Charlotte, NC

- Median Property Price: $474,769

- Price per Square Foot: $240

- Price to Rent Ratio: 23

- Monthly Traditional Rental Income: $1,715

- Traditional Cash on Cash Return: 2.3%

3. Dallas, TX

- Median Property Price: $465,534

- Price per Square Foot: $227

- Price to Rent Ratio: 21

- Monthly Traditional Rental Income: $1,854

- Traditional Cash on Cash Return: 2.0%

4. Des Moines, IA

- Median Property Price: $569,994

- Price per Square Foot: $373

- Price to Rent Ratio: 21

- Monthly Traditional Rental Income: $2,221

- Traditional Cash on Cash Return: 3.3%

5. Kansas City, MO

- Median Property Price: $313,759

- Price per Square Foot: NA

- Price to Rent Ratio: 21

- Monthly Traditional Rental Income: $1,231

- Traditional Cash on Cash Return: 2.4%

6. Memphis, TN

Memphis Real Estate Market

- Median Property Price: $287,493

- Price per Square Foot: $81

- Price to Rent Ratio: 22

- Monthly Traditional Rental Income: $1,093

- Traditional Cash on Cash Return: 2.9%

7. Nashville, TN

- Median Property Price: $482,565

- Price per Square Foot: NA

- Price to Rent Ratio: 24

- Monthly Traditional Rental Income: $1,676

- Traditional Cash on Cash Return: 2.7%

8. Oklahoma City, OK

- Median Property Price: $192,805

- Price per Square Foot: $113

- Price to Rent Ratio: 16

- Monthly Traditional Rental Income: $1,025

- Traditional Cash on Cash Return: 3.8%

9. Omaha, NE

- Median Property Price: $425,754

- Price per Square Foot: $165

- Price to Rent Ratio: 17

- Monthly Traditional Rental Income: $2,112

- Traditional Cash on Cash Return: 3.6%

10. San Antonio, TX

- Median Property Price: $288,008

- Price per Square Foot: $156

- Price to Rent Ratio: 17

- Monthly Traditional Rental Income: $1,452

- Traditional Cash on Cash Return: 2.4%

11. Tampa, FL

- Median Property Price: $488,753

- Price per Square Foot: $251

- Price to Rent Ratio: 23

- Monthly Traditional Rental Income: $1,766

- Traditional Cash on Cash Return: 2.7%

To search for a profitable long-term rental property in any of these markets, sign up for Mashvisor.

What Next?

Knowing the affordable real estate markets to live in the US is not enough to find the best income properties to purchase. You need to further narrow down your investment property search to the neighborhood level and analyze multiple investment properties for sale to find the best one.

You can do so with the following Mashvisor real estate investment tools for that purpose:

1. Real Estate Heatmap

To find the best neighborhood for owning a traditional rental property in your market of choice, you need to conduct a thorough neighborhood analysis. This can be easily done using Mashvisor’s real estate heatmap. The heatmap uses different color codes to show the performance of different neighborhoods based on the filters you set. These include:

- Listing Price

- Airbnb Occupancy Rate

- Airbnb Rental Income

- Traditional Rental Income

- Airbnb Cash on Cash Return

- Traditional Cash on Cash Return

Related: Heatmap Analysis: The Secret to Successful Real Estate Investing

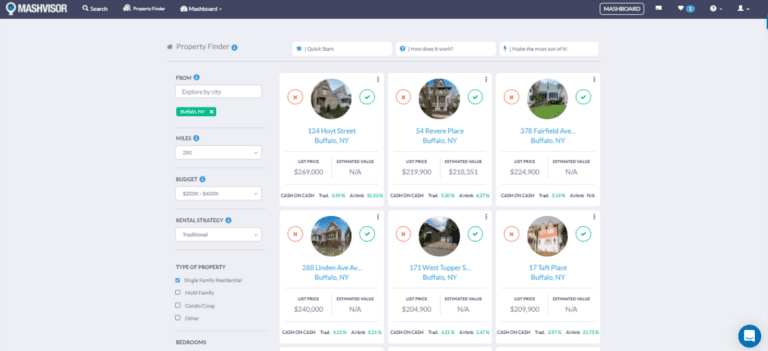

2. Property Finder

After identifying the best neighborhood to invest in, the next step is to find investment properties for sale that meet your budget and criteria. The easiest way to do your property search is to use Mashvisor’s property finder. The property finder allows you to search for profitable investment properties for sale based on the following filters:

- Location

- Miles

- Budget

- Rental strategy

- Property type

- Number of bedrooms

- Number of bathrooms

Mashvisor’s Property Finder

3. Investment Property Calculator

The final step to finding a profitable property in the cheapest places to live in USA is to conduct an investment property analysis. The tool to help you with this is Mashvisor’s rental property calculator. The calculator computes key real estate metrics such as cash flow, cap rate, cash on cash return, and Airbnb occupancy rate based on the performance of traditional rental comps in the area. Moreover, you will get estimates of the expected one-time startup costs as well as recurrently monthly expenses. All numbers in the Mashvisor investment property calculator are adjustable, so that you can customize the analysis to your particular situation as an investor.

The Bottom Line

With the pandemic having normalized remote work, people can basically live anywhere. This is a cost-saving opportunity that many are taking advantage of by looking for the cheapest places to live in the US. This trend also makes the cheapest cities in the US housing market more lucrative. With proper real estate market analysis, real estate investors can also turn a profit by investing in these places. To start searching for lucrative investment opportunities in these markets, sign up for a 7-day free trial of Mashvisor followed by a 15% discount for life.